Energy Transfer owns industrial pipelines and other facilities, mostly in the Gulf region.

The long-awaited conversion of more than a dozen preferred stock issues from fixed to floating payments is accelerating, just as rising short-term interest rates have made them attractive investments.

As I wrote in February, NYSE:ET.PC (Quantum description) becomes the first of the partnership’s three publicly traded preferred series to convert to a floating rate on May 15. The previous fixed rate of 7.375% no longer applies. The prospectus states:

The distribution rate for each distribution period in the Floating Rate Period will be determined by the calculation agent using three-month LIBOR as in effect on the second London banking day prior to the beginning of the distribution period, which date is the “distribution determination date” for the distribution period. The calculation agent then will add the spread of 4.530% per annum to three-month LIBOR as determined on the distribution determination date.

The rate for the next three months should be fixed at the level of three-month LIBOR as of May 11 (two business days prior to May 15). I had been waiting impatiently for weeks to plug this number into my spreadsheet, and it turned out to be 5.32%.This figure, plus the 4.53% spread, means a quarterly distribution of 9.85% on August 15 based on the $25 reference price. Annualized, this would be a $2.4625 distribution. At the recent market price below $25, the yield would be above 10%.

Commenters on my previous article suggested the company might call the series on May 15, but that is no longer possible since the required notice stated in the prospectus was not given.

We must provide not less than 30 days’ and not more than 60 days’ written notice of any such redemption.”

The first payment under the new rate should be made on August 15, and unless an announcement is made by July 15, a second payment will be made in November. Since the LIBOR index is being discontinued, the second payment most likely will be at 4.53% plus the Structured Overnight Finance Rate (SOFR) plus a spread adjustment of 0.26%. Overall, the change should make little difference.

Energy Transfer (ET) owns crude oil, natural gas, and natural gas liquid assets primarily in Texas and the midcontinent. It also has gathering and processing facilities such as pipelines, one of the largest fractionation facilities in the U.S., fuel distribution, and the Lake Charles gas liquefaction facility. Its assets exceed $105 billion. Its common units pay a distribution of $1.23, or 9.98%.

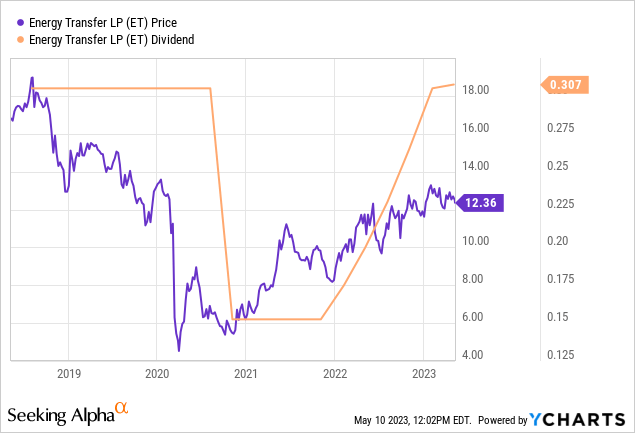

Aggressive investors should consider the common units, but they tend to be highly volatile. Since the preferred distribution is guaranteed before any common distributions, I like it as the safer choice for income investors. The chart below shows what happened to the payout and price of the common during the Covid-19 bust.

Risk Factors

The biggest risk is that the Fed rapidly will lower interest rates if there is a recession. The price of the units would begin falling about one quarter before the distribution itself would be affected. I don’t see this as likely in 2023, but if you’re in the recession-is-nigh camp, you’ll probably want to avoid floating-rate preferreds.

The C preferred could be called at any time for $25, but as long as the price remains below that level, this would result in a gain rather than a capital loss. My guess is it won’t be called until after they announce the issuance of a replacement preferred. This is because the company says it wants to keep a 4 times to 4.5 times leverage ratio target range, and ET’s recent issues of preferred stock have been counted 50% toward equity by ratings agencies, while debt is not. The use of preferred stock, while more expensive than debt, frees up capital for growth projects.

The risk of a suspension of payment is fairly minimal, given that ET’s common distribution is twice its cash flow. Most of ET’s income comes from fee-based payments to use pipelines and the like. Still, the price of the preferred units would likely decline in an energy bust, as occurred most recently in 2020.

Preferred Series Compared

ET has three series of $25 reference-price cumulative preferred units. I calculated the estimated forward distribution of ET.PC for the next four quarters if LIBOR stays the same (which obviously it won’t), and ET.PD based on one final quarter of a fixed payment plus three quarters of the floating rate. For ET.PE, the next four quarters will be at the fixed rate, thus the estimated distribution and yield are lower.

| Ticker | Original Coupon | Est. fwd. distribution | Recent Price | Est. Yield | Conversion/call date | Notes | ||

| ET.PC | 7.38% | 2.46 | 23.875 | 0.103 | 5/15/2023 | Fixed to floating LIBOR+4.53% | ||

| ET.PD | 7.62% | 2.37 | 23.61 | 0.1004 | 8/15/2023 | Fixed to floating LIBOR+4.738% | ||

| ET.PE | 7.60% | 1.9 | 23.08 | 0.0823 | 5/15/2024 | Fixed to floating LIBOR+5.161% | ||

Source: Author’s spreadsheet

The greater capital appreciation possibility of the D compensates for the lower forward yield of the C. Both appear to be excellent buys, while the E–with the most generous terms of all–should perk up next year if rates stay level or rise.

Read the full article here