A Quick Take On Vinci Partners Investments

Vinci Partners Investments (NASDAQ:VINP) reported its Q3 2023 financial results on November 8, 2023, reporting year-over-year fee-related revenue growth of 4%.

The firm provides investors with access to various investment products in Brazil.

I previously wrote about VINP with a Buy outlook on its growth potential from the Brazilian pension market and a favorable interest rate environment.

With the recent $100 million Ares Capital investment, the firm has attracted growth capital and collaboration opportunities.

This should position VINP well for a coming improvement in cost of capital conditions, so I reiterate my Buy outlook at around $10.30.

Vinci Partners Overview And Market

Brazil-based Vinci was founded in 2009 to operate as a private equity firm, creating a portfolio of private and public investments and generating profits from the sale of portfolio firms as well as through asset management fees.

The firm is led by co-founder and CEO Alessandro Horta, who was previously a vice president at Banco Pactual and headed the long-term investments segment.

The company’s primary investment offerings include:

-

Private Equity

-

Infrastructure

-

Real Estate

-

Credit

-

Public Equities

-

Hedge Funds

-

Financial Advisory

VINP seeks to increase its assets under management [AUM] in order to invest in promising alternative investment categories throughout Brazil and generate higher fees based on its AUM base.

According to a 2025 market research report by Chambers & Partners, the 2019 private equity investment volume was an estimated $12.8 billion in Brazil.

A number of highly valued companies came of age in 2019, including logistics company Loggi, health & fitness firm Gympass, property technology company Quinto Andar and Fintech firm Ebanx.

Also, private equity firms may be in the process of changing their deal criteria, focusing on more resilient businesses and ones focused on how customer behavior has changed and will change as a result of the recent pandemic.

Major competitive or other industry participants include:

-

Advent International

-

Patria Investments

-

Kinea Investimentos

-

Perfin

-

XP

-

Banco BTG Pactual

-

Brazilian Banks

Vinci Partners’s Recent Financial Trends

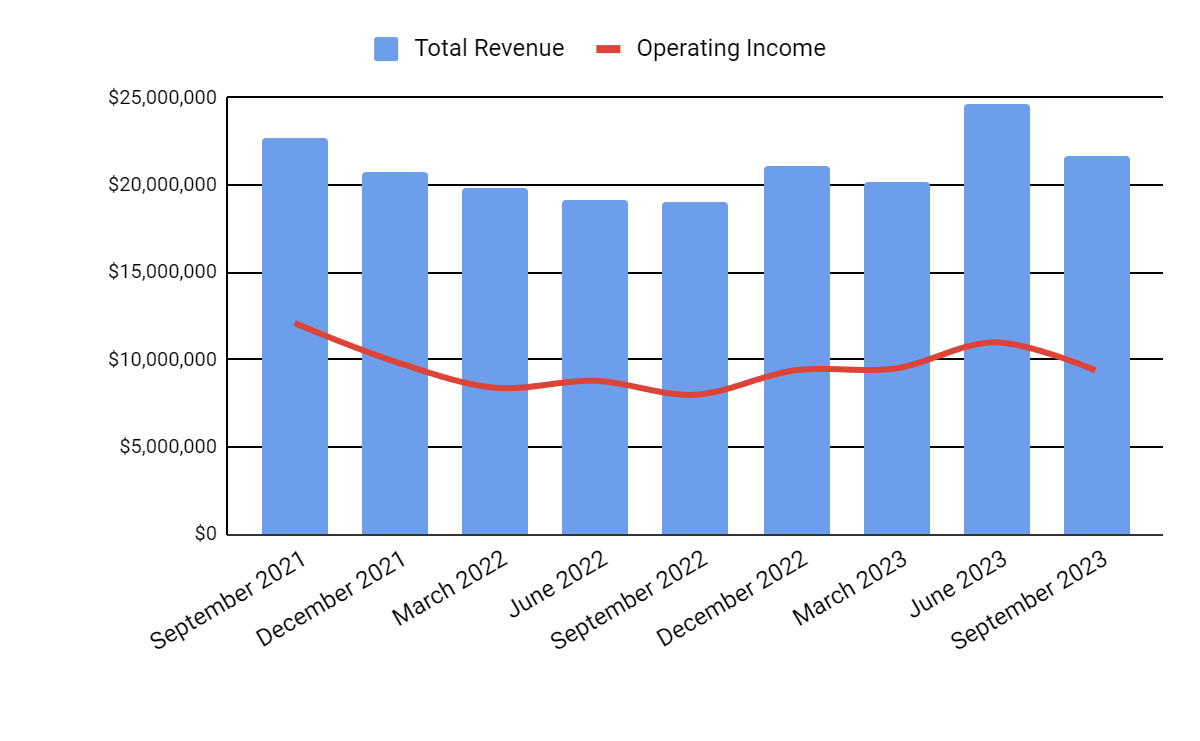

Total revenue by quarter (blue columns) has rebounded in recent quarters from a dip in 2022. Operating income by quarter (red line) has also trended higher since late 2022:

Seeking Alpha

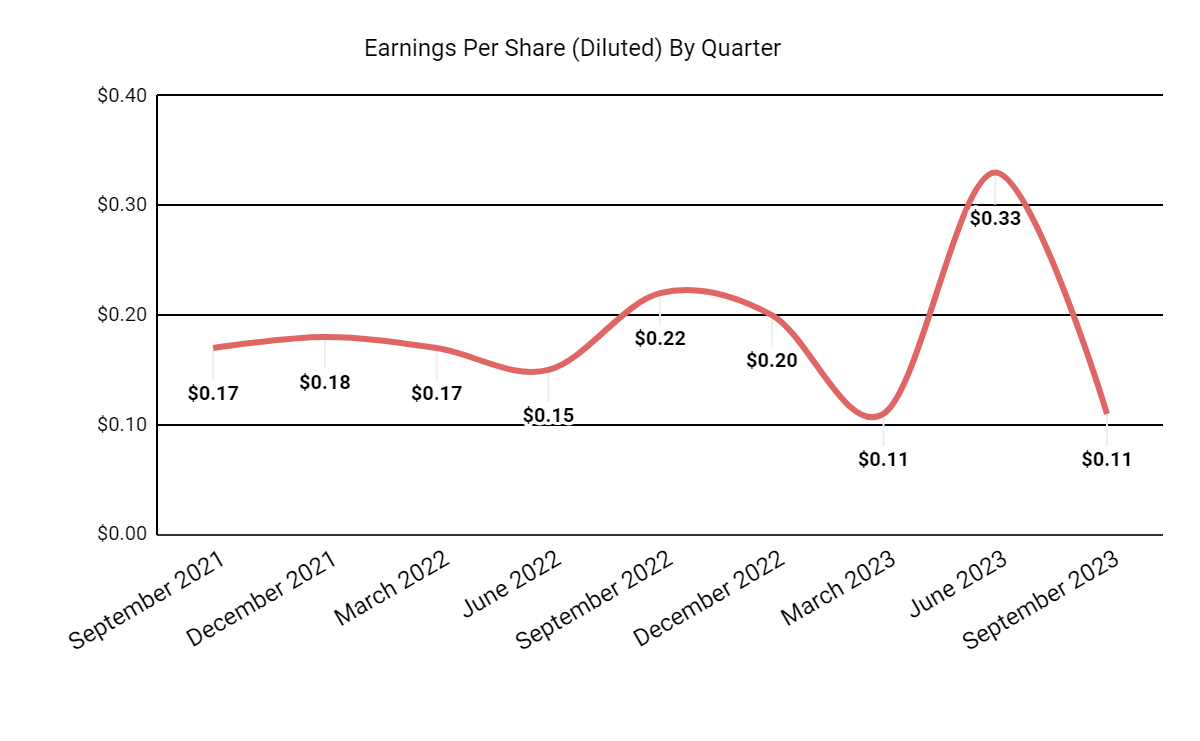

Earnings per share (Diluted) have been volatile in recent quarters, as the chart shows below:

Seeking Alpha

(All data in the above charts is GAAP.)

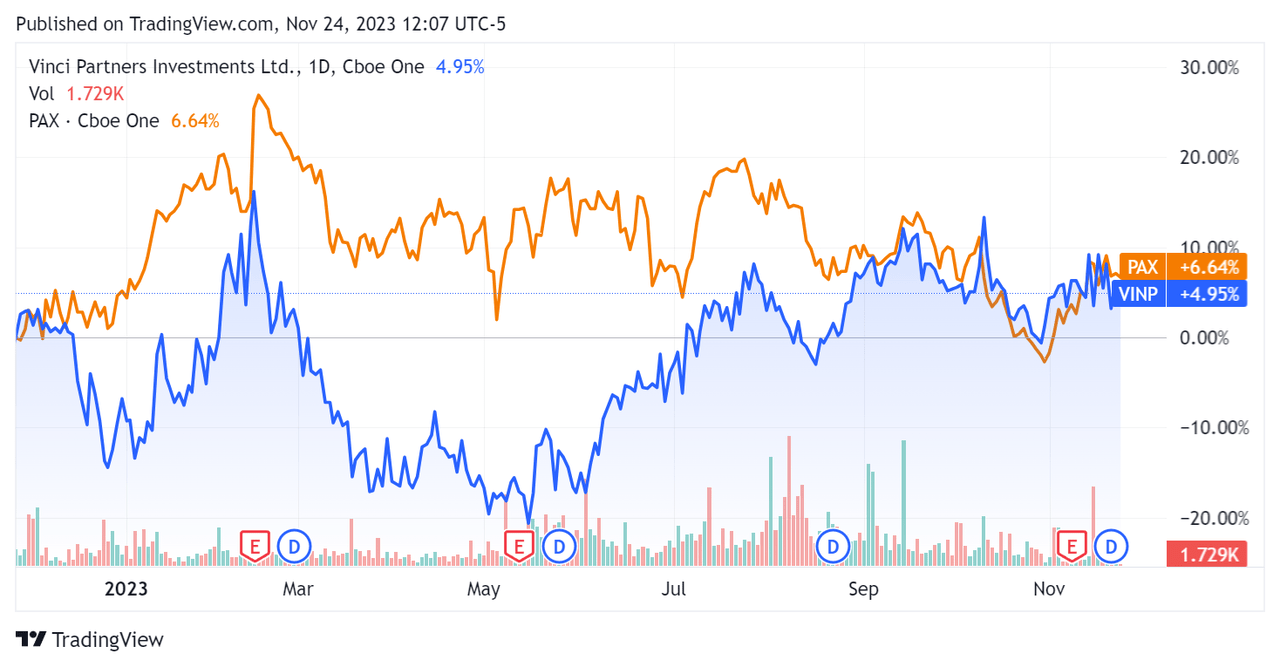

In the past 12 months, VINP’s stock price has gained 4.95% vs. that of Patria Investments’ (PAX) rise of 6.64%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $261.7 million in cash, equivalents and trading asset securities and $25.4 million in total debt, of which $13.1 million was categorized as the current portion due within 12 months.

Valuation And Other Metrics For Vinci Partners

Below is a table of relevant capitalization and valuation figures for the company:

|

Enterprise Value / Sales |

3.7 |

|

Enterprise Value / EBITDA |

7.8 |

|

Price / Sales |

6.2 |

|

Revenue Growth Rate |

7.0% |

|

Net Income Margin |

48.8% |

|

EBITDA % |

48.1% |

|

Market Capitalization |

$539,260,000 |

|

Enterprise Value |

$326,880,000 |

|

Operating Cash Flow |

$27,320,000 |

|

Earnings Per Share (Fully Diluted) |

$0.75 |

|

Forward EPS Estimate |

$0.90 |

|

SA Quant Score |

Hold – 3.16 |

(Source – Seeking Alpha)

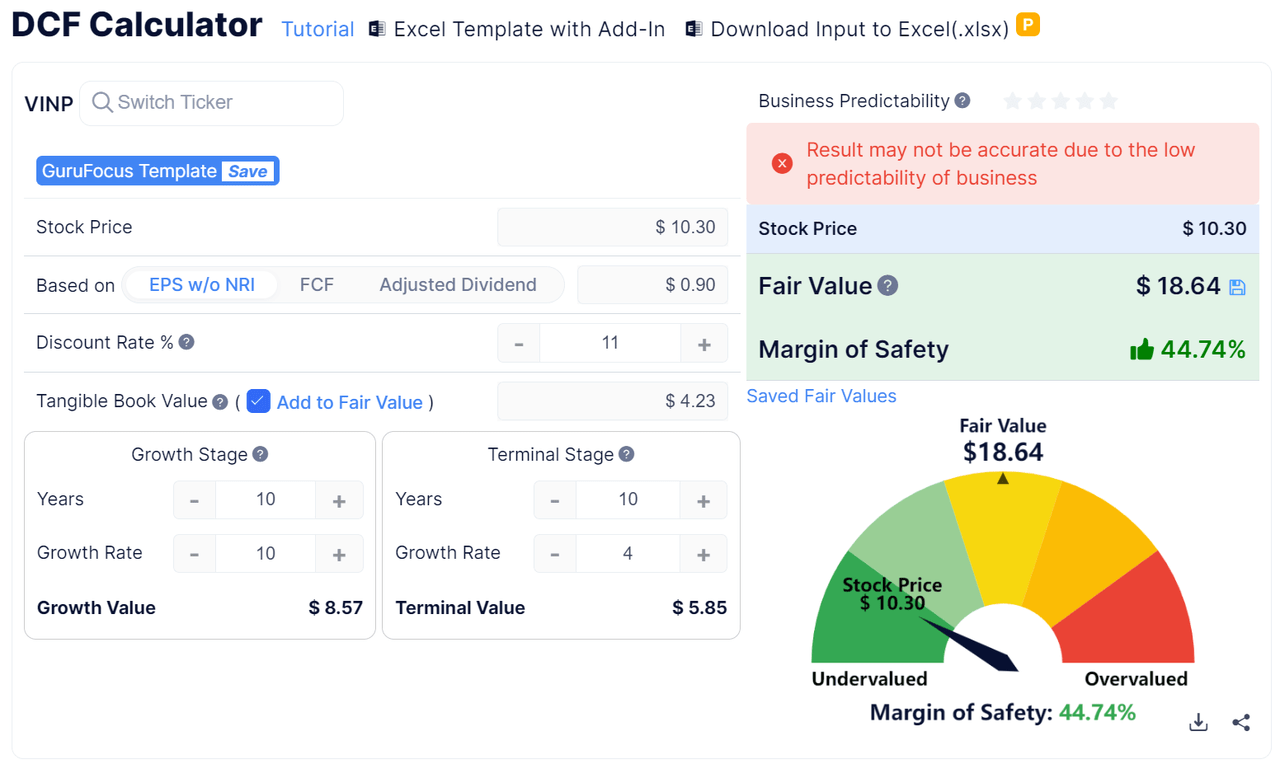

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

GuruFocus

Based on the DCF, the firm’s shares would be valued at approximately $18.64 versus the current price of $10.30, indicating they are potentially currently undervalued.

As a reference, a relevant partial public comparable would be Patria Investments:

|

Metric (Trailing Twelve Months) |

Patria Investments |

Vinci Partners Investments |

Variance |

|

Enterprise Value / Sales |

6.0 |

3.7 |

-37.8% |

|

Enterprise Value / EBITDA |

12.5 |

7.8 |

-38.0% |

|

Revenue Growth Rate |

43.7% |

7.0% |

-83.9% |

|

Net Income Margin |

38.4% |

48.8% |

27.1% |

|

Operating Cash Flow |

$119,070,000 |

$27,320,000 |

-77.1% |

(Source – Seeking Alpha)

Commentary On Vinci Partners

In its last earnings call (Source – Seeking Alpha), covering Q3 2023’s results, management’s prepared remarks highlighted the recent partnership with and investment of $100 million from Ares Capital (ARCC).

The purposes of the partnership include a desire to increase Vinci’s growth in Latin America and for collaboration efforts on fundraising, best practices, and new product development.

Ares believes that Latin America is in the very early stages of adoption of private market financial strategies.

Vinci management has set a goal to double its distributable earnings within five years.

It also believes the interest rate hiking cycle is likely coming to an end, ‘entering a positive scenario with an easing cycle for interest rates starting in Brazil.’

Lower interest rates would likely mean a lower cost of capital, which is an important component of investment returns.

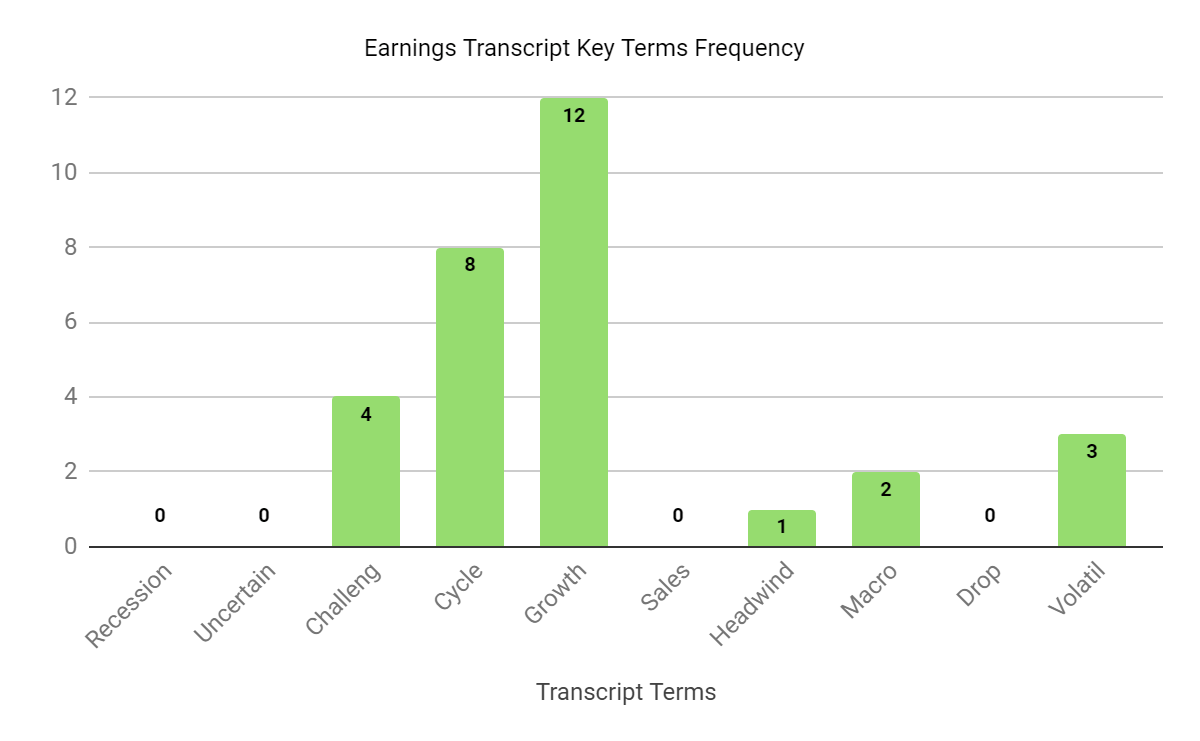

In the earnings call, I tracked the frequency of various keywords and terms mentioned by management and analysts, as shown in the chart below:

Seeking Alpha

Analysts asked management about the firm’s fundraising progress, use of retail distribution channels and the impact of variable interest rates on liquid portfolio returns.

Management replied that it was seeing net stable AUM for liquid funds, and major fundraising appeared to be around 65% of target on average, with fundraising coming to an end by mid-2024.

The firm expects to continue using local distribution while being cautious about costs and comparing results to external placement agents.

Leadership said that it has built its approach to the highly cyclical Brazilian interest rates, ‘to excel when we have favorable market cycles, and […] to be resilient when facing tougher ones.’

Total revenue for Q3 2023 rose by 14.2% year-over-year, while Selling, G&A expenses as a percentage of total revenue dropped by 4.1%. Operating income for the quarter rose by 17.5% YoY to $9.4 million. The company’s financial position is strong, with substantial liquidity and very little debt.

Looking ahead, full-year 2023 topline revenue is expected to grow by 14.2% over 2022. If achieved, this would represent a surge in revenue growth rate versus 2022’s decline rate of 8.7% over 2021. Based on my discounted cash flow calculation, the stock may be undervalued here.

With the Ares investment, the firm has attracted growth capital and collaboration opportunities. This should position VINP well for a coming improvement in cost of capital conditions, so I reiterate my Buy outlook at around $10.30.

Read the full article here