Following the heavy selling we saw in equities during the summer of 2023, dividend stocks that have larger-than-normal yields were everywhere. The combination of weak equities and spiking Treasury rates created an environment where dividend stocks honestly just didn’t look very attractive. After all, why take earnings risk for a 3%-yielding consumer staple when you can get a risk-free (and tax-advantaged) 5% yield by lending money to the Treasury?

With the move up in Treasuries starting to be unwound, however, some dividend stocks are beginning to look more attractive again. You mustn’t just chase yield, as that can lead to disastrous consequences. In my view, the best dividend stocks are those with earnings and free cash flow growth, because without that, the ability of the company to continue to pay the dividend (let alone raise it), is impaired.

In this article, we’ll take a look at Kenvue (NYSE:KVUE), which was spun off from dividend legend Johnson & Johnson (JNJ) earlier this year. In short, Kenvue is no J&J, and I think there are better choices out there for income-focused investors.

Where’s the growth?

Obviously, Kenvue is a large, mature consumer-facing maker of staples, so growth is never going to be its strongest trait. However, if you’re investing your money for the long-term, wealth-compounding effects that dividends can have, long-term growth trajectories matter a lot for your wealth accumulation. Kenvue has no ability – as far as I can tell – to produce meaningful growth. Given it’s already paying most of what it can afford for the dividend, this looks like an issue to me for the stock.

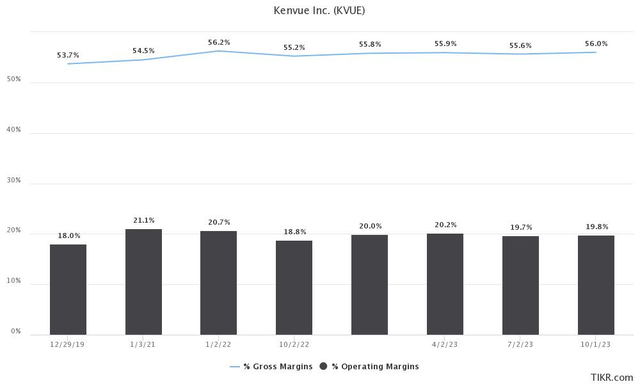

Let’s start with margins, with gross and operating margins plotted below on a rolling-twelve-months basis for the past several quarters.

TIKR

Both of these look like tabletops; there’s no movement anywhere. That’s fine in a sense, because volatile margins have all kinds of nasty impacts, so this isn’t all bad. But it does show that if Kenvue had the ability to boost margins, it would have done so already. Instead, the most recent reading was 130 basis points below that of the year-end 2020 quarter. Margins, it would seem, are not going to help.

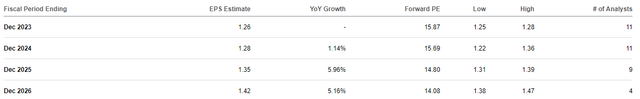

Given that Kenvue is a mature staples producer, you’d figure revenue growth isn’t all that strong either, and you’d be right. That combination of diminutive revenue and margin growth means EPS isn’t going anywhere fast, either.

Seeking Alpha

There’s some hope among some analysts that 2025+ will start to show some signs of life, and maybe it will. But I’m not willing to sit around and hope for two years while there are better stocks to own; that’s a choice each of us has to make.

A full balance sheet

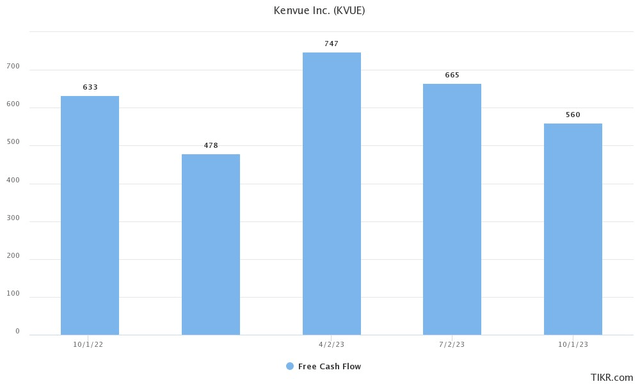

Now that we’ve established there’s likely not a lot of growth coming, let’s focus on the present. Below, we have free cash flow on a quarterly basis for the past five quarters, in millions. FCF is almost always pretty lumpy and Kenvue is no different, but let’s call it $600 million quarterly on average.

TIKR

Given Kenvue’s earnings stability, I wouldn’t expect this number to move much over time, either. That means we can pretty reliably count on something like $2.4 billion in cash generation per year. But is that good enough?

Well, the current dividend is 80 cents per share annually, of which there are ~1.85 billion. That’s ~$1.5 billion in dividend payments (assuming the 80 cents per share annually and flat share count), leaving about $900 million for everything else.

Among “everything else” we have, of course, debt. In Kenvue’s case, quite a lot of it, as it turns out: $7.3 billion in net debt as of October. Kenvue is paying net adjusted interest expense of about $300 million annually, or about 4% annually, on its debt, so it’s not overly burdensome. However, for a company with limited growth potential and less than a billion dollars in FCF ex-dividend, I’d argue that is quite a lot of debt. That means the ability to continue to borrow in the future is limited as well given leverage is already so high.

Given all of this, as I evaluate Kenvue as a long-term income stock, I’m not exactly impressed. J&J, for instance, is an absolute legend in the income investing game with more than six decades of consecutive annual increases to its credit. I don’t see how Kenvue will have any chance to hit sustainable dividend growth at the moment. Now, will growth come to fruition in the future? Totally possible, and if it does, I’d be happy to change my stance on the stock. But for now, it’s a stock with little growth, a lot of debt, and most of its FCF already going the way of shareholders via dividends.

A valuation only a mother could love

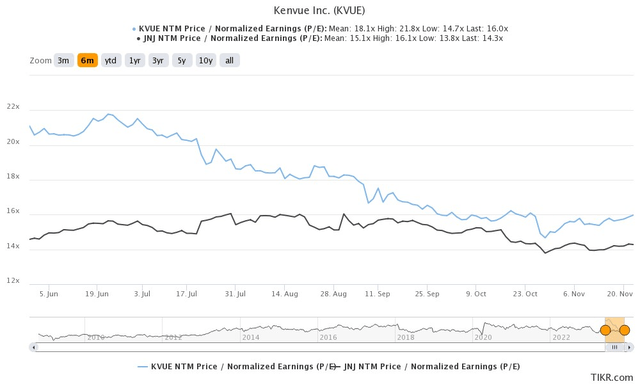

Let’s wrap up here with one more point illustrating why I think Kenvue is unattractive: its valuation. The stock traded for 21X forward earnings when it was first spun off, and has since retreated to a more reasonable 16X earnings. However, I’d still argue 16X is too expensive based upon little to no growth for the foreseeable future, and you can actually get J&J cheaper than Kenvue still.

TIKR

The gap was huge at first and has narrowed swiftly, but there is no chance I’d pay more for Kenvue over its former parent J&J, which actually has growth prospects and is dividend royalty.

In short, I don’t see any reason to own Kenvue at the moment, and I think you’re better off elsewhere when searching for a growing dividend.

Read the full article here