T-Mobile US, Inc. (NASDAQ:TMUS) has just released its Q4 and FY 2023 earnings results as Seeking Alpha has covered here. The stock is down about 2% after hours as the market is digesting the result as well as FY 2024’s guidance. My previous coverage on T-Mobile was in September 2023, when I rated the stock a “Hold” but supported the company’s ability to reward shareholders in the form of both buybacks and dividends. Since then, the stock has gained about 16% compared to the market’s 10% run.

With that background out of the way, let us now review The Good, The Bad, and The Ugly, from the report.

The Good

- After 9 consecutive revenue misses, T-Mobile finally turned the tide as it beat Q4’s revenue estimates by about 4%. The $20.48 billion in Q4 2023 is the highest since December 2021 and marks at least the fourth consecutive Q4 in which T-Mobile crossed $20 billion in revenue.

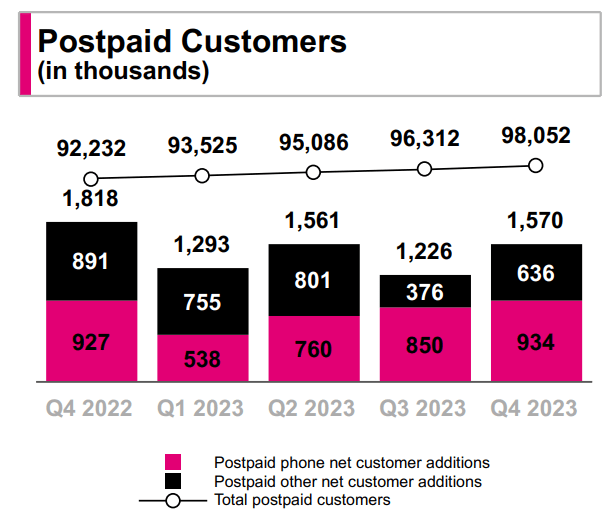

- The term “industry-leading” was found 16 times in the company’s Q4 press release. If there is one thing T-Mobile cannot be faulted with right from its days under John Legere till now, it is about being modest. The company has worked on its aggressive growth plans and has delivered on those time and again with industry-leading growth in postpaid additions and high-speed internet additions, along with the lowest postpaid phone churn rate. The company has also guided for postpaid net customer adds to come in between 5 and 5.5 million, which should make T-Mobile an industry leader in this category for the 10th consecutive year. On a YoY basis, T-Mobile showed a 6% growth in total postpaid customer count.

TMUS Postpaid Customers (investor.t-mobile.com)

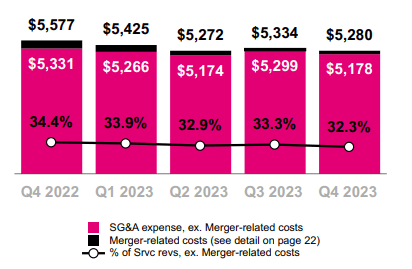

- Although revenue jumped just 1% YoY in Q4, T-Mobile appears to have operated with great discipline in Q4, as selling and general expenses went down by more than 5%. Let’s evaluate in the sections below as to what may have contributed to the EPS miss despite revenue jumping up and cost going down.

TMUS Expenses (investor.t-mobile.com)

- At the end of FY 2023, T-Mobile has 1.19 billion shares outstanding, which is a reduction of 3% compared to FY 2022. The company paid about $750 million to shareholders in the form of dividends in Q4. Annualizing that, T-Mobile would need about $3 billion in free cash flow to meet its dividend commitment to shareholders. T-Mobile has guided for 22% growth in adjusted free cash flow or about $16.5 billion. These two factors give credence to my thesis that T-Mobile does indeed have the ability to reward shareholders in the form of both dividends and buybacks.

The Bad and The Ugly

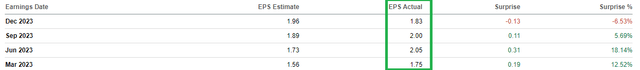

- This is like a flip-flop of the first point under “The Good” section above. After at least 15 consecutive quarters of beating EPS estimates, T-Mobile finally missed normalized EPS estimates by 13 cents to come in at $1.83/share. That means T-Mobile earned $7.63/share in FY 2023, giving its stock a rich trailing multiple of 21.

TMUS EPS (Seekingalpha.com)

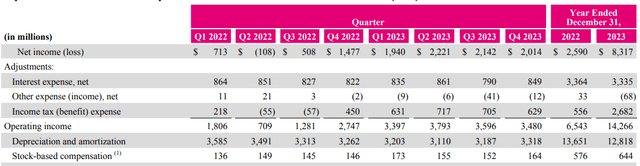

- Investors may recall that T-Mobile slashed its workforce by 7% in August 2023, which means the recently reported Q4 was the first full quarter post these cost savings. The fact that T-Mobile missed EPS estimates raises profitability concerns (against expectations) as pointed out here by Seeking Alpha. Stock-based compensation went up nearly 12% YoY for FY 2023, which brings into question the real impact of the buyback program. Don’t get this wrong, I welcome any buyback, but we need to scrutinize dilution-offsetting buybacks.

TMUS SBC (investor.t-mobile.com)

- While T-Mobile is still leading in many metrics, as it rightly pointed out in its report, future growth expectations may need to be tempered. It is worth noting that T-Mobile guided both EBITDA and net cash from operations at the midpoint of the expected guidance range. This makes me call into question the optimistic growth rate expectations into 2027 and hence the stock’s valuation as well.

TMUS EPS Estimate (Seekingalpha.com)

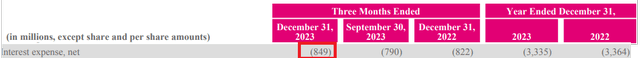

- Finally, T-Mobile’s long-term debt went up 7% YoY to finish FY 2023 with nearly $70 billion. Although this is just about 40% of the company’s market cap now, history says it is quite easy for Telecom companies to accumulate debt quickly. For example, AT&T (T) currently has $148 billion in net debt, which is $25 billion more than its entire market capitalization. Back to T-Mobile’s Q4, high-interest expense also played a role in reducing the profit margin as interest expense went up 3% YoY to reach nearly $850 million.

TMUS Interest Expense (investor.t-mobile.com)

Conclusion

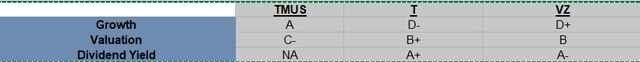

T-Mobile’s 2023 had enough strong points to convince me that it is perhaps the best among the “Big 3” telecommunication stocks to own if one is looking for growth at a reasonable price, as evidenced by its “Growth” rating on Seeking Alpha, in comparison to AT&T and Verizon Communications Inc. (VZ). T-Mobile’s past investments in 5G are having a dual positive impact these days in terms of growth as well as reduced expenses. However, being the best of a bad lot does not make TMUS stock a convincing investment here. At more than 20 times forward earnings, the stock is not cheap enough (C- rating for TMUS compared to B+ for T and B for VZ) nor does it boast the high yield that its close competitors do. Hence, I am sticking with my “Hold” rating on the stock, as I believe the post-earnings sell-off is likely to present better buying opportunities down the road.

Big 3 Comparison (seekingalpha.com)

PS: Please note that even though SA does not have a rating yet for T-Mobile’s dividend yield, T-Mobile paid its first quarterly dividend in Q4.

Read the full article here