At a Glance

InMode (NASDAQ:INMD), a leader in cosmetic medical technology, is at a critical juncture, balancing innovative prowess with financial and market challenges. Their minimally invasive laser technologies, like Morpheus8 and Evolve, mark a significant advancement in cosmetic treatments. This innovation is pivotal in driving demand and expanding their market share, as evidenced by their international sales growth and technological leadership. Financially, however, InMode faces headwinds. Despite robust liquid assets and a strong balance sheet, operational challenges, increased expenses, and market volatility, compounded by geopolitical tensions, are notable. The downward revision of FY 2023 revenues and a contraction in gross margins indicate potential struggles in maintaining growth momentum. Investors should be attentive to how InMode manages these challenges while leveraging its clinical advancements. The following article suggests a balanced investment view, recognizing InMode’s innovative edge and financial strength, yet being cautious of short-term market pressures and operational challenges.

InMode’s Global Growth Meets Geopolitical and Economic Headwinds

InMode is navigating an increasingly complex business environment. This landscape is marked by both promising opportunities and notable challenges, painting a picture of a company at a pivotal juncture in its growth trajectory.

Innovation Driving Market Opportunities

InMode’s remarkable growth is anchored in its avant-garde product line, which effectively bridges the gap between conventional laser therapies and surgical interventions. Their minimally invasive laser solutions merge the benefits of surgery’s substantial outcomes with the reduced recovery periods typical of traditional laser treatments. This distinctive offering has been pivotal in fostering demand, especially among individuals aged 40 and above.

InMode’s dedication to continuous innovation is clear from its consistent enhancement of existing products like Morpheus8 and Evolve, as well as the launch of new technologies, including Envision in the U.S. market. The increased adoption of Envision by U.S. ophthalmologists and optometrists is a testament to the market’s enthusiastic reception of InMode’s forward-thinking approaches.

On the international front, InMode has achieved significant progress. The company witnessed a 13% rise in international sales in the third quarter of 2023, relative to the same period the previous year. This uptick underscores InMode’s growing international influence and the strong global demand for its innovative product offerings.

Challenges and Market Pressures

InMode’s strategic positioning in a niche market, though a key strength, also ties the company’s fortunes closely to the sustained appeal and acceptance of its specialized technology. Operating in a dynamic market, InMode faces the risk that shifts in consumer preferences or breakthroughs in rival technologies could markedly affect its business. The company’s focus on a specific segment of the cosmetic medicine market means it is vulnerable to rapid changes in industry trends and dynamics. This specialized approach, while currently beneficial, carries inherent risks in the event of an industry shift or evolution in consumer demands.

Geopolitical Concerns and Economic Factors

Recent developments in Israel, where InMode is headquartered, have introduced additional complexities to its operational framework, impacting investor outlook and contributing to fluctuations in its stock value. These geopolitical issues are further intensified by economic variables, notably InMode’s revised forecast for its fiscal year 2023 revenues. This revision is largely ascribed to slower growth than expected in the third quarter, a phenomenon connected to broader global economic downturns, increased interest rates, and more stringent leasing terms for its equipment. These factors, when considered collectively, suggest a challenging economic landscape that could foster a bearish perspective on InMode’s stock.

Seasonal Slowdown and Financial Guidance

The additional hurdle for InMode comes from the seasonal slowdown that prompted the company to lower its 2023 revenue projections. This revision, influenced by rising interest rates that affect purchasers of its equipment, underscores the challenges InMode confronts in sustaining its growth trajectory. In the fast-paced realm of cosmetic medical technology, these fluctuations in financial forecasts carry substantial weight. They mirror the prevailing market conditions and indicate potential challenges in maintaining growth in a sector continually transformed by emerging trends and technological innovations. For InMode, navigating these changes while keeping up with industry evolution is critical for its long-term success.

Looking Ahead

In summary, while InMode continues to innovate and expand its market presence, it must navigate a complex array of challenges. From its business model’s reliance on a specific market segment to the broader impacts of geopolitical and economic factors and the inherent risks of a seasonal industry, InMode’s journey ahead will require careful balancing of these multifaceted pressures.

Q3 Earnings

Taking a closer look at InMode’s most recent earnings report, for the three months ended September 30, 2023, there’s a marginal increase in revenue to $123.1M from $121.2M YOY. Gross profit is slightly up at $103.0M compared to $102.5M in 2022. However, operating expenses increased notably, particularly in sales and marketing, rising to $50.8M from $43.1M YOY. This led to a decrease in income from operations, dropping to $46.4M from $53.7M. Net income also saw a decline to $46.5M from $48.8M YOY. Moreover, there has been a contraction in gross margins, with GAAP and non-GAAP gross margins for Q3 2023 at 84%, down from 85% in the same quarter the previous year. Lastly, share dilution is evident, with the diluted average number of shares outstanding increasing slightly to 86.0M from 84.8M.

Financial Health

Turning to InMode’s balance sheet, their liquid assets comprising cash and cash equivalents ($133.7M), marketable securities ($385.9M), and short-term bank deposits ($156.3M) total $676M. The current ratio, calculated as total current assets ($777.9M) divided by total current liabilities ($62.2M), is approximately 12.5, indicating a strong ability to cover short-term obligations. Comparing total assets ($793.5M) to debts, including accounts payable ($12.3M), contract liabilities ($10.6M), and other liabilities ($39.2M), with negligible long-term liabilities, shows a healthy asset-to-liability ratio.

The net cash provided by operating activities over the last nine months is $115.6M, indicating an average monthly addition of $12.8M to the company’s resources, enhancing its financial stability.

Considering InMode’s substantial liquid assets, positive cash flow from operations, and minimal debt, the likelihood of requiring additional financing within the next twelve months is low.

In the short term, InMode’s financial health is robust, and this robustness extends into the long term, given its current financial structure and performance trends. However, it’s important to remember that these values and estimates are based on past data and may not predict future performance.

Market Sentiment

According to Seeking Alpha data, InMode, with a market cap of $1.91 billion, reflects adequate market confidence given its innovative product line and global expansion, although the recent decline in stock price may signal some investor doubts. Its growth prospects are positive, with projected revenue growth of 11.06% in 2023, though earnings revisions suggest a cautious outlook. InMode’s stock momentum shows underperformance compared to the S&P 500, with a one-year decline of 36.60% versus SPY’s gain of 13.21%, indicating weaker investor sentiment.

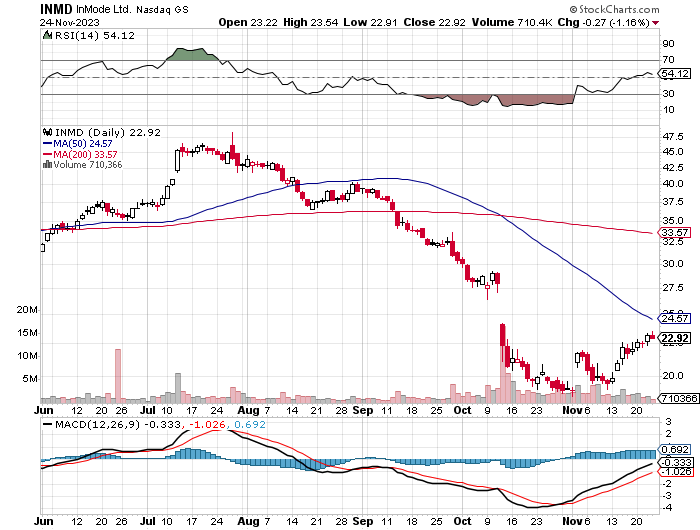

StockCharts.com

A significant short interest of 13.31% with 9.57 million shares short highlights market skepticism or speculation on the stock’s future decline.

Institutional ownership is substantial at 69.66%, with noteworthy changes including BlackRock increasing its position by 1.026%, while Acadian Asset Management decreased its holding by 26.822%. These shifts among major holders like State Street Corp and LSV Asset Management indicate active institutional repositioning.

The absence of recent insider activity could suggest stability in insider confidence or a wait-and-see approach.

Overall, considering these factors, InMode’s market sentiment appears Adequate, balancing between growth potential and current market challenges.

My Analysis & Recommendation

In conclusion, InMode presents a complex investment profile. The company’s innovative products, such as Envision, are driving market opportunities and its 13% increase in international sales is notable. However, InMode faces significant challenges, including a reliance on a specialized market segment, geopolitical concerns in Israel, economic headwinds, and a seasonal slowdown impacting its revenue forecast.

Investors should closely monitor InMode’s ability to balance innovation with financial prudence in this volatile market. The company’s robust balance sheet, characterized by a high current ratio and strong cash reserves, positions it well to weather short-term economic fluctuations without requiring additional financing. Nevertheless, the contraction in gross margins, increased operating expenses, and market skepticism, as evidenced by a substantial short interest, are areas of concern.

In the coming weeks and months, investors should watch for signs of market stabilization, changes in consumer preferences within the cosmetic medical technology sector, and InMode’s strategic responses to these dynamics. Diversification in investment portfolios, focusing on sectors less affected by the current economic climate, and a cautious approach to new investments in the cosmetic medical technology sector could mitigate risks.

Considering these factors, I rate InMode with a confidence score of 55 out of 100, positioning it as a ‘Hold’. The arguments from both bulls and bears are compelling, yet the current undervalued status leans slightly in favor of the bulls. It’s prudent for investors to adopt a watchful stance towards the stock, weighing its robust financial standing and innovation prospects against prevailing market hurdles and economic volatilities.

Read the full article here