Safety Shot (NASDAQ:SHOT) is about to launch a new, disruptive, anti-alcohol beverage in the market. This drove the stock into a 1,000% rally since this summer, and the mania seems far from finished, with double-digit gains continuing. We feel mixed on this stock, as the rising valuation provides a little margin of safety on the execution risk of launching the new product. However, at the same time, we understand the possible value coming out of this innovative good.

We feel that at the current levels, the stock is a sell, with a target price around $2.7.

Overview: What is SHOT and its innovative product?

Safety Shot is a “functional beverage company”. They produce and sell various products that have the most disparate applications, from treating hair loss to “women’s sexual wellness”. They claim that they have proprietary patents protecting these assets. The company’s currently marketed and sold products include (1) Photocil to address psoriasis and vitiligo, (2) JW-700 to treat hair loss, and (3) JW-500 for women’s sexual wellness. Cumulative sales for these existing consumables reached $6 million in revenues in 2022 and are on track for around $5 million this year. These products are however of very little focus right now, and barely mentioned even in the last 10-Q, as management prepares to concentrate all efforts on a new, innovative beverage that we discuss soon.

Overall, during the last few years, they grew revenues from zero to around $6 million, but are still incurring losses above $15 million as operating costs eat away profits. But right now it looks like a turnaround is around the corner. Also explaining the change of name from Jupiter Wellness to Safety Shot, the company is about to bring to the market the

world’s first patented beverage that helps people feel better faster by reducing blood alcohol content and boosting clarity

They explained in a recent press release that the study reached statistical significance and they were able to drastically reduce the effect of alcohol in just 30 minutes. They performed the study with a control group and a study group. The former did not assume Safety Shot, while the latter did. This allowed them to perform statistical analysis on different reactions and distinguish between random and non-random events.

Safety Shot Drink (SHOT Website)

But now big things should come with the launch of this innovative and disruptive product. It is set to start commercialization on the West Coast on December 7. With additional launches in more markets coming during Q4 and Q1 2024.

The market opportunity is clear and huge.

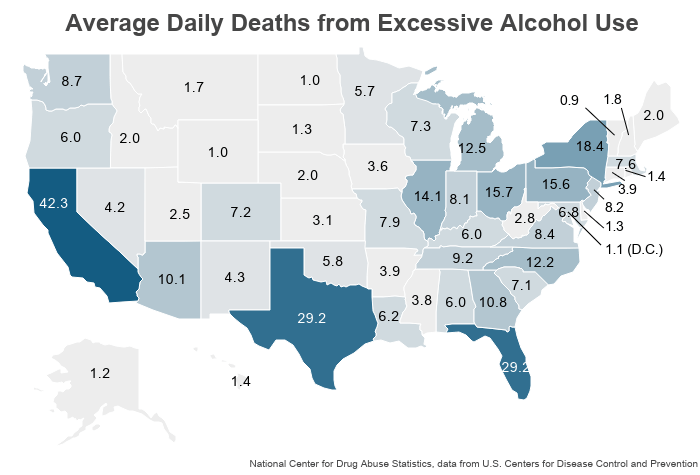

Daily Deaths from Alcohol (Drug Abuses Statistics)

These are the daily(!) deaths from excessive alcohol use in the US during 2023. Around 140,000 people die every year from abusing alcohol in the US. It is clearly a catastrophe and while SHOT cannot totally avoid this, it could possibly offer a short-term solution for many drastic cases. The company estimates a total TAM of around $1.5 billion, which is expected to grow at 15% CAGR for the next years. Other independent estimates of this market size and growth are even more optimistic, citing an overall $2 billion opportunity that could reach the $6 billion range by 2030. Given the current market cap of $130 million and revenues of $6 million, even a 10% market share that remains constant over time would be a tremendous success. However, SHOT does not come free of concerns, at least for us. Let’s have a look at them.

The concerns: Patents and liquidity

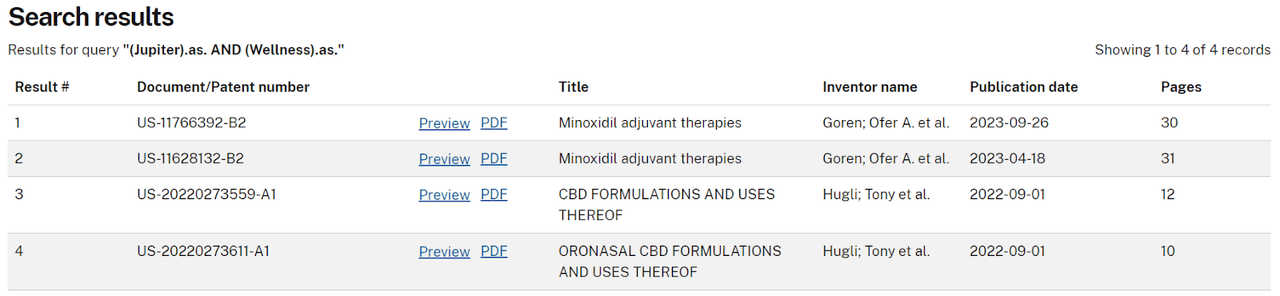

We have two major concerns around Safety Shot: (1) the actual validity of its product, and (2) liquidity. We read the claims that SHOT has various patents covering not only their flagship product, the Safety Shot beverage, but also other compounds that they currently market. However, after running various searched on the US Patent Office (United States Patent and Trademark Office) database, we were not able to find more than 4 patents.

SHOT Patents (USPTO Database)

This is the exhaustive list of patents assigned at Jupiter Wellness, the former name of the company. As one can notice, two of these patents are related to CBD formulations, while the other two are for hair loss condition treatment. This explains our concerns about the actual coverage of their current technologies by a strong IP portfolio. Without validly assigned patents, it is almost impossible to protect a product from wild competition that could easily disrupt margins and growth. However, not everything might be lost. It might be the case that the patents are assigned to some unknown subsidiary controlled by SHOT.

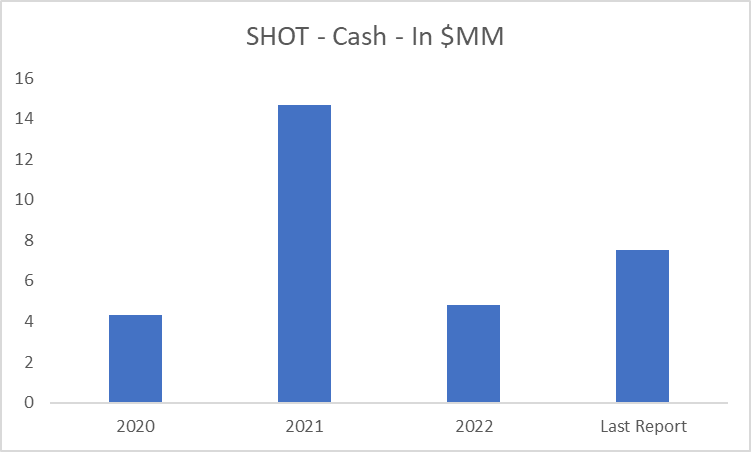

The second concern is more fundamentals-related. We notice that as of September 30, the company had some $7 million of cash & equivalents, and was burning around the same figure per year in cash from operations. Our concern is that they might not be able to sustain a big product launch without another capital raise. In particular, we notice that SHOT is currently incurring some $14 million of SG&A expenses to sustain $5 million of revenues from its existing products. We feel comfortable estimating some $20-30 million of expenses between marketing and general & administrative for 2024, which would represent a significant portion of the $50 million in revenues we estimate. This means possible cash needs in the $10-15 million range on top of existing cash. We will discuss more about our growth and margins assumption in the modeling section.

Given the incredible stock increase of around 1,000% since this summer, it would make perfect sense to file a stock offering to raise at least another $10 million of cash.

SHOT – Cash (Seeking Alpha)

The idea is that it is hard for them to be self-sustaining in the short term, as is often the case with new product launches. The consumers need to try the product first, and then familiarize themselves with it at the point of becoming recurring customers. Only after that point SHOT can reduce the marketing spending, increase prices, and benefit from higher gross and operating margins.

Valuation: Between a great opportunity and some concerns

We now try to assess a possible fair price per share for SHOT. We will use a standard DCF model, and we will try to weigh in both the incredibly high TAM and market opportunity, along with the concerns we expressed. We feel very optimistic about the speed at which SHOT could gain market share in that $1.5 billion total market, as their product would solve many problems and will likely come in high demand. If Safety Shot is as good as it is being marketed, one could also argue that little marketing spending would be necessary 1 or 2 years from now as demand would be self-sustaining.

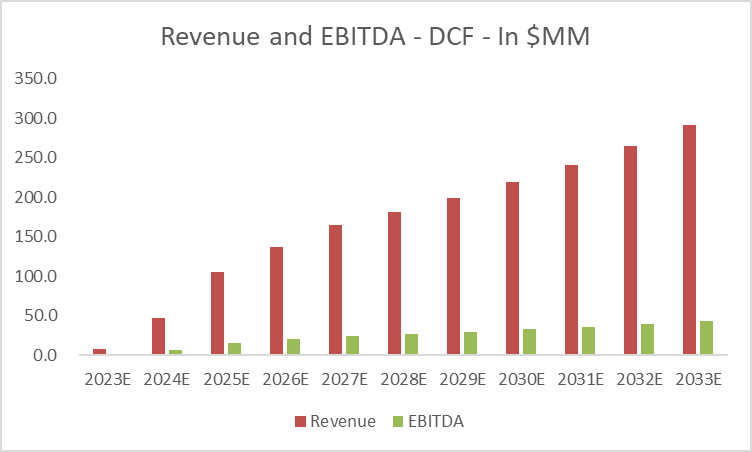

Let’s break down our assumptions for the model:

-

Revenue growth of 60% CAGR for the next 5 years, and 10% for the remaining forecasting period (up to 2033).

-

EBITDA margins of 15% and 20% reflect the initial efforts to scale with rising SG&A expenses and marketing expenses rising likely faster than revenues in the short term.

-

Very low Capex needs of only 3-4% of revenues over time, as the latter will grow very quickly this means Capex of $8-10 million after 2026.

Revenue and EBITDA (Author’s DCF model)

This is the outcome of our analysis. As one can notice, growth is extraordinarily high and it’s expected to come from both TAM growth and market share growth. We estimate that revenues could come close to $300 million per year at the end of the period. Our concerns are however reflected on a more conservative EBITDA profile, which aims to include our thoughts on possible competition and lack of visibility on marketing spending.

The conclusion is a fair price per share of $2.7, which represents an overvaluation of around 30% from the current (volatile) price of $3.6.

Conclusion

Safety Shot is a very interesting company with an even more compelling product. They aim to launch this innovative beverage in the incoming months, and we remain on the side to watch how this will play out. Our concerns are around patent coverage and lack of visibility on liquidity and marketing spending. Our cash flow analysis also suggests that a fair price is $2.70, and we will think that anything above that level would offer a low margin of safety.

Read the full article here