Investment thesis

Our current investment thesis is:

- Dole is a well-positioned business in a resilient, growing industry. Although the company is unlikely to outperform, we see limited downside risk and the scope for healthy cash returns (current FCF yield of ~6%).

- Dole’s financial performance is expected to improve, following the sale of its underperforming vegetable division.

- Relative to other food businesses, Dole looks attractive, with similar margins and less debt usage. Based on this, Dole looks undervalued.

Company description

Dole plc (NYSE:DOLE) is a global leader in the production and distribution of fresh fruits and vegetables. With a rich history spanning over a century, Dole operates across various segments, including fresh produce, packaged foods, and nutritional products.

Dole is a combination of Total Produce plc, Europe’s leading fresh produce company, and Dole Food Company, Inc., having listed in 2021 as a combined business.

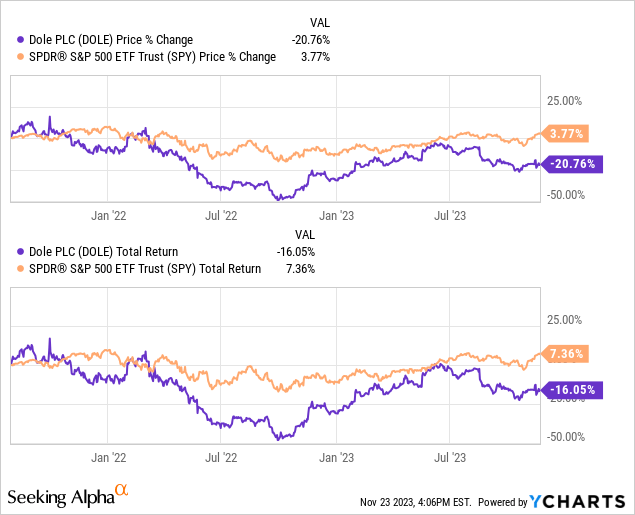

Share price

Dole’s share price has experienced substantial volatility since listing, partially due to weaker market conditions in light of the current economic environment.

Financial analysis

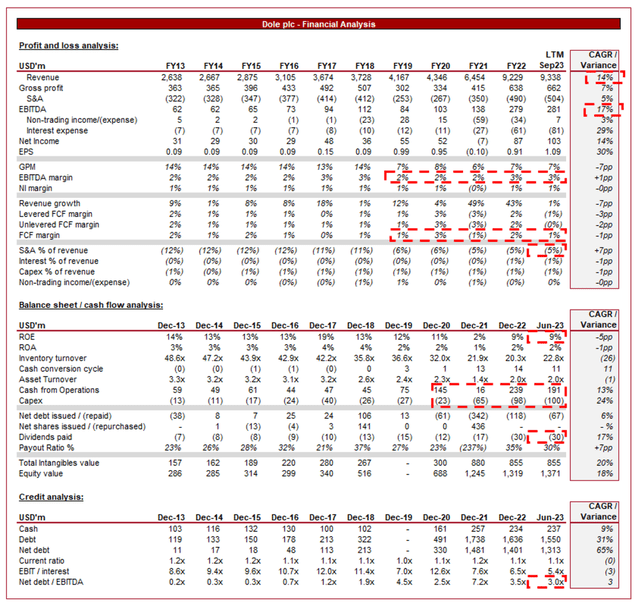

Dole Financials (Capital IQ)

Presented above is Dole’s financial performance for the last decade. (Note: FX conversions from EUR to USD has caused some distortion to historical data)

Revenue & Commercial Factors

Dole’s revenue has grown at an impressive 14% rate during the last 10 years, accelerated by the combination of the two businesses. During the last decade, the company has faced several periods of weakness, operating in what is a highly competitive, low-margin industry.

Business Model

Dole produces, markets, and distributes an extensive variety of fresh produce, which is sourced both locally and from around the world via the company’s deep sourcing network. Given the commoditized nature of this industry, differentiation is achieved through the ability to develop scale, reach, and product breadth. All three factors begin with the development of a quality supply chain. Dole owns several highly valuable strategic assets, including over 114k acres of owned and other land holdings, as well as >250 facilities and 11 vessels. This gives Dole a market-leading position in the industry, creating reliability and dependency to deliver at scale.

Dole’s approach is an interesting one, owning and managing a vertically integrated supply chain. This allows the business to ensure quality control, benefit from flexibility via control of the assets, and traceability, while also enhancing long-term value through minimizing costs over time.

Alongside providing reach and scale, Dole offers a wide range of fresh fruits, vegetables, and value-added products, catering to both consumer and business-to-business markets. This is a fundamental requirement for winning large contracts while being associated with higher costs. This is not a problem, however, as it discourages competition, giving Dole a stronger market position.

These factors have allowed the business to rapidly expand overseas, currently operating in 30 counties with employees around the globe. Slim margins mean profitability is improved and enhanced through economies of scale, as expertise and processes can be replicated globally.

Statistics (DOLE)

Dole emphasizes sustainable agriculture practices, reducing environmental impact, and promoting social responsibility throughout its supply chain. This has been a key focus for the business, as it seeks to respond to social and economic pressures to become sustainable. Given Dole’s size, it is best positioned to conduct this transition, which should attract improved sales and brand recognition.

Speaking of brand, the above factors have allowed the company to develop a well-established and recognized brand, namely for its commitment to quality, freshness, and healthy food options.

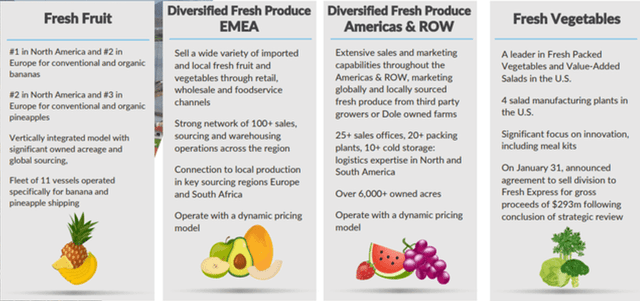

Dole operates across 4 main segments, although the Fresh Vegetables unit has been agreed to be sold, representing the smallest of the 4. Every segment is well-resourced and positioned to grow. The Fresh Vegetables business has been subsequently sold.

Business Units (DOLE)

Food Produce Industry

Given the tight margins, competitors generally avoid a price war, as the race to the bottom would be relatively quick. Businesses compete based on factors such as product quality, freshness, distribution network, brand reputation, and sustainable practices. This is why our assessment above focused on these factors and suggests Dole is well-placed in the market to benefit from growth. Dole faces competition from other global produce companies, including Fresh Del Monte Produce (FDP) and Chiquita Brands International, among others.

Firstly, global population growth with support growth over time, as consumption of food will inevitably remain resilient. This dependency will provide downside protection during economic downturns as although demand may be impacted, we expect it to be small relative to other industries. This is a key attractive quality of this industry.

A key trend we have observed in the industry is an increasing consumer focus on healthy eating and demand for fresh, nutritious foods. This is driven by greater understanding and focus on the impact of a healthy diet, as well as a change in socio-economic factors. Dole expects this to drive healthy growth in the coming years, which we concur with. The critical factor is to maintain its wide variety of products.

In conjunction with the above, plant-based diets are rising in popularity, influencing the demand for produce, both as an input into the creation of foods for sale and as an ingredient at home. Similarly to the above, we expect this to drive growth in the industry.

With an international presence, trade policies, tariffs, and regulatory changes impact the import/export of agricultural products, materially influencing market dynamics. This remains a key opportunity and threat to Dole over time, as economic development has the potential to drive changing legislation.

Tapping into growing consumer markets in emerging economies offers significant growth potential for Dole, supplementing its mild growth thus far. The only issue with this is the significant cash cost required to enter new markets, which may not be readily possible in the medium term.

Margins

Dole operates with slim margins, which are a reflection of the commoditized nature of this industry. It currently has a GPM of 7%, EBITDA-M of 3%, and a NIM of 1%. Margins have generally remained flat across the historical period, implying scale economies are being offset by macro factors and investment in growth. For this reason, it is unlikely that further improvement is materially possible, although remains an opportunity given there is a fixed element of S&A costs.

Balance sheet & cash flows

Dole operates with a large amount of debt, primarily relating to its lease facilities. Our view is that a 3-4x ND/EBITDA multiple is a healthy maximum but with a 5x interest coverage, we are not overly concerned currently.

Cash flows have been consistent in line with profitability, as capex has been restricted to 1% of revenue.

Outlook

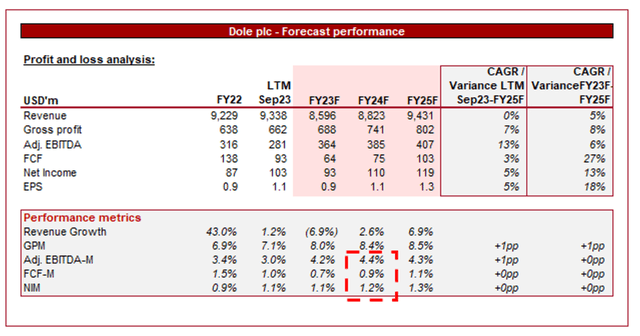

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are nil growth in the coming 3 years, a reasonable estimate given the slowdown in growth during the LTM, the sale of its Vegetables businesses, and the high level of competition within the industry.

Margins are expected to improve, again due to the sale of the Vegetable business (currently loss-making) alongside potential scale economies and improved pricing.

Peer analysis

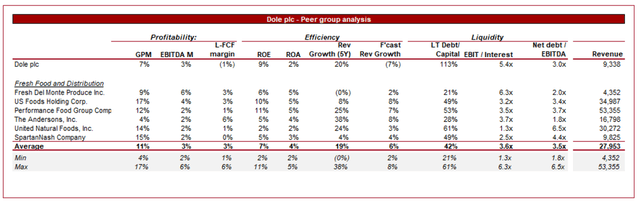

Peer analysis (Capital IQ)

Presented above is a comparison of Dole to a cohort of Food-related distributors.

Dole looks about average relative to the peer group. On an EBITDA-M basis, the company is marginally the third highest, with scope for further improvement following the sale of the Vegetable business. This will likely take the company into second place.

Further, the company has utilized less debt to generate said earnings, allowing for a greater proportion to flow to free cash flow and superior optionality in the future for M&A or distributions. Confirming its strength is the company’s ROE, which is above average and sufficiently ahead of the RfR.

Growth is a muddied metric due to acquisitions and divestitures but it is worth highlighting that Dole is currently above average, with at least the market-average rate achievable.

Valuation

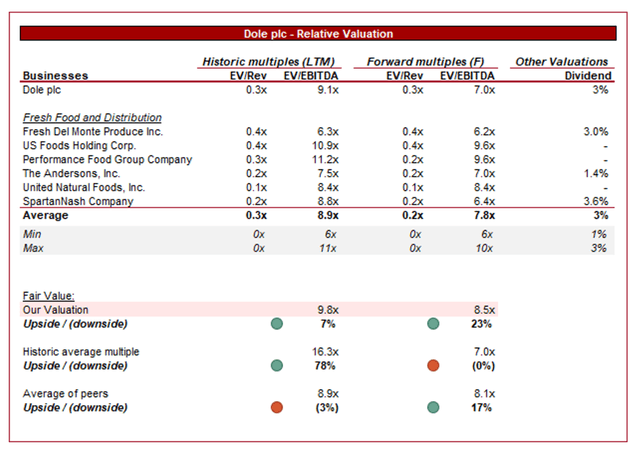

Dole is currently trading at 9x LTM EBITDA and 7x NTM EBITDA.

Given the slightly superior performance relative to peers’ average, and the scope for financial improvement in the near-term, we believe a 10% valuation premium is justifiable.

Valuation (Capital IQ)

Based on this, it implies an upside of 7-23%. The industry is trading within a tight range, implying a good level of stability but equally difficulty with breaking significantly beyond this range.

Firming our view that the company is undervalued is its current FCF yield, which is ~6%. In conjunction with this, Dole’s dividend yield is ~3%, which cannot be found with its more expensive peers.

Key risks with our thesis

The risks to our current thesis are:

- Price competition impacting margins. Although we do not think this will happen as it’s mutually destructive, there is an ongoing risk that margins could erode despite its leading position.

- Inflation. Inflationary pressures have not materially impacted the company’s margins yet but remain an ongoing risk, especially in the near term.

Final thoughts

Dole is a leading business in a resilient market. Its growth trajectory looks positive, with several trends possibly enhancing this in the medium term. Management is seeking to improve the returns of the company following a strategic review, which we expect to drive margin improvement.

Relative to similar businesses, Dole looks attractively positioned, implying upside at its current price.

Read the full article here