Overview

Note that I previously rated ANSYS, Inc. (NASDAQ:ANSS) a hold due to its high valuation. In this post, I am reiterating my hold rating due to its mixed 3Q23 results, which show both positive and negative results, such as growing ACV, maintenance, and service revenue, but total revenue declined. In addition, the US Department of Commerce’s decision to subject certain ANSS’s goods and services to export limitations and other sales restrictions, as well as the inclusion of incremental approval procedures to prevent ANSS software from falling into the hands of those engaging in US government-defined restricted activities, has created challenges for ANSS. However, ANSS is working hard to ensure its long-term growth, as it is consistently investing in AI to not just enhance its existing offerings but also to introduce new AI-enabled solutions.

Recent results & updates

In 3Q23, ANSS’s annual contract value [ACV] grew 10.4% and was impacted by $20 million tied to incremental restrictions for exports to China. ACV growth during the quarter was driven by all three regions, with strong performance in the high-tech and automotive industries. ACV from recurring sources grew 16% on a trailing 12-month basis and represented 83% of the total. Revenue was down 3%, driven by lease revenue 3% below, and perpetual revenue was 20% lower, while maintenance revenue was 4% better and service revenue was 7% above. Operating margins were strong and reported at 34.1%. ANSS ended the quarter with a total balance of GAAP deferred revenue and a backlog of $1.2 billion, which grew 9% year-over-year. On the full year, ANSS decreased ACV guidance by $42 million at the midpoint, as it continues to see broad-based customer demand and operationally increased full-year ACV by $11 million, though offset by $25 million of the impact from incremental China trade restrictions and $28 million of additional FX headwind. Unlevered operating cash-flow guidance was lowered by $4 million at the midpoint, which includes a $10 million increase from operational improvement, offset by $7 million of impact from incremental China trade restrictions and $7 million of additional FX headwind.

In a recent announcement, ANSS detailed the upcoming release of Ansys SimAI, a physics-neutral platform accessible through cloud services that will enable users in various industries to speed up innovation and maximize time to market. Ansys SimAI will allow users to speed up the prediction of the outcome of complicated problems. This platform allows for more frequent testing because of its improved result speed, thus promoting more innovations. In addition, ANSS also announced the introduction of AI+, which complements its current AI-enabled product. Separate packaging and pricing will be implemented for the new AI+ products, such as the Ansys Granta MI AI+ and the optiSLang AI+. Incorporating and expanding AI and machine learning capabilities into ANSS desktop products, the new products will offer customers more ANSS AI solutions and improve their main functions to conduct efficient optimization and sensitivity studies. Although Ansys SimAI won’t be available until early 2024, it will release AI+ capabilities first on a rolling basis.

In addition to this, AnsysGPT, which was at its beta stage in early July, will be available to users starting in 1Q24. ANSS is dedicated to democratizing simulation and powering next-generation innovation. ANSS’ integration of AI capabilities into new and existing products speeds up predictions of complex models’ performance from 15 days to a few minutes. I believe such an improvement has the potential to boost clients’ product development efficiency due to the immense time saving it is able to create. Thus, I expect this to contribute to ANSS’s solutions demand.

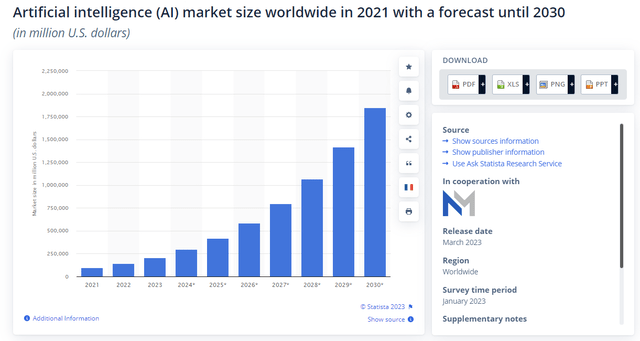

The AI market is expected to grow to $1.8 trillion by 2030 from the current $2 billion market size. This represents a big market for ANSS and provides it with a golden opportunity to grow. Hence, I believe its venture and consistent innovation into AI is the right decision and it also position them well to capture this anticipated rapid growth.

Statista

On the other hand, certain ANSS’s goods and services are subject to export limitations and other sales restrictions, and the US Department of Commerce informed ANSS of these restrictions in Q323 along with other measures, including incremental approval procedures. Additional screening of Chinese prospects is one example of this incremental clearance procedure. They caused a holdup in processing certain orders for Chinese customers, which might cause the cancellation or postponement of some deals that were supposed to conclude in 3Q. In 2023 and 2024, ANSS’s growth in China will be muted due to revised export limits and incremental procedures. Following this, management anticipates that business in China will return to steady-state growth. In my opinion, this is just a temporary setback and not a fundamental issue. The percentage of ANSS sales that come from China is quite small, at about 5%. For this year, ANSS anticipates a $25 million hit to ACV and a $7 million hit to cash, influencing both lease and perpetual revenue. The $25 million ACV projection drop for 2023 is split between revenue shifts and revenue fallout, with a third going toward the former. The revenue that is lost comprises the revenue associated with particular names that are on the restricted list and those that were lost due to the lengthy processing time. In 2024, ANSS anticipates a $10–$30 million drop in ACV/cash flow, although they think tuck-in M&A would mitigate this effect. In 2024, ANSS anticipates a 10% increase in constant currency ACV. The Department of Commerce contacted ANSS in the middle of the quarter to implement additional vetting procedures for their China prospects under ANSS’s industry-standard export controls. In order to clarify their requirements, ANSS halted sales into China when they were requested to perform additional screening. By the end of the quarter, they had finished their request. In response to a request from the Department of Commerce for further verification, ANSS has expanded its data analysis capabilities to include a third data source. This new data set will supplement the other data sets already in use. This results in a method of end-user certification that is similar to the previous one but uses additional data and analysis. This is not an attempt to enforce the law but rather an extra safeguard to prevent ANSS software from falling into the hands of those engaging in US government-defined restricted activities.

Valuation and risk

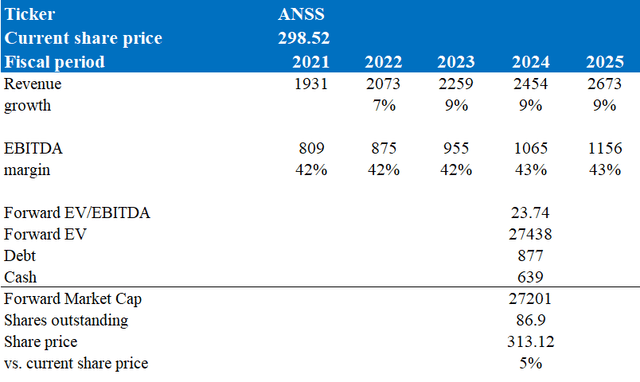

According to my model, my target price for ANSS is $313 in FY25, representing a 5% increase. This target price is based on my growth forecast of high single-digit growth for the next 5 years. The rationale for my assumption is based on its robust 3Q23 results, where ACV grew double digits, which was driven by strong performance in the high-tech and automotive industries. In addition, the expected rapid growth in AI market size worldwide serves as an opportunity for ANSS due to its consistent reinvestment in AI to enhance its current product offerings. However, the US Department of Commerce’s export limitations and other sales restrictions on certain ANSS’s goods and services, along with enhanced approval procedures, are creating roadblocks and challenges for ANSS.

Author’s valuation model

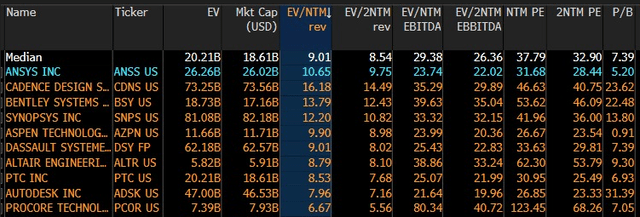

As of now, ANSS’s forward EV/EBITDA stands at 23.74x, below peers’ median EV/EBITDA of 29.38x. this lower multiple is attributed to ANSS’s weaker growth outlook. For 2023, it is expected to grow at 9% while peers are expected to grow at 13%. For 2024, it is the same case, ANSS is expected to grow at 9% while peers are expected to grow at 11%. As ANSS operates in the application software industry which is known for high growth, market places a lot more emphasis on growth outlook. Hence, this is the reason why ANSS’s forward EV/EBITDA is trading lower than peers.

Bloomberg

As ANSS operates in the application software industry, tech spending by customers are very sensitive to interest rate. If macro pressures where to rise, it might result in rising inflation which will negative impact tech spending. Hence, this might put pressure on its growth outlook which is already underperforming its peers.

Summary

The strong ACV growth that ANSS reported in 3Q23 was to a certain degree mitigated by export limitations to China, but ACV from recurring sources grew strongly. On the other hand, overall revenue decreased as a result of declining lease and perpetual revenue, but maintenance and service revenues grew. Overall, its 3Q23 results reported mixed performance. Although new export rules in China have created headwinds, ANSS’s innovative AI initiatives, such as Ansys SimAI and AI+ products, position them well to capture the expected rapid growth in the AI market. With these factors, a weaker growth outlook compared to peers, and a low share price gain, I maintain my hold rating for ANSS.

Read the full article here