Overview

My recommendation for WillScot Mobile Mini (NASDAQ:WSC) is a buy rating, as I believe the fundamental outlook for the business remains positive. Key operating metrics like pricing and orders remain very healthy. There are also upcoming growth catalysts that should drive growth over the medium term (fed infrastructure projects). Note that I previously gave a buy rating for WSC because I expected the business to perform as guided. Such performance would attract a higher multiple.

Recent results & updates

WSC reported a decent 3Q23 result. On a pro-forma [PF] basis, revenue grew 5%. EBITDA margins improved 250 bps to 43.9%, which led to an EPS of $0.46, coming in slightly above consensus estimates of $0.45. For guidance, management narrowed their FY23 outlook, now guiding to sales of $2.36 to $2.39 billion, with the midpoint declining from $2.4 billion to $2.375 billion, and EBITDA of $1.05 to $1.065 billion, with the midpoint increasing from $1.05 billion to $1.06 billion. The revenue guide indicates 11% PF growth at the midpoint, and the EBITDA outlook suggests a strong 330 bps margin expansion on a PF basis.

Again, I believe the share price movement is not reflecting the positive fundamental improvements that WSC is demonstrating. While Storage performance is still a little soft, note that management is still seeing a strong net new order increase on an annual basis. Importantly, WSC is not seeing any pricing impact. Average monthly [AMR] rates on portable storage units are up 25% vs. 3Q22, and the spot price spread vs. AMR is still 30% in modular and 10% in storage. I expect WSC to continue seeing a positive pricing tailwind going into FY24 following the recent change in CRM (customer relationship management). The completion of this change in CRM should enable WSC to identify more opportunities to upsell or cross-sell its VAPS (value-added products). According to management estimates, VAPS and the current rate situation will drive ~10% pricing growth, regardless of market conditions.

And our average monthly rates on portable storage units were up 25% year-over-year. So we haven’t seen any pricing weakness across either segment despite the softer demanded backdrop, and we’re being quite disciplined about that. From: 2Q2023 earnings call

If I were to look at the long-term growth potential, my fundamental outlook remains bullish. I see WSC as a low-cost provider of a mission-critical service, which represents only ~50bps of the average total project cost (source: 1Q22 earnings). WSC solutions are relocatable, customizable, and have a short time-to-market; as such, they attract an increasing number of customers who are looking for convenience. I believe these dynamics give WSC pricing power, especially due to the point of convenience, as customers want the product to be ready as soon as possible.

I think it’s becoming obvious that customers are looking for convenience and you can see that evidenced by what they’ve done with the Ready to Work service and also Mobile Mini as managed service business that’s grown substantially although at a much lesser degree. 4Q19 earnings call

In addition, there is a multi-year demand from various federal infrastructure projects that I see as growth catalysts. My view is that WSC has an advantage here because such megaprojects are often complex and require solutions that smaller competitors typically can’t provide. Larger players have a larger fleet capacity that can cater to the massive construction plans that smaller players will not be able to provide. You could argue that using multiple small players can work too; however, it is more logical to deal with one player (it is easier to negotiate project details). Even if there are many subcontractors, I believe WSC is attractively positioned to take advantage of that situation as well because it has the capacity to provide additional storage and other solutions. Also, do not forget that these units are on a 3-year lease and require regular maintenance, which only a company the size and scale of WSC can do efficiently.

One last important point to note is that WSC has the ability to meet new demand without incremental capex, which means FCF is set to accelerate if demand flows in. Over the last 12 months, WSC has generated around $460 million of FCF, translating to 6% FCF yield, and based on consensus estimates, WSC is expected to generate ~$600 million of FCF in FY24, translating to 8.2% FCF yield. This is a very attractive FCF yield profile, given the current rate environment. Importantly, management has a shareholder-friendly capital return policy. So far into this year, management has already bought back ~6% of the shares outstanding. As such, this is one of the key reasons why I am reiterating my buy rating.

Valuation and risk

Author’s valuation model

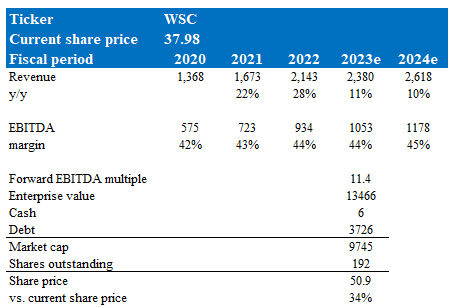

According to my model, WSC is valued at $50.90 in FY24, representing a 34% increase. This increase in target price is based on my revised growth assumptions for FY23 and FY24. Due to the softness in storage so far, I am reducing my growth expectation for FY23 (11% growth). However, I remain optimistic about the growth runway next year (pricing and net new orders remain strong); hence, I increase my growth expectation to 10%. I held my margin expectation steady as per my previous model, which is based on consensus expectations.

For new readers, the valuation multiple that I used for WSC is based on a relative multiple against the S&P index. Reiterating the math: the ratio between WSC and SPX forward EBITDA multiple has an average of 0.9x over the course of WSC trading history. The ratio is currently at 0.73x. I continue to believe this is not justifiable given the positive fundamental outlook. Attaching 0.9x to the current S&P multiple (12.7x), WSC should trade at 11.4x forward EBITDA.

My take on the risk here is that the federally funded projects might flow through as demand is slower than expected (mega projects typically take longer to finalise), which will impact the timing of growth in the near term (i.e., growth gets pushed out to the outer years). Additionally, another round of steep increases in rates would hurt consumers and the overall demand environment as well. Note that current US fed rates are still considered low when viewed from a 30Y horizon.

Summary

I continue to recommend a buy rating for WSC as the fundamental outlook remains unchanged. Despite softer storage performance, strong pricing trends and robust net new orders remain. WSC’s scale should continue to give it an advantage over small players, especially when dealing with large competitors. Notably, WSC’s capability to meet new demand without increased capex bodes well for potential FCF acceleration.

Read the full article here