The SPDR S&P 500 (SPY) has ruled the global equity markets since the start of the pandemic. SPY topped on February 19 of that year and promptly fell 33% in 5 weeks. That was the start of a major reset in how I think about equity investing. That continued when the Fed went from suppressing rates to raising them 11 times, and that brings us to today. I think it is Asia’s turn, much as it was decades ago, earlier in my career, when these markets had something the US did not at the time: Economic growth that was more than just a tepid level. Furthermore, even if economic growth in Asia does not flourish, iShares Asia 50 ETF (NASDAQ:AIA) has so dramatically underperformed SPY, I see a reversion to the mean situation brewing worst.

The region of the globe from which the pandemic started, and arguably the area of the world that struggled the most economically since that time, is Asia. When it comes to stocks in Asia, that often means China first, then the rest of the smaller nations of the region.

AIA: Concentrated on Asian Innovation and Technology

In the case of the $1.45 billion in assets, AIA, which owns the ETF with holdings in the top 50 Asian stocks, is concentrated toward Chinese companies and the technology sector. If we look at a country allocation for AIA, outside of South Korea’s 23% weighting, it’s China (36%), Taiwan (27%), and Hong Kong (9%). More than 70% of collective allocation is all China-related and driven by the Chinese economy above the rest. China’s struggles are headline news lately, and it is difficult not to have some mixed emotions about investing there, given the geopolitical nature of things these days. But putting that aside, there is a lot to like here for long-term investors who don’t believe the SPY tree will grow to the sky to play off a popular expression.

Financials, cyclicals, and communications stocks combine for 52% of AIA’s current asset base, but technology is at 40%. The pace of innovation in Asia, as well as the demographics and consumer mindset, make Asia a potential hotbed for technology.

In everything from space technology to the digital future of next-gen software, quantum computing, augmented reality, and virtual reality to generative AI, companies in Asia are involved. In the past year alone, this region accounted for 86% of patents filed and 75% of STEM graduates (McKinsey). Asia also has a large consumer base – consumers that are very open to adapting new technology.

AIA: Contrarian’s Delight?

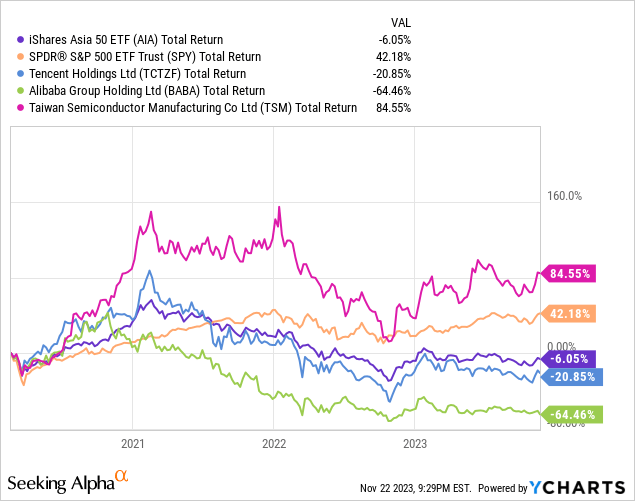

The above chart shows just how much AIA has lagged behind SPY since the start of the pandemic in February 2020. The main culprits, not surprisingly, are the largest holdings. In fact, 2 of the 3 iconic Asian business leaders, pictured above, which account for more than 1/3 of AIA’s assets, have contributed mightily to dragging those returns.

Expecting a 48% deficit versus the S&P 500 to remain or widen significantly assumes that China’s current economic malaise continues. And that market is just too big and influential in its region for that to happen. Furthermore, the US consumer is challenged, and I firmly believe that the US market will experience moderating returns over the next decade. Too much of that excess return of SPY over AIA represents US consumer demand pulled forward.

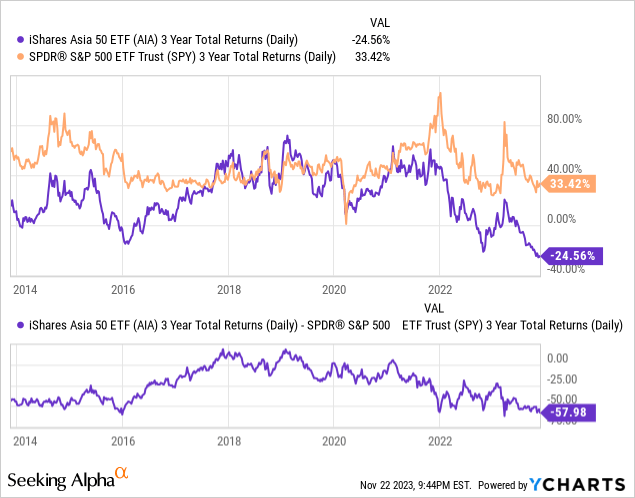

This chart shows 3-year rolling returns (not annualized) of SPY versus AIA. The lower portion of the chart shows a remarkable 58% gap between the 2 over the past 3 years. As the left side of the chart shows, that same level represented the trough for AIA versus SPY at the end of 2015. SPY treaded water the next 2 years, while AIA staged a strong comeback. I see the potential for a repeat performance, especially given the potential vulnerability of the US Dollar and the potential for an expanded BRICS nation partnership, with China and India at the forefront, as an economic trading bloc.

The Effect of Trade Wars and the Potential of Pandas

The US and China are the two largest global economies, producing 40% of global goods and services. When the economic competition between the two countries heats up into possible conflict, the entire world suffers, as countries are forced to decide whether to trade with Beijing or Washington, when in reality it would be better to trade with both.

The Chinese economy and consumer base are the largest in Asia, and the past two years have been especially hard on the Chinese economy. This is, at least in part, due to the lingering effects of the pandemic and China’s zero-Covid policies, and their disruption to supply chains and consumer confidence. Added to this is the ongoing tensions between the United States and China, over Taiwan and China’s military presence in the South Pacific, creating volatility and uncertainty in the Asian market.

Over the past 5 years, tensions between the two countries have only escalated, with a trade war ongoing. Taxes on goods from China have gone from 3% in 2018 to more than 19%, while China’s taxes on US goods has escalated from 8% to 21%. In the technology sector, President Biden has imposed sanctions designed to keep China from receiving advanced computer chips and equipment, and China retaliated in August by adding new restrictions to exporting the minerals needed to produce computer chips and solar panels, like gallium and germanium.

However, last week – November 15th, 2023, President Biden and President Xi sat down for a face-to-face meeting, their first meeting of any kind in a year. They emerged from the meeting with positive promises of better communication and cooperation, in spite of their continuing differences. President Biden said they promised to “pick up the phone and call one another” if either of them had concerns, and President Xi “signaled later Wednesday that China would send the U.S. new pandas.” – apnews.com. Perhaps these promising signs point toward renewed stability in southern Asia and greater potential for investment in as well as trade with Asian markets.

Summary Thoughts

As an ETF that invests in Asian companies, AIA is susceptible to instability in the region but also benefits from the potential of Asian innovation and consumer demand. The recent talk between Biden and Xi is promising, but as Robert Moritz, Global Chairman for the consulting firm PwC, said “What we are looking for is a de-escalation and a bringing of the temperature down. Discussion isn’t good enough, it’s the execution on getting things done that will matter.” (apnews.com)

Will adorable pandas lead to more substantial changes in a positive direction? No. But reversion to the mean in returns, driven by a return to earth for the US market relative to the rest of the globe is likely. And, AIA trades at under a 12x P/E multiple on trailing earnings versus 21x for the inflated SPY. I rate AIA a Buy on a 3-5-year time frame. Long-term investors, start your engines.

Read the full article here