Back in February, I placed a “Buy” rating on Antero Midstream (NYSE:AM), writing the company should benefit from a recent acquisition, rebate roll-offs, and a commitment to lower its leverage. The stock has generated a 28% return since then, outpacing the S&P, which is up over 13%. More recently, I reiterated my rating, saying the company looked well-positioned heading into next year. The stock has returned nearly 12% since then. So far, my thesis has been playing out largely as expected. With the company having since reported its Q3 results in late October, let’s take a closer look.

Company Profile

As a quick reminder, AM is a gathering and processing midstream company that owns a network of low-pressure and high-pressure gathering pipelines. Its primary customer is Antero Resources (AR), which owns 29% of AM. Its contracts are fee-based or serviced-based with inflation escalators. It also has a 50% equity interest in a joint venture with MarkWest, a subsidiary of MPLX (MPLX), to develop processing and fractionation assets in the Marcellus and Utica. AM also has a freshwater delivery business that accounts for about 15% of its EBITDA.

AR Volume Growth Leads To Strong AM Results

Given its ties to AR, AM’s results are very dependent on the drilling activity of AR. The E&P saw its Q3 volumes rise 9% year-over-year, accelerating from a 5% increase in Q2 and a 3% increase in Q2. Natural gas volumes rose 4%, while liquids volumes climbed 18% as it continued to focus its development on more liquids-rich areas.

On its Q3 call, AR said that its operations momentum continued from its record-setting first half. It said that completion stages averaged more than 11 per day in the quarter, a 35% improvement from a year ago, while completion pumping hours per day increased 50% year over year. As a result, the AR increased its full-year production growth by 25 MMcfe/d at the midpoint, after increasing its production guidance by 100 MMcfe/d last quarter. AR now expects its 2023 production exit rate to be 7% higher than 2022 production exit rate.

AM is by and large a volume play on AR, as the E&P is its predominant customer and AM has no direct exposure to natural gas or liquids prices.

AR’s drilling activity as well as some acquisitions by AM helped power its results in Q3. AM saw a 13% increase in low-pressure gathering to 3,323 MMcf/d and a 17% increase in compression to 3,271 MMcf/d. High-pressure gathering rose 5% to 2,935 MMcf/d, while freshwater delivery rose 3% to 106 MBbl/d. Note that the CEQP acquisition added 200 Mcf/d of low pressure gathering, and that organic low pressure volumes rose 6%.

Gross JV Processing volumes, meanwhile, climbed 10% to 1,616 MMcf/d, while gross JV fractionation volumes jumped 11% to 40 MBbl/d.

The strong volume growth led to a 12% increase in adjusted EBITDA to $250.9 million for AM. Free cash flow, meanwhile, edged up slightly to $138.4 million from $138.1 million a year ago, as it saw higher interest expense and capex.

AM ended the quarter with leverage of 3.4x, down from 3.5x last quarter and 3.7x at the end of 2022. It is targeting 3.0x leverage by the end of 2024.

Looking ahead, AM raised the bottom end of its prior full-year adjusted EBITDA of between $950-990 million, and it now expects full-year adjusted EBITDA of $970-990 million. CapEx is projected to be between $180-200 million. Free cash flow is expected to be between $565-585 million, an increase of $5 million at the midpoint from its prior guidance and $40 million from its initial forecast. It anticipates paying out approximately $430 million in dividends and producing free cash flow after dividends of between $135-155 million.

Looking towards 2024, on its Q3 earnings call, CFO Brendan Kruger said:

There’s really the 3 components [to 2024 growth]. So the fee rebates rolling off will be about $48 million next year. So that’s roughly 5% growth on the midpoint of our guidance this year. The CPI, it’s measured June to June. So we know that number already. It was a 3% CPI number, and then you take 55% of that. So you’re, call it, 1.5%, so given that 6% to 7% overall EBITDA growth. And then if you look at the drilling partnership and what AR said, the benefit is that AR has continued to improve with well performance, acceleration of completions. And so the production number at AR is up over 200 million a day from year-end ’22 to year-end ’23. And so depending on what they run from a maintenance capital plan will drive kind of that third component of growth at AM. So you can be anywhere, call it, in the 6% to 7% up to that low double-digit number that you talked about, just depending on the development plan that we see at the AR level and AM is well positioned just from a capital standpoint to be able to meet those levels.”

AM turned in another strong quarter and once again raised its guidance as its parent AR continues to have some of the strongest volume growth among natural gas-oriented producers. Despite the big drop in natural gas prices and a slowdown in rigs across many natural gas basins, AR production growth has been strong due to its liquids-rich production profile, low breakevens, and transport to premium markets. The acquisition of Crestwood’s AR acre dedication at an inexpensive price and some compression from Enlink (ENLC) also further bolstered AM’s results.

Looking ahead, the G&P will benefit from AR’s continued growth, as well as from volumetric discounts rolling off next year. AM gave AR quarterly rebates if certain volumetric targets were reached between 2020-23, with AR getting back $48 million last year and set to get back the same amount this year. That’s a nice 5% boost to EBITDA before even taking into account AR’s likely continued solid production growth in 2024.

Valuation

AM trades at 9.0x the 2023 EBITDA consensus of $980.6 million. Based on the 2024 EBITDA consensus of $1.07 billion, it is valued at 8.2x.

The stock has a free cash flow yield of about 9.4% based on 2023 projections calling for $575 million in FCF. And it pays out a dividend yield of ~6.9%.

The company was leveraged 3.4x at the end of Q3. It anticipated getting to 3.0x leverage by the end of 2024.

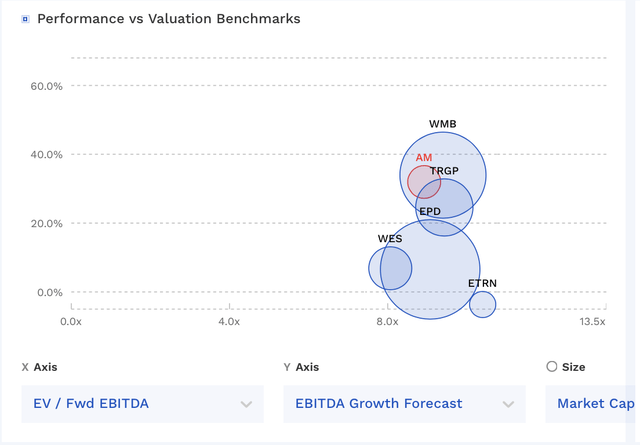

AM has one of the cheaper valuations in the space, but it has closed a lot since I first started covering the name, as the stock has risen off its strong performance.

AM Valuation Vs Peers (FinBox)

Given its strong recent operation performance and outstanding balance sheet and growth, I’m going to up my target from $13.50 to $14.50, which is a 9x EBITDA multiple on the 2024 consensus, which I think is probably slightly low.

Conclusion

AM is set up well for 2024 given AR’s production growth profile and the $48 million in rebate roll-offs it will benefit from next year. The next big catalyst for the stock could be a distribution increase, something it has not seen since 2019. Given its low leverage and excess cash flow after distribution, this could make sense for the company and help spur increased investor interest.

AM has great visibility into AR’s production plans, and the biggest risk to the stock would be a change in those plans. That would most likely come from an energy price crash, although AR is still one of the lowest-cost natural gas providers and natural gas demand still continues to be robust and growing, led by increased power consumption and LNG exports.

With still around 18% return potential based on my $14.50 price target, AM remains a “Buy” for the time being.

Read the full article here