Overview

My recommendation for The Wendy’s Company (NASDAQ:WEN) is a hold rating. While SSS came in weak for the quarter, I see potential for it to accelerate sequentially in 4Q23, which should dismiss the bearish thought that SSS remains weak. Other aspects of the business are also progressing well, such as unit growth and digital sales. Despite these, the reason for my hold rating is that I think it is still safer to wait for 4Q23 results to validate my hypothesis regarding SSS performance. Note that I previously gave a hold rating as I was unsure if WEN was able to accelerate its unit growth despite good traction in SSS performance.

Recent results & updates

WEN reported 3Q23 total revenue of $550.6 million, restaurant level profits [RLP] of $35.2 million, adj EBIT of $102.3 million, adj EBITDA of $139.2 million, and adj net income of $57.6 million. From a growth and margin perspective, total revenue grew 3.4%, RLP grew7.9%,% and margin improved 74bps to 15%; adj EBITDA/EBIT margin improved 52bps to 25.4% and 2bps to 18.4%, respectively; adj net income margin improved to 10.4%.

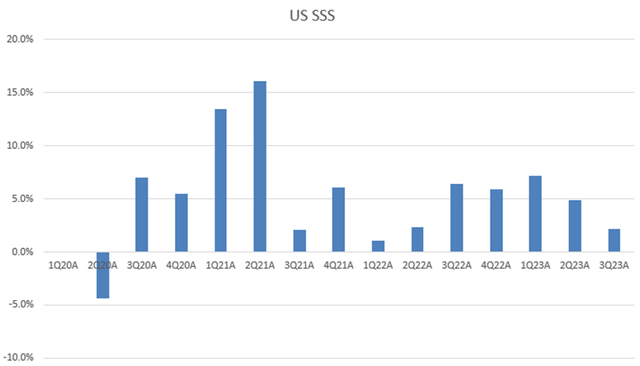

While the headline results were encouraging, I still have concerns about WEN’s ability to accelerate growth. WEN US same-store sales [SSS] came in at only 2.2%, which is a deceleration when compared to 2Q23 and 3Q22. If we split the SSS into its 2 key elements: pricing and traffic, As effective pricing was up 7% (3Q23 call), this implies that US traffic remains down at mid-single-digits, which is a concerning factor for me. This suggests that the competitive environment for traffic remains tough, as management hinted during the call.

under 75,000 consumers a little more stressed, especially as you go down the income core, it gets even more stressed.

But again, we’ve lost a little bit of traffic there, but still holding our share with that consumer. From a trade-down perspective, we are seeing some trade down from mid-scale casual and sit down into QSR. But we’re also seeing some trade out of the category from the lower income consumer out of QSR and into food at home. So it was kind of wash each other out along the way. 3Q23 earnings call

The saving grace, and something that I am still hoping for, is that the 3Q23 performance might not be fully representative. In the quarter, management rolled off the $3 Croissant deal and was slow in pushing out the next promotion, leading to a quiet first half of the quarter. The next promotions (2 for $3 breakfast bundle) and $1 burger kicked off late in the quarter; hence, the full impact of these promotions was not fully reflected in 3Q23. That said, I will only be convinced that this is the case if 4Q23 SSS accelerates from 3Q23, given that 4Q should see the full benefit of current promotions vs. 3Q23, which only benefited in the 2nd half of the quarter.

Author’s valuation model

Aside from the weakness in SSS, WEN seems to be progressing well on other parts of the growth equation, which is very encouraging. Management has done an excellent job of reducing the build cost of new restaurants by 10%. This is major news as it means lower ROI (return on investment) requirements when looking for locations, which means more potential for growth. Also, payback periods have been shortened as a result of the franchisee incentive programme’s restructuring. The levered payback period for franchisees has been reduced to three years with the implementation of the Build-to-Suit programme. Given that a large part of WEN stores are driven by franchisees, I believe this move to a lower payback period will support unit development, which I see as a possible solution to accelerate unit count. (Recall that previously I mentioned that WEN is not a new brand, so how could they accelerate unit growth easily?)

This narrative complements the fact that WEN added 51 net new units (17 in the US and 34 internationally). Followers of WEN would appreciate that management is finally not cutting its outlook, which has happened frequently over the past few quarters. It appears that the unit growth inflection point has arrived, as management has mentioned stronger demand and the possibility of overcoming some of the challenges from previous quarters.

Our development pace accelerated in the third quarter … we are tracking towards our 2023 global net unit growth target of approximately 2% with 100% of our current year pipeline open or under construction. 3Q23 earnings call

Notably, there was a massive change in confidence level as compared to the previous periods. They are now guiding FY23 unit growth of 2 to 3% of systemwide unit development goals in FY24 and 3% to 4% in FY25. While I am sceptical on SSS acceleration, I am turning slightly more positive on unit growth development, especially with the data showing that there is an increase in the percentage of long-term pipeline with agreements (70% in 3Q23 vs. 60% in 2Q23).

Across the US and Canada, we experienced a significant uptick in agreements across our suite of development programs with new sign-ups for the pacesetter and ground-breaker incentives, and growing commitments to our build-to-suit fund, which is now 70% committed. 3Q23 earnings call

Finally, I also like that WEN is continuing to improve on its digital front, which should support SSS growth and RLM over the long term. Digital sales momentum has continued to be strong over the past few quarters, with digital sales up 30% vs. 3Q22 and up 100bps as a percentage of sales vs. 2Q23. Consequently, management revised its digital sales guidance upwards by $300 million to $1.8 billion (~13% of sales). The one successful peer that I can think of who has pulled off the digital strategy really well is Wingstop (WING). As of 3Q23, WING has almost 70% of sales coming from digital channels, and I believe this is a key reason why they have a structurally higher margin profile vs. WEN (29% EBITDA margin vs. WEN’s ~25%). As WEN continues to focus on developing its digital sales channel (kiosks, delivery, mobile orders), I see a path for WEN to achieve a similar margin profile. An indirect implication of having more mobile orders is that WEN is able to gather more data to understand consumer preferences and, more importantly, be able to push out direct marketing at a very low cost. I believe this impact is already starting to surface, as US loyalty saw 40% q/q growth in the 3Q23 MAU and now has over 30 million members.

Valuation and risk

Author’s valuation model

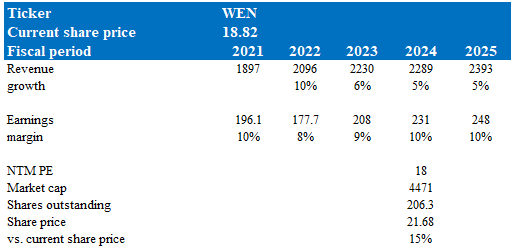

According to my model, NTNX is valued at $21.68 in FY24, representing a 15% increase. My target price has increased slightly from my previous model as I increased my growth expectations modestly in FY23 and FY24 due to my positive take on WEN’s unit growth potential and progress on the digital front. However, I held the same assumptions for margins, as I see the benefits from the digital momentum being offset by the potential acceleration in unit growth. Note that new units typically have a lower margin as they require time to ramp up. Using management guidance, they are expecting an acceleration in unit growth, which I expect to impact margins.

WEN is now trading at 17x forward earnings, a reduction of 1x since I last wrote about it. Based on my view, I don’t see a major reason for WEN to be derated. While it is true that SSS is weak, there is a logical explanation that explains it. Elsewhere, WEN is progressing well on unit growth and digital sales. That said, I am keeping my multiple assumptions steady at 18x forward earnings for now.

The risk to my buy rating is that SSS might fail to see an acceleration despite the promotions and easy comps in 3Q23. In this scenario, I believe the negative sentiment will take over the stock, driving the share price down regardless of success in other aspects of the business.

Summary

I reiterate my hold rating for WEN as I await the 4Q23 SSS performance. The slowdown in SSS is definitely a concern; however, delayed promotions in 3Q23 potentially impacting SSS underscores the importance of waiting for 4Q23 results to gain more clarity. Encouragingly, WEN has made significant strides in lowering new restaurant build costs and shortening franchisee payback periods, fueling unit growth potential.

Read the full article here