My previous Strong Buy ratings on Bristol Myers Squibb Company, or BMS (NYSE:BMY), have not worked out accordingly, despite glimpses of a reversal in late August 2023. However, the company’s third-quarter or FQ3 earnings release in late October 2023 indicated a robust near- to medium-term recovery in its operating performance looks increasingly elusive.

The company sees heightened challenges in its new product segment momentum while dealing with the near-term loss of exclusivity or LOE with Revlimid. Accordingly, management downgraded its medium-term outlook through 2025, suggesting a delayed ramp in its new product roadmap.

Bristol Myers Squibb’s disappointing medium-term guidance on its new product portfolio justified the valuation de-rating as investors assessed the increased execution risks. Accordingly, BMS estimates the new product portfolio revenue will no longer range between $10B and $13B by 2025. As a result, the company’s revised outlook suggests a >$10B ramp by 2026. Therefore, not only is the target extended by another year, but the revenue outlook is also much less optimistic than BMS’s previous guidance.

In addition, the company also sees margin pressure in the portfolio. Coupled with the LOE challenges afflicting Bristol Myers Squibb over the same period, the company has revised its adjusted operating margin guidance to >37% through 2025. It’s down markedly from its previous outlook of an above-40 % margin estimate.

As a result, I believe the continued battering in BMS is justified, as the company is seeing significant challenges in its revenue ramp cadence. Therefore, BMS investors could see relatively tepid growth over the next few years, even though the headwinds on Revlimid are expected to be less intense moving ahead.

Observant investors should recall the company forecasts a $4B revenue contribution from its previous blockbuster in 2024, down from this year’s estimated $6B. In addition, the revenue contribution is expected to decline to $2B by 2025. As a result, BMS expects its LOE portfolio to “represent less than 10% of total revenue by 2025.” With that in mind, the company is channeling its efforts to engineer “a younger portfolio by 2025, which will set the stage for 2026.”

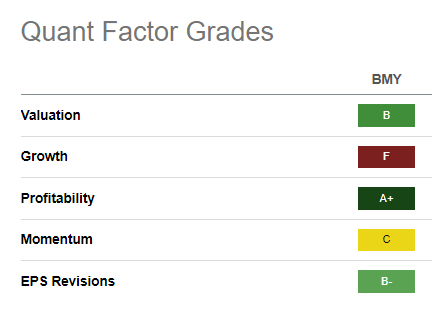

BMY Quant Grades (Seeking Alpha)

Given the hammering, BMY continues to trade at an attractive valuation, rated “B” by Seeking Alpha Quant. Its forward EBITDA multiple of 7.2x is well below the Pharma industry peers’ median of 10.3x (according to S&P Cap IQ data). As a result, I believe it’s arguable that much of BMY’s near-term pessimism has been priced in.

However, it should also be noted that buyers have yet to return aggressively, as seen by its “C” momentum grade. The “F” growth grade is likely the most significant factor to consider, as investors reflected on the immense challenges over the next three to four years as BMS ramps up its new product revenue.

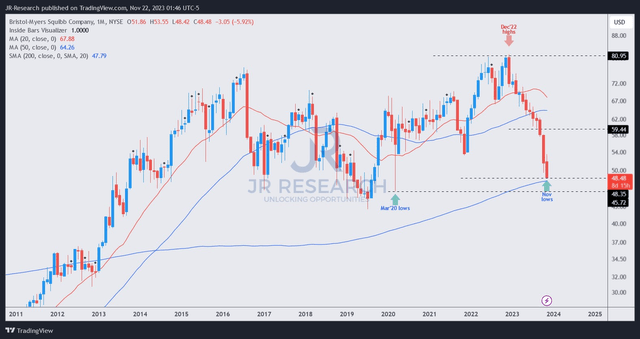

BMY price chart (monthly) (TradingView)

I must highlight that the recent developments have invalidated the price action thesis I indicated in August.

BMY’s recent price action has not indicated a robust bottoming that could bolster my confidence in maintaining my Strong Buy thesis. Despite that, there’s a possibility that BMY could still bottom out close to the 200-month moving average (purple line), suggesting peak pessimism.

Therefore, the current levels are pivotal for BMY to maintain its long-term uptrend bias. Given the extent and pace of its fall from its December 2022 highs, I continue to lean bullish but withdraw my Strong Buy thesis until I gleaned a validated bullish reversal.

Rating: Downgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here