If you’re like me, you rarely transact in cash anymore. I can probably count on one hand how many times I use physical cash in a given year. Pretty much all of my purchases are done by using a credit card or debit card, whether that is with the card presented or not. One of the top companies in the world of digital payments has undoubtedly got to be Visa (NYSE:V). From its founding in 1958, the company has grown to become a global operator that facilitates transactions and money movements across more than 200 different countries and territories.

You would think that such a large company in an industry that many view to be mature would exhibit slow growth and limited upside. But the fact of the matter is that the company continues to grow at a nice clip. It is unclear how many more years of attractive growth that has before it finally does level off. But in the meantime, investors get the opportunity to own stock in an industry leader that generates tremendous amounts of cash. Personally, I think that its shares are a bit too high for my liking. But for those who don’t mind paying a premium for a premium business, this is definitely one opportunity to seriously consider.

Great performance in recent years

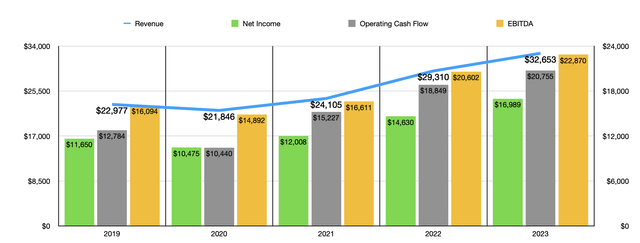

Author – SEC EDGAR Data

Just last month, the management team at Visa announced financial results covering the final quarter of the company’s 2023 fiscal year. Revenue for that window of time came in at $32.65 billion. That represents an increase of 11.4% over the $29.31 billion the company generated one year earlier. Those who are not terribly familiar with the business might think that the kind of growth scene during that window of time is a one-time blip on the radar. But that couldn’t be further from the truth. Even after seeing revenue drop from 2019 to 2020, sales of the payment processor have continued to increase at a nice clip, rising at an annual rate of 9.2%.

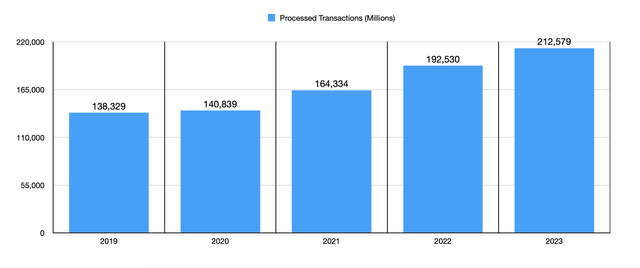

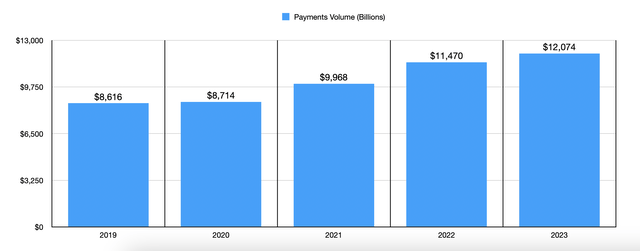

Author – SEC EDGAR Data

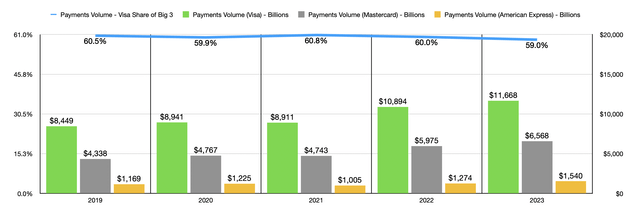

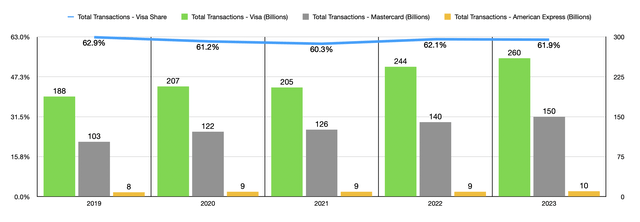

The top line growth achieved by Visa has been made possible by an increase in the number of transactions that the company facilitates and by higher overall payment volumes. To see what I mean, consider first the processed transactions of the company. These have jumped from 138.33 billion in 2019 to 212.58 billion in 2023. That’s a rise of 11.3% per annum. But it’s more than just the number of transactions completed that the company is benefiting from. The amount of money actually being transacted has also been on the rise. Back in 2019, the company handled $8.62 trillion worth of payments. That number in 2023 totaled $12.07 trillion for an annualized growth rate of 8.8%.

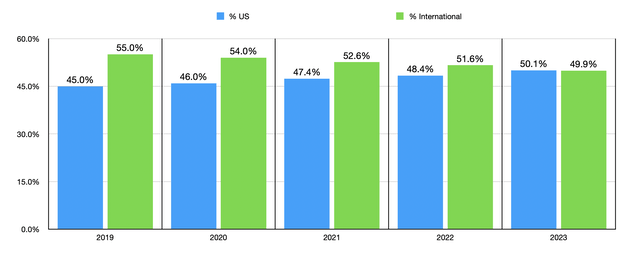

Author – SEC EDGAR Data

You would think that the US market would no longer be a hotbed of activity for the company. After all, the US is where the credit and debit card industry was invented and it is often seen as one of the most mature markets, if not the most mature market, for financial transactions. But the fact of the matter is that not even the US market is done growing yet. I say this because, back in 2019, 45% of the payment volumes handled by Visa were from here at home. That number has grown literally every year since then, hitting 50.1% in 2023. For those focused on the long-term outlook, this should be encouraging. If such a developed market can show signs of attractive expansion, then that means the big picture internationally should be quite appealing.

Author – SEC EDGAR Data

The growth on the top line for the company has not gone without competition. There are countless payment processors on the market. But if we focus on the three largest US based card processors, we would have Visa, Mastercard (MA), and American Express (AXP). Ideally, I would have liked to have seen Visa’s market share grow in recent years in relation to these other two players. But that is not what we have experienced. In fact, market share has remained virtually flat, bouncing around in a fairly narrow range of between 59% of the sum of the three and 60.8%. A similar share can be seen when looking at the total number of transactions as opposed to just the payments volumes. The range in this case has been between 60.3% and 62.9%.

Author – SEC EDGAR Data Author – SEC EDGAR Data

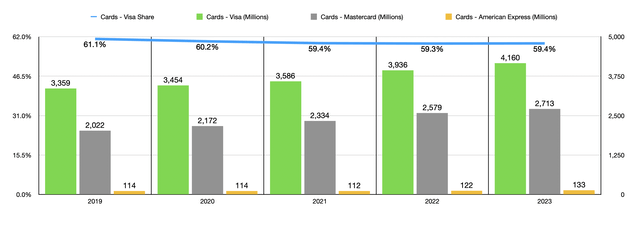

Even though Visa is the big fish between the three, the other two players in the space have succeeded, in the aggregate, of increasing the number of cards that they have outstanding at a similar pace to what Visa has demonstrated. The number of American Express cards went from 114 million in 2019 to 133 million in 2023. MasterCard has seen an increase from 2.02 billion to 2.71 billion. But over that same window of time, Visa has seen an increase from 3.36 billion to 4.16 billion.

Author – SEC EDGAR Data

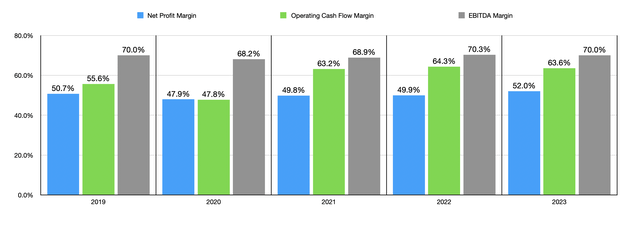

Despite the fierce competition, Visa has not had any problem growing its bottom line. Net income at the company has expanded from $11.65 billion back in 2019 to $16.99 billion in 2023. Other profitability metrics have followed a similar trajectory. As an example, operating cash flow has jumped from $12.78 billion to $20.76 billion. Meanwhile, EBITDA for the company rose from $16.09 billion to $22.87 billion. One thing I would like to point out here is that, in addition to profits growing, margins have mostly increased. We did see a decline in margins from 2019 to 2020. But ever since then, we have seen a pretty consistent increase from year to year. In 2023, for instance, the net profit margin of the company was 52%. This compares to the 50.7% than it was back in 2019. The operating cash flow margin rose from 55.6% to 63.6%, while the EBITDA margin for the company has remained unchanged at 70%. If, however, we move forward one year to 2020, we would have actually seen an increase from 68.2% to 70%. These differences may not seem like much. But when applied to the revenue generated in 2023 alone, a 0.1% improvement translates to an extra $32.7 million in profits or cash flows for shareholders.

Author – SEC EDGAR Data

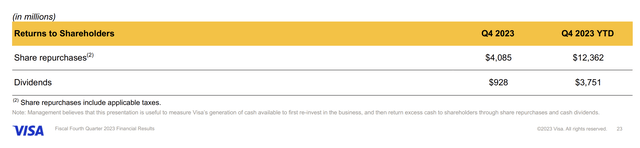

With this strong financial performance, management has been very active in returning capital to shareholders. In the final quarter of 2023 alone, the company allocated $4.09 billion toward share repurchases and another $928 million toward dividends. For 2023 in its entirety, the company spent $12.36 billion on share buybacks and $3.75 billion on dividends. Investors can likely expect this trend to continue, at least for the 2024 fiscal year. This is because management is forecasting high single digit to low double digit revenue growth next year, with diluted earnings per share growth coming in at the high teens.

Visa

This doesn’t necessarily mean that I am advocating that shareholders increase their stake in the company or that market watchers buy the stock. In the long run, I suspect that Visa will do just fine. But the stock does not come cheap. Using the data from 2023, the company is trading at a price to earnings multiple of 29.5. The price to operating cash flow multiple is 24.2, while the EV to EBITDA multiple of the enterprise is 22. To put this in perspective, it is cheaper than MasterCard, which is probably the best comparable out there. MasterCard ‘s multiples are 35.6, 35.6, and 26.3, respectively. But even though the stock is cheaper on a relative basis does not mean that it is cheap enough to warrant attractive upside.

There’s also the fact that economic conditions are rather uncertain at this point in time. The Federal Reserve has been explicit in stating their goal of weakening consumer spending in order to combat inflation. And while we might be in for a soft landing, it’s unlikely that interest rates will come down in the near term. We are also starting to see credit card delinquency rates rise rather materially. The most recent data provided by the Federal Reserve estimated that around 8% of the balance of credit cards has moved into a state of delinquency. That’s actually the highest rate we have seen since around 2012.

Takeaway

Based on all the data provided, Visa is a solid company that is doing well for itself and creating attractive value for shareholders. In the long run, I have no doubt that this trend will continue. Those who have a very long-term investment horizon and who don’t mind accepting the risk of underperforming the market would do well to seriously consider picking up shares of it. But for those who are more value oriented like myself, there are other opportunities in the market that are more sensible right now. Even so, I do believe that a ‘hold’ rating is appropriate for the company at this time.

Read the full article here