I last wrote about Archer Aviation (NYSE:ACHR) in May 2022; I rated them a sell, and the stock priced at $4 fell to a low of $3 by the end of 2022. Over 2023, much has changed. A raft of announcements and high-profile investments propelled the stock above $12 in June, but since then, it has fallen back to $5.

The legal battle with Wisk was the basis of my sell rating for Archer. However, when Boeing (BA) bought Wisk, they turned the legal battle into a cooperative agreement, which I covered in this article on Boeing. My bear case evaporated at that point.

I have covered JOBY, BA, EH, EVTL, and LILM in the eVTOL space, and in each article, I have provided an overview of where I am on each company. Right now, I am long JOBY and BA; I have a negative view of EH after making considerable gains in 2022 and early 2023 and remain negative on LILM and EVTL. I have moved to the sidelines on Archer.

Why am I not ready to buy?

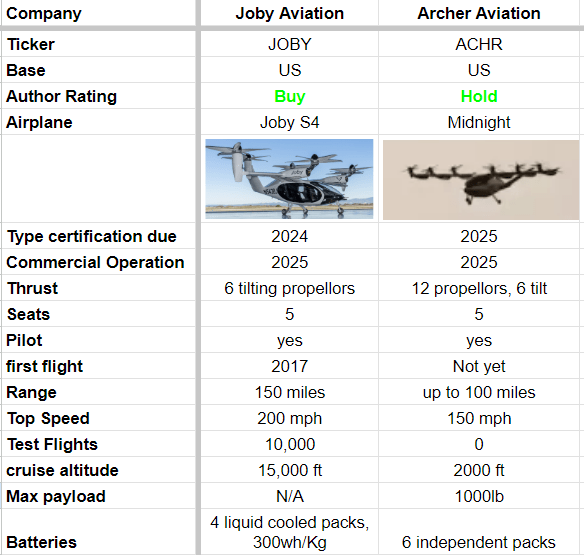

In short, I do not believe the time frames supplied by Archer, and as a result, I think that further disappointments lie ahead that will depress the stock price. I remain concerned about the competitive situation as the JOBY S4 aircraft appears to have better specifications in crucial areas and will likely be the first to market.

Delayed timelines are a constant issue for people who invest in these new technologies. I believe Archer is overpromising, and they must backtrack on promises made. I also think Archer is overstating their chosen suppliers’ importance and effect on their certification process. I do not believe their charging technology will be the industry standard as they hope, and I suspect others will adopt the freely available Joby version.

Over the longer term, I think Archer will be a good investment because of its contracts, order book, investors, and cash, but now is not the time to buy.

Short-term Delivery Spin

In Q2 2023, Archer said it would deliver its first aircraft to the Airforce this year; in the Q&A section of the Q3 earnings, the Analyst from JP Morgan pushed this issue. He said the shareholder letter said the aircraft would no longer be completed in Q4 this year and that manned flights had been pushed back a quarter. The Archer CEO tried to bat this away, almost denying the delay, but the JP Morgan analyst rightly asserted that the timeline had drifted by at least one quarter. I think it has slipped by far more than this.

Comparison with Joby is inevitable, and it is not good for Archer. Archer delayed its first delivery to the US Air Force, and Joby delivered its aircraft ahead of schedule. This pattern repeats in several areas and will pressure the Archer share price.

The 6 Conforming aircraft

Archer said in the Q4 2022 earnings call that they will build 6 conforming aircraft to speed up certification and demonstrate their capabilities to customers. They gave guidance on the first plane being built in Q4 2023 and flown in Q1 2024. In the Q3 2023 earnings, details cast doubts on this plan. In answer to the Deutsche Bank analyst, the CEO said that they had only ordered parts for the first of these six aircraft, but in some cases, they had ordered parts for the second one. He also said they do not need all the aircraft at once and will build one or two at a time to support the flight test program.

In his prepared remarks, the CEO said,

Our suppliers continue to accelerate manufacturing of parts for our piloted conforming Midnight aircraft. We’ll begin the final assembly integration of the piloted aircraft early next year, so that we can start flight testing in the middle of the year.

This is a significant delay; if piloted tests start mid-next year, I do not see how the Air Force will receive its first aircraft before the end of 2024; it is more like a 12-month delay.

Certification Progress

Archer hopes to achieve certification in 2025, which aligns with its main competitor. It is going to be a push to make it. They will not make piloted flights until the middle of 2024 and will only complete the six conforming aircraft they have said they need for certification in late 2024 (Q3 earnings). I don’t believe they can make the 2025 certification deadline.

Archer has implied that their choice of suppliers will allow them to move quickly through the certification process. The COO said (Q3 earnings),

…. leveraging the best partners in the industry will significantly reduce our certification scope, in turn, provide the fastest path to market…By leveraging key products with certification heritage…

The implication is that the choice of supplier reduces the amount of certification needed, but I do not believe this is true. It means that Archer does not have to certify the parts as the supplier is doing that, but all of the components need to be certified. None of them have certification already. “certification Heritage” means the suppliers have certified other things, but that will not speed up the process for the new components. This issue was addressed in the Q&A section, and the answer was quite evasive, stating that the suppliers are the “best of the best” and Archer is confident they can deliver. The answer to “how many of these third parties have actually gone through certification?” appears to be zero.

The FAA has published draft airworthiness criteria for Archer, and Archer believes the FAA is “on the cusp of publishing the final rule” it means that all of the work done so far is provisional, and until the final rule is published and in the federal register it is impossible to calculate what percentage of the certification process is complete I have to assume it is currently close to zero, the aircraft has not been built and as I have already said the component suppliers have not yet been through the certification process.

(The Joby criteria are published in the register, and they have completed 3 of 5 stages)

The Archer Order Book

Archer is a long way ahead of the rest of the industry regarding the quality of its order book. When they get the aircraft certified and fly, they will have the best order book in the industry to start work on.

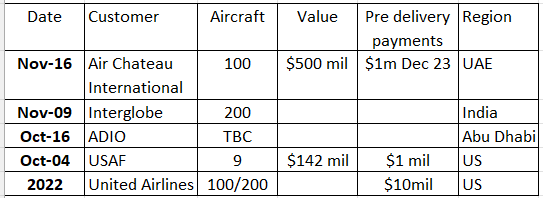

Recent order announcements

Archer orders (Author database)

This order book and the pre-delivery payments are in a different league from the rest of the industry. Probably the next best is EHang (EH), with around 100 orders, but in terms of value, they are not close.

The published order book numbers are as follows (information from the database I keep on companies garnered from press releases),

Archer 200, EVTL 975, LILM 582, EH 1200, Volocopter 260, EVEX 2165, DUFOUR 200, BET 175, JAUNT 160, Overair 50.

Only the Archer book is accompanied by significant deposits. The Volocopter and Dufour orders seem legitimate. I have not looked into the EVEX, BET, or JAUNT numbers but doubted the validity of the LILM, EH, and EVTL figures in my articles on those companies.

The obvious omission is Joby; they do not intend to sell aircraft but to operate them with partners and have signed up American Airlines, JetBlue, and Nippon Airways, amongst others.

United and the Warrants

I am always wary when customers receive warrants for orders.

United Airlines (UAL) signed a deal in 2021, amended in 2022, to buy aircraft from Archer; the amended deal was for 100 aircraft, and a $10 million deposit was paid. In return for the order, United received 14.7 million warrants that will vest in 4 tranches dependent on milestones; the warrants have an exercise price of $0.01. The first 737,000 warrants vested on Aug 9th, 2022 ( value $3.4 million on that date). 2.2 million were vested on Feb 9th (value $6 million), meaning United got its $10 million back in warrants within six months. The remainder of the warrants vest at a rate of 3,700 for the first 160 aircraft and 22,000 for the next 40.

Archer has never released the actual cost of a plane. However, we can estimate. Air Chateau bought 100 aircraft for $500 million, so we could assume $5 million per aircraft.

It would be safe to assume that when Archer gets its planes certified and in the sky its share price will significantly increase in value. If the share price reaches $227, United gets the last 40 aircraft for free!

Investments: Another big win for Archer

The second area in which Archer leads the industry is the size and quality of its principal backers. United Airlines, Stellantis (STLA), and Ark Investments are the big three backers.

United owns 1% of Archer but represents the go-to-market strategy. Without United and their orders, Archer would be difficult to invest in. The orders and investments from United are a vote of confidence from a respected player in the industry.

Ark Investments owns 9% of Archer; they were part of the $215 million fundraising in August along with Stellantis, United, and Boeing. Ark has also regularly bought shares on the open market since August 2021. ARK is followed by many investors and hedge funds (including me), and wherever they go, many will follow, supporting the share price.

Stellantis put out a press release in January stating that its goal is to be the exclusive contract manufacturer of the Midnight aircraft and that it would provide $150 million of equity capital for Archer to use at its discretion. Stellantis also stated it intends to purchase shares in the open market.

Manufacturing

The first factory capable of building 650 aircraft per year is being built in Georgia ( it has a potential capacity of 2,000 units per annum). Stellantis will be helping get the factory working, but the precise nature of how the two companies will work together is unclear. In the Q3 earnings, the CFO said the first site will be for final assembly, likening it to automotive production.

The Aircraft

There are two main competitors in the US market, Archer and Joby. Looking at the two proposed aircraft, Joby does appear to have a competitive edge. It has a more extended range, faster top speed, higher cruising altitude, and more than 10,000 flights completed. The Archer plane is bigger and heavier, has a longer wing span, and may have a larger payload of 1,000 pounds.

S4 v Midnight (Author Database)

Charging

Apart from the venomous legal case between Wisk and Archer, the players in the eVTOL field have been true gentlemen, even congratulating each other on their achievements. However, that may all have changed in recent weeks, and charging infrastructure might be a new battleground. Charging infrastructure has held back the growth of heavy-duty EVs, and eVTOLs need even more power.

Joby was hoping to get its charging tech to be the industry standard and has offered it free to all industry stakeholders, they said in a press release,

Importantly, the technology we have developed is optimized to support all types of electric aircraft under development today, from air taxis delivering short range city flights to more conventional electric aircraft flying longer distances — something that is not true of the alternative concept

(Joby italics, not mine).

The press release makes it clear that they believe the alternative proposition is inferior in almost every way and, crucially, will not get FAA approval due to the cybersecurity requirements of the FAA. Joby claims several technical advantages that mean the alternative proposition will not work correctly, saying an upgraded automotive charging system will not be up to the task.

For “alternative proposition”, you should read Archer’s proposition. The Joby press release arrived virtually simultaneously with the Archer press release covered below. It is speculated that when Joby contacted all industry players offering their specifications and technology for free, Archer decided to publish its vision.

Archer Charging with Beta

On Nov 7th, Archer issued a press release describing its arrangement with BETA Technologies ( BETA manufactures an electric aircraft and has already delivered one to the USAF as well as a charging system). The two are hoping to roll out an electric charging system nationwide. Archer has two of BETA’s charge cubes at its facility and said they are already in use at 14 locations and are due to be installed at a further 55.

The battle over charging infrastructure could be important, but we must wait to see how it plays out.

Archer Planned Routes

Archer has made some excellent progress with regional authorities. They are negotiating with New York, Chicago, Texas, San Fransisco, and Los Angeles in the US. The UAE, Delhi, Bengaluru, and Mumbai in India, amongst others. (Q3 earnings)

New York is the launch market in partnership with the Mayor and United Airlines. The CEO said more news should be expected in the coming weeks. We did see photographs of the Joby S4 flying in New York, which shows the city is committed to this type of transport. It is probably not the news the CEO was referring to, but it does highlight one of my key concerns. JOBY is already flying and showing cities how its vehicle works, and it must give them a competitive advantage in negotiations.

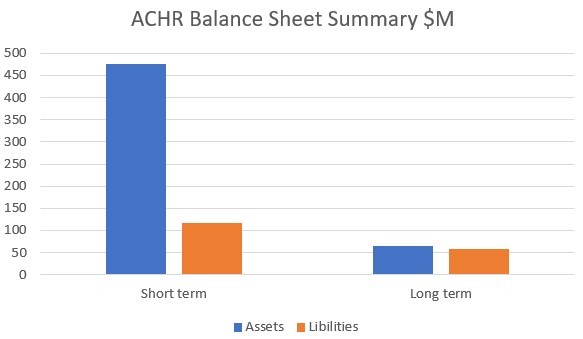

Finances

The Archer balance sheet looks pretty solid.

Archer Balance sheet (Author Database)

The current situation gives it a cash runway of about 1.5 years, but they have access to significant liquidity from their big donors, especially Stellantis and United. They are unlikely to encounter a cash issue even with a delayed time frame.

Insiders have been significant purchasers of shares for the last 12 months, and the ownership split of Insiders 26%, Companies 10%, Institutions 36%, and the general public 28% suggests that the price should not be overly volatile. I find the size of the general public holding often correlates with volatility.

Archer has seven analysts following it, and their average price target for the next 12 months is $9, a 50% increase, but the analysts are not in close agreement. One Analyst forecasts a fall to $4.50, and another gives a target of $12.

The analysts forecast earnings of -$444 million in 2023, almost 50% lower than the 2022 figure of -$317 million.

The current EPS is -$1.72 and is not forecasted to have a material improvement before 2027. No analyst is currently predicting a profitable operation in the medium term.

Conclusion

Archer is valued at $1.8bn and has an equity value of $365 million; it is pre-revenue and has not yet conducted a piloted flight of its prototype aircraft, built its first conforming aircraft, or progressed its certification beyond discussions. It must be viewed as a risky investment; we have all seen these exciting new technology companies fall to penny stock status.

Archer appears to be behind JOBY, its main competitor, in several regards. Joby is already flying, has delivered its first vehicle, and built its first company-conforming aircraft, which is undergoing certification. Archer may have an advantage in payload but appears to have a lower spec in most other regards.

On the plus side, Archer has excellent backing from some high-profile investment companies, United Airlines is a customer, and Stellantis is a production and manufacturing partner. This backing means they have all the support and financial backing to overcome whatever problems lie ahead.

The settlement with Boeing has allowed me to upgrade my rating to Hold, but I am not ready to buy yet. I think delays are inevitable for Archer, and I suspect we will see many more pictures of Joby’s aircraft flying, but we will get only words and promises from Archer.

I believe in the longer term, Archer will be a good investment; it has the money, the product, the partners, and the customers.

I expect the pullback that began in August to continue, perhaps taking the stock price to around $4. I will review Archer in the new year or when it flies its first Midnight aircraft, but I am on the sidelines for now. I will publish an updated view on Joby in the coming days.

Read the full article here