Manulife Financial Corp (NYSE:MFC) is a great income investment in the financial sector, due to an attractive dividend yield and strong business fundamentals, plus a valuation that seems to be undemanding for the company’s profitability level.

Business Overview

Manulife is a Canadian life insurance company, providing financial protection and investment management services to its customers. It has operations in Canada, the U.S., and Asia, plus reinsurance operations across the globe. The company is one of the 10 largest life insurance companies in the world, and its current market value is about $40 billion.

It has more than 40,000 employees, serving some 34 million customers through several sales channels, including distribution partners, while its assets under management and administration were above $1.3 trillion at the end of last September.

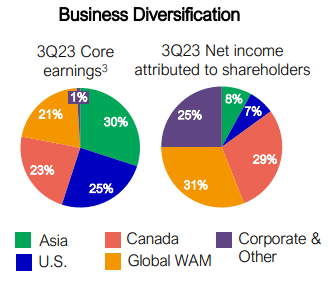

Manulife has a good business diversification, with its earnings being well spread across its operations in Canada, the U.S, Asia, and wealth and asset management, as shown in the next graph.

Business diversification (Manulife)

Regarding its business growth, Manulife has a very good history and its growth prospects are also quite good, supported especially by Asia and wealth and asset management. The company’s strategy is to focus on organic growth by providing a good customer service, aiming to use digitalization to improve its offerings and customer service in a sustainable way.

While its business was negatively affected by the pandemic, Manulife has been able to optimize its business profile in recent years, which had positive capital benefits. This has allowed Manulife to invest in other growth areas, namely in Asia, and to further invest in technology to improve its operating efficiency.

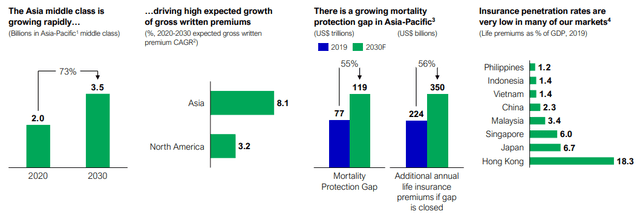

Regarding growth, the company is well positioned to benefit from several structural trends, such as aging global population, rising middle-class in Asia, and digitalization. Moreover, insurance penetration is relatively low in most Asian countries where Manulife is present, boding well for industry growth over the next few years, being a strong support for the company’s business growth in this region.

Asia Growth (Manulife)

In developed markets, an aging population is a secular trend supporting demand for its retirement and asset management solutions, being a supportive backdrop for its operations in North America and Europe. Indeed, a large part of its AuM in the Global Wealth & Asset Management division is related to retirement, being a distinctive factor to other competitors that usually are more exposed to retail or institutional clients.

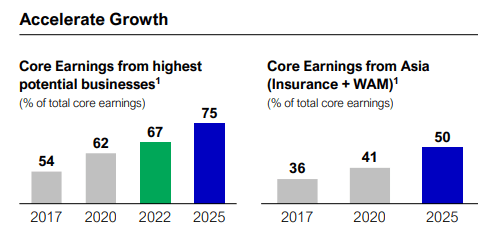

Going forward, its strategy is not expected to change much, being focused on growing organically in its current businesses, while further selective use of M&A is not ruled out if the opportunity arises. Regarding its main financial targets, Manulife aims to achieve a higher contribution of earnings from higher potential businesses and from Asia and Global WAM, as shown in the next graph, plus reduce its expense ratio to below 50% and achieve core EPS growth of 10-12% and a return on equity above 13% in its core operations.

Key targets (Manulife)

Financial Overview

Regarding its financial performance, Manulife has a very positive track record, with the exception being 2020 when its business was hit by the pandemic and higher mortality rates than expected. Since then, it has reported strong growth, showing that Manulife has strong fundamentals and positive operating momentum.

In 2022, it reported positive financial figures, with the value of new business up by 25% in the U.S. and 18% in Canada, while in Asia its performance was more subdued due to Covid restrictions in China and Hong Kong. Additionally, weaker capital markets also impacted its investment return, leading to lower core earnings in the year (-7% YoY to nearly CAD $6.2 billion), while its net income increased by 2.7% YoY to CAD $7.3 billion, reaching a new record high. Its return on equity (ROE) ratio, a key measure of profitability in the insurance sector, was 14.1%, which is a very good level of profitability compared to peers.

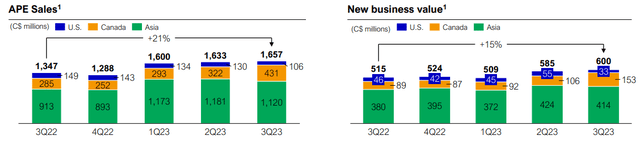

During the first nine months of 2023, Manulife has maintained a good operating income, reporting strong business and earnings growth. In Q3 2023, Manulife’s APE sales and new business value increased at 21% YoY and 15% YoY, respectively, driven by strong growth in Asia.

Sales (Manulife)

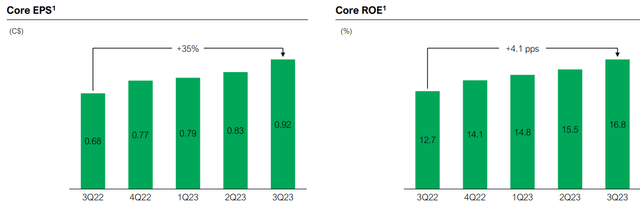

In the global wealth & asset management unit, Manulife was able to report positive net flows during 9M 2023, being also supportive of earnings growth, while higher interest rates were a tailwind for investment return. On the other hand, the inflationary environment led to higher operating expenses, but this was not enough to offset strength across the business leading to strong core earnings growth and a level of profitability (16.8% in Q3) above its medium-term target of more than 15%.

Earnings (Manulife)

The company also seems to be on track to reach its goals of generating more earnings from its highest potential businesses and reach about 50% of its core earnings from Asia by 2025.

To optimize its portfolio and reduce its exposure to legacy business, Manulife entered into another reinsurance transaction back in December, amounting to $13 billion of reserves related to Long-Term Care insurance policies, implying a valuation of 1x book value, both in the U.S. and Japan.

This transaction led to a capital release of CAD $1.2 billion, which the company plans to return to shareholders through share buybacks. This is in-line with its strategy over the past few years to reduce risk from legacy products, which cumulatively have reduced Manulife’s capital by about CAD $10 billion since 2017 and have been an important driver of higher profitability in recent years.

Moreover, the weight of LTC insurance and Variable Annuities has been reduced from 24% in 2017, to 11% nowadays, showing that Manulife has made a clear effort to reduce legacy risk and allocate capital toward higher-growth operations, boding well for its growth prospects and profitability in the future.

Regarding its balance sheet, Manulife has a strong position and its financial leverage is at moderate levels, thus it does not need to retain much earnings and can provide an attractive shareholder remuneration policy.

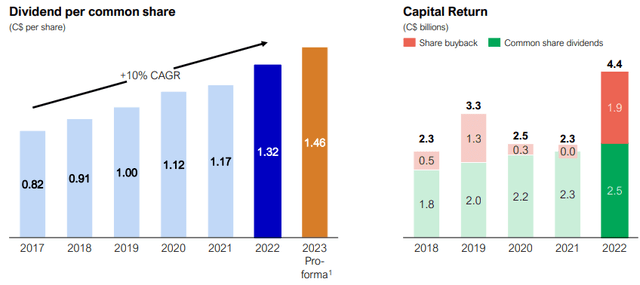

Indeed, one of Manulife’s most attractive features of its investment case is its dividend history and capital return policy through share buybacks, as the company has delivered a growing dividend and has made several stock repurchase programs in recent years, as shown in the next graph.

Capital returns (Manulife)

While its dividend has grown at double-digit growth rates over the past few years, its dividend payout ratio is quite conservative, as Manulife’s payout range is to be between 35-45% of earnings, which means its dividend is clearly sustainable over the long-term. Its current quarterly dividend is CAD $0.365 per share, or CAD $1.46 per share annually, which represents an annual increase of 11% compared to the previous year. At its current share price, Manulife offers a dividend yield of about 4.8%, which is quite attractive to income-oriented investors.

This yield is quite interesting and is expected to increase in the next few years, given that according to analysts’ estimates, Manulife is likely to maintain a growing dividend path ahead. Its dividend is expected to increase to more than CAD $1.70 by 2026, or about 5% annually over the next three years. Considering Manulife’s dividend growth history and its good business growth prospects, these expectations seem to be somewhat conservative and the company seems to have some room to beat current estimates over the coming years.

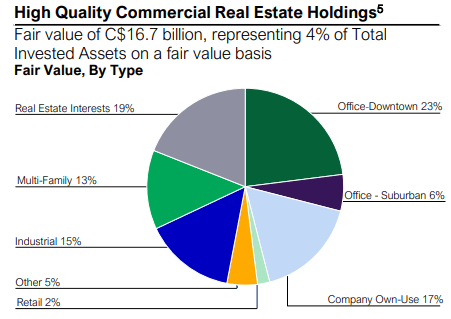

Regarding its investment allocation, Manulife’s portfolio is well diversified and is mostly exposed to low-risk bonds and mortgages, while equities represent some 6% of its total investment portfolio and real estate (RE) represents 3%. This means that while investors are increasingly concerned about commercial real estate exposure, Manulife is not significantly exposed to this risk, plus within its corporate bond portfolio REITs/ real estate only represents 4% of corporate exposure.

Within real estate exposure, the area that is showing more weakness currently is office, which has a weight of about 29% in the RE portfolio, representing a total amount of CAD $4.8 billion. Within real estate, its largest investment region is Toronto, followed by Los Angeles/San Diego, and Boston, while other regions which have shown more weakness recently, such as San Francisco or New York, have smaller weights and therefore I’m not expecting significant losses for Manulife from its RE portfolio.

CRE (Manulife)

Conclusion

Manulife has strong fundamentals and good growth prospects, as the business is considerably exposed to Asia and global wealth and asset management, having therefore an attractive business profile over the long term within the insurance sector.

Moreover, its dividend yield of 4.8% is quite attractive and its shares are currently valued at 1.3x book value, which seems undemanding for a company that has a ROE above 15%, making it a great income investment right now.

Read the full article here