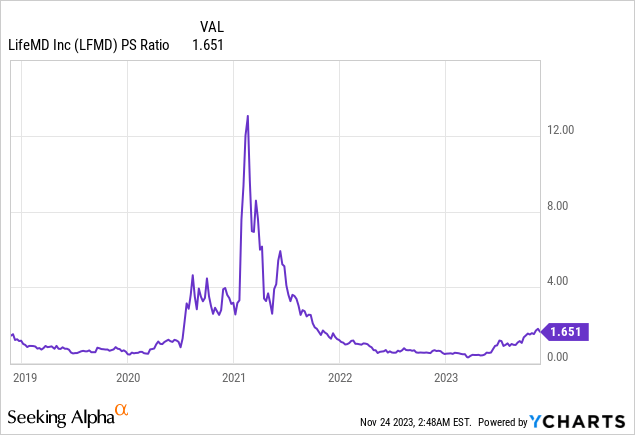

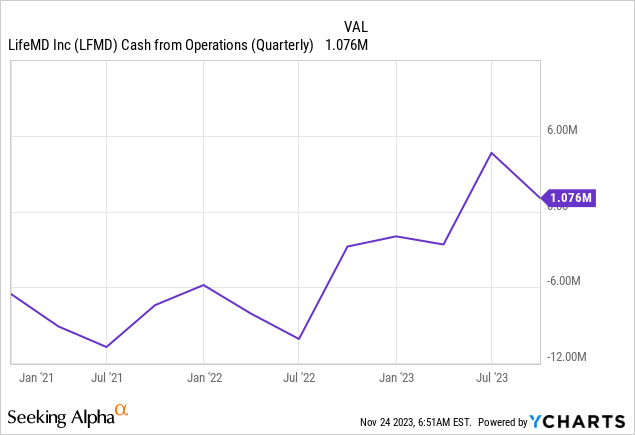

LifeMD (NASDAQ:LFMD) is my top tech ticker for 2024 with the commons of the telehealth company set to record further wins on the back of ramping revenue, gross margins, and cash flow. The bull case is multilayered, LifeMD is currently swapping hands at 1.65x price-to-sales multiple as it realized 23% year-over-year revenue growth for its recent fiscal 2023 third quarter with gross margins clocking in at 87.62%. This is essentially a SaaS stock trading with the multiple of a mature consumer packaged goods firm. Hence, the investment pitch for 2024 is built on the maintenance of current margins combined with increased cost efficiency and higher levels of cash flow generation. This should deliver a ramp to cash and equivalents that came in at $15.3 million at the end of the third quarter, up $9.5 million from the year-ago comp on the back of $1.1 million in positive operating cash flow. LifeMD has performed well year-to-date but I think it still has legs.

Whilst 2024 offers a quagmire of possible economic scenarios from a recession to a soft landing, we can say we have significantly more certainty that the Fed is done raising rates. CME’s 30-Day Fed Funds futures pricing data has essentially ruled out the prospects of further hikes with the base case now being for the FOMC to pause interest rates at their current 5.25% to 5.50% up until the June meeting where a 25 basis points cut is expected. This adds to LifeMD’s investment pitch as broad capital flight from small-cap growth tech stocks should return on the back of capital becoming cheaper. To be clear, SaaS stocks with 80%+ gross margins were trading hands for 8x to 12x price-to-sales multiple in the era before the pandemic. I don’t expect this to be LifeMD’s terminal multiple unless we jump back to ZIRP next year, but the company should see the aggregate of strong financial performance and falling interest rates help to deliver a continued appreciation of the common and Series A preferred shares (NASDAQ:LFMDP).

Growth, WorkSimpli, And Gross Margins

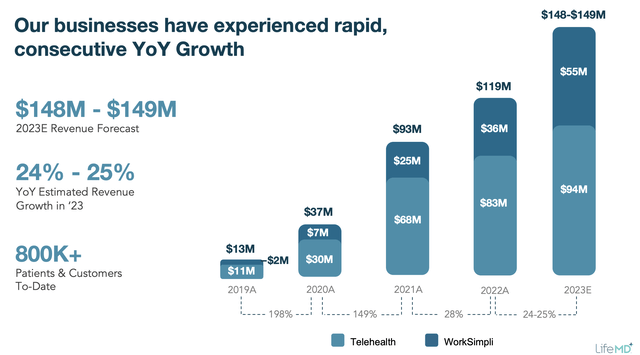

LifeMD is a 50-state direct-to-patient telehealth company offering diagnostics, virtual primary care, and treatment for men’s and women’s health. The field is admittedly crowded with private startups and large public firms like Amazon (AMZN), Teladoc (TDOC), and Hims & Hers Health (HIMS) being strong players in the space. LifeMD also has a 73% equity stake in WorkSimpli (“WSI”), a SaaS business in the document management space with around 170,000 subscribers at the end of the third quarter. LifeMD acquired a 51% stake in the business, previously called LegalSimpli Software, in the summer of 2018. This stake initially went as high as 85.58% following an ownership restructuring transaction in 2021 that also granted founding members an option to re-purchase a stake in the SaaS firm. Those options were granted at LifeMD’s stake now rests at 73% at the end of the third quarter.

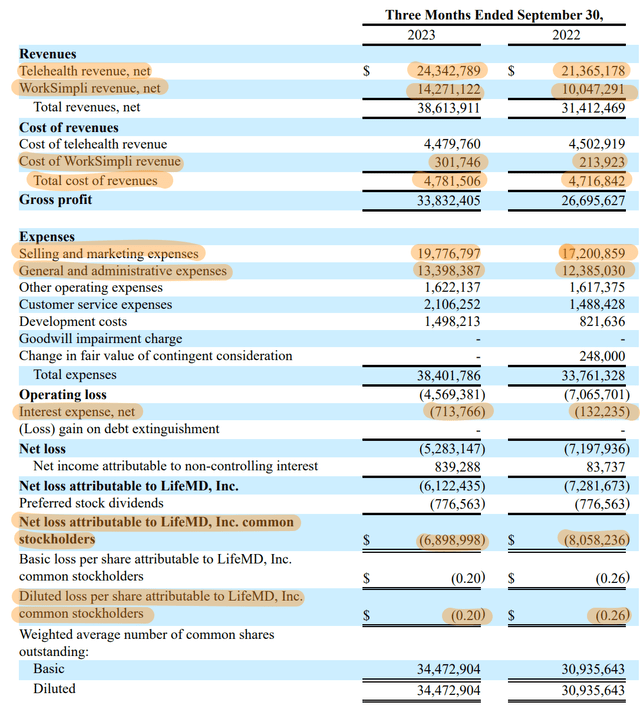

LifeMD Fiscal 2023 Third Quarter Form 10-Q

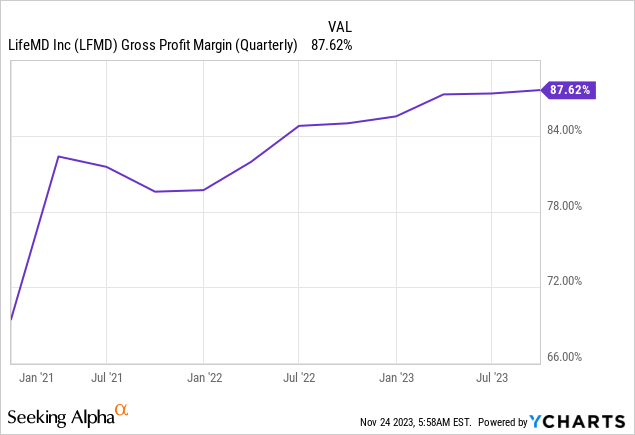

LifeMD’s revenue of $38.6 million was 22.9% year-over-year growth and a beat by $430,000 on consensus estimates. Roughly 63% of this was from telehealth, down 500 basis points from 68% in the year-ago comp as WSI’s revenue continues to notch strong growth. This grew by 42% year-over-year. Both divisions are growing but WSI is ahead of what was a year-over-year growth rate of 14% for telehealth. The impact of this has been a gradual ramp of gross profit margins. This was 87.62% at the end of the third quarter, up 27 basis points sequentially and by 265 basis points over the year-ago period.

Costs Efficiency, Operating Cash Flow, And Valuation

LifeMD November 2023 Investor Presentation

Net loss at $6.9 million dropped from $8 million in the year-ago period on the back of SG&A efficiency gains. This was at $35.3 million during the third quarter, around 91.37% of revenue, and an improvement from SG&A which was 98.92% of revenue in the year-ago comp. Telehealth could also see growth expand as LifeMD works to grow its GLP-1 weight management offering. Management stated during their third-quarter earnings call that GLP-1 revenue quadrupled over the prior quarter and was materially ahead of their initial projections.

Whilst I lean heavily towards income investing and own the preferreds, the commons offer more upside as capital gains on the preferreds are capped at their $25 par value ceiling. The commons are currently trading hands at a sub 2x price to sales multiple and come with strong growth now backed by fast-improving profitability. I think the current valuation to sales is cheap and means a potential expansion to 4x to 5x over the next 2 years if growth is maintained. I stated I was buying both securities when I last covered LifeMD, the preferreds are now currently offering a 12% yield on cost. LifeMD’s cash from operations was positive during the quarter after adjusting net loss for some non-cash items. Whilst the company is still losing money on a GAAP basis, an improvement of its cash-generating position should enhance its liquidity base. The ticker continues to form a buy and is my tech pick for 2024.

Read the full article here