Introduction

Who wants to be a dividend collector? Me! Many here on Seeking Alpha are also huge fans of collecting dividends. That’s probably why you’re reading this article honestly. A fellow analyst, Austin Rogers, recently wrote an article titled, “How To Live Off Dividends Forever.” I’m a big fan of Austin. Been a follower of his for a while and after reading his article it inspired me to write this.

I’ve actually been thinking of writing one like this for a while but just never got around to it. It’s something a little different than my usual. Being in the military for 21 years got me used to getting a steady paycheck every 2 weeks. I knew a few years ago that time was coming to an end. So I got more serious about dividend investing as I wanted to someday supplement my income in retirement.

Most of us collect dividends on a quarterly basis. Several years ago I thought to myself, “It would be cool to collect dividends on a bi-weekly basis.” Then I thought, “What about weekly?” For example, the SoFi Weekly Dividend ETF (WKLY) pay out dividends on a weekly basis but that doesn’t fit my strategy. One reason is it currently only pays a $0.02 dividend on a weekly basis, equaling $0.08 a month. And secondly, I like to do the research and hold companies I’ve done my due diligence on, and not what some random management team of an ETF (has done). So, in this article I get into how to collect dividends on a weekly basis.

How To Collect Dividends Weekly

Collecting dividends is not as easy as it sounds. Especially if you want to collect dividends from high-quality companies. What I consider high-quality may not be high-quality to someone else. But it takes a lot of research and due diligence when looking to invest in quality businesses. As we all know, most companies pay out dividends quarterly. There are some sectors that pay monthly dividends, like REITs. Two of the most well-known monthly paying REITs are Realty Income (O) and Agree Realty (ADC) whom I happen to hold. But for this article I decided not to use them as examples. I purposely picked quarterly paying dividend stocks because most companies that pay dividends pay out quarterly instead of monthly.

#1 Find A Quality Dividend Paying Stock

The first step to collecting dividends is to find a quality quarterly paying stock. Some very important metrics I like to look at are earnings payout ratio, free cash flow payout ratio, balance sheet health, i.e. is the company continuously taking on a substantial debt load, or have they been paying it down over the years. Share buybacks are a factor I like to see as this is a way to return extra cash to its shareholders. But I’ll admit this is something I don’t take into account as heavily as the others.

A company with a low free cash flow & earnings payout ratios means they have ample amounts of cash left over to invest back into the business. Which also means it is more likely to continue paying a dividend. Those with elevated payout ratios could signal that the company is having issues and this could lead to a dividend cut could be in the works. Although companies can have a bad quarter or two, miss earnings or have an elevated payout ratio for a short period. This was evident during COVID when several high-quality businesses experienced this for a short period in 2020.

Growing cash flows and earnings are also something you want to see from businesses. The more their financials grow, the higher chance of their dividend growing as well. There are several other important factors when looking to invest but these are just some of the ones I deem most important as a dividend investor.

#2 Pay Schedule

Here I use four stocks that I consider to be high-quality businesses that pay dividends on a quarterly basis. The most important thing to do when looking for dividend stocks is to find ones that you think could continue paying dividends for the long term. Of course, a business’ fundamentals can change over time so staying up to date on your stocks is key. Job pay schedules differ but a good amount of us who work get paid on a bi-weekly basis. In the military that’s the pay schedule. And when you retire, it’s once a month.

For some that’s a huge change after getting two paychecks a month to just one. I think the biggest difference is your bills are still due at the same time even though your paycheck schedule changes. So, it can be a big adjustment. One way to mitigate to this is collecting dividends on a bi-weekly or weekly basis.

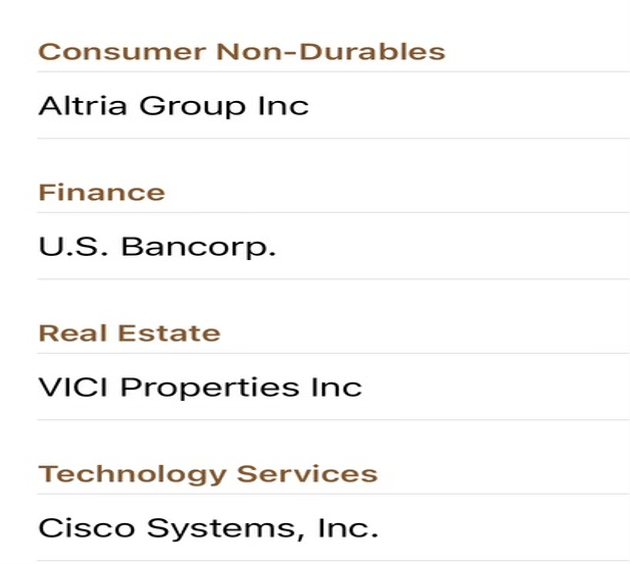

As you can see below, investors would get paid a dividend on a weekly basis with these four companies. Disclaimer: I hold 3 of the 4 listed. Hypothetically, if you held 100 shares in each of the them, you’d collect $226.50 for the month of January. For some that’s their groceries. Of course, dividends are declared by management and are not guaranteed. But if you invest in quality companies, chances are they’ll continue paying out dividends.

DivTracker

After that look at the pay date. Companies usually pay out dividends around the same time each quarter. For example, if they usually pay out dividends on the 3rd of say January, then chances are they’re going to pay on the 3rd or around that time three months later in April. The three months after that and so on and so forth.

So now you have a stock that pays in the month of Jan, Apr, Jul, Oct, and the cycle repeats. After finding a stock that pays in those months, find a quality one that pays the next month. So Feb, May, Aug, Nov. The the next step is to find one that pays in March. After finding three that pay you one month after the other, now you’re collecting a dividend check on a monthly basis.

#3 Diversify

Another important factor when collecting dividends is to make sure your diversify into different sectors. I use four different companies from four different sectors. In this case, Real Estate, Information Technology, Consumer Discretionary, and Financial. Although diversification is a key factor when selecting stocks, one has to be careful not to over diversify, or what they call diworsification. You have to be able to stay up to date on your holdings, and a portfolio of too many can be difficult to manage. But that also depends on the investor. Some may prefer to hold several different stocks. I prefer to hold 10 to 15, with no more than 20-25. That’s just a personal preference of mine. I know people who hold 3 stocks, and I also know people who hold 75. Again there’s no wrong answer. It’s also okay to hold multiple stocks within the same sector as well, as long you deem them to be high-quality.

DivTracker

A mixture of stocks is also important. As an income investor of course payment and sustainability of dividends are key, but a mixture plays a role as well. Business Development Companies like Ares Capital (ARCC) and Capital Southwest (CSWC) are strictly income vehicles while stocks like Starbucks (SBUX) and Microsoft (MSFT) offer investors capital appreciation and dividend growth. So, finding a good balance between the two is suggested. REITs, BDCs, MLPs, CEFs, ETFs, and bonds are some of the ways to mix it up when dividend investing. Some may prefer to hold all growth stocks or some may prefer to hold all income stocks. I like to hold a mix of what I call dividend showers and growers. Those who pay a sustainable dividend that doesn’t offer much growth. Say one like Starwood Properties (STWD). Or a grower like Altria (MO). Again factors like age, amount invested, time horizon, are all to be taken into account when considering this. Taxes also play a large factor when investing for dividends.

#4 Dividend Growth & Performance

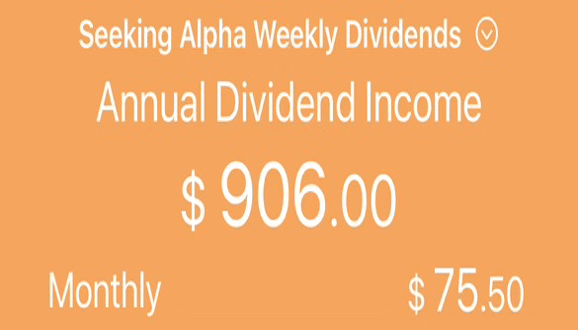

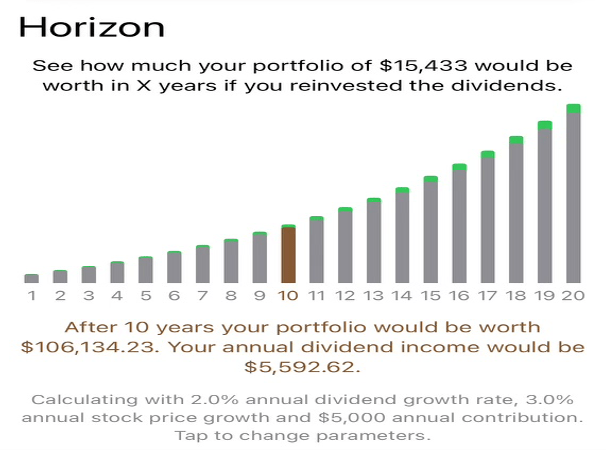

Holding a portfolio of dividend stocks, one could only hope that those stocks not only continue to pay a dividend for a long time, but grow their dividend as well. Holding 100 shares in each of these stocks currently would give you $906 in annual dividend income and this would grow more than 517% to nearly $5,600 in 10 years. I get dividend investing may be boring for some but I truly enjoy seeing dividends hit my brokerage account on a weekly basis. Collecting weekly dividends helps compound at a much faster rate. And the good thing about collecting them is that you can choose to reinvest or use your dividends in a time of need.

DivTracker

A monthly dividend of $75.50 could be your cell phone bill. Or maybe they can use that for food or pay for your monthly gym membership. Collecting more in dividends allows you to use your retirement or active income for other things or expenses. I always said my goal was to collect similar or more than I was collecting while on active duty. Of course collecting a substantial amount takes time and patience but it’ll all be worth it in the end.

Below is what your portfolio would be worth in 10 years if you had an annual dividend growth rate of 2%, 3% annual capital appreciation, and contributed $5,000 yearly. I decided to be more conservative but if you wanted more growth then you could select different stocks from different sectors. The tech sector is often considered high growth so investors seeking more of that could choose to invest their money there.

DivTracker

All four stocks listed have a 5-yr dividend growth rate in the single-digits with the exception of VICI Properties (VICI) who has a growth rate of 17.42%. The company has only been public for a few short years but has been growing at a rapid pace since its IPO in 2018. They have also been added to the S&P and received an investment grade rating since then. Credit rating is another factor that plays a part when dividend investing. Stocks that are investment grade rated tend to fare better than those who are not.

Think of this as two individuals. One has an 800 credit score and one has a 500. Who is more likely to get that brand new corvette off the car lot? Doesn’t mean the person with the 500 credit score isn’t capable of making the monthly payment or doesn’t make enough money. But looking at their credit history, a dealership is likely to give the new car to the person with the 800 credit score because of their history. Same goes for stocks. All four of these have IG ratings of BBB- or above and payout ratios that could sustain them paying a dividend for the foreseeable future.

Author

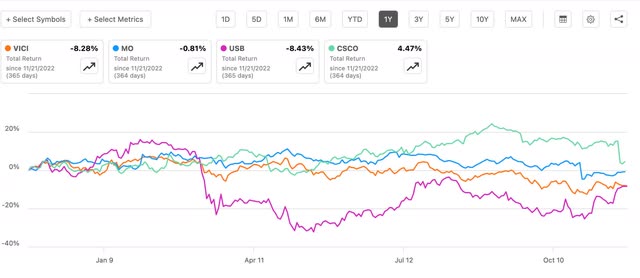

If you look over the past year, 3 of the 4 stocks are down with the exception of Cisco (CSCO), the one tech stock. As most know it hasn’t been a great year for the other three. Especially when you factor in the high interest rates pummeling REITs, the banking crisis earlier this year, and the JUUL fiasco with Altria and the recent NJOY acquisition.

Seeking Alpha

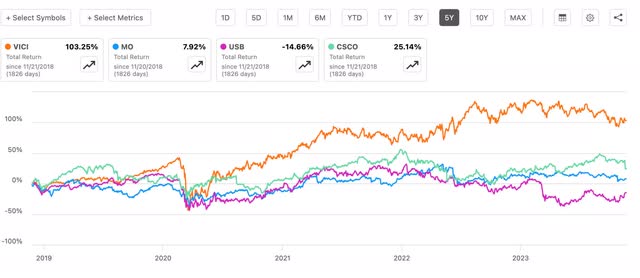

But if you look like over a 5-year period 3 of the 4 stocks have positive total returns. As a dividend investor I think it’s good to play the long game. Some may prefer to capture dividends and build their portfolio that way, but I prefer to be more conservative. I’ve heard of investors capturing dividends. Buying them before the ex-dividend date, then dumping the stock on the record date to collect the dividend, then move onto the next stock. That’s one reason why some dividend stocks prices decline on/and or around their ex-dividend or record dates.

Seeking Alpha

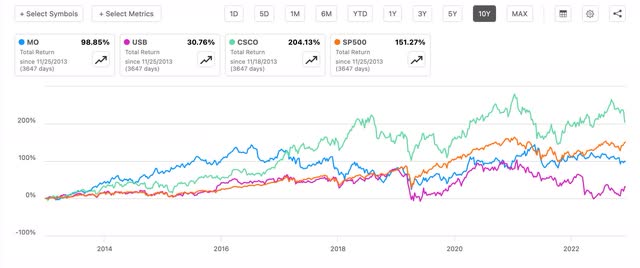

I like to look at a minimum 5-year period when researching my dividend stocks with a plan to hold them forever assuming the fundamentals don’t change. Here I compared 3 of the 4 stocks to the total returns of the S&P over a 10-year period. I left out VICI as the stock has not been public for 10 years. All have positive returns and CSCO even outperforms the S&P over that time. U.S. Bancorp (USB) significantly underperforms but every stock you hold is not going to be an out performer. Some investors may have portfolios or hold individual stocks that outperform the S&P but what I look for is positive returns from high-quality businesses that can continue to pay a steady and/or growing dividend. A simple, yet effective strategy.

Seeking Alpha

Investing In Dividend Stocks & Risks To Consider

You could argue that dividend stocks have been slaughtered over the past year with the rise in interest rates. And that’s a fair point. But while many are down, collecting dividends can help alleviate some of the pain as an investor. Remember as investors, you never actually take a loss unless you sell. Some investors prefer to hold dividend stocks as they can reduce risk and volatility. So while your account may be in the red, that’s why it’s important to invest in stocks of high-quality because usually they don’t stay down for long. That’s why time horizon is important too. And never invest money that you can’t afford to lose.

However, there are some risks to consider when investing for dividends. A notable risk to dividend investing are taxes. If you’re like me I hold stocks like BDCs and REITs who are both subject to higher taxes, or ordinary taxes. Those who prefer to hold dividend growth stocks like like Apple (AAPL) or SBUX are taxed at a lower rate because they pay out qualified dividends.

This is why some prefer to hold stocks such as REITs and BDCs in retirement accounts like Roth IRA’s. But if you plan to live off your dividends in the next 5 to 10 years and you’re not of age, then a taxable account would be the best option in my opinion. Tax brackets may also play a factor in the type of account to hold your dividend stocks in as well.

Conclusion

The stocks listed in this article were just an example on how to collect dividends on a weekly basis. Investors may prefer to invest in different stocks or sectors for their own reasons. There are hundreds of dividend paying stocks that pay on different dates. This is a strategy I decided to use a few years ago to help me compound much faster to reach my goal of supplementing my income with dividends in the next 5-10 years. Those who have a shorter or longer time frame may select different stocks. Investing in quality dividend stocks takes a lot of patience and due diligence. Those who don’t have those may prefer to invest in dividend ETFs. Dividend investing may not be for everyone, but it’s a very rewarding process for those willing to do the work and have the time and to do so.

Read the full article here