If They Did A 10:1 Split, I Could Buy 3 More Shares

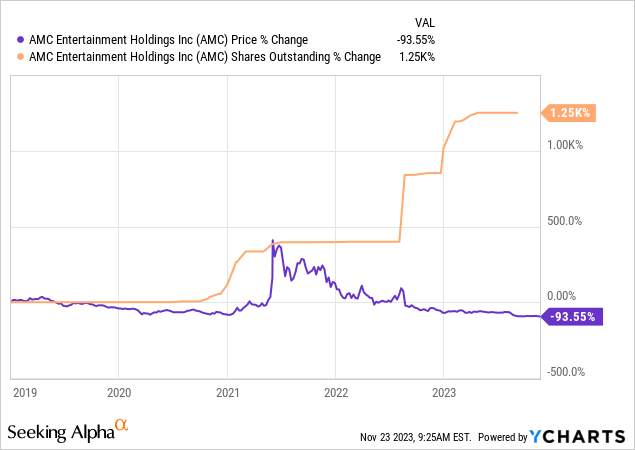

Since our first Sell rating on AMC (NYSE:AMC), the stock has given the bears 100% satisfaction.

Seeking Alpha

Well, technically, it has given them 102.21% satisfaction, as that is the amount by which AMC has underperformed the S&P 500 (SPY).

On our last coverage, we gave a definite timeline for when this long-running saga would finally end.

We think this saga will end by Q2-2024 now. This does not change the rating on the common shares, which we maintain at Strong Sell to account for a potential corporate bankruptcy or theoretical issuance of infinite shares. We encourage management to continue to hit the bid on this bounce with the same urgency and aim for option number two.

Source: Save The Last Bounce

The stock has dropped 86.41% since then and is tracking our midline estimates. We update our readers with the Q3-2023 numbers and the capital market access that we have seen to date.

Q3-2023

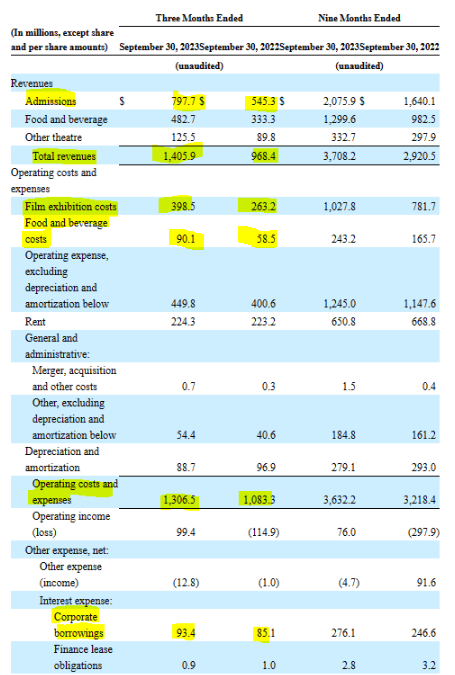

Q3-2023 was an outstanding quarter by AMC’s standards. Mega hits like Barbie and Oppenheimer powered the top line and revenues jumped 45% over 2022 levels. Bulls have often found this solace in this quarter-by-quarter analysis based on top line changes and this was perhaps the best they have seen. Unfortunately, AMC maintains some of the highest variable cost structures we can find. What that means is that the expenses tend to rise almost as fast. Film exhibition costs, for example, moved up by 51.4%. Food and beverage costs moved up by about 54%.

AMC Q3-2023 10-Q

Fortunately, for AMC, not all of the expenses move up at that base and some costs are more fixed than variable. Overall, operating costs increased by about 20% and the company was able to deliver a nearly $100 million operating profit. Interest expenses were up about 10%, but even taking that into account, this was a splendid quarter for AMC. Management did not hesitate to bring this to forefront.

For AMC, it might be right now right after reporting AMC’s third quarter 2023 earnings. It was, after all, the single best third quarter for AMC in some 103 years. These were stellar results. To our shareholders listening in to this webcast. We hope you share our pride in the progress that’s being made by AMC. This, after all, is your company. And we benefit in so many ways from your enthusiasm and from your passion for AMC.

Source: AMC Q3-2023 Conference Call Transcript (emphasis ours)

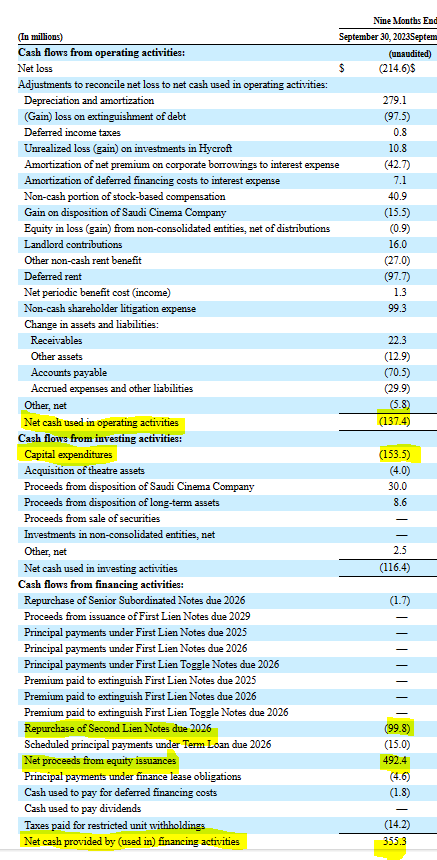

Great. Single best quarter. But that did not mean much for the company’s cash flow. Year-to-date, operating cash flow was still negative to the tune of $137.4 million. The company burnt through another $153.5 million in capex. That right there is $290 million of cash burn and we are not even done with the last quarter. How did AMC finance this?

AMC Q3-2023 10-Q

Oh, they did so as they always do. They issued almost half a billion of stock ($492.4 million to be exact) year-to-date. A lot of that came in Q3-2023.

AMC Entertainment Holdings Inc. raised about $325.5 million through the sale of 40 million shares, a move that it said would address a cash crunch as the movie-theater industry rebounds.

The offering, which began Sept. 6, sold stock at an average price of $8.14 a share, the cinema chain said in a statement Wednesday. The money-losing company has struggled with weak box office sales since the pandemic ravaged its industry.

“Raising more than $325 million in gross proceeds has bolstered our ability to survive and then thrive,” Chief Executive Officer Adam Aron said in the statement.

The stock sale was unpopular with AMC investors due to its dilutive effect, and its shares have plunged nearly 80% this year. But AMC is now in a better position to benefit from an industry recovery, Aron said.

“This infusion of capital provides us with flexibility to assist us in navigating the waters ahead and continue delivering the magic of movies to our guests,” Aron said.

Source: BNN Bloomberg

Outlook

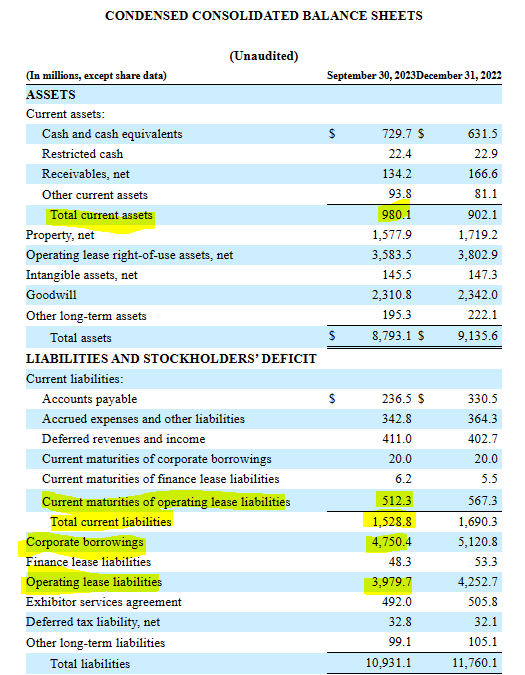

All of those share issuances have barely made a dent in the company’s liability profile. Our crude measure for this is working capital excluding operating lease liabilities and corporate borrowings.

AMC Q3-2023 10-Q

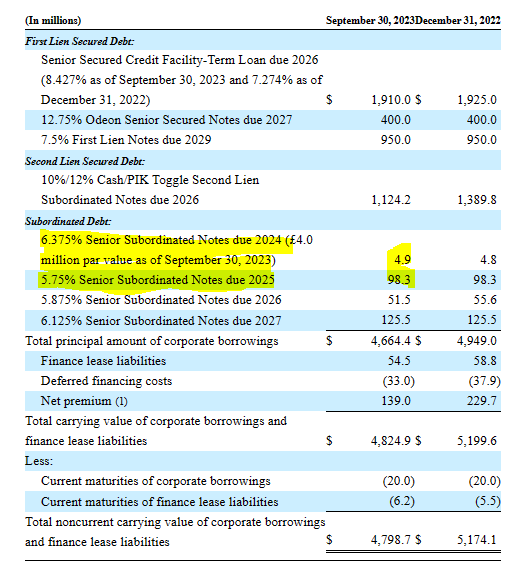

On the working capital side, current assets and current liabilities are about equal if you disregard operating lease liabilities. On the longer-term liabilities, we again ignore the operating lease liabilities as those are essentially the equivalent of rent to be paid. Corporate borrowings though, still stand at a massive $4.75 billion. This is a slight improvement from last year, but we are still in extremely dangerous territory. Hence, to the surprise of no one except those blaming short sellers for their woes, AMC did yet another round of equity issuance.

On November 9, 2023, AMC Entertainment Holdings, Inc. (the “Company”) entered into an equity distribution agreement (the “Equity Distribution Agreement”) with Citigroup Global Markets Inc., Barclays Capital Inc., B. Riley Securities, Inc., and Goldman Sachs & Co. LLC as sales agents (each, a “Sales Agent” and collectively, the “Sales Agents”), to sell shares of Class A common stock, par value $0.01 per share, of the Company (the “Common Stock”), from time to time, having an aggregate offering price of $350,000,000, through an “at-the-market” offering program.

Source: AMC 8-K

While the stock price is down, we are still surprised at the phenomenal ability of the market to absorb such massive amounts of equity relentlessly. There are a ton of meme traders who are still into the delusion that the price is manipulated. But even for them to keep buying such constant issuances must be difficult. Just look at the share count (up over 1200%) over the last 5 years vs the stock price.

Verdict

If we add the recent issuance to the balance sheet, we buy the company some more time. The upcoming maturities for 2024 and 2025 are now very easy to address.

AMC Q3-2023 10-Q

They also trade at a big discount to par so the company can clear them up even faster. So far, the buybacks have focused on the 2026 arena. That is where over $3.0 billion comes due. Even if we assume every quarter is a “Barbie” quarter and the company can fund expenses and capex through its business model (not likely), we need another 5-10 such $350 million equity issuances. We have given a range as that debt too trades at a huge discount. We don’t know at what price AMC can extinguish the debt.

So as big as the equity issuance was, we think it was too little and a lot more will have to come at progressively lower prices. What we do know hence, is that the share count is going to explode up. We would assume each of these issuances drops the price by 90%. So assuming the market allows it and not accounting for the inevitable reverse splits, the share count increases would be as follows.

1) First round – 50 million

2) Second round – 500 million

3) Third round – 5 billion

4) Fourth round – 50 billion

5) Fifth round – 500 billion.

So that complete wipe-out is still coming. Whatever price you enter at, you will lose effectively 100% though technically, it is possible the company makes it. We continue to rate this a strong sell and think investors should use any rallies to exit.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here