One of the nine companies that I currently own shares in is The Charles Schwab Corporation (NYSE:SCHW). As of this writing, the company is my smallest holding, making up only 4.1% of my portfolio. But that doesn’t mean that I don’t have a tremendous amount of faith in it.

Earlier this year, because of the banking crisis, the business came into focus and some investors had doubts about the stability of the enterprise. But given the nature of the operation, how diverse its business model is, and relying on data that has come out since then, I have been incredibly bullish. And on May 12th, the management team at the company revealed even more reasons why investors should be optimistic about the firm moving forward.

Solid data

The past couple of months have been really hard for shareholders of Charles Schwab from a share price perspective. Since the end of February, which was right before the banking crisis began, shares of the enterprise have fallen 37.2%. That’s a massive decline and underscores just how worried about the business investors and market watchers are. But at the end of the day, it’s not the concern that investors have that matters. Rather, it’s the data that is reported by management that ultimately determines how things are going. And when that data is solid, investors should use the low share price of the business as an opportunity to buy in or to increase their stake in the company.

Author – Charles Schwab Data

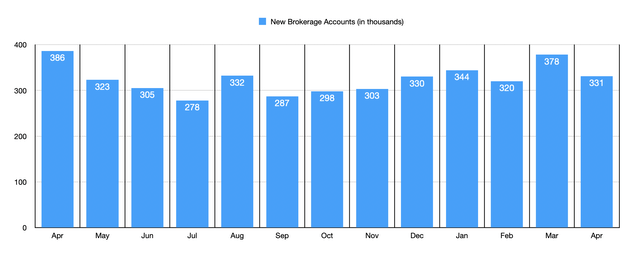

The most recent data provided by management that is noteworthy came out on May 12th. This was in the form of the monthly activity report that management comes out with every month. At top of mind, at least for me, was the account data provided by management. During April, the company reported an additional 331,000 brokerage accounts being opened on its platform. This falls nicely in the typical range for the company over the past several months. For context, this number in March was 378,000. Back in April of last year, it totaled 386,000. For those worried that the most recent reading might indicate a weakening in the company’s value proposition, keep in mind that, from April of last year through April of this year, 9 different months had new brokerage account additions lower than what the company achieved last month.

Author – Charles Schwab Data

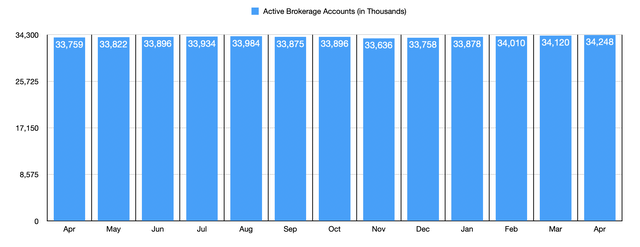

Actual active brokerage accounts were a slightly different story. This number also rose, but the increase was less than the 331,000 reported. For the month, the company had 34.25 million active brokerage accounts on its platform. This was 128,000 above what it was in March of last year and represented an increase of 489,000 compared to April 2022. In fact, the number reported for April was the highest on record for the company. No matter how you stack it, that’s a positive outcome for shareholders. The number of banking accounts for the company also hit a high of just under 1.76 million. That compares to the 1.75 million reported one month earlier and the 1.65 million reported in April of last year. It’s also worth noting that the company recorded 530,700 customers receiving what management calls “investor services” during the month. That’s up from the 526,200 seen one month earlier and compares nicely to the 509,300 reported in April of last year. Meanwhile, the number receiving ‘advisor services’ grew to 3.39 million. This number was 3.37 million one month earlier and stood at 3.19 million in April of 2022.

Author – Charles Schwab Data

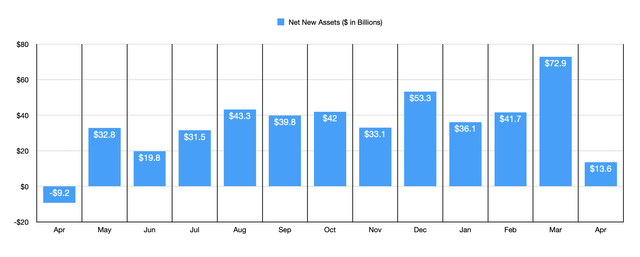

We should shift some at this point to the assets the company holds. There are two different measures of changes to the assets on the company’s books. The first and more volatile is what management calls new market gains or losses. This is largely associated with returns or losses experienced in accounts based on fluctuating security prices. In April, this was only $37.9 billion. But considering this number fluctuates significantly with market conditions, I don’t have any qualms on this.

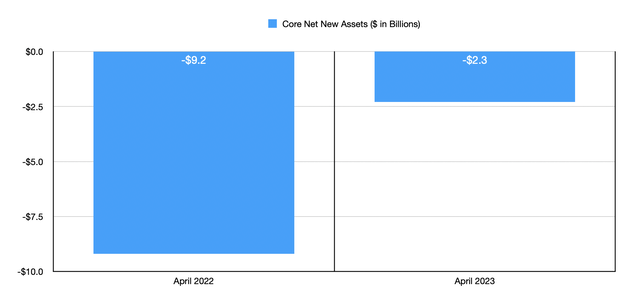

More important in my eyes would be the net new assets they have come onto the platform. After a massive haul of $72.9 billion in the month of March, the company experienced a net inflow of $13.6 billion in April. While this is smaller than the typical $20 billion to $50 billion that the company historically achieves, it’s not unexpected. In fact, in April of last year, the company saw a net outflow of $9.2 billion. Management attributes the weakness in the month of April to its clients taking out capital in order to pay taxes. This makes a tremendous amount of sense. There is a separate measure of this called core net new assets. This basically adjusts for large acquisitions and other one-time events. The company unfortunately did see a net outflow of $2.3 billion for the month. But again, that was better than the $9.2 billion in outflow reported one year earlier.

Author – Charles Schwab Data

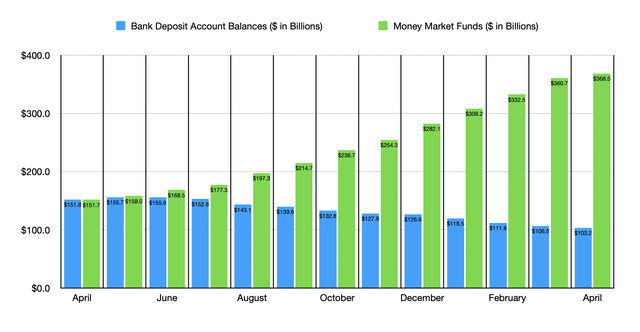

This is not to say that everything was perfect for the company. The big weak spot that some might point to is the sum of the bank deposit accounts that the company has on its books. This number came in during the month of April at $103.2 billion. That’s down from the $106.5 billion reported in March and down from the $151.8 billion reported in April of 2022. In fact, this metric has declined every single month since hitting $155.7 billion in May 2022. Though this may seem disconcerting to some, this is likely being driven by clients looking for more attractive returns by allocating their capital in other ways. We can actually see this reflected in the money market funds that Charles Schwab controls. In April of last year, the business had $151.7 billion in money market funds. By March of this year, that number had ballooned to $360.7 billion. And last month, it grew further to $368.5 billion.

Author – Charles Schwab Data

Takeaway

Although some investors will point out the declining bank account figures, I would argue that, on the whole, The Charles Schwab Corporation is doing really well for itself. The total value of its assets came in at $7.63 trillion for the month of April. This was up nicely from the $7.58 trillion reported in March, and it’s up from those $7.28 billion reported for April of last year. Almost all The Charles Schwab Corporation metrics that matter are continuing to grow and, I would argue, the business is healthier than it was even a year ago.

Given how this data looks and how much shares have fallen in recent weeks, I cannot help but rate The Charles Schwab Corporation a “strong buy.” I likely will use some incoming capital to increase my stake in the company a bit more.

Read the full article here