Summary

Following my coverage of Casella Waste Systems (NASDAQ:CWST), I recommended a buy rating as I thought that CWST fundamentals were still strong, unlike what the headline was suggesting back then. I saw the drop in share price as an attractive opportunity to long the stock. This post is to provide an update on my thoughts on the business and stock. I am reiterating my buy rating for CWST as I don’t find the decline in volume alarming at all, and pricing growth remains very healthy (and I expect it to continue being supportive of growth).

Investment thesis

CWST reported 3Q23 revenue of $353 million due to weaker disposal revenue and volume but was driven higher due to acquisitions. Overall revenue grew by 19.5%, with 18.9% coming from acquisitions. Within it, collections revenues grew 43% to $206 million, while disposal was weak, with revenues flat at $66 million. A number of challenges, including bad weather, higher fuel costs, and a decrease in specialty waste volume, contributed to CWST’s EBITDA margin of 25.4% ($89.6 million). For guidance, at the midpoint, EBITDA guidance was increased to $295 million, while adjusted FCF guidance was raised to $128 million from $126 million.

I believe the weak headline performance seen in CWST volumes has caused some concerns among investors. For instance, solid waste was down 3.3%. But I don’t think it’s cause for alarm because the drop was mostly attributable to the loss of residential accounts. As CWST processes and integrates new acquisitions, it is common practice to shed accounts that are not margin accretive. Remember that the solid waste revenue segment grew by 28.9%, with 25.5% coming from acquisitions. For the benefit of new readers, CWST has been adopting a strategy to focus on quality contracts that carry high margins (I wrote about this in my last post). This is something that management seems intent on pursuing, and I couldn’t be happier about it. A solid proof of this is that, during the call, management shed off 1% of roll-off revenue in one of the business lines, but the margin saw a 400-bps increment. Aside from solid waste, specialty waste also saw a volume drop of 35% due to lower regional activity. Again, I don’t think this should be a reason for alarm because the volume of specialty waste tends to be lumpy because of the timing of projects during times of economic uncertainty (projects being delayed, etc.). As such, I caution against extrapolating this negative volume over the near term.

Moreover, I would also note the additional capacity that is going to come online from the Boston Material Recovery Facility, which is undergoing upgrades. With this capacity coming online, CWST productivity should increase accordingly, and I believe this positions the company well in the near term.

In my opinion, the key focus of the quarter should be on the strong pricing performance. Collection pricing grew 7.6%, disposal pricing grew 5.9%, and the solid waste price grew 6.9%. The strong pricing performance continues to show that CWST is able to grow above inflation, and the current inflationary environment benefits CWST. I expect CWST to continue demonstrating strong pricing growth, as the CWST surcharge mechanism calculation is based on historical data and, as such, is not reflective of the latest fuel inflation. As the calculations catch up, pricing should inflect higher. Consequently, given that inflation is likely to remain sticky and management is focused on shedding contracts that carry low margins, I believe the CWST price-to-cost spread will continue to widen. In other words, the margin should expand accordingly.

Our fuel recovery fees under-recovered rising fuel costs by approximately $2.6 million during the third quarter as fuel prices increased sequentially throughout the quarter and our surcharge program calculation lags in a rising environment. 3Q23 earnings results call

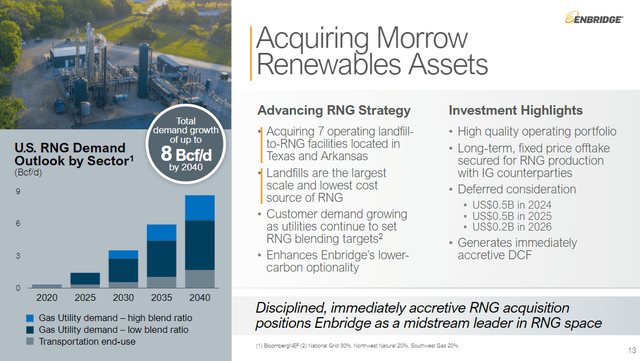

Enbridge

The fact that Enbridge paid $1.2 billion to acquire seven landfill gas facilities from Morrow Renewables is another noteworthy event that I would like to draw attention to. The efforts of gas utilities to establish RNG blending targets were cited by Enbridge as evidence that RNG demand remains favorable over the long term. In my opinion, this is good news for CWST because investors will be better able to gauge the potential profit or monetization from CWST’s landfill gases as more M&A deals are done.

Valuation

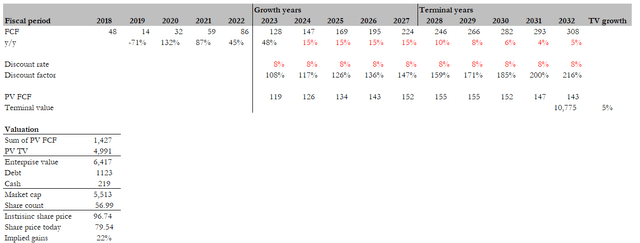

Own calculation

My target price for CWST based on my DCF model is $96.74, which is similar to my previous target price as my model assumptions are largely the same. The key changes are:

- FY23 FCF, which I increased by $2 million, reflects management’s revised guidance.

- Cash and debt positions reflect the latest balance sheet.

I continue to believe that CWST should be able to grow FCF in the mid-teens range, supported by topline growth and margin expansion. Top-line growth is going to be supported by sticky inflation, driving higher pricing growth. Margins expansion will be driven by a recovery in volumes and financial leverage. I note that CWST has a lower EBITDA margin profile than its larger peers like Waste Management (28%), Waste Connection (30.5%), Republic Service (28.8%), and GFL Environmental (23.45%). The major difference that leads to this margin differential is size. These players are a lot larger than CWST in terms of revenue. With scale, these businesses have better negotiation power for better prices, better route density, and a larger capacity to handle more volumes. Hence, as CWST continues to grow in size (organically or through M&As), it should be able to expand its margins.

Risk

As CWST is the smallest player in the group, the fastest way for it to grow is through acquisition. The risk is that management acquires for the sake of acquiring-to become larger-and neglects whether the acquisitions are accretive or not. If it is value-destructive, it would hurt shareholder returns.

Conclusion

My recommendation remains a buy CWST. The drop in certain waste volumes, mainly residential accounts, aligns with the company’s strategy of focusing on high-margin contracts. Notably, the substantial growth in pricing across collection, disposal, and solid waste segments underscores CWST’s ability to surpass inflationary trends, driving margin expansion.

Read the full article here