My last article is Rate Cuts For 2024? How About None? Is None Okay For Stocks? My premise for this past article was the very real possibility that the CPI would not give the result everyone was taking for granted. My point wasn’t rooted deeply in econometrics, just life experience when it comes to economic data, and this notion goes for stock prices as well. Nothing goes straight up; it is that simple. Also, the periodicity of when the numbers retreat follows a loose pattern. This was a partial influence, the main impetus for the call was the rise in the 10-year US bond rate. The article predicted that interest rates would break above 3.19% and headed to 4.30% this was on February 11. Here is the screenshot that I made that day of the 10-year bond…

CNBC

You can see how sharply the rates started to change right out of the gates of 2024, the trend was unmistakable and led me to believe the CPI has a good chance of coming in hot. Why? Well, the US bond market is the deepest and most liquid market on the planet, and this uptrend is merely mapping the wisdom of the crowds. These untold millions of investors from mom and pop to the Central Bank of China, the PBOC are putting their money at risk. That was enough for me. I know you all here constant messaging not to even try to trade the market because it’s impossible to tell where the market is going beforehand. Honestly, sometimes that is true, most of the time the market goes up. Sometimes, at crucial points, the market is knowable, it takes work, and knowing where to look.

We do our best to intuit where the market is going.

Part of what I do on the daily with my members is to monitor what I consider indicators that measure investor enthusiasm for stocks. I always have my eye on a variety of economic data, even when the market shows no sign of instability. I reflexively watch them, even if there is a hint that there is movement toward instability. Two important measures made themselves plain were the VIX, which started moving the Friday before last, and the 10-year Bond, which I shared will influence trading once it rises above 4.19%. The move on interest rates came powerfully forward during the CPI economic data reveal. The 10-year leapt to 4.31% and only retreated a bit until Friday’s PPI report. Neither data revealed was supportive of a rapidly retreating inflation, in fact, inflation remains stubbornly high. Core CPI experienced a 0.4% rise in January, core CPI accelerated 3.9% year-over-year. PPI was also not comforting for our inflation fears. The PPI Producer price index increased 0.3% in January, the highest move since August 2023. PPI rises 0.9% year-on-year, PPI excluding food, energy, and trade jumps 0.6%.

Even before the rise in interest rates began, or we saw the inflationary data from CPI and PPI, the VIX started acting up, as I said, but let’s look at the VIX chart from CNBC.com.

CNBC

On Friday, the VIX jumped from 12.69 to 13.01, yes these are low numbers, I have learned to mind the delta. A 2.5% move might not seem like much, but it prepared me for further moves the following week. As you can see, on Monday before the CPI the VIX moved even higher, even as the S&P 500 remained elevated on Monday. Then on Tuesday, we saw the S&P 500, and the Nasdaq-100 dropped precipitously. The VIX moved in the opposite direction to nearly 18. It quickly reversed by Friday, it got as low as 13.75 before jumping back to 14.71 and closing at 14.24, The stock prices were more affected by the PPI than the VIX was showing. This could be influenced by options expirations which this past Friday February options expirations. In any case, I will keep monitoring the VIX but like before, the 10-year US Bond and its impetus to rise even further has captured my attention. I think my last article – Rate Cuts For 2024? How About None? Is None Okay For Stocks? could supersede at some point with, putting additional cuts back on the table. In fact, Larry Summers, the former Secretary of the Treasury under Bill Clinton, was quoted on Bloomberg’s Wall Street Week this weekend as calling for just that. Begin the discussion, for at least the possibility of a hike! I found this a bit shocking since many commentators are willing to dish off the hot numbers to seasonal adjustment issues. This makes for a fraught stock market this holiday shortened week, we have the Fed minutes to be revealed this Wednesday. While we saw the VIX retreat on Friday, I urge you to monitor the VIX this week, if it does begin to move higher, cut back on your risk taking. I haven’t spoken about the Cash Management Discipline, but now is the time to trim trading positions. Let me also introduce another major indicator and that is when the leading stocks, the once with the most beta, when they falter watch out!

Here are some charts I shared with my crew.

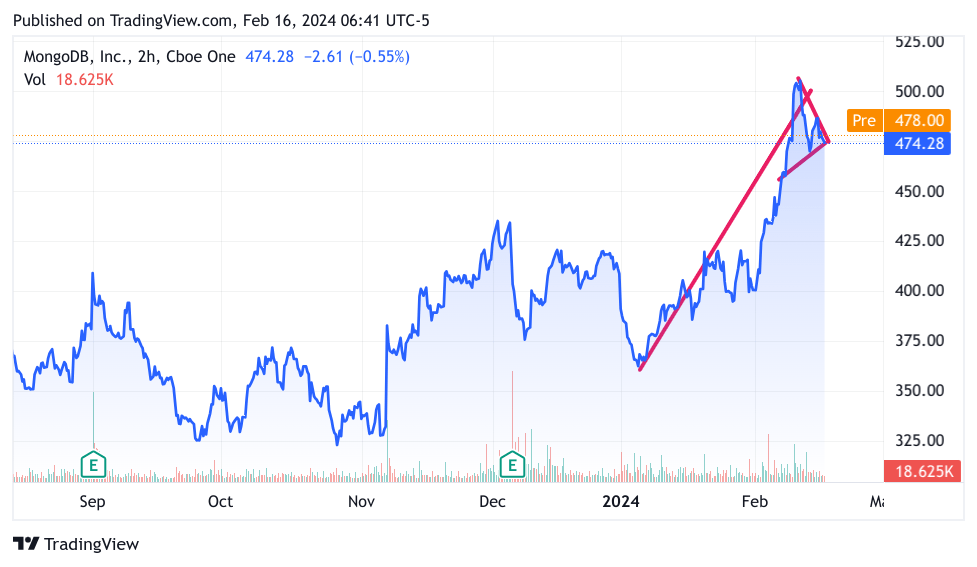

I created this chart of MDB Friday before the market opened at 6:41 am… My premise for surfacing this name was the sharp rise and then a sideways action that displayed a pennant formation. This pennant formation looked bearish to me.

TradingView

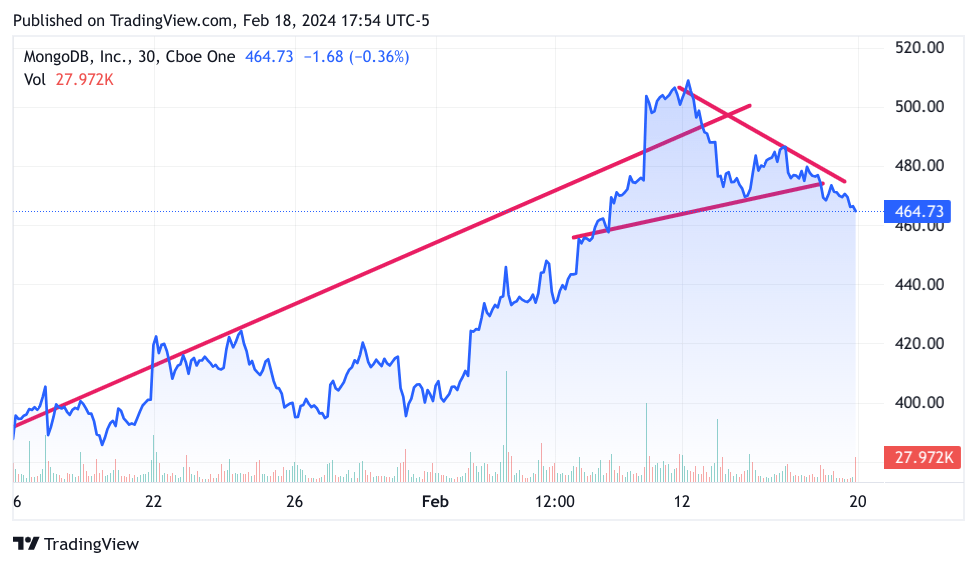

The next chart is the result after the market closed yesterday. The pennant was resolved to the downside. With more to come in my opinion.

TradingView

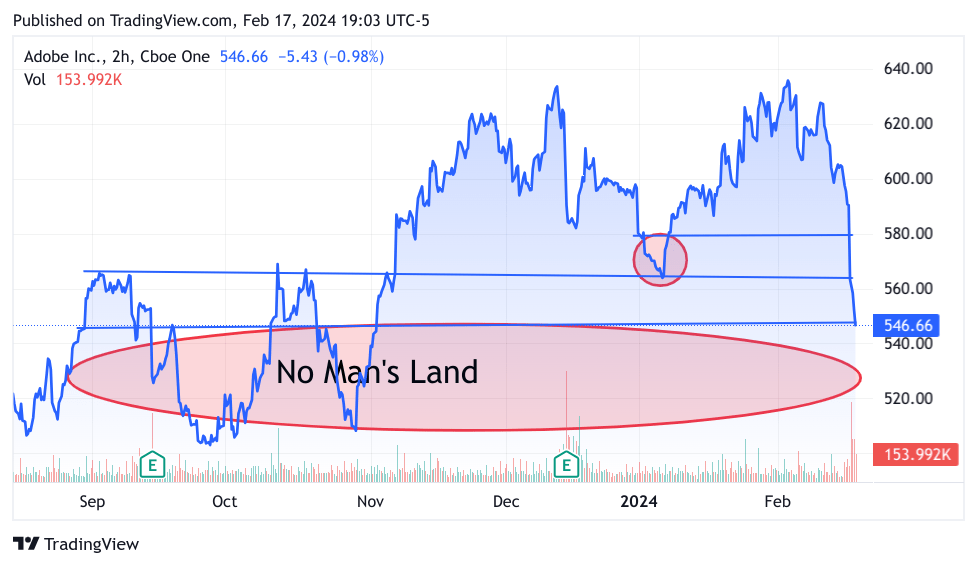

Another name that causes concern is Adobe (ADBE). I noted on Friday that if traders could take ADBE out on a stretcher, they can do it to any stock. Looking at the chart, the technical damage on this name is huge, and I am worried that if it doesn’t make a stand at this level, and further retreat will create more downside momentum as short sellers like vultures could come swooping in.

TradingView

The first oval was where I pointed out to my members, ADBE could fall if it didn’t hold 580. I figured somewhere in that space buyers would come in. Of course, I was wrong, now we are sitting on an even bigger vacuum of support. I have said that I wanted to wait for ADBE to base before getting in and I am glad that I held to that notion. The fundamental reason for the decimation of a great name like ADBE is that generative AI is going to destroy its business model. This is just nonsense, in fact, I can make the case for the exact opposite, at least for the next several years. The reason why I believe this is bullish for ADBE is that any marketing department will want to directly manage, edit and produce this video. More to the point, this is really no more than automated “story boarding”, and frankly, the more storyboards the more work for the marketing, advertising and media in all its forms. I am excited to buy ADBE when it settles down.

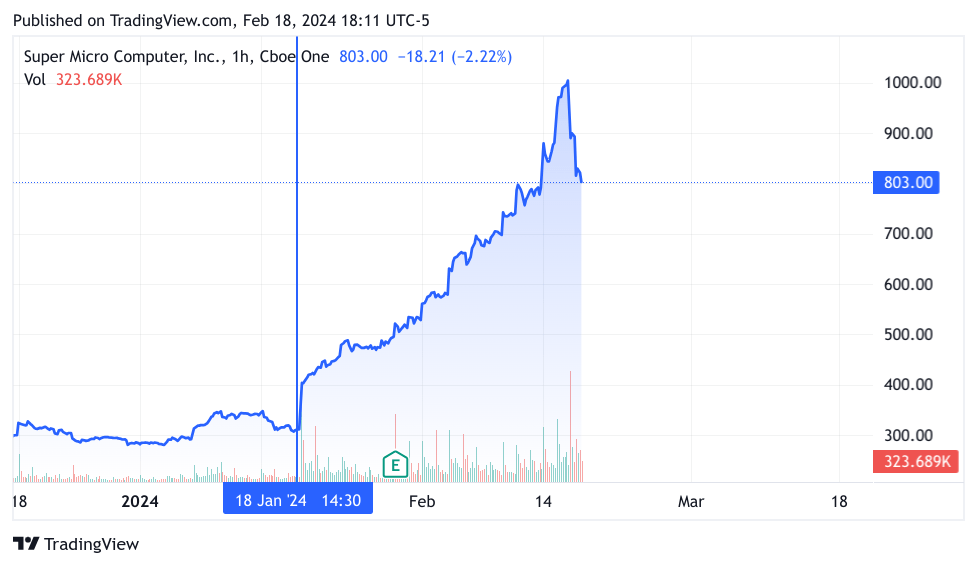

The biggest indicator and what it portends for this week is Super Micro Computer (SMCI)

I sat through yet another interview with the CEO of SMCI and I still haven’t heard one particle of difference between what their boxes can do that is different than Dell Computing (DELL) or Hewlett Packard Enterprise (HPE). Though I have been saying that for about 500+ points, so I have to approach this with some humility. Even so, the retreat on Friday was stunning, though not surprising, and there could be more for SMCI, but also I am afraid it foretells a similar fate for NVIDIA (NVDA). I know I will receive much blowback for this opinion, in fact, we hear that NVDA is a bargain at these prices because they own AI, chips, the software, everything. How dare I! Funny thing about the free market is customers don’t like to have one supplier. I digress, let’s take a look at SMCI. Here is a 2-month chart of SMCI.

TradingView

Exactly one month ago from today, SMCI was 300 per share. This past Friday the stock opened at 1045, reached 1077 and then crashed to 803 at the close. This was a classic bearish “key” reversal, meaning that it leapt straight up, then reversed, and closed below the prior day’s low. It did so in dramatic fashion, having gone above the high of the day before them plummeted 20%. I think this picture will live on in books about charting for quite a while.

I leave you with the obvious concern; wherefore Nvidia?

Part of me wants to get up on my soap box and lecture everyone about bubbles, Perhaps share how I lost a boatload in the Dot.Com implosion of 1999/2000 and connect the dots. I am not going to do that because this is a completely different era. Real things are being sold and clearly tremendous productivity is on the offer. Perhaps it is as big as the industrial revolution. I am too much of a curmudgeon to give in to that much credulity. No, this is not that. What it is that market participants are getting too manic and now stocks are getting taken out and shot behind the barn. So here’s the deal – unless NVDA has another super-dee-duper blow out earnings and revenue, but even more importantly, a higher guidance on revenue, then the stock has been bid up too high for now. That doesn’t mean it falls 200 points and it never exceeds the current 726. It probably does reach this level again. I do think the stock has a lot of consolidating to do in the meantime.

My Trades

So what am I doing? I have been sitting in some cash and hedging. I have Puts on the Chips ETF 3X (SOXL) for the chips like NVDA, I have Long Puts on the Russell small caps 3X ETF (TNA) which SMCI is a large component of, and I also have Puts on Tesla (TSLA), I am still long Affirm (AFRM), Boeing (BA), UiPath (PATH), Palantir (PLTR), and SentinelOne (S) all Long Calls all out to May or June. I am itching to get me some ADBE Calls.

Good luck friends!

Read the full article here