We previously covered ZIM Integrated Shipping (NYSE:ZIM) in August 2023, discussing its well supported stock prices at the IPO levels of $12, attributed to the supposedly recovering container spot prices then.

With the lack of dividend already anticipated, we had continued to rate the stock as a Buy for speculative income oriented investors, who were comfortable with cyclical industries and variable payouts, since we had believed that H2’23 might bring forth improved TEU rates.

For now, it appears that we have been proven wrong, with the global macroeconomic outlook still uncertain, triggering the prolonged demand recovery for finished goods, worsened by the oversupply of container vessels.

The same has also been reported by ZIM, with its TEU rates likely to face further downward pressure and dividends unlikely to be reinstated through 2024.

We shall discuss why it may be better to wait on the sidelines for now.

ZIM’s Dividend Investment Thesis May Be Absent In The Near Term

For now, ZIM reported a double miss in its FQ3’23 earnings call, with revenues of $1.27B (-2.3% QoQ/ -60.6% YoY) and adj EBITDA of $211M (-23.2% QoQ/ -89% YoY).

While its carried volumes remain somewhat stable at 867K TEUs (+1% QoQ/ +2.9% YoY), the impacted adj EBITDA margins of 17% (-4 points QoQ/ -43 YoY) has been disappointing after all, though still improved from FY2019 levels of 11.6% (+7 points YoY).

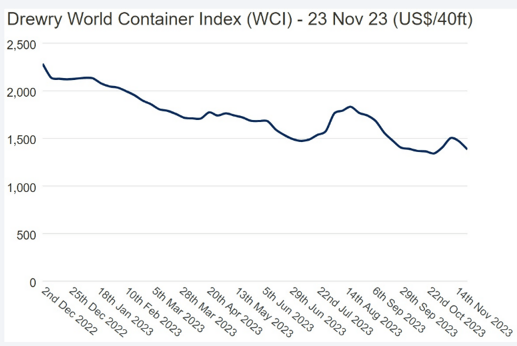

Drewry’s World Container Index

Drewry’s World Container Index

Much of ZIM’s headwind is attributed to the normalizing average freight rate per TEU of $1.13K (-5% QoQ/ -66.2% YoY), nearer to its FY2019 averages of $1K (+2.7% YoY) and naturally down from the peak of $3.24K in FY2022 (+16% YoY).

The same has been reported in the Drewry’s World Container Index by November 23, 2023, with a spot pricing of $1.38K per 40ft container (-42% YoY), down by -3% from the 2019 averages of $1.42K.

This has been further exacerbated by ZIM’s elevated operating costs of $1B (+2.9% QoQ/ -19.3% YoY). Particularly, the volatile bunker expenses of $266.5M (-5.2% QoQ/ -36.4% YoY) comprise an increasing portion of its costs at 26.6% in FQ3’23 (-2.2 points QoQ/ -6.9 YoY), compared to 19% in FY2019.

It is unsurprising that the container company is facing this headwind, due to the elevated/ volatile energy prices, with the Brent crude oil spot prices currently at $80.43 per barrel (+11.9% QoQ from 2023 bottom), up by +34% from the 2019 averages of $60 per barrel.

In addition, thanks to the IMO 2020, the company has had to switch from the regular HSFO in 2019 to the more expensive VLSFO from 2020 onwards, with the latter costing up to +42% more at the time of writing.

Perhaps this is why ZIM has invested heavily in 28 new LNG vessels, with the fuel type increasingly being more price competitive and environmentally friendly than conventional marine fuels, as similarly mandated by the IMO 2023.

Therefore, while we agree that the management has been overly aggressive in its fleet renewal, with a staged delivery of 47 new chartered vessels between Q1’23 – Q4’24, we believe that these investments may deliver improved top and bottom line performances by 2025, as demand slowly returns.

On the other hand, ZIM’s elevated lease/ loan liabilities of $3.03B (-8.4% QoQ/ -4.1% YoY) over the next few quarters imply that the management may suspend the dividend payouts until most of its obligations are satisfied, with the last one being the blockbuster FQ4’22 dividends per share of $6.40.

In addition, the stock’s lack of bullish support may be attributed to a decreased level of management confidence who has failed to offer a reliable forward guidance, with its FY2023 numbers already lowered twice by the FQ3’23 earnings call.

This is from the original adj EBITDA guidance range of between $1.8B – $2.2B offered in the FQ4’22 earnings call (-73.4% YoY at the midpoint), down to $1.2B – $1.6B in the FQ2’23 earnings call (-81.4% YoY) and finally, to $900M – $1.1B in the FQ3’23 earnings call (-86.7% YoY).

The combination of uncertain contracted rates, elevated operating costs, and ongoing fleet renewal suggest that the ZIM management may be singularly focused on capital preservation ahead, as demonstrated by its deteriorating balance sheet with cash/ equivalents of $1.83B (-3.6% QoQ/ -41.9% YoY).

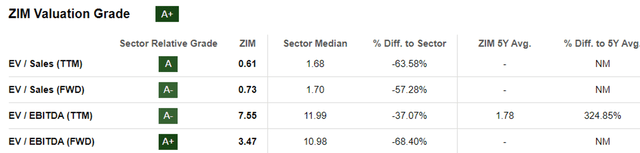

ZIM Valuations

Seeking Alpha

Perhaps this is why ZIM’s FWD EV/ EBITDA valuation of 3.47x appears to be depressed, compared to its 1Y mean of 7.55x and the sector median of 10.98x.

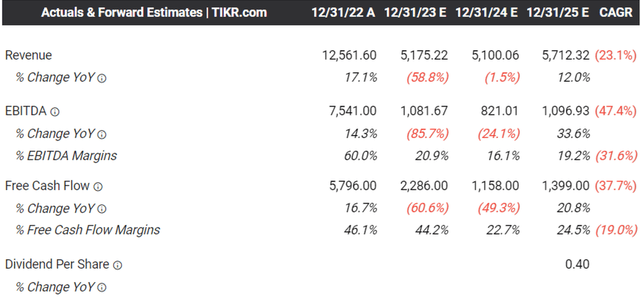

The Consensus Forward Estimates

Tikr Terminal

Most importantly, the consensus estimates that ZIM’s top and bottom line performance through FY2025 may disappoint after all, with it remaining to be seen when freight rates may improve and dividends may be reinstated.

These numbers are not overly pessimistic indeed, since the Fed expects a normalized economy only by 2026, with a pivot likely to occur much later than the historical average of eight months.

While we maintain our long-term thesis that ZIM may emerge stronger over the next few years, with newer and more efficient fleets, it appears that things may get worse before it gets better.

So, Is ZIM Stock A Buy, Sell, or Hold?

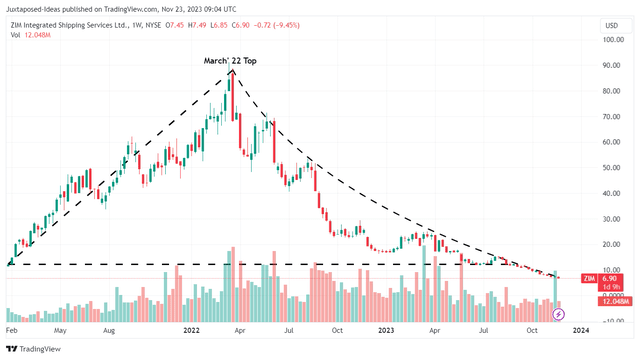

ZIM 1Y Stock Price

Trading View

For now, ZIM has charted lower lows and lower highs since the March 2022 top, with no floor in sight to the decline.

The combination of a near penny stock status and an eye-watering short interest of 20.29% is extremely concerning for serious long-term shareholders indeed, since the volatility from aggressive short sellers may negate the potential upside from these bottom levels.

Unfortunately, we believe that ZIM’s sell-off may not end yet.

If anything, the highly pessimistic commentary by one of the largest container shipping company, Maersk (AMKBY), is more than enough to depress the entire industry in the near-to-intermediate-term, with recovery unlikely until macroeconomic sentiments improve:

The new normal we are now headed into is one of more subdued macroeconomic outlook and thus of soft volume demands for the coming years, prices back in line with historical levels and inflationary pressures on our cost base, especially from energy cost and will also increase geopolitical uncertainty.

This outlook is compounded in the shipping front by increasing supply-side risk. Since the summer, we have seen overcapacity across most regions, triggering a new wave of price reductions. At the same time, scrapping and idling of tonnage has not yet picked up. We therefore expect further headwinds as the market conditions in ocean are worsening.

As a result of the potential volatility and capital losses, we prefer to rate the ZIM stock as a Hold (Neutral) here, since anyone who remains are likely strong handed buyers, with most conservative investors already out of the highly cyclical dividend game, as previously discussed in our January 2023 article.

Read the full article here