The Company

Established in 1912, Lockheed Martin Corporation (NYSE:LMT) is a leading aerospace and security company with a market cap of $111 billion, specializing in the research, design, development, and integration of advanced technology systems for both U.S. government and international defense clients. With 116,000 employees, the company is divided into 4 key segments: Aeronautics (39.8% of total sales in Q3 FY2023), Missiles and Fire Control (17.4%), Rotary and Mission Systems (24.4%), and Space (18.4%).

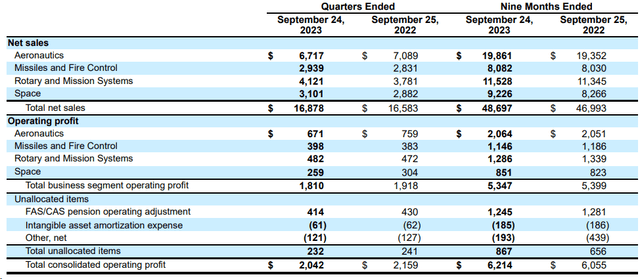

In Q3 FY2023, three of Lockheed Martin’s four segments experienced revenue growth. The Aeronautics Division saw a 5% YoY decline in revenue due to lower net sales for the F-35 program, while Missiles and Fire Control, Space Systems, and Rotary and Mission Systems reported increases of 4%, 8%, and 9%, respectively. Lockheed Martin delivered 30 F-35 aircraft in the quarter, with a YTD total of 80, aiming for a full-year target of 97. The company closed Q3 with a backlog of $156 billion, up 4% from the previous year. However, the total segment operating margin decreased to 10.6%, down 90 basis points from the prior year, with narrower margins in Aeronautics, Space, and Rotary and Mission Systems.

LMT’s 10-Q

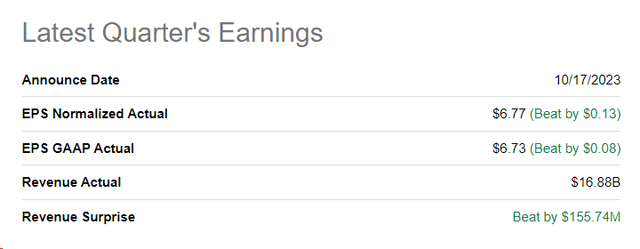

As a result of lower margins, Lockheed Martin reported a 5.3% decline in net earnings to $1.68 billion. But LMT’s adjusted EPS of $6.77 surpassed the Wall Street estimate of $6.63. Sales of $16.9 billion also exceeded the estimated $16.72 billion:

Seeking Alpha

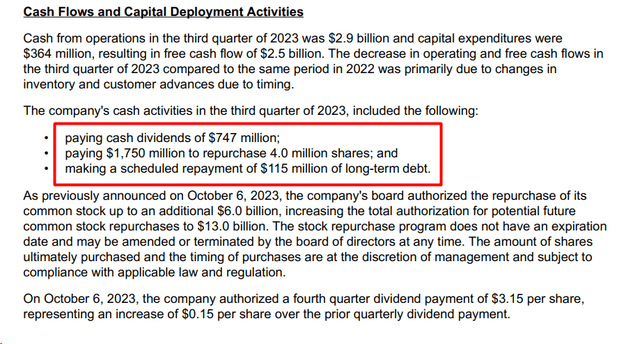

During the earnings call, the CEO highlighted LMT’s generation of $2.5 billion in free cash flow, with nearly 100% returned to shareholders through dividends and share repurchases.

LMT’s press release, author’s notes

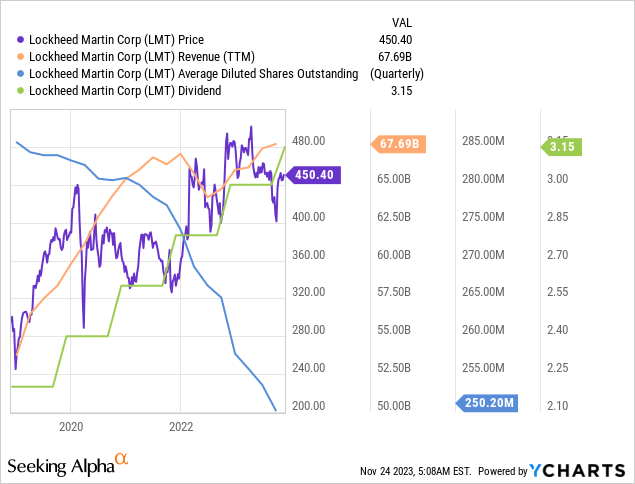

Perhaps this is precisely the reason why investors love the company: Relatively steadily growing sales volumes and stable profitability allow it to pursue a shareholder-friendly policy for many years, and even severe crises such as COVID do not prevent LMT from doing this:

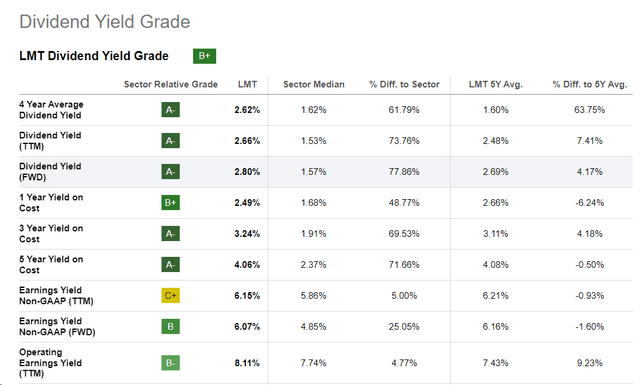

On October 6, 2023, the company increased its quarterly dividend by 5%, resulting in a new payout of $3.15 per share or $12.60 annually. This adjustment positions the company’s yield at ~2.8%, surpassing the industry median:

Seeking Alpha, LMT

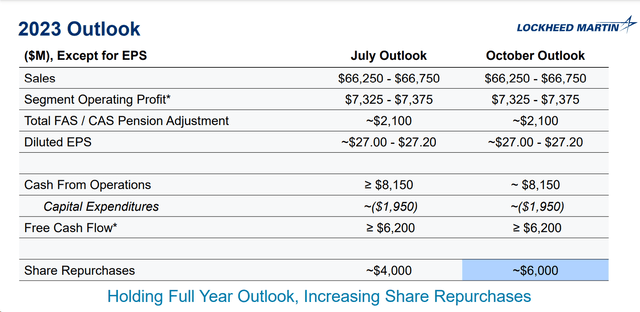

I assume that the company’s dividend stability will not be affected in any way in the foreseeable future, because at the moment there is no indication that it could be otherwise. The same applies to share buybacks: In its new guidance LMT suggests that the superior FCF generation capacity will not abate and that the company will buy back its shares from the market on an even larger scale:

LMT’s IR materials

But is this step justified for LMT? After all, if the company’s shares are trading at a premium today, increasing buybacks can theoretically destroy value for shareholders. Let’s try to answer my question together.

The Valuation

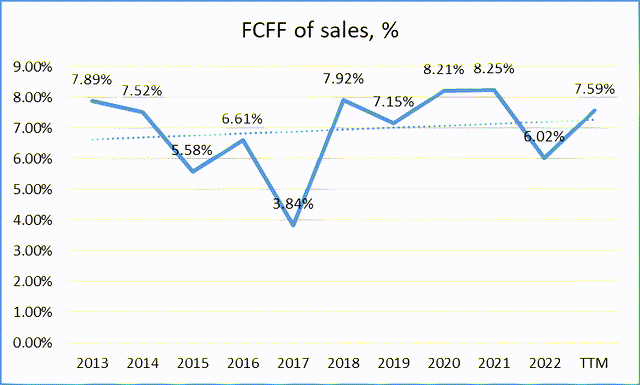

Over the last 10 years, the average FCFF margin was 6.96%: This indicator was relatively volatile, but always remained within the positive range of a slightly growing trend.

Author’s work, Seeking Alpha data

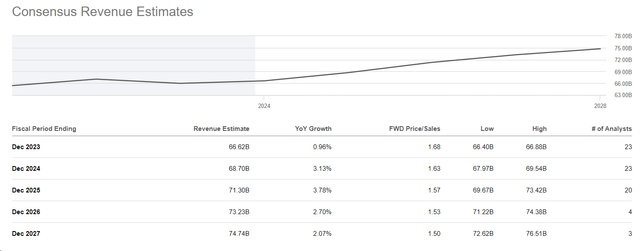

I assume that this type of margin will continue to rise and reach a long-term average of 7.1% by the end of FY 2027. Let’s also assume that Wall Street’s consensus estimates of LMT’s low single-digit revenue growth rates for the next 4 years are correct:

Seeking Alpha data

So the implied FCF growth for the next 4 years is ~2.51%, which seems reasonable to me. I also assume that the company’s FCFF will grow at a CAGR of 1.5% from 2027 to 2035 to introduce some sort of conservatism into my calculations.

LMT’s September 2026 3.55% bonds are trading at ~5.23% yield to maturity according to my calculations, so let’s assume that the 10-year cost of debt should be around 6.5% (longer maturity). Logically, the cost of equity will be higher – I think it is fair to assume 8% in the long term, given the current relatively high-interest rates and the high likelihood of them coming down in the future. Since the company’s capital structure is 89% equity (market capitalization to enterprise value), the resulting WACC should be ~7.83% according to my calculations.

Assuming that FCFF grows at a rate of 2% in the period after the forecast, LMT’s fair value today should be $128.8 billion, which is 9.4% above its current market capitalization.

| WACC, % | 7.83% |

| SUM of discounted FCFF, $B | $41.40 |

| TV, $B | $106.56 |

| Net debt, $B | $13.84 |

| Pension Liabilities, $B | $5.32 |

| Equity Value, $B | $128.80 |

Source: Author’s calculations

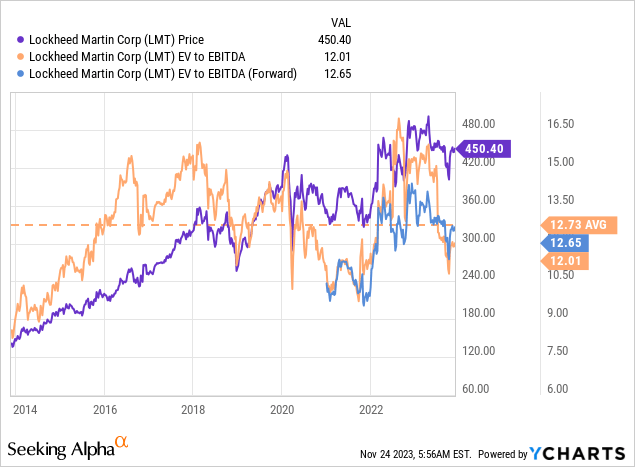

However, the Gordon model terminal value forecast is not always realistic and very often underestimates the possible hidden potential of the company. However, if we look at an alternative valuation method – valuation multiples – we will find that the company is also fairly valued in terms of EV/EBITDA, supporting my DCF calculations above:

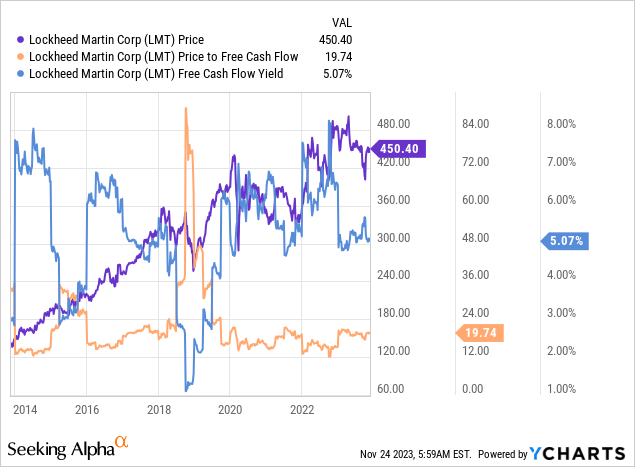

The FCF-related multiples also suggest a fair valuation of the stock: with an FCF yield of almost 8% and a price-to-FCF ratio of 12-15x, LMT was a very attractive stock to buy recently. Now these indicators are at 5.07% and 19.74x respectively, which makes the stock look a bit pricey.

I think that LMT could become very attractive again if the price corrects by 15-20% from the current level.

The Bottom Line

In fact, I am taking a big risk by rating LMT as a ‘Hold’ today. Why? Because LMT obviously may have tremendous growth opportunities in the foreseeable future due to global instability and the U.S. government’s attempts to strengthen its position in the weapons space. In my last article on CACI International (CACI), I already wrote that the US defense budget as a percentage of GDP should sooner or later rise to its historic norms, making companies in the defense industry quite attractive investments. Measured by its fair value, Lockheed Martin looks expensive today, but as I know from Howard Marks’ Cycle Theory, just as a pendulum does not stop in the middle, so the shares of companies that have come out of undervaluation do not necessarily stay at ‘fair’ value and easily begin to master the overvaluation zone – sometimes for years.

Anyway, the growth potential I calculated at 9.4% does not give me the right to issue a ‘Buy’ rating this time. LMT is a strong ‘Hold’, meaning that it should be in investors’ diversified portfolios focused on large caps, but you shouldn’t overweight it there, in my view.

Thanks for reading!

Read the full article here