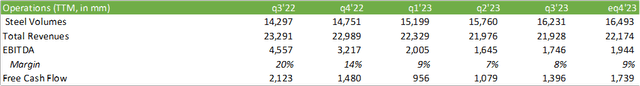

Cleveland-Cliffs (NYSE:CLF) experienced a flat Q3’23 on a TTM basis with revenue slightly down at $21,928mm. Overall, operations were expansive with EBITDA margin expanding slightly to 8%. Management remains prudent in maximizing shareholder returns by decreasing the firm’s debt levels and returning cash to shareholders through buybacks. As management anticipates a slight slowdown in direct sales to automotive and increased volumes to service centers at a higher price, I anticipate FY23 revenue to clear $22b with EBITDA at $1,944mm for an improved 11% margin and free cash flow to reach $2,400mm for an FCF yield of 21%. With this, I provide CLF a BUY recommendation with a price target of $28/share.

U.S. Steel (X) Merger Updates

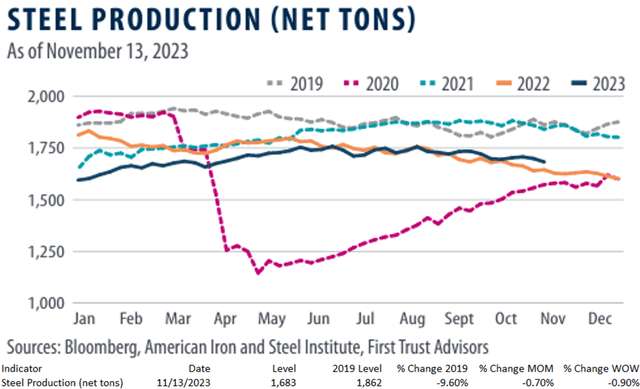

There has been some very mixed reception since Cleveland Cliff’s merger announcement with US Steel. Off the cuff, the United Steel Workers Union (“USW”) was highly supportive of the merger given Cleveland Cliff’s reputation with its employees. It has been more recently reported that the Alliance for Automotive Innovation suggested that the merger would increase costs in the automotive industry as well as slow down EV sales. Despite these statements, consumer demand for EVs has slowed down without a merger, suggesting the statements made by the Alliance for Automotive Innovation were in fact false and fabricated especially as Cleveland-Cliffs had been the only producer of electrical steel up until US Steel entered the market in the summer of 2023. In fact, steel production overall is currently down -9.6% from 2019 levels, as reported by First Trust.

First Trust

I understand the Alliance’s rationale in that the merger will create a domestic monopoly for blast furnaces in the US; however, what is being neglected is that steel is a global commodity. In total, the US imported 30mm net tons of steel in 2022.

The automotive business in the United States is extremely competitive. Automotive is an industry that every steel producer wants to serve. When we negotiate our annual deals, we are competing against offers from countless other suppliers, including Korea, Japanese, German, other European, as well as against Mexican joint ventures and Mexican trans-shipments. We also have seen growing competition from EAFs and the ongoing threats from aluminum substitution. There is no unfair advantage we have from that standpoint. The United States is, by far, the largest importer of steel in the world, importing more than 30 million net tons of steel in 2022, alone. No matter what change with the market structure of integrated blast furnace/basic oxygen furnace operations in the United States might happen, these competitive forces are there and will continue to be there.

– Lourenco Goncalves, Chairman, President, and CEO

Lastly, it is believed that new suiters have entered the bid for US Steel since Cleveland Cliff’s announcement. It is suggested that Temium, Nucor, Stelco, Steel Dynamics, Nippon Steel, and ArcelorMittal have entered the bidding process.

Operations

Management remains prudent in lowering costs throughout the end of the year and through FY24 with contracts in place for metallurgical coal and natural gas and is expecting the resulting cost reduction of $250mm and $150mm, respectively. Management is expecting costs to reduce by $15/net ton for Q4’23, resulting in a $165/net ton of cost savings since Q3’22. Though the UAW strike hadn’t impacted Q3’23 results, management expects the sales mix to shift down from automotive and into service centers as service center inventory has been drawn down and anticipated higher selling prices for steel as a result.

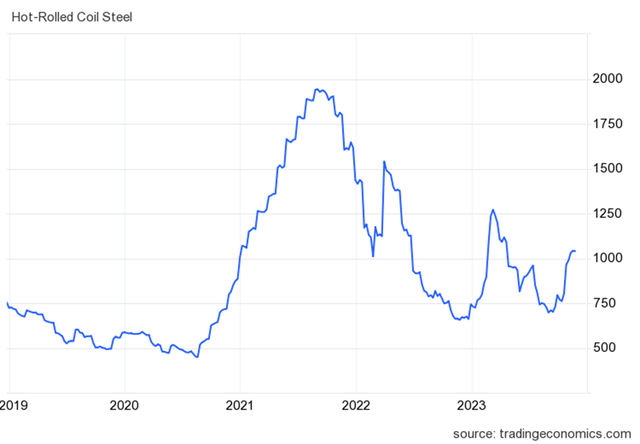

TradingEconomics

Despite the flat growth experienced in Q3’23, Cleveland-Cliffs experienced some margin expansion as cost-cutting efforts have proved to be effective. As management is expecting to continue this measure with an additional $15/net ton in cost reductions, I expect Q4’23 to close out with TTM EBITDA margin expanding to 9% along with a TTM 25% increase in free cash flow to $1,739mm.

Corporate Reports

My baked-in assumption is 4,100 net tons produced with an average selling price of $1,250. As management discerned in their Q3’23 earnings call, it is expected that direct automotive sales will decline as inventory is worked through with service center sales up with higher selling prices.

Capital Structure

Cleveland-Cliffs remains active in paying down their debt facilities as the firm has paid down $1,539mm of their variable rate ABL facility YTD Q3’23, or $508mm since q2’23, reducing their net debt to $3,427mm. As base rates have become more expensive, so has their ABL. Since FY22, the facility’s rate has increased from 5.602% to 7.148%. Paying this down throughout the period has saved the firm ~$38mm in interest payments for 2h23. As of Q3’23, the firm has $4,331mm in available credit under this facility.

We’ve paid down–we’ve got back-to-back quarters of $500 million of net debt reduction. You can look through Q4 and see how much cash we’re going to generate. We’ll continue using that cash toward paying down debt, toward buying back shares, when appropriate, and being aggressive and opportunistic with M&A opportunities.

– Cleso Goncalves

I anticipate Cleveland-Cliffs to produce similar free cash flow for Q4’23 at $605mm, providing the bandwidth to extinguish more debt and buy back more shares. Cleveland-Cliffs has no current maturities through 2026 and has the flexibility to extinguish their more expensive 7% 2027 notes as well as a portion of their 6.750% 2026 senior notes in the next quarter.

Valuation

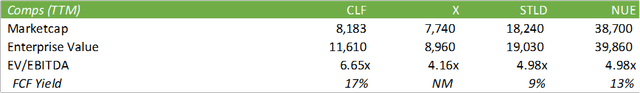

Cleveland-Cliffs currently trades at a significant premium over their competitors at 6.65x trailing EV/EBITDA.

Seeking Alpha

Despite this premium, I believe the competitive value Cleveland-Cliffs brings with their lower carbon intensity steel production through the use of HBI and soon-to-be-released Cliffs H2 (hydrogen-reduced steel production) will bring significant value to customers throughout the supply chain and deems a higher premium over competitors. Using a single-stage DCF model with a discount rate of 14.32% and a 2% growth rate, we can value CLF shares at $28/share, or 9x eFY23 EV/EBITDA.

WallStreei.io

Read the full article here