Investment Rundown

I have covered Excelerate Energy, Inc. (NYSE:EE) before and I am this time around a little more bullish on the company, and with the stock price also reaching a far more reasonable level, meaning less premium against the rest of the sector, I do think a buy case can be established here. This means I am upgrading my rating for the company. The last report from EE showcased strong reductions in the operating expenses and this ultimately led to a very impressive YoY EPS growth of around 55%. Now, I think that some level of volatility will be seen in the EPS results largely due to the markets that the company operates in and the fact commodities can be volatile themselves.

Since my last coverage of the company they have released their Q3 report so I figured some updating on my views of the business was in order, but the company has also managed to secure a long-term LNG deal with Bangladesh which is a growing economy that will likely place a significant demand on companies like EE and others, which presents an appealing market opportunity in my opinion.

Company Segments

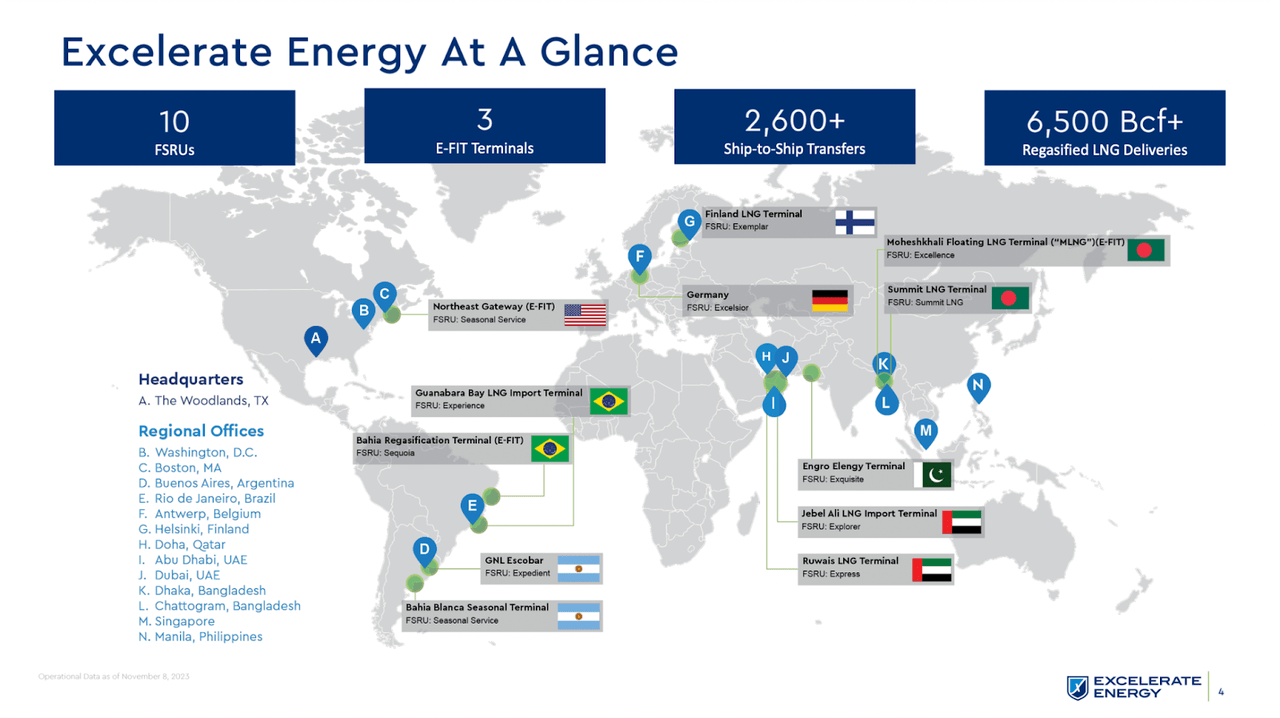

EE functions as a leading provider of adaptable solutions in the liquefied natural gas (LNG) sector, boasting a global clientele that has firmly established its position in the market. The company’s portfolio encompasses a spectrum of services, prominently featuring regasification solutions that span floating storage and regasification units. In addition to these, EE extends its expertise to infrastructure development services and distribution solutions, underscoring its commitment to delivering comprehensive and integrated offerings across the LNG value chain.

Market Overview (Investor Presentation)

This diversification and global outreach have contributed significantly to EE’s robust market presence, positioning it as a versatile and reliable player in the LNG industry. By catering to a broad spectrum of customer needs and providing a holistic suite of services, EE remains well-positioned to navigate the dynamic landscape of the LNG market and capitalize on emerging opportunities.

Markets They Are In

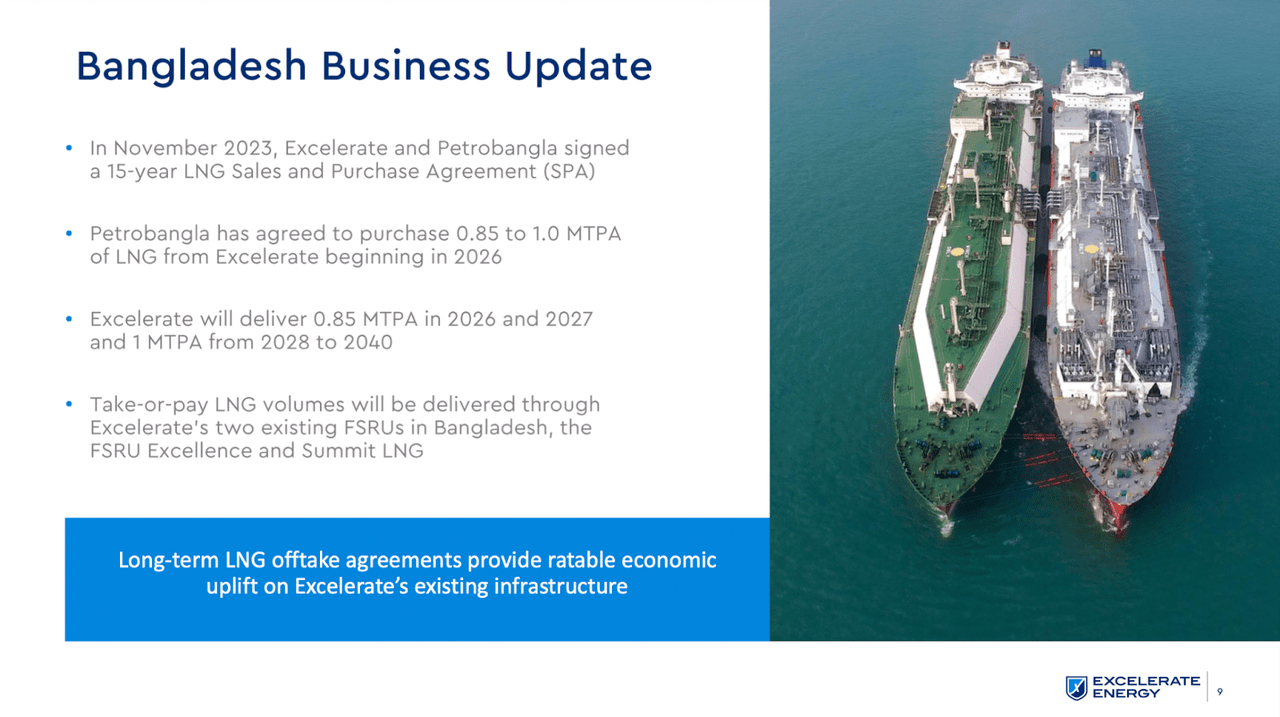

EE is actively venturing into the burgeoning and notably promising Bangladeshi market, presenting an exciting avenue for expansion. In this strategic move, EE not only addresses the imperative of providing essential natural gas supplies to Bangladesh but also seizes the opportunity to integrate neighboring markets in the region into its portfolio, fostering overall growth in earnings.

Market Update (Investor Presentation)

Key milestones in this foray into the Bangladeshi market include noteworthy achievements, such as being awarded the second LNG cargo for the year 2023 and the long-term LNG agreement with Bangladesh Petrobangla. The deal involves Petrobangla agreeing to purchase between 850k – 1M metric tons annually of LNG from EE. The deal is 15 years long and will begin in 2026. In the last earnings report, CEO Steven Kobos said this is now putting EE in a position where they can predict they will have roughly $4 billion of cash flows in the coming years. This has significantly strengthened the company’s financial position and will enable them to continue investing quite aggressively I think. These developments underscore EE’s commitment to capitalizing on emerging opportunities and solidifying its position as a pivotal player in the regional energy landscape. By actively engaging in such markets and securing significant projects, EE positions itself for sustained growth and diversification within the dynamic energy sector.

Earnings Highlights

On November 8 EE released its last earnings report that showcased quite strong results in my opinion. The market certainly seemed to approve of the results as the share price quickly rose from just under $15 per share to over $18.

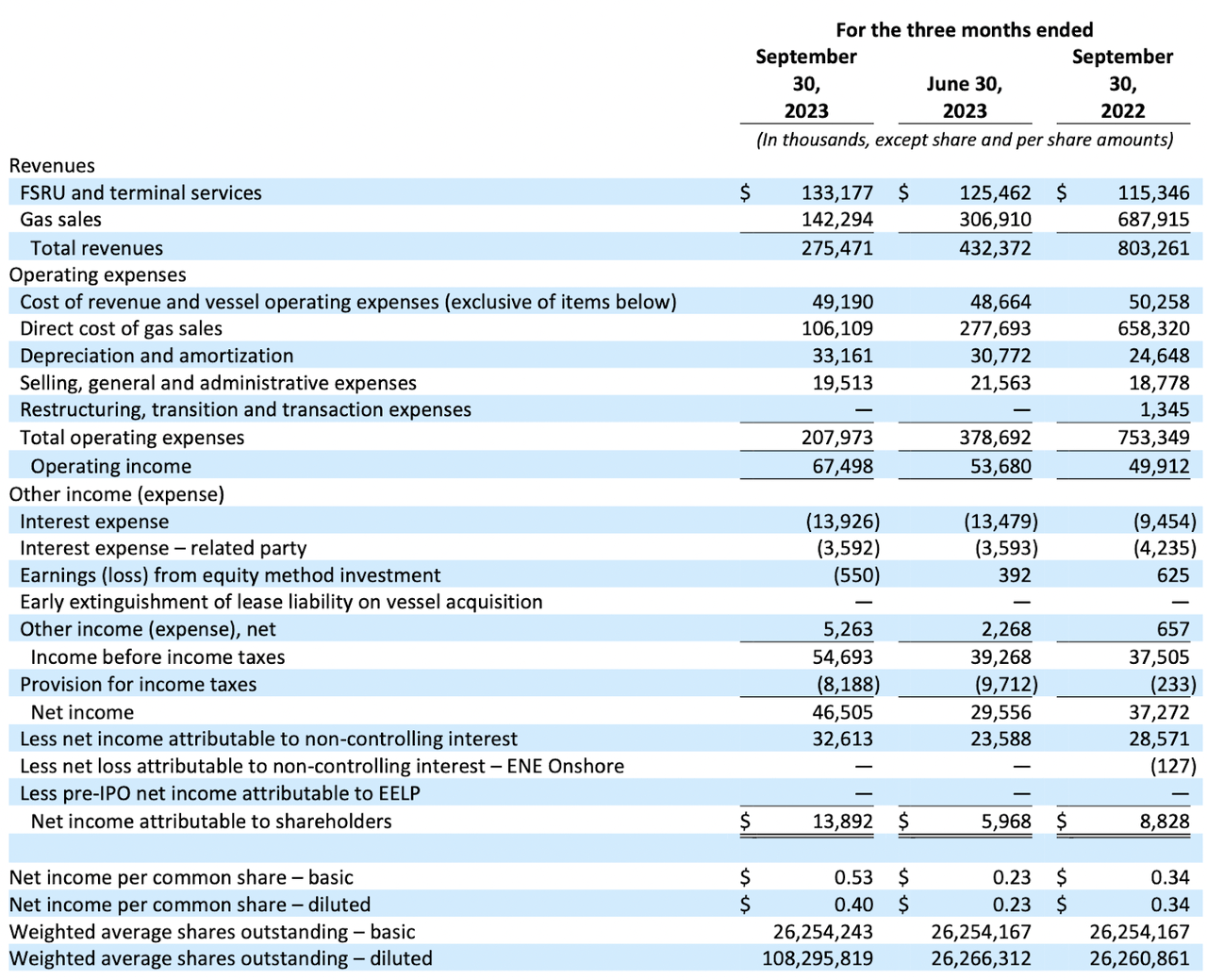

Income Statement (Earnings Report)

Looking deeper at what the last quarter’s results included we can see the FSRU and terminal services increasing by around 15% YoY. What is notable though is the decline in gas sales. During the same quarter in 2022, the company had over $687 million in gas sales and the last report showcased a decline down to $142 million. When we look at the EPS though it rose by over 55% YoY which is due to the robust growth in the FSRU and terminal services which don’t seem to come with quite the same amount of expenses or cost of revenues as gas sales do. What also was a significant aid was the growth in other income to over $5 million, up from under $1 million last year. Looking at the total shares outstanding there has been a slight increase of shares but not to a point where I would consider it enough to neglect my buy theses here.

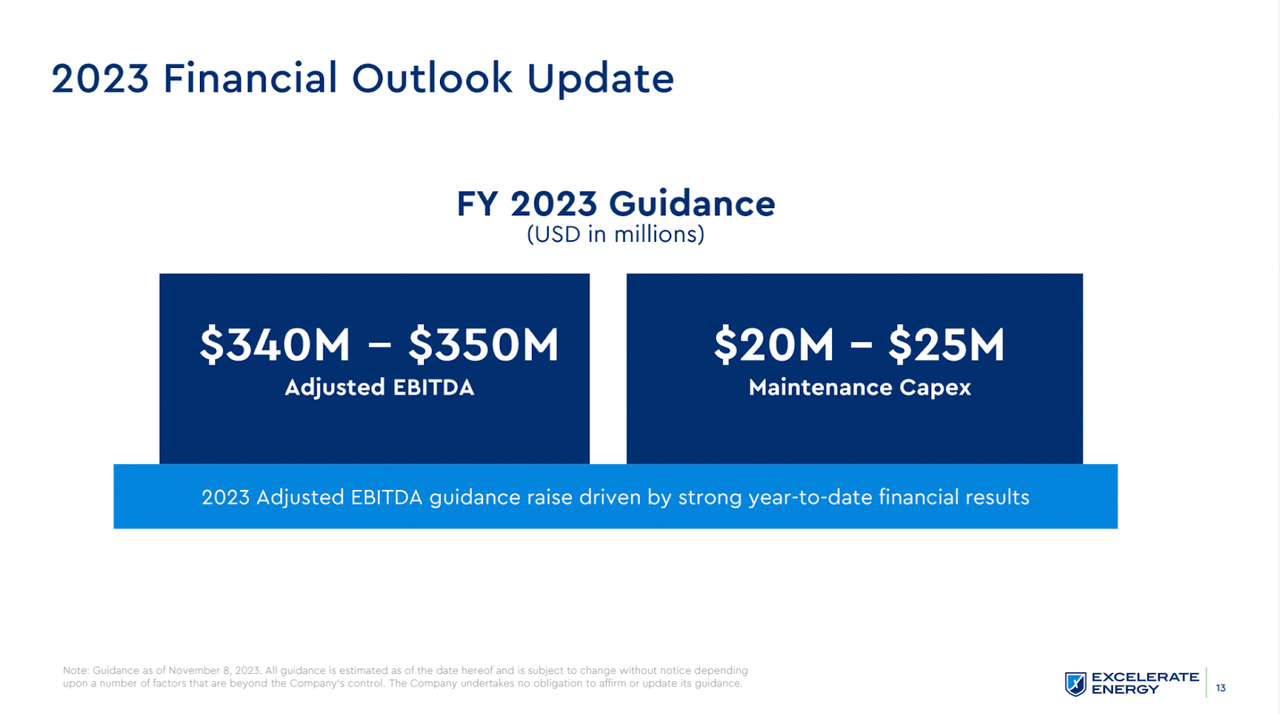

2023 Outlook (Investor Presentation)

Guidance for the year is now at $340 – $350 million in EBITDA and maintenance Capex $20 – $25 million. In 2022 the EBITDA came in at $292 million which means EE expects a 19.8% increase YoY on the higher end for the EBITDA. I think this is a growth number that justifies a higher valuation. I think that EE can grow its EPS very well in the coming years which means it will grow into its valuation, both through additional margin expansions and buybacks. With the deal signed with Bangladesh I do think an EPS estimate of over $2.5 in 2027 or so is reasonable. With a multiple of around 12x earnings, we land at a price target of $30 leaving an upside potential of 62% until then. Together with the slight dividend you also get I think that EE is an appealing buy at these price levels. In my previous article, I rated them hold much because I didn’t see enough appeal to buying at those price levels. Looking back it seems to have been the right choice as the stock price has declined by around 20%. I think the company has also managed to post some strong rebounds in the business which is something I looked for last time around. This all concludes to me rating EE a buy now.

Risks

EE is grappling with a noteworthy and troubling upswing in total operating expenses, casting a significant shadow over the company’s revenue. This surge in costs has exerted substantial pressure on its financial performance, prompting concerns about EE’s capacity to sustain profitability and financial resilience amid escalating expenses.

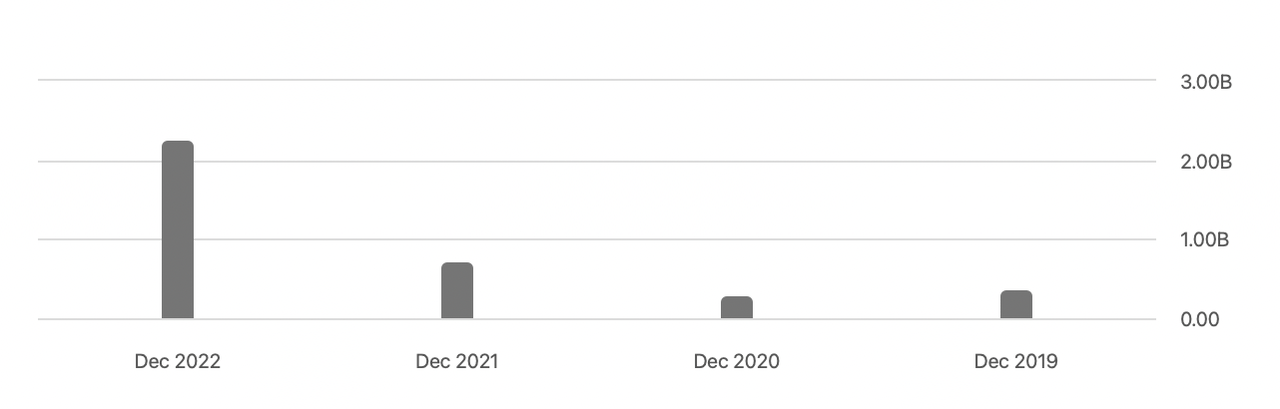

Operating Expenses (Seeking Alpha)

The escalation in operating expenses could be attributed to a multitude of factors, including mounting labor costs, the impact of inflation, increased energy expenditures, or substantial investments in innovative technologies and infrastructure. Irrespective of the specific drivers behind this surge, it becomes imperative for the company to conduct a thorough examination and strategic intervention to manage these cost dynamics effectively.

Addressing the root causes of rising expenses is crucial for EE to ensure its long-term viability and competitive edge within its industry. This necessitates a judicious approach to cost management, potentially involving operational optimizations, strategic restructuring, or targeted investments in efficiency-enhancing measures. By proactively addressing these challenges, EE can position itself for sustained financial health and success in a dynamic business environment. Looking at the last report though from the company it was very evident that the operating expenses have gotten far lower over the last 12 month period. It came in at $207 million for the quarter, a reduction of over $500 million from last year, primarily due to lower expenses from the direct cost of gas sales.

Final Words

I have covered EE before as I mentioned and this time around I am more bullish on the business and will be rating it an upgrade now. The company has shown to efficiently expand the bottom line and with the deal signed to deliver large amounts of LNG to Bangladesh, it has secured cash flows for many years going forward.

Read the full article here