Thesis

Robinhood Markets, Inc. (NASDAQ:HOOD) is an American financial services company that facilitates commission-free trades of stocks, exchange-traded funds, and currencies. It shot to fame when it was at the center of the Game-stop, or rather the meme-stock saga, in early 2021, as retail traders from a Reddit group piled into over-shorted stocks, resulting in a short squeeze that trapped hedge funds. The stock, however, is down close to 75% of its listing price. While the company is improving on overall profitability, it faces major challenges, such as a decline in key performance indicators (KPI), and risks associated with expansion into the UK and the EU.

Catalysts

Declining in Key Performance Indicators

Robinhood recently announced its 3rd quarter earnings for FY 2023, and my attention was immediately drawn toward a decline in key financial metrics such as Transaction-Based Revenues and Trading Volume.

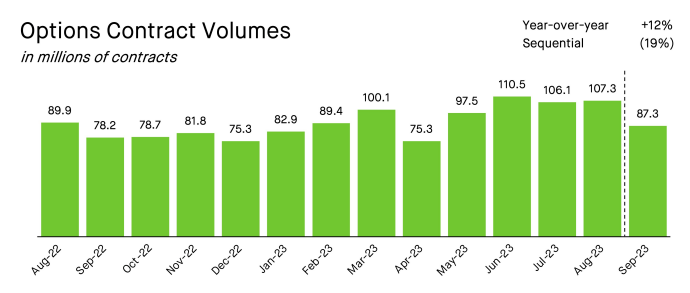

Over two-thirds of its transaction revenue is now derived from Options Trading as retail traders are piling into the recent phenomenon called 0 Days-To-Expiry (0DTE) options, and more than 75% of their trades in S&P 500 options today are in 0DTE contracts. 0DTE Options are options contracts that expire on the same day or are active only for one trading day. These are highly speculative investments and may often be used by the average retail investor as a lottery ticket because they are extremely cheap compared to long-term options contracts.

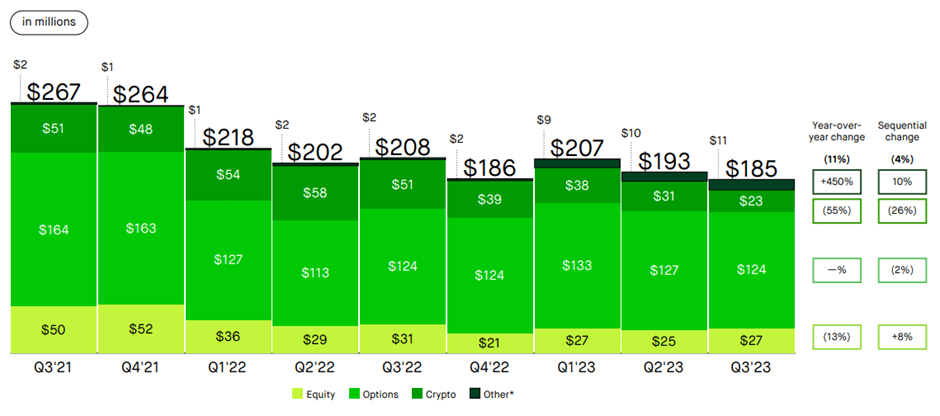

Meanwhile, Equity and Crypto transaction revenues have declined which is a major red flag. Transaction Revenue now contributes only 42% of its revenues in 9 months of FY 2023 compared to 60% of revenues in all of FY 2022. Overall transactions revenue is down 11% YoY and 4% QoQ, whereas crypto revenue is down 55% YoY and 26% QoQ. Equity transaction revenue is also down 13% YoY.

Robinhood Q3 Earnings Presentation

In my opinion, most retail traders are somewhat neglecting the risk that these 0DTE options possess. Additionally, to some degree, there is a misalignment in incentives between the brokers and the customers. Brokers benefit from the customers trading more and taking higher risks, but eventually, the latter runs a higher risk of going bust, which, in the long term, hurts the broker.

What I mean by this is that the broker typically gains more financially from customers, making riskier investments in the short term, for example, trading on margins through futures and options. However, most retail traders tend to lose money. In the long run, customers who often lose money are not a good sign for a broker, as such customers may switch brokers more often.

Research has proven that, on average, retail investors tend to lose in these risky investments. Between February 2021 and February 2023, retail investors reportedly lost $184,000 on average per day; since introducing a daily expiration calendar in May 2022, this number has grown to average losses of $358,000 per day.

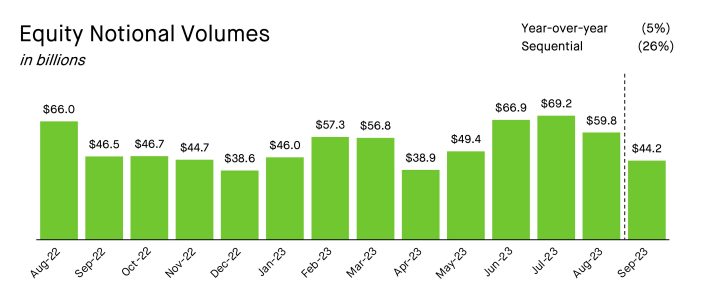

Robinhood Q3 Earnings Presentation Robinhood Q3 Earnings Presentation

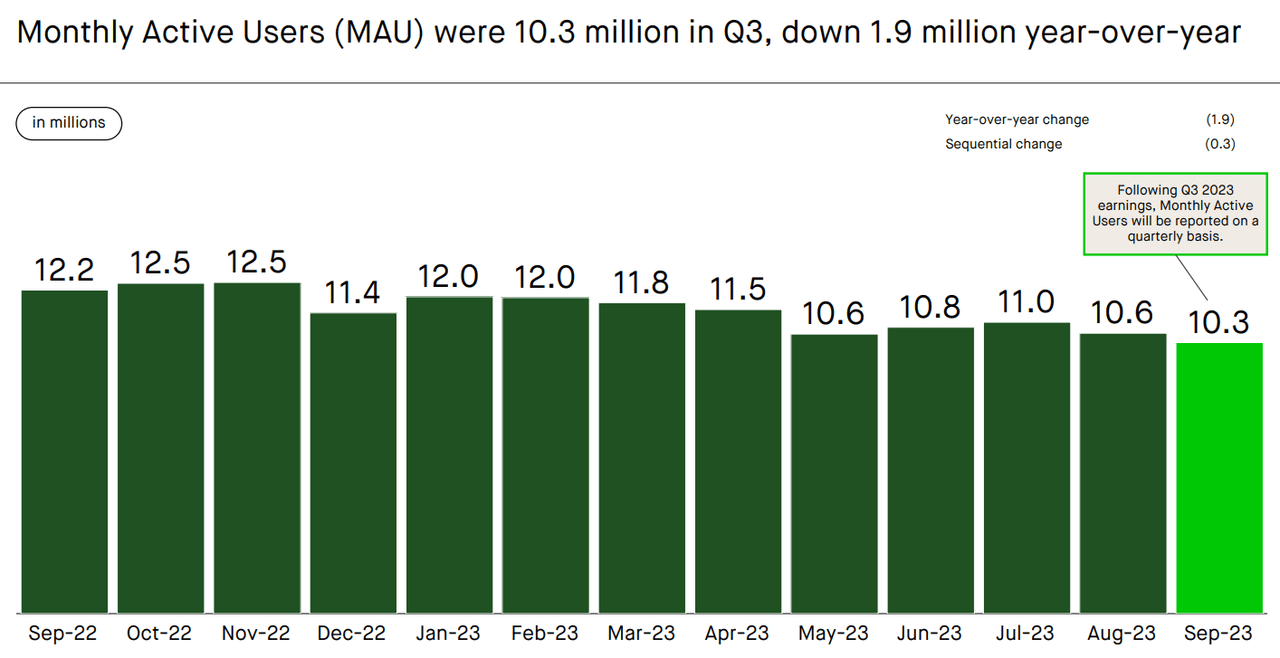

I believe that this trend is likely to continue in the coming few months. The reason behind this is that trading volume on Robinhood typically declines heading into the holiday season in November-December. Another reason is that June, July, and August were the latter months of the market rally that started in April/May, and average retail investors are typically the last ones to participate in a market rally. As the market has drifted lower in September and October, net buying on Robinhood has been weaker, and securities lending in Q4-to-date has also been worse than Q3 averages, as confirmed by the CFO in the Q3 earnings call. This forecast is also meant to be consistent with the steady decline in Monthly Active Users, which spiked in June-July, and the metric has since declined.

Robinhood Q3 Earnings Presentation

Expansion into the UK/Europe

In most cases, expansion into new markets would be a tailwind. However, when a loss-making company ventures into a new market with a major source of revenue not available due to regulatory risk or rules and regulations, I would hardly call it a tailwind. In its Q3 Earnings Press Release, the company announced that in the coming weeks, it plans to start brokerage options in the UK and Crypto trading operations in the EU. However, an extremely important contributor to Robinhood’s trading revenues is the Payment for Order Flow (PFOF). This involves financial middlemen, in this case hedge funds such as Citadel Securities and Melvin Capital, being the middlemen to Robinhood customers, and this practice is banned in the UK and EU.

While the company now earns a large chunk of its revenue from interest-related income, I do not believe that expansion into UK and EU markets is a wise decision when one of the most important trading revenue sources is not available. In my opinion, this will result in increased losses over the next few quarters and increased cash outflows due to the unavailability of a major revenue source and the increased market expenditure it would need to convince users to switch to its platform. Robinhood has previously acknowledged that a ban on Payment for Order Flow (PFOF) makes the free stock trading business model incredibly risky and threatens its existence.

Unsustainable Robinhood Gold Plan

The company launched its Gold Cash Sweep plan in July 2023, where it earns a spread between the returns earned by it from its bank and the Annual Percentage Yield (APY) offered to its clients, which is between 4.65% and 4.90%.

The company has used the prevailing high-interest rate scenario to increase the number of customers onboarded to the Gold plan. The company currently has 1.33 million customers subscribed to its Gold plan, which has helped the company bring in ~$56 million in revenue this year (4% of total revenue).

However, I believe that the Gold Plan will be less successful 12 months down the line, for the following reasons:

1) Gold-plan cash balances have increased from $1.5 billion at the end of Q3 2022 to $8 billion at the end of Q1 2023 to $12.9 billion at the end of Q3 2023, which at 4.9% APY represents an interest burden of ~$600 million. If interest rates are to decline either due to recession or due to rate cuts as a result of bringing inflation under control, the company may not be able to earn higher than 4.9% itself for it to be able to pay that yield without hurting its profits are lowering the offered yield, which I believe will dissuade investors from buying gold subscriptions.

2) I expect declines in the interest rate spread that the company earns on its Cash/Equivalent holdings over the next 8-12 months as the economy could enter an environment with lower interest rates. This is based on my recessionary outlook on the US and global economy, backed up by the fact that Taylor’s rule suggests that the Fed Funds rate could be lower. Calculations as per Taylor’s rule indicate that the Fed Funds rate should be at 4.31% by the first quarter of next year. This assumes rate cuts of nearly 100bps that need to be achieved.

Risks

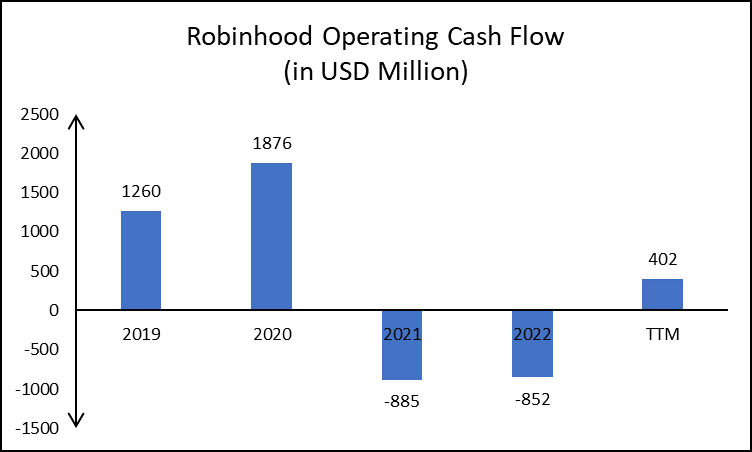

Improvement in Operating Cash Flows

Robinhood was cashflow positive in 2019 and 2020 until it turned cashflow negative in the last two financial years, FY 2021 and FY 2022. The reasons for turning cash flow negative in 2021 were high amounts of Net Loss – $3 billion in Net Loss in 2021 and $1 billion in Net Loss in 2022 compared to $7 million net profit in 2020. This rise in operating expenses in 2021 came from a near quadrupling in operating expenditures from $945 million in 2020 to $3.456 billion in 2021. Since then, operating expenditures have steadily declined, and the company now has positive operating cash flow on a Trailing Twelve Month basis. The company’s operating loss margins have also declined (meaning improvement), from -73% in 2022 to -41.5% on a trailing twelve-month basis, so things are maybe not as worrying as they may appear to be. Robinhood’s revenue growth is negative, and they have transitioned from a growth-focused approach to focusing on positive cash flows, which may signal the company does not have a bright future in regards to expanding its user base and profiting purely out of brokerage-based revenues.

Seeking Alpha

Crypto Market Capitalisation Rising Again – With Fewer Brokers

Revenues from Cryptocurrency trading account for 12.5% of Robinhood’s trading revenue and ~5% of all revenues based on Q3 2023. However, at its peak in Q2 2022, revenue from cryptocurrency was ~28% of all trading revenue and one-sixth of the quarterly revenue for the company.

In the last few months, the total market capitalization of cryptocurrencies, measured as a sum of the top 125 coins by market capitalization, has increased from $756 Billion at the end of December 2022 to $1.027 Trillion in August 2023 to $1.388 Trillion in early November 2023. This shows a rising demand for cryptocurrencies over the last 12 months.

The company obviously may directly benefit from renewed interest in cryptocurrencies and the fact that it can capitalize on issues faced by major cryptocurrency exchanges – the shutdown of FTX and Binance US holding withdrawals. The company has also made improvements to the User Interface for crypto traders on their mobile application, which may attract some crypto traders to join the platform. However, so far, there has not been a significant improvement in revenue from crypto, which has been steadily declining over the last year or so. The CFO also confirmed that crypto volume was in line with Q3 averages. Thus, so far the risk does not seem to present enough strength to outpower the catalysts outlined earlier, but it may be possible in the future and has hence been included as a risk to our thesis.

Conclusions

To conclude, my opinion is that the headwinds that the company faces through no Payments for Order Flow in the UK and EU and a decline in KPIs such as Monthly Active Users, trading volumes, and transaction revenues will be far more impactful and hurtful to the company’s ability to turn sustainably profitable and remain cashflow positive than the risks to my thesis. Thus, I would like to place a Sell Recommendation on the Robinhood stock.

Read the full article here