I assessed N-able, Inc. (NYSE:NABL) a year ago and suggested a hold rating, considering its declining stock trend post-spinoff from SolarWinds Corporation. Despite robust financial performance, uncertainties in the IT industry and limited financial history prompted a cautious approach. However, its recent Q3 2023 report reveals a 15% YoY revenue surge to $107.6 million, prompting an upward revision in its adjusted EBITDA outlook for FY2023.

I’m now more bullish due to the growing demand in the IT outsourcing market, where companies are expanding IT landscapes and seeking managed services and security solutions. With well-recognised offerings amongst the SME IT service providers, strategic growth partnerships, positive cash flow, and a solid balance sheet, N-able is positioned for continued investments and growth in this dynamic industry. Hence, I’m upgrading my stance due to a clearer growth path and upside potential.

Stock trend since IPO (SeekingAlpha.com)

Company updates

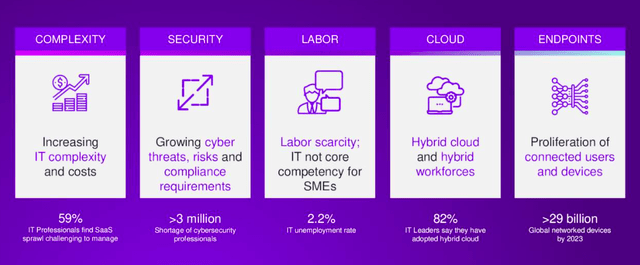

In my prior article, I provided an overview of N-able, which operates on a SAAS business model tailored for managed service providers (MSPs) and offers industry-specific solutions. Known for catering specifically to IT industry SME-managed service providers, the company has secured the top spot in remote-managed services for three consecutive years, highlighting its niche expertise. Furthermore, its customers have to deal with greater complexities within the IT environment that they are servicing.

IT environment growingly complex (Investor Presentation 2023)

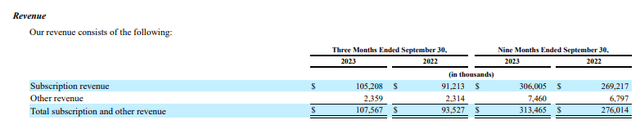

The company heavily relies on a recurring revenue subscription model, which has exhibited consistent growth over the past three quarters compared to a year ago.

Revenue Q3 2023 versus Q3 2022 (Sec.gov)

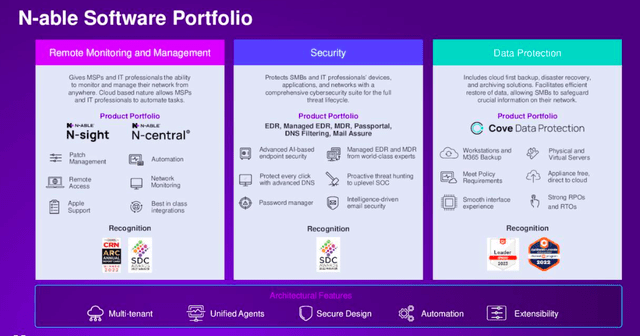

It is expanding its reach by growing its position in security and aiming towards larger customers, N-able partnered with SentinelOne to introduce an enterprise-grade security solution, demonstrating strategic growth initiatives. If we look at potential growth drivers, the thriving IT outsourcing market, anticipated to reach a value of $1416.3 billion by 2031 at a growth rate of 9.3%, indicates a strong market for N-able. The company is witnessing robust demand, aligning with this industry trend.

Software portfolio (Investor Presentation 2023)

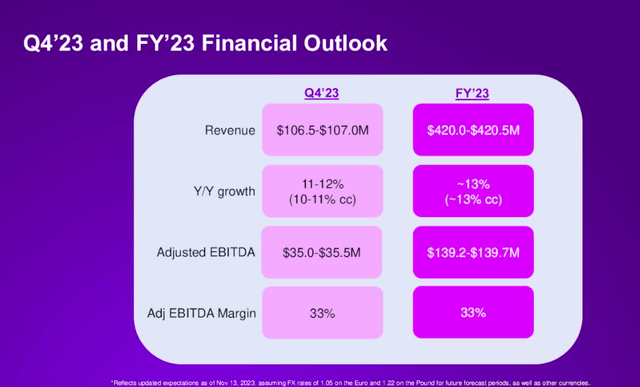

Through investments in diverse solutions catering to expanding SME IT ecosystems and security needs, including a new security suite, N-able is poised for significant upside potential. This positions the company to capitalise on existing customer bases and target larger clientele with its solutions. Notably, N-able has raised its FY 2023 guidance for adjusted EBITDA to approximately $139.2 million, projecting a total revenue of $420 million, reflecting a solid 13% year-over-year growth trajectory.

FY 2023 Outlook (Investor presentation 2023)

Financial updates

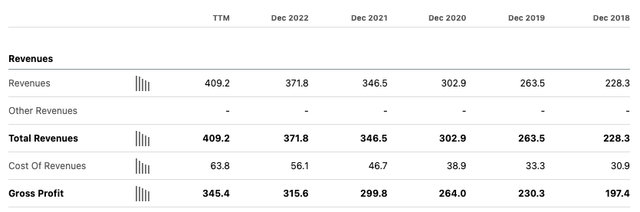

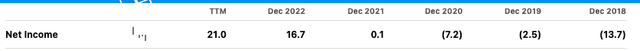

Although N-able remains relatively young in its financial history, initial results are promising. Both top and bottom lines are on an upward trajectory, showcasing improved cash flow and a robust, liquid balance sheet. TTM revenue stands at $409.2 million, surpassing the previous year, and the FY2023 forecast hovers around $420 million. Additionally, TTM net income reflects a positive trend, reaching $21 million.

Annual revenue and gross profit (SeekingAlpha.com) Annual net income (SeekingAlpha.com)

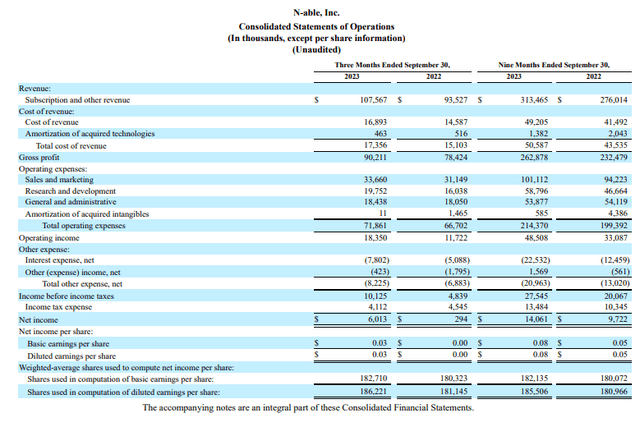

In the latest Q3 2023 earnings report, the company exhibited impressive growth with a 15% year-over-year revenue surge, reaching $107.6 million. Notably, it maintains a GAAP gross margin of 83.9%. With a GAAP net income of $6 million and an exceptional 27% year-over-year growth in Adjusted EBITDA, which hit $36.6 million, the company showcased a robust financial performance.

Financial highlights Q3 2023 versus Q3 2022 (Sec.gov)

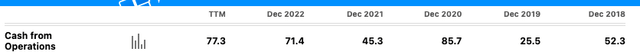

Examining the company’s cash flow, there’s a clear upward trajectory in cash from operations, standing at a TTM figure of $77.3 million, surpassing the past two financial years. Moreover, the company demonstrates an upward trend in positive levered free cash flow, a promising sign for a young company. This positive trend is pivotal, allowing investments in technology and debt repayment and potentially rewarding investors.

Annual cash from operations (SeekingAlpha.com) Levered free cash flow (SeekingAlpha.com)

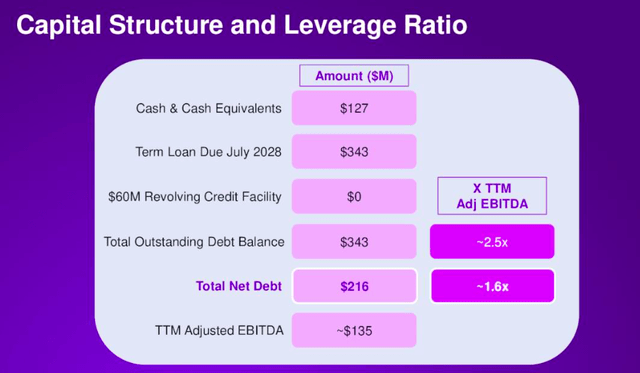

The company’s balance sheet reveals total cash and cash equivalents amounting to $127.4 million, alongside total debt standing at $335.5 million. Assessing liquidity, the company boasts a reassuringly strong position, evidenced by its quick ratio of 2.3, showcasing its capacity to readily cover short-term liabilities. This robust liquidity position provides ample flexibility for ongoing investments and operational activities.

Capital structure (Investor presentation 2023)

Valuation

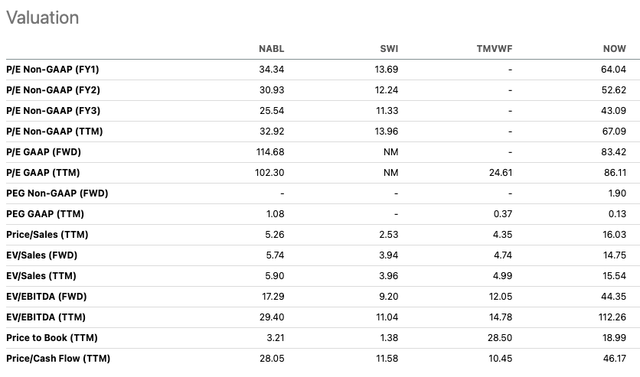

N-able currently trades under its average price target of $15.25, indicating a potential 28% upside. While analyst coverage isn’t extensive, it does hold a Wall Street Buy rating of 3.8. Notably, its competitors in SME-managed services, like Connectwise and Kaseya, operate privately. In the broader realm of managed and security solutions, I’ve compared it to ServiceNow (NOW) and TeamViewer (OTCPK:TMVWF) and even revisited the comparison with SolarWinds. While it might appear a bit overvalued compared to SolarWinds, its relation to ServiceNow at a price-to-earnings ratio of 32.92 suggests it could be undervalued.

Considering the tailwinds of increasing IT outsourcing and complexity, the company’s upwardly revised EBITDA forecast based on strong results and robust profit margins is noteworthy. Its recurring SAAS-based model points to potential gains with extended customer tenure. This anticipation, coupled with ongoing popular innovations in the managed services arena, hints at a promising potential for a notable increase in the price-to-earnings ratio in the future.

Relative peer valuation (SeekingAlpha.com)

Risks

N-able’s reliance on the SME market could face hurdles during economic uncertainty, as SMEs often tighten their budgets instead of investing in new solutions. This might impact the company’s ability to acquire and retain customers. Additionally, in a highly competitive landscape where regular updates are essential, any delay in launching new products might lead to a loss of market share and customers, potentially impacting the company’s overall performance.

Final thoughts

Over the past year, N-able has shown significant growth, notably with a 15% YoY revenue increase in Q3 2023 to $107.6 million and an improved FY2023 adjusted EBITDA outlook. This performance shift has led me to upgrade my stance to bullish. Furthermore, the company has expanded on its solutions and can grow through recent partnerships. With a strong position in the expanding IT outsourcing market, solid partnerships, positive cash flow, and a sturdy balance sheet, N-able seems primed for sustained growth and substantial potential.

Read the full article here