Topline

Loop Capital downgraded its stock rating for Google parent Alphabet from a buy to a hold in a buzzy Monday morning note to clients, throwing some cold water on last week’s boundless optimism for the Google parent’s future in the budding artificial intelligence sphere.

Key Facts

The boom in AI chatbots could cause “behavioral changes” that make users less likely to rely on traditional search engines, placing a “ceiling” on Alphabet’s valuation, Loop Capital analysts Rob Sanderson and Alan Gould wrote in a Monday note.

The strategists set a $118 target for Alphabet shares, a tick above the stock’s $117 price Monday and well below the $130 average analyst target for the stock, according to FactSet.

It’s the first downgrade for Alphabet since at least March 3, per Factset.

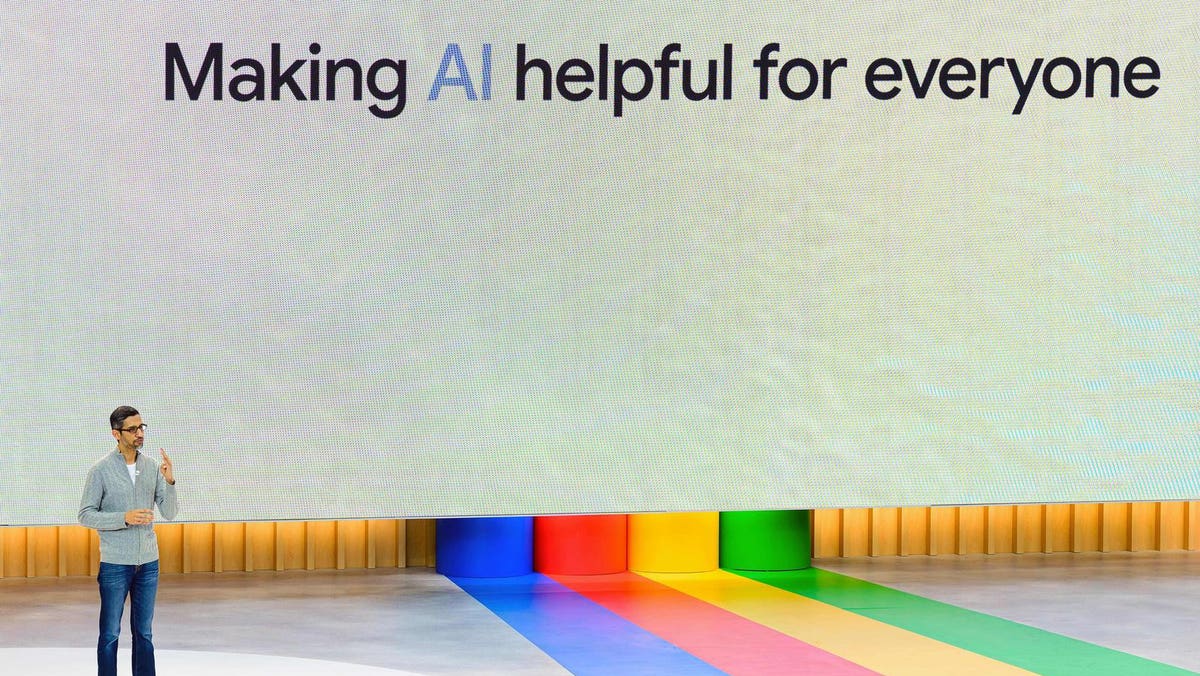

Shares of Alphabet tumbled as much as 1% in early Monday trading, moving against the tech-heavy Nasdaq’s slight gains, though the stock is still up more than 10% over the past week as investors cheered on the company’s Wednesday presentation outlining the incorporation of AI into various phases of its business.

Loop’s skepticism on Alphabet comes not from concerns about the oft-discussed gains made by Microsoft in the AI space but rather about how generative AI chatbots like Microsoft-backed ChatGPT call into question Google’s long-standing status as the primary gateway to the web, calling the shift among users a “competitive force against its dominance in connecting users to information.”

Surprising Fact

Even if AI caps Alphabet’s upside, it remains one of the largest companies on earth, with its $1.4 trillion market capitalization trailing only those of Apple, Microsoft and Saudi Aramco.

Contra

Google has “unmatched AI competencies” and “will be a major beneficiary of AI adoption over the long-term,” Sanderson and Gould clarified. That echoes the bullish sentiments expressed by many analysts following Google’s I/O developer conference; firms such as Bank of America, Goldman Sachs, UBS and JPMorgan reiterated their buy ratings for Alphabet in notes late last week.

Tangent

Sanderson and Gould published another note early Monday upgrading Meta’s stock from a hold to a buy, setting a $320 price target for the Facebook and Instagram parent, indicating 37% upside in what would be the stock’s highest price since January 2022. Shifting macroeconomic tides and faith in Instagram Reels and Meta’s AI push in advertising all serve as tailwinds for the stock, according to the strategists. Meta shares rallied 1% in early trading.

Google Insiders Are $9 Billion Richer After AI-Fueled Stock Rally (Forbes)

Google Adding AI To Search Engine For Some Users—Closing In On Microsoft’s AI Push (Forbes)

Google’s ‘Peacetime’ CEO Sundar Pichai Faces Criticism As The AI War Heats Up (Forbes)

Read the full article here