The Schwab High Yield Bond ETF (NYSEARCA:SCYB) is a relatively new high yield bond ETF which was launched in July 2023.

The fund stands out to do its extremely low expense ratio as well as a focus on the higher quality part of the high yield bond market.

Overall, I find SCYB to be a very high quality product offering. This is particularly true for investors who prefer a slightly lower risk high yield bond vehicle.

ETF Overview

SCYB was launched on July 11, 2023. The fund currently has total assets of ~$108 million and charges has a total expense ratio of just 0.03%.

SCYB is a passively managed fund which tracks the ICE BofA US Cash Pay High Yield Constrained Index. The index is well diversified as it caps issuer exposure at 2%.

Currently the fund is characterized by a 30-day SEC yield of 7.43% and an average yield to maturity of 7.65%.

Low Expense Ratio Is A Positive

Perhaps the biggest positive that SCYB has going for it compared to other high yield funds is its extremely low total expense ratio of just 0.03%. Comparably, other leading high yield ETFs have much higher fees. The largest high yield ETF, the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) charges a total expense ratio of 0.49%. Other large high yield funds include the iShares Broad USD High Yield Corporate Bond ETF (USHY), the SPDR Bloomberg High Yield Bond ETF (JNK), and the SPDR Portfolio High Yield Bond ETF (SPHY) which charge expense ratios of 0.08%, 0.40%, and 0.05%, respectively.

Given the fact that all of the ETFs mentioned above are passive, one might wonder why two of the largest ETFs, HYG and JNK are able to charge much higher fees. One reason for this is that these ETFs were among the earliest high yield bond ETFs and have grown to become large funds which can offer superior liquidity vs smaller funds. However, the liquidity benefit due to owning a larger ETF is much less relevant to retail investors who tend to have smaller trades sizes compared to institutional investors.

One of the ways in which new ETFs try and enter a crowded space is by offering a lower fee, which is exactly what Schwab has done in this case with SCYB.

I view SCYB’s low fee as a key advantage vs other passive high yield funds though USHY and SPHY also offer very similar fees.

Historical Performance & Holdings Analysis

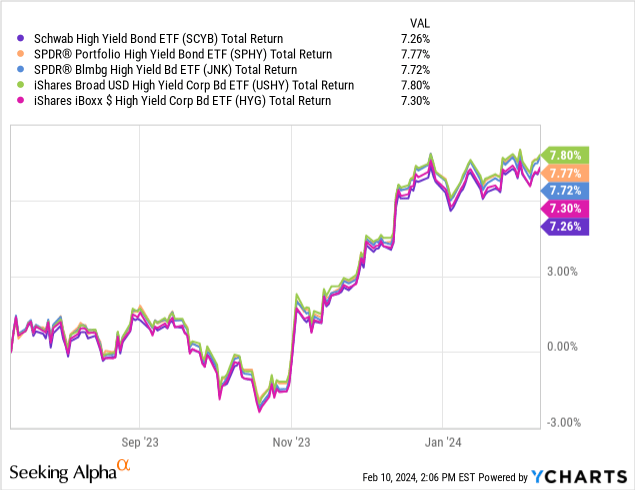

As shown by the chart below, since inception, SCYB has delivered a total return of 7.26% which ranks worst among peers though dispersion amongst the group has been fairly low.

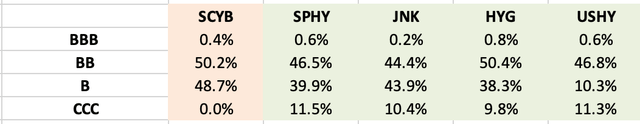

I believe the biggest driver of SCYB’s underperformance is the fact that its exposures are tilted more towards the higher quality part of the high yield bond market as it does not hold any CCC rated bonds. As shown by the comparison table below, SPHY, JNK, HYG, and USHY all hold ~10% CCC rated bonds.

Aside from this notable credit quality difference, SCYB’s portfolio characteristics are fairly similar to peers. The fund has an effective duration of 3.3 years. Comparably, SPHY, JNK, HYG, and USHY have durations of 3.2 years, 3.2 years, 3.3 years, and 3.4 years, respectively.

Generally speaking, CCC rated bonds tend to be riskier than BB or B bonds and offer a higher credit spread. To get a sense of the impact that even a small allocation to CCC rated bonds can have on a high yield portfolio consider that USHY has an average yield to maturity of 7.84% compared to SCYB which has an average yield to maturity of 7.65%.

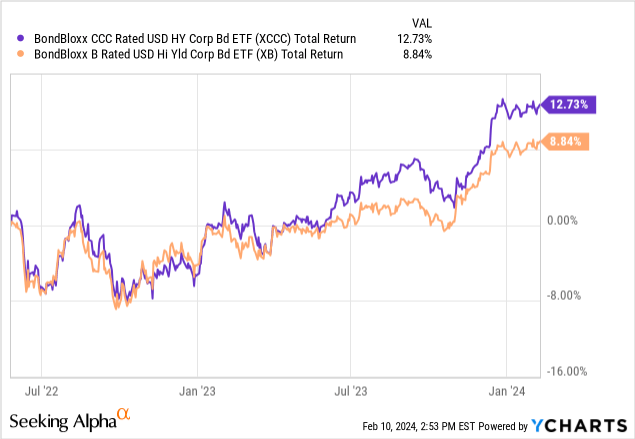

Another way to get a sense of the potential impact rated to CCC exposure is to compare performance of two recently launched ETFs: the BondBloxx B Rated USD High Yield Corporate Bond ETF (XB) and the BondBloxx CCC Rated USD High Yield Corporate Bond ETF (XCCC) which both launched in May 2022. Since then, XCCC has delivered a total return of 12.7% while XB has delivered a total return of 8.84%.

Author

Is More CCC Exposure A Better Way To Play High Yield?

Given the chart above, one might wonder if SCYB is at a disadvantage relative to peers due to its lack of CCC exposure. I don’t necessarily believe that to be the case.

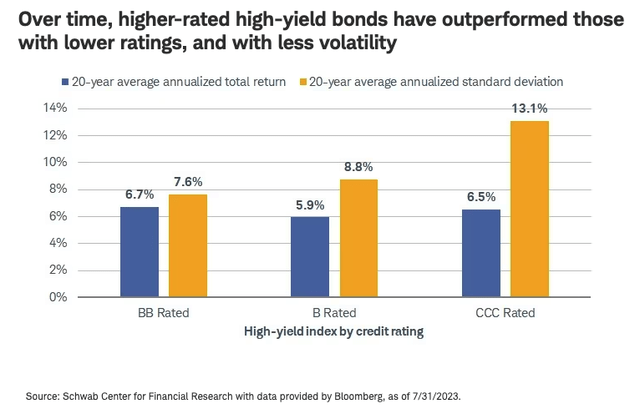

While CCC bonds tend to offer higher returns than BB or B rated bonds, they tend to come with more risk on average. There are certainly individual CCC rated bonds which have similar risk or are less risky than B rated bonds but generally speaking that is not the case.

As shown by the chart below, CCC bonds have experienced a much higher volatility than BB or B rated bonds. While CCC bonds appear to have delivered better returns than B rated bonds over the past 20 years, they have not done so on a risk adjusted basis.

For this reason, I do not believe that holding CCC rated bonds as part of a high yield portfolio is a better way to get exposure to the market segment vs avoiding them. This is particularly true for investors concerned more with risk adjusted returns as opposed to simply maximizing total return potential.

Charles Schwab

CCC vs B Credit Spreads

While I have a structural bias against owning generic CCC bonds for the reasons noted above, it is also important to consider current market dynamics.

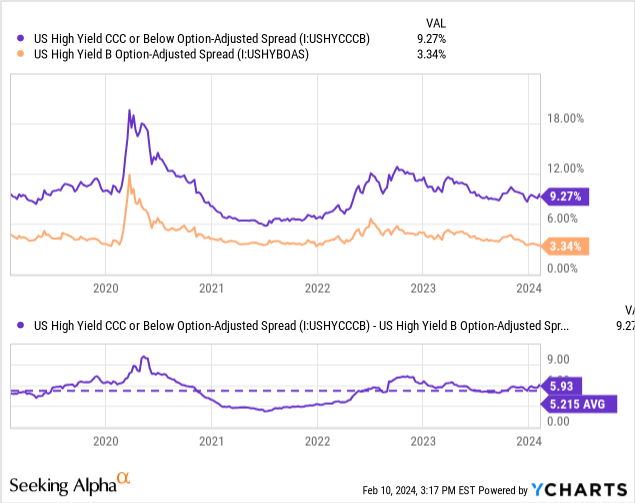

As shown by the chart below, CCC credit spreads are just modestly wider than their historical averages vs B credit spreads. I do not view this level of additional spread compensation vs historical averages to be highly appealing given the long-term data noted above.

Conclusion

SCYB is a recently launched high yield bond fund which stands out due to its low fees and focus on the higher quality part of the high yield bond market.

While the fund does not have a long-performance history, it has slightly underperformed other high yield ETFs thus far. I believe the reason for this is that SCYB lacks exposure to CCC credits which have offered better returns of late given the positive risk on environment.

Historical evidence suggests that while CCC rated bonds may offer better returns than B rated bonds, they tend to do so with much more volatility. Thus, in the event of a substantial risk off event I would expect SCYB to outperform peers which tend to have ~10% exposure to the CCC segment of the high yield market.

I rate SCYB a Buy as I find the mix of low fees and a focus on the higher quality part of the high yield sector attractive. I would view SCYB less attractive on a relative basis if the credit spread on CCC rated corporate bonds vs B rated corporate bonds were to widen substantially from current levels.

Read the full article here