Thesis

The Western Asset Premier Bond Fund (NYSE:WEA) is a fixed income closed end fund. The vehicle is an interesting CEF that offers a blend of investment grade securities and high yield. Investment grade (‘IG’) securities make up over 69% of the collateral pool, while the rest is composed of ‘BB’ securities. The fund is a bit unusual in its mix, since it tends to run mostly rates risk via its investment grade bond portfolio, with credit spreads secondary. The high yield sleeve acts as a dividend enhancer here, generating additional cash-flow to support the CEF’s 7.9% yield.

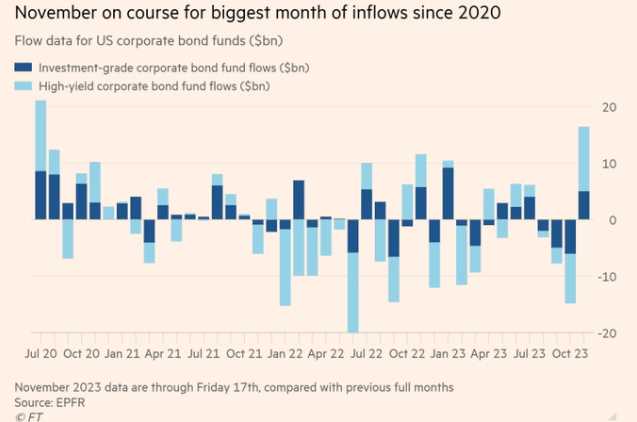

We are living through historic times, and we believe in hindsight investors will recognize this period as the ‘peak rates’ one. This feature is not lost on the investment community, which has plowed a record amount of cash in bond funds in November:

Corporate bond flows (FT)

After significant outflows starting in August, investors have pumped record cash into investment grade and high yield corporate bond funds, levels not seen since July 2020.

There is an inverse relationship between rates and bond prices, and as rates move lower, bond prices will move higher. WEA’s portfolio has a 5.6 years duration, and is ideally set up to take advantage of the run-up in IG corporate bond prices as rates move down (the main risk factor for IG debt).

In this article we are going to look at WEA’s composition, its analytics and risk factors, and articulate why this CEF looks attractive at the current juncture for a long term holder.

We have covered this name before here, in the beginning of 2023, when the lack of clarity on the interest rate path had us at ‘Hold’ for the name. At the time we expressed a preference towards the BlackRock Multi-Sector Income Trust (BIT), a CEF which successfully hedged its duration profile during this monetary tightening cycle. We were correct in that view, with BIT outperforming 2x this year:

WEA vs BIT (Seeking Alpha)

The rating upgrade is due to the main risk factor for WEA peaking, namely rates. As rates are set to move lower, a retail investor would be well served to gain more duration in their investment account to benefit from the lower rates/higher bond prices impact.

Analytics

- AUM: $0.13 billion.

- Sharpe Ratio: -0.5 (3Y).

- Std. Deviation: 10 (3Y).

- Yield: 7.9%.

- Premium/Discount to NAV: -3%.

- Z-Stat: 1.2.

- Leverage Ratio: 27%

- Duration: 5.6 years

Portfolio

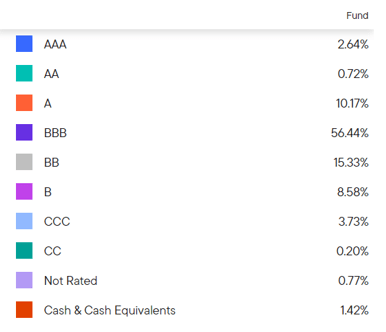

The fund holds a mix of investment grade and high yielding bonds:

Rating mix (Fund fact sheet)

If we add up the AAA, AA, A and BBB securities, we get an investment grade sleeve in excess of 69% currently. The fund has the ability to adjust the specific exposures, so expect a dynamic portfolio that will, however, be overweight investment grade bonds.

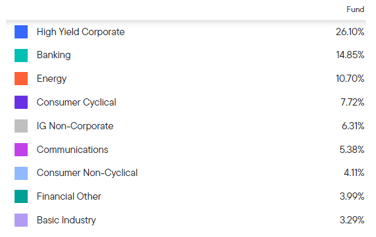

From a sectoral standpoint on the investment grade side the fund has the largest exposures to financials and energy:

Holdings (Fund Fact Sheet)

Risk Factors

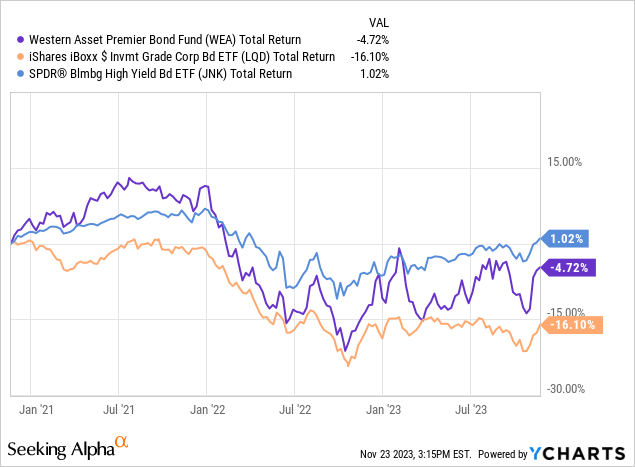

The main risk factor for this CEF has been constituted by rates, with the vehicle down from its duration drag as the Fed moved rates higher:

The iShares iBoxx Investment Grade Bond ETF (LQD) has the highest duration from the cohort (8.3 years), hence its drawdown is the largest during the Fed monetary tightening process.

With rates in a bottoming process, and the last Fed rate hike behind us in the opinion of many analysts, we are contemplating a 2024 that will be marked by rate cuts. The actively traded SOFR futures market is telling us that much, with 100 bps of cuts priced in for 2024.

Lower rates will translate into higher bond prices for WEA, all else equal. The fund has a 5.6 years duration, thus we should expect a 5.6% positive price performance in addition to the fund’s dividend yield.

The only remaining risk factor to be considered is represented by a deep recession, which would widen out credit spreads and thus negate the positive move in prices from lower rates. When credit spreads rise (i.e. the market requires a bond issuer to pay more in spread on new issues) bond prices fall. There are diverging opinions on this topic, with the equity market telling us that a soft landing is in the cards, while many leading economic indicators are turning negative.

In our base case the positive windfall from lower rates will be negated by wider credit spreads. With investment grade corporate spreads currently at 120 bps, the current projected rate fed funds cuts are well set up to negate a doubling in credit spreads. The base case assumes a parallel shift in the yield curve (i.e. the five year node will perform the same as the front end).

Yield and distributions

The fund has a covered distribution, with the high yield sleeve being used to generate a higher yield than a conventional investment grade bond fund:

Distributions (Fund website)

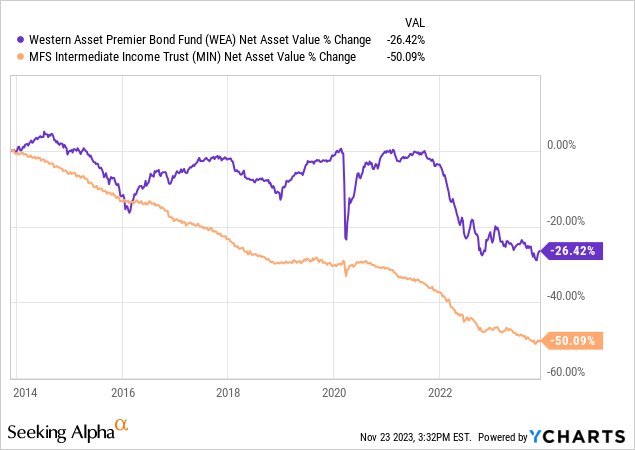

A retail investor needs to be very weary of CEF structures which overdistribute, because ultimately they will just return your capital back, decrease their NAV, and hamper their ability to perform in the future. We can see that type of behavior in the MFS Intermediate Income Trust (MIN), which we covered on Seeking Alpha in the past with a ‘Sell’ rating, specifically due to its propensity to overdistribute:

We can observe the vast difference between a fund like WEA which only sees NAV hits during recessions or periods of monetary tightening like 2022/2023, while the likes of MIN have a NAV performance that resembles a downward pointing arrow.

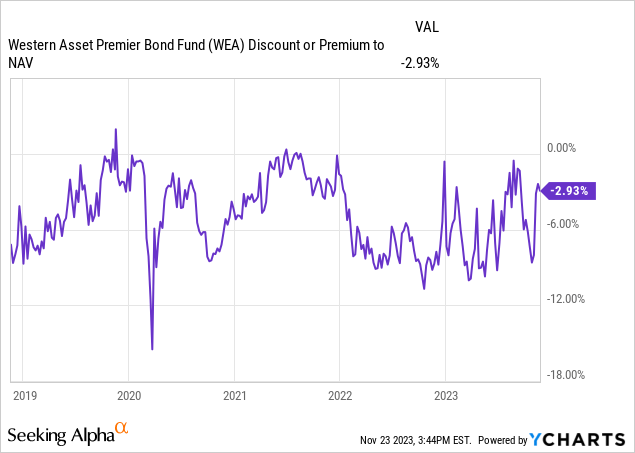

Discount to NAV

The fund displays a range bound discount to NAV that has fluctuated with the move in rates:

The vehicle has recently gained in excess of 4% from its discount narrowing on the back of the relief rally in fixed income. We can see the CEF being almost flat to NAV during the low rates environment that characterized 2021.

Expect more of the same into 2024/2025. As rates normalize lower the fund will move again to being flat to NAV, but since the current discount is very low there is not much to gain from this structural aspect for the CEF.

Conclusion

WEA is a fixed income closed end fund. The vehicle focuses on investment grade bonds which make up over 69% of the collateral pool. The remaining balance is invested in U.S. high yield bonds. WEA has rates as its primary risk factor, and with a peak in yields acknowledged by many analysts, we have seen record flows into corporate bond funds. WEA has been a beneficiary, with a 4% narrowing of its discount to NAV, and a move up in the value of its collateral. We are at the beginning of a significant bull market in investment grade bonds, mainly driven by lower rates as priced by SOFR futures. The CEF’s distribution and historic NAV performance denote a robust vehicle that does not overdistribute. We are a buyer for the name at the current levels.

Read the full article here