Shares of Marathon Petroleum (NYSE:MPC) have been a strong performer over the past year, rising by about 23% as the company has been aggressively reducing its share count with its excess cash on hand and strong free cash flow. Several year ago, I argued MPC was a strong buy due to its sum of the parts valuation, and shares have returned 370% since then. Since then, MPC has sold its gas station business, which has enabled large share repurchases. While it has fewer parts today, their sum still points to upside relative to where MPC trades.

Seeking Alpha

In the company’s third quarter, it earned $8.14 in non-GAAP EPS, $0.39 ahead of consensus. While revenue fell 12% to $41.6 billion, it is important to remember that refiners are generally agnostic to the price of crude oil, which drives revenue. Rather, they make money based on the spread between oil and refined products like gasoline. Year to date, MPC has earned $19.44, and it should earn well over $24.50 this year, for just a 6x earnings multiple.

Now, it is important to note that these earnings include the consolidated results of MPLX (MPLX), MPC’s MLP, which houses its midstream assets. Marathon owns 65% of MPLX’s common units. This provides MPC with about $2.2 billion in annual cash flow via quarterly distribution payments. Based on where MPLX trades, this stake is worth about $22 billion. I believe it is best to value MPC’s wholly-owned assets on a stand-alone basis, and then add this $22 billion of equity value in MPLX to derive a fair value for where MPC equity should trade.

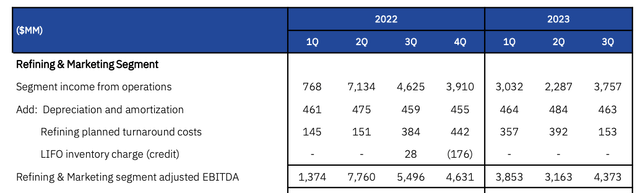

Marathon’s wholly owned assets are its refining & marketing unit, and here results are quite strong. In the quarter, the company ran at 94% utilization and realized 93% of market spread levels. As a result, R&M generated $4.4 billion of EBITDA in the quarter. While margins increased by $1.2 billion sequentially, segment income of $3.76 billion was down from $4.5 billion last year, as you can see below.

Marathon

This was primarily due to tighter crack spreads, which are the margin refiners receive for turning crude oil into gasoline, diesel, jet fuel, and other refined products. EBITDA per barrel was $16.06 from $19.87 last year while margins were $26.16 from $30.21. EBITDA declined by less than margins due to lower refinery turnaround costs of $153 million. These vary from quarter to quarter, and in Q4, they are expected to rise back to about $300 million.

Last summer, crack spreads were extremely wide. Sanctions on Russia led to significant tightness in refined markets, particularly for diesel with Europe scrambling to buy what supply it could find. As the world has gradually shifted energy supplies, some of these shortages have alleviated, leading to more normalized margins, though they are still relatively wide vs. history. As you can see below, crack spreads have fallen from their highs last year, which is why margins and segment income have fallen.

Energy Stock Channel

Now over the past few months, they have begun to widen again as demand for refined products has remained solid, defying fears of a recession, which have largely abated. Pre-COVID, refining spreads varied between $10 and $20 a barrel, so while they are lower than 2021-2022 levels, they are at the high-end of pre-COVID levels. This may lead some investors to worry that MPC is still “over-earning” relative to its long-term margin potential. While I see this risk, I believe refining margins are likely to be persistently wider than they used to be.

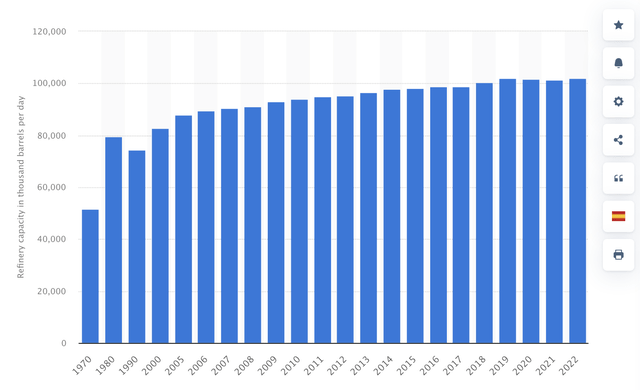

This is because the world has underinvested in refining capacity. The world has added no refining capacity over the past four years even as global demand has continued to rise about 1% per year. This is a marked slowing in refining capacity vs. the 2000s. No supply growth relative to even modest demand growth means that the market is relatively tighter than it used to be, and tighter markets mean greater pricing power.

Statista

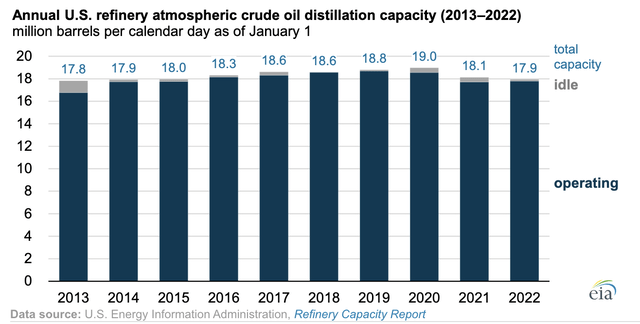

While the global refining market has stopped growing, in the US, capacity is shrinking as some smaller refiners were closed in 2020-2021. Given the regulatory environment, it is hard to imagine another major US refinery will be built—it has been over four decades since the last one was completed. Beyond the regulatory environment, the cost may be prohibitive (Mexico’s new refinery ended up costing $20 billion).

EIA

Now, refining will always be a cyclical business, but I would argue that where spreads move within that cycle is now wider as the market is so much tighter, and likely to stay that way for years. While $10-$20 was the old range, $15-25 (or even somewhat higher) is likely to be the normal range.

With 2.9-3 million barrels a day of processing capacity, about $1.2 million in cap-ex needs, $800 million in corporate overhead. $5.50 in operating costs, and $1-$1.2 billion of annual turnaround expenses, this is a business that at a $20 average spread would earn $7.5 billion (assuming a 90% market capture, less than it received in Q3) in annual run-rate free cash flow. At the $15 pre-COVID average, free cash flow would be $4 billion.

This strong free cash flow capacity is enabling it to buy back tremendous amounts of shares. In the quarter, it did $2.8 billion of share repurchases, and its share count is down by 20% from a year ago. Marathon has done $9 billion in repurchases this year and is carrying slightly more consolidated cash and equivalents on its balance sheet than last year

In fact, Marathon has also said that it will not participate in bidding for Citgo’s assets. Instead, it has announced a $5 billion share repurchase program alongside a 10% dividend increase to $0.825. That brings its total authorization to $8.3 billion. In October, it purchased a further $1 billion in stock.

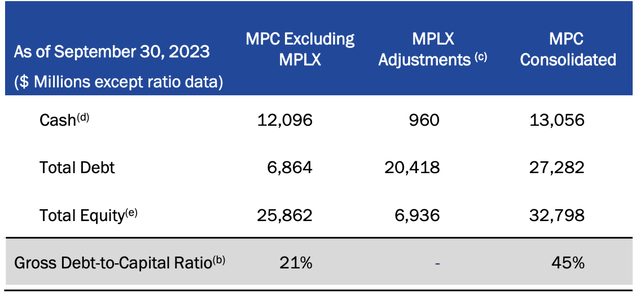

When looking at its balance sheet, it is also important to separate out MPLX’s consolidated financials. With its fee-based revenue, MPLX can carry debt, but that is already factored into its $35 market capitalization. MPC itself actually carries $5.2 billion of net cash. Its stand-alone balance sheet is pristine.

Marathon Petroleum

Given the cyclicality of refining and working capital swings, it is important to carry limited debt and significant cash balances. Still over time, I expect MPC to work towards a zero net debt position. At my $7.5 billion free cash flow estimate, alongside $1.5 billion in after-tax distributions from MPLX, if MPC seeks to get to net cash in three years, MPC can return $10.5-$11 billion to shareholders per year. Its dividend costs $1.3 billion, so with over $9 billion in share repurchase capacity, it can reduce the share count by another 16-18% over the next year. This means even if refining profits fall somewhat, EPS can rise thanks to the lower share count.

After MPLX, MPC has a $34 billion market cap. After its $5 billion in net cash, its refining operations are being valued at just $29 billion. That is about 4x free cash flow. With this multiple and the capacity to return about 20% of its market cap to shareholders, this is an extremely attractive valuation. I would be a buyer until at least 6x refining free cash flow, adding about $15 billion in market value or a share price of $186, up 25% from current levels. With each day that passes, it continues to buy back stock at accretive levels, further reducing the share count and driving up its fair value.

MPC has been a tremendous performer over the years, but with its large capital return program, which is supported by a structurally improved refining market and solid cash flow, the sum of the parts value has still not been fully realized. Investors should stay long and enjoy the benefits of growing dividends and a declining share count.

Read the full article here