Hospital REIT Medical Properties Trust (NYSE:MPW) last week submitted its earnings sheet for the fourth-quarter which widely missed EPS expectations due to the company’s financial statements reflecting the impact of the previously disclosed Steward problems. Medical Properties’ impairment charges skewed the REIT’s results for the fourth-quarter as well as for FY 2023 by a significant amount, but in a telling reversal of investor sentiment, shares actually increased after earnings, and soared 9% on Tuesday.

The REIT’s cash flow situation doesn’t look as bad as investors may assume and MPT did manage to fully earn its reduced dividend payment of $0.15 per-share with normalized FFO (NFFO). Given that Medical Properties is actively working with Steward to improve the tenant’s financial situation, I believe the REIT remains an attractive turnaround investment.

Previous rating

I downgraded Medical Properties to hold after the REIT warned in January that its biggest operator, Steward, was in financial difficulties, resulting in the REIT hiring financial and legal advisors to protect the value of its assets: Time To Worry About The Dividend. While MPT investors still have to deal with considerable uncertainty and negative sentiment overhang, bad news is already sufficiently priced into Medical Properties’ valuation at this time.

Steward situation, financial statement impact

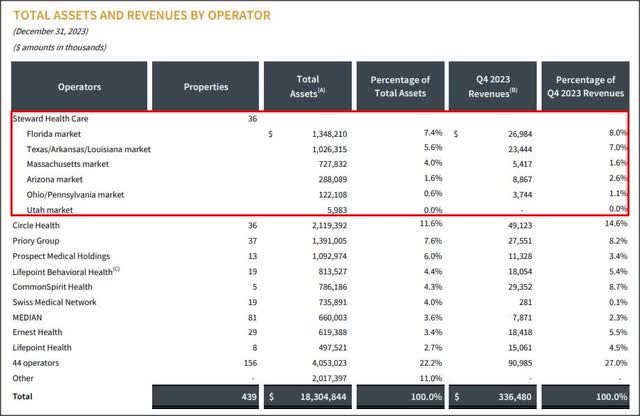

Steward, which leases 41 properties from Medical Properties in major markets such as Florida, Texas and Massachusetts is the REIT’s largest tenant and therefore any financial difficulties at the operator level have resulted in concerns about MPT’s cash flow and dividend safety. Steward is a big tenant indeed and it was responsible for $68.5M of revenues on a Q4’23 basis (equivalent to 20.3% of revenues).

MPT

Steward is a health care system that operates mainly hospitals and has been falling behind its rental payment schedule, necessitating MPT to step in and provide a bridge loan of $60M. The operator is currently exploring options and it may have to sell assets and raise cash in a bid to restructure its operations and shrink to a more manageable level.

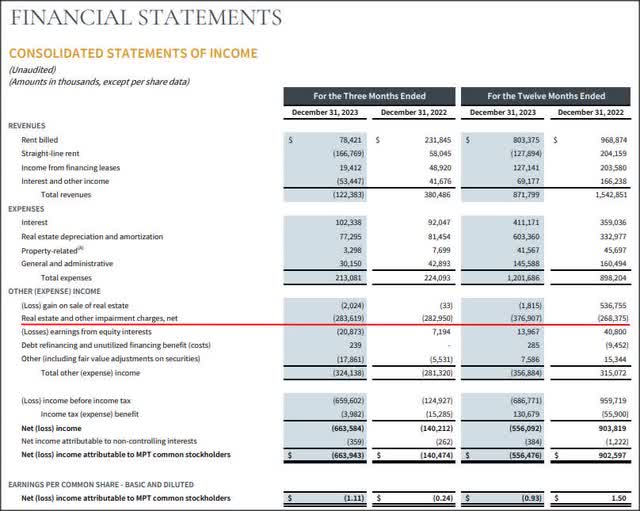

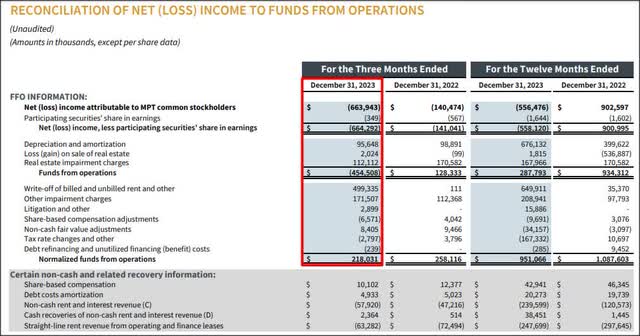

Because of Steward’s financial struggles, which were announced in January, causing a large valuation drawdown for Medical Properties, MPT was forced to recognize a large non-cash impairment charge in the fourth-quarter. In total, Medical Properties recognized $283.6M in impairments in the fourth-quarter which resulted in a $663.9M net loss for the quarter and a full-year net loss of $556.5M.

MPT

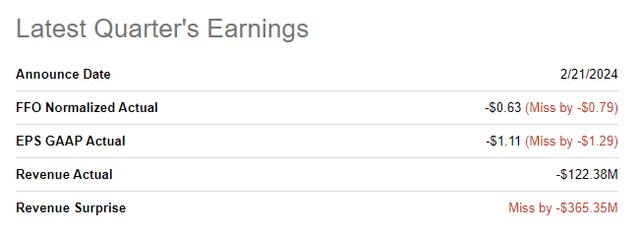

As a result, MPT also drastically under-performed EPS expectations for Q4’23.

Seeking Alpha

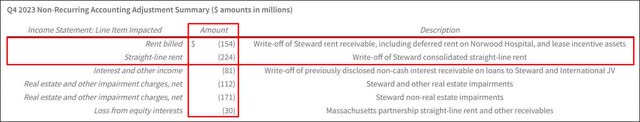

Mostly, these FY 2023 impairments were related to a $154M write-off of Steward’s monthly rent bill as well as a $224M write-off of the tenant’s straight-line rent receivables. Given that Medical Properties has already recorded these non-recurring impairments (a more detailed breakdown is provided below) in FY 2023 and that MPT’s cash flow was sufficient to sustain the $0.15 per-share dividend, I believe the situation is not as dire as I myself concluded in January.

MPT

Medical Properties could most likely continue paying its dividend even if it won’t be able to recover any rent from its biggest tenant. In Q4’23, MPT’s NFFO, which adds back non-cash impairment charges, was $218.0M, showing a decline of 15.5% year over year. If we were to apply a reasonable discount to this NFFO, then MPT would still generate enough cash from its operations to easily pay the current dividend.

MPT

Steward represents 33% of net investments and about 20% of revenues. Assuming a 20% decline in NFFO, then Medical Properties could easily keep paying its dividend without having to make a change to its dividend policy again. Here’s how this works:

MPT reported $1.59 per-share in NFFO in FY 2023, showing a 12.6% decline year over year. Applying another 20% discount to reflect Steward’s revenue share results in an estimated Steward-corrected NFFO level of $1.27 per-share. Or, on an annualized Q4’23 basis, $1.15 per-share. The mid-point of this NFFO approximation range would be $1.21 per-share. The dividend costs $0.15 per-share quarterly or $0.60 annually. Based off of the risk-adjusted NFFO level that I calculated here, the dividend coverage ratio is ~200%. This means that even in the worst case scenario, Medical Properties should be able to meet its dividend obligations to shareholders which results in an improved risk profile for MPT post-earnings.

Valuation

My estimate for FY 2024 NFFO indicates that the dividend is reasonably well-supported by cash flow, but things at Medical Properties have evolved quickly lately and one must pay constant attention to developments at the REIT, especially with regard to Steward and any potential life lines that MPT is throwing its operator.

Based off of my estimate for NFFO, $1.21 per-share at the midpoint, shares of Medical Properties are currently valued at 3.5X. I believe Medical Properties could reasonably trade at 7.0X P/NFFO ratio, implying an NFFO yield of 14%, under the condition that the REIT can resolve its Steward situation and restore clarity about its baseline NFFO level going forward. My fair value estimate depends on the company’s ability to restore earnings and FFO visibility and remove investor doubts about dividend sustainability. A 7X P/NFFO ratio implies a fair value of $8.47 per-share.

Risks with MPT

Even without Steward, Medical Properties could support its dividend with NFFO, but of course, I would like to see a gradual recovery in Steward’s financial profile so that Medical Properties’ financial stress levels also decline. I am definitely going to monitor Medical Properties’ dividend coverage, the progress the company is making in collecting unpaid rent from its biggest tenant and the REIT’s general cash flow trend, as measured by its NFFO.

Final thoughts

Medical Properties is a steady hold for me after the REIT reported earnings and missed estimates by a mile due to the recognition of Steward-related impairment charges. The dividend seems well-supported by NFFO, however, and even if Steward were to fold entirely as a revenue contributor, I believe Medical Properties won’t have to cut its dividend. What I believe the market is still getting wrong about MPT is that the REIT has potential to improve its liquidity and dispose of non-core assets, which I discussed in January. Cash proceeds from non-core asset sales could help shore up the balance sheet, lead to a speedier repayment of high-cost debt and, most importantly, cushion any blow from a potentially deteriorating Steward situation!

Read the full article here