Overview

Legendary value investor Warren Buffett has been outspoken regarding his distaste for Bitcoin. Telling investors nearly a decade ago that he doesn’t believe it to be a ‘store of value’ or a ‘reliable means of exchange’, he has made clear that it doesn’t even fulfill the definition of a currency. This year he referred to it as a ‘gambling token’ unworthy of serious fundamental investors.

Yet, time has proven the worth of these digital currencies. While highly volatile, Bitcoin and Ethereum have maintained threshold levels of value while also continuing to act as a means of exchange. At this point it is fair to assert that Buffett may not be entirely correct regarding these instruments.

While I do agree with Buffett in that Bitcoin and digital currencies in general cannot be looked at through a traditional value lens, I think it is evident at this point that they have some level of fundamental value if we are to consider them as currencies.

I will note that It is important for us to consider cryptocurrencies as currencies specifically. They are decidedly not like owning stocks; owning cryptocurrencies does not represent a fractional claim on a company’s cash flows like owning shares of stock does.

Rather, cryptocurrencies should be evaluated on the basis of their value as currencies: to what extent they provide for, and are used for, exchanging value. Since we have readily available metrics for this we can work towards establishing a fundamental valuation methodology for cryptocurrencies.

This article will outline these metrics and compare Bitcoin and Ethereum on this basis.

Currency Fundamentals For Cryptocurrencies

A currency’s worth is established from the set of transactions that it supports. In macroeconomics there is an established body of theory around this. The more ‘demand’ (total transactions) for a currency, the higher the value of it. At constant levels of currency supply, more transaction volume implies a higher value for a given currency. A second-order demand effect would be countries holding certain currencies in reserve so that they can transact in those currencies in the future.

Fiat currencies’ value are then derived from both the size of a country’s economy as well as the international transaction volume for its respective currency. The total of domestic and international transaction volume forms the total demand for a given currency. A good example of this in the real world would be the large global levels of Dollar-denominated debt as well as Dollar-denominated energy trading; these are well understood to represent fundamental underpinnings to the Dollar’s uniquely high value.

With that being said we can establish a fundamental supply and demand metric, along with a relative valuation, for Bitcoin and Ethereum.

The demand here is the level of transactions occurring ‘on-chain’, as in directly using the blockchain network for like-kind exchange. This metric doesn’t take into consideration secondary market demand for these two cryptocurrencies, namely crypto-to-fiat conversions. While these secondary market forces are undoubtedly a material price driver, this goes beyond the scope of functioning as a currency per se and won’t play into our fundamental analysis this time around.

The supply here is of course the actual quantity of cryptocurrency outstanding.

|

Date |

BTC Volume |

ETH Volume |

|

4/11/23 |

.385 M |

1.085 M |

|

4/12/23 |

.338 M |

1.022 M |

|

4/13/23 |

.332 M |

1.095 M |

|

4/14/23 |

.316 M |

1.166 M |

|

4/15/23 |

.276 M |

1.056 M |

|

4/16/23 |

.232 M |

.854 M |

|

4/17/23 |

.316 M |

1.012 M |

|

4/18/23 |

.313 M |

1.070 M |

|

4/19/23 |

.302 M |

1.085 M |

|

4/20/23 |

.297 M |

1.074 M |

|

4/21/23 |

.352 M |

1.010 M |

|

4/22/23 |

.355 M |

.862 M |

|

4/23/23 |

.433 M |

.868 M |

|

4/24/23 |

.360 M |

.941 M |

|

4/25/23 |

.370 M |

.976 M |

|

4/26/23 |

.436 M |

.978 M |

|

4/27/23 |

.419 M |

.939 M |

|

4/28/23 |

.484 M |

.988 M |

|

4/29/23 |

.486 M |

.887 M |

|

4/30/23 |

.569 M |

.975 M |

|

5/1/23 |

.682 M |

1.102 M |

|

5/2/23 |

.458 M |

1.128 M |

|

5/3/23 |

.490 M |

1.117 M |

|

5/4/23 |

.491 M |

1.110 M |

|

5/5/23 |

.411 M |

1.209 M |

|

5/6/23 |

.601 M |

1.146 M |

|

5/7/23 |

.608 M |

1.101 M |

|

5/8/23 |

.575 M |

1.146 M |

|

5/9/23 |

.598 M |

1.127 M |

|

5/10/23 |

.672 M |

1.086 M |

|

5/11/23 |

.547 M |

1.100 M |

Source: Excel, YCharts

|

BTC Price |

$26,808 |

|

ETH Price |

$1,808.39 |

|

BTC Average Daily Volume (30 Days) |

.450 M |

|

BTC Average Daily Volume In $ |

$12.07 B |

|

ETH Average Daily Volume (30 Days) |

1.077 M |

|

ETH Average Daily Volume In $ |

$1.95 B |

Source: Excel, YCharts

We can see that over the last 30 days, the Bitcoin network has processed 6.2x the amount of transactions that the Ethereum network has on a Dollar basis.

|

BTC Circulating Supply |

19.370 M |

|

ETH Circulating Supply |

121.340 M |

Source: Excel, YCharts

We can now divide the average transaction volume (in Dollars) by the total supply to arrive at a ‘total transaction value per unit’ metric:

|

Transaction Value Per Unit Supply BTC |

$622.91 |

|

Transaction Value Per Unit Supply ETH |

$16.05 |

Source: Excel, YCharts

This paints a stark picture. On a pure supply/demand basis for the past month, Bitcoin is presently 38.8x more valuable than Ethereum – even though its price is only 14.82x that of Ethereum.

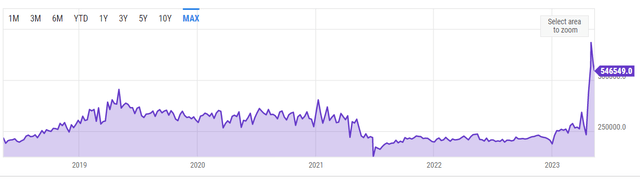

We must contextualize this further, however. Worth noting is that there has been a very significant uptick in Bitcoin network volume over the past month; it is currently far beyond historical norms. It appears that this surge is receding, but it is inconclusive which way it will go. Furthermore the average network activity for Bitcoin appears to have settled lower than historical norms over the course of 2022 and the first 2 months of 2023. This longer-term, structural, trend may well continue when the short-term uptick recedes.

YCharts

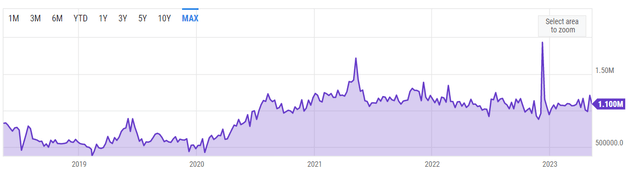

As to Ethereum, the recent trendline also saw volatility but delayed by 3 months. The structural trend here appears to be the reverse of Bitcoin; Ethereum utilization has been fluctuating at a higher level than it was at previously.

YCharts

While the data is stark on 30 days trailing basis, a review of the longer-term technical picture here indicates that Bitcoin’s network utilization trend is too short-term and high-variance to constitute a reliable buying signal.

The other thing to consider is the significant multiples that each of these cryptocurrencies trade at relative to the amount of daily transaction volume they support.

For a monthly level of utilization, however, the prices appear to be more grounded relative to market prices:

| Monthly Transaction Volume Per Unit Supply BTC | $18,687.41 |

| Monthly Transaction Volume Per Unit Supply ETH | $481.61 |

As such I will venture that this is the metric best utilized now and going forward.

On this measure BTC also appears to be relatively cheap:

| BTC Price / Monthly Transaction Volume Per Unit | 1.435 |

| ETH Price / Monthly Transaction Volume Per Unit | 3.755 |

Conclusion

While we have established a sensible way to relatively value these two cryptocurrencies, current fluctuations in Bitcoin’s network utilization are too variable to make the numbers reliable for an investment decision. If Bitcoin’s massive uptick in utilization proves to be consistent for another 3 months, I would feel comfortable calling it a buy on a relative basis.

Alternatively, if the BTC trend normalizes and Ethereum’s structural trend continues to accelerate towards higher utilization, I would call Ethereum a buy.

At present I would be cautious and rate Bitcoin a hold while network utilization evens out to something more in line with historical norms.

Read the full article here