The signs of historically weak overseas investment in China are everywhere. And not just in the traditional sense of FDI — or foreign direct investment — inflows, though those are at record lows.

Demand for Chinese goods is weak. Foreign companies continue to shift parts of their supply chains elsewhere. Even student exchanges and tourist visits are tumbling.

There are many reasons, but they circle back to two main ones: China’s economy remains weak, and foreigners no longer feel safe in the country, financially or personally.

“Even the number of students going to China has cratered. More than 11,000 Americans studied in China in 2019. That number has fallen to a mere 350 this year, according to the U.S. Embassy in Beijing.”

But, first, how bad is the foreign exodus exactly? The short answer: very bad.

Last month, observers expected Beijing to announce weak inbound FDI numbers — but even the pessimists were shocked.

Direct investment liabilities — a gauge of FDI that includes foreign businesses’ retained earnings in China — hit an $11.8 billion deficit for the July-through-September period, according to the State Administration of Foreign Exchange. It was the first such quarterly deficit China has ever recorded.

From the archives (October 2023): Chinese stocks have erased 4½ years of gains as foreign investors flee at record pace

Most analysts blamed “de-risking,” but additional factors made matters worse.

“Foreign firms operating in China are not only declining to reinvest their earnings but — for the first time ever — they are large net sellers of their existing investments to Chinese companies and repatriating the funds,” said Nicholas R. Lardy, a nonresident senior fellow at the Peterson Institute.

As Goldman Sachs observed, “With interest rates in China ‘lower for longer’ [and] interest rates outside of China ‘higher for longer,’ capital outflow pressures are likely to persist.”

“Listings of Chinese companies on U.S. markets have plummeted at nearly unbelievable levels.”

U.S.-China tensions are partly to blame, making investors more cautious.

But Beijing has also closed foreign consultancy and due-diligence firms, which are vital for potential investors and foreign companies to understand risk and other corporate and policy factors before making investment decisions.

It didn’t help that these crackdowns took the form of authorities raiding the China offices of multiple U.S. firms, including Mintz Group and Bain & Co., and detaining local staff.

Chinese companies listed overseas also aren’t raking in the level of stock purchases they used to.

Offshore listings of Chinese companies in U.S. markets have plummeted at nearly unbelievable levels. In 2021, 34 Chinese initial public offerings in the U.S. raised $12.6 billion. Last year, that had nosedived to $468 million from 14 IPOs.

See: Shein’s IPO faces frosty reception in Washington

Also: PDD’s stock rockets as Temu parent crushes estimates, sees revenue nearly double

The reasons include regulatory uncertainty and weak performances from Chinese companies at home.

The Western chorus advising firms to “de-risk” their supply chains from China has grown all year. It got so bad that on Tuesday that Vice Premier Li Qiang struck back.

“We are willing to build closer production and industrial supply-chain partnerships with all countries,” Li told the first China International Supply Chain Expo, adding that foreign firms need to be “more wary of the challenges and risks brought about by protectionism and uncontrolled globalization.”

Don’t miss: How digitized supply chains can help cut waste and CO2 emissions

Also: White House claims credit for lower inflation as Biden convenes supply-chain council

Even the number of students going to China has cratered. More than 11,000 Americans studied in China in 2019. That number has fallen to a mere 350 this year, according to the U.S. Embassy in Beijing.

China is attempting to stanch these outflows — sometimes desperately.

In August, China announced a 24-point plan to attract foreign investment and improve the country’s business environment, particularly in key sectors, such as tech and biomedicine. China said it would “expand channels for foreign capital inflows” for eligible foreign investors,” but gave few concrete details.

As foreign investment continued to shrink, officials made more overtures.

From the archives (June 2023): Foreign companies are shifting investment out of China, business group says

Don’t miss: India, Vietnam and Mexico are picking up the pieces of China’s broken economy

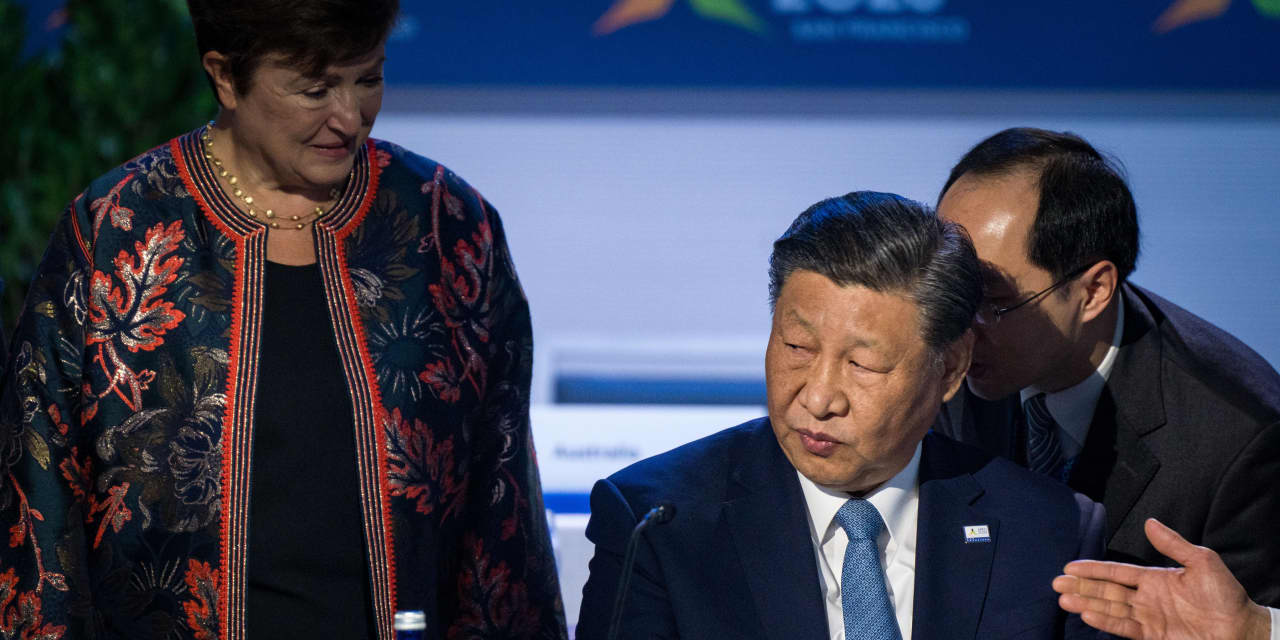

At the recent APEC summit in San Francisco, President Xi Jinping himself addressed the issue. “We will further shorten the negative list on foreign investment and fully ensure national treatment for foreign investors,” he said.

China will also improve policies to help foreigners’ entry and stays in China, including removing barriers in financial, medical and digital payment services, he said, again without supplying many details.

See: Apple’s iPhone 15 still sees strong demand, especially in China, analyst says

The problems are too big and China’s remedies too small to make a substantial difference, said Peter Petri, a professor of international finance at Brandeis University.

“Uncertainty about U.S.-China relations is the reason many U.S. companies are pulling out of China, and turning that around will take years of a generally positive environment,” he said. “None of this will solve China’s immediate short-term economic challenges.”

Tanner Brown covers China for MarketWatch and Barron’s.

More dispatches from Tanner Brown:

U.S. businesses operating in China are confused and worried. Here’s why.

China’s property woes offer a window into the demise of the country’s boom times

Walmart keeps head above water in China as local supermarkets eat themselves alive

China’s economy is suffering, and consumers won’t open their wallets — except to see movies

China’s youth job market is a nightmare. It’s changing the face of the country.

Read the full article here