Introduction

What about UAN?

This may be one of the most asked questions I get whenever I publish an article covering agriculture fertilizer producers.

As much as I like the fertilizer plays in my portfolio, like Nutrien (NTR), Mosaic (MOS), or CF Industries (CF), none of them deliver what some investors are looking for, which is high-income dividends.

That’s where CVR Partners (NYSE:UAN) comes in.

However, in the case of UAN, we are dealing with distributions instead of dividends and units instead of shares, as the company is a limited partnership, which issues a K-1 form. So, please bear that in mind, as it could have positive (or negative) consequences for your tax situation.

That said, I tend to use both dividends and distributions, as I noticed it’s just easier for some to understand what we’re talking about. It may not be the correct way, but it won’t change anything.

Furthermore, one reason why I haven’t discussed UAN in the past is its small size. I tend to stay away from companies that have a market cap of less than $1 billion and no analyst coverage.

Nonetheless, UAN is a fascinating play with a very juicy distribution/dividend yield.

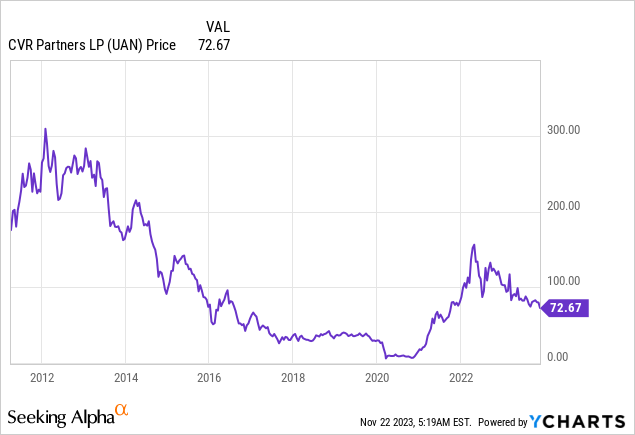

It also needs to be said that its shares have been in a very steady downtrend since early 2022, which has pushed its stock price from more than $170 to almost $70.

In light of this decline and healthy developments in the fertilizer industry, let’s take a closer look at UAN!

On a side note, please note that the ticker “UAN” is the same as the abbreviation for urea ammonium nitrate (a key fertilizer). I use both in this article. I try to be as clear as possible to avoid confusion.

UAN’s Assets And Benefits Are Impressive

Let’s briefly start at the very beginning.

CVR Partners was created in 2011 by CVR Energy (CVI).

The partnership focuses on owning, operating, and expanding its nitrogen fertilizer business in the United States.

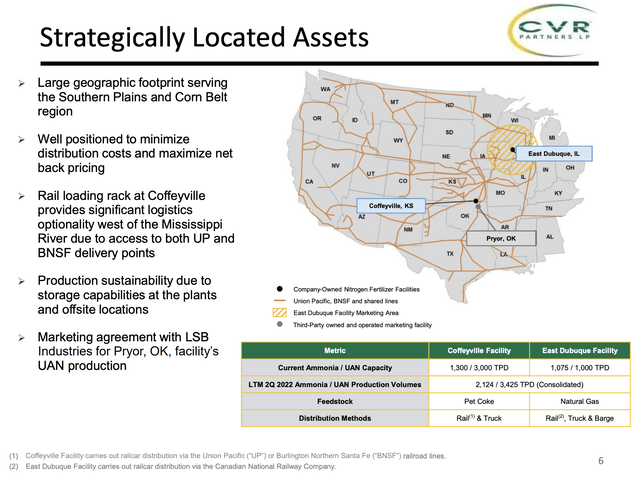

It operates two manufacturing facilities, one in Coffeyville, Kansas (“CRNF”) and another in East Dubuque, Illinois (“EDNF”), producing ammonia and upgrading it to urea ammonium nitrate (“UAN”).

- Coffeyville Facility: This facility employs a unique pet coke gasification process, making it the sole nitrogen fertilizer plant in North America utilizing this method. It boasts a gasifier complex with a hydrogen capacity of 89 million standard cubic feet per day, an ammonia unit with a 1,300-ton per day capacity, and a UAN unit with a 3,100-ton per day capacity.

- East Dubuque Facility: Operating in Illinois, this facility has a 1,075-ton per day capacity ammonia unit and a 950-ton per day capacity UAN unit. Its flexibility enables variable product mixes, allowing it to upgrade a portion of its ammonia production based on market demand, pricing, and storage availability.

These products are sold wholesale in the United States and have the benefit of the strategic location of the company’s plants, covering America’s demand hotspots, as we can see in the map below.

CVR Partners

The reason why the company’s plants reach so many customers is its distribution network. Its Kansas plant is serviced by Union Pacific (UNP) and BNSF, whereas its Illinois plant is serviced by Canadian Pacific Kansas City (CP), barges, and high regional demand is serviced through trucks and related transportation.

Google Maps

Both CP and UNP are significant holdings of my dividend growth portfolio, which is one way I use to get diversified exposure to many industries.

Another important aspect of UAN production is feedstock (raw materials).

In this case, UAN has top-tier access to competitive prices.

- The Coffeyville Facility utilizes a pet coke gasification process. Approximately 44% of its pet coke requirements, on average over the past five years, were supplied by CVR Energy’s adjacent Coffeyville, Kansas refinery through a supply agreement. The remainder of pet coke needs are typically fulfilled through third-party contracts, often at a discount to the spot market.

- The East Dubuque Facility primarily uses natural gas as a feedstock for its nitrogen fertilizer production. The facility has the advantage of being connected to the Northern Natural Gas interstate pipeline system, ensuring competitive pricing.

Now, bear in mind that even if natural gas and/or coal prices rise, UAN is still in a good position to get better prices! This adds to its competitiveness and makes it a very attractive play in a situation of rising input costs.

For example, if natural gas prices rise, producers overseas (like in Europe) quickly become unprofitable, which hurts supply. In such a scenario, UAN benefits from less supply entering the market and price benefits compared to some of its peers.

As I have a background in supply chains, I have to say UAN is truly in a terrific position to not only provide much-needed input products for farms but also with much less risk.

So, How Is UAN Doing?

As its stock price may suggest, CVR Partners is seeing some headwinds.

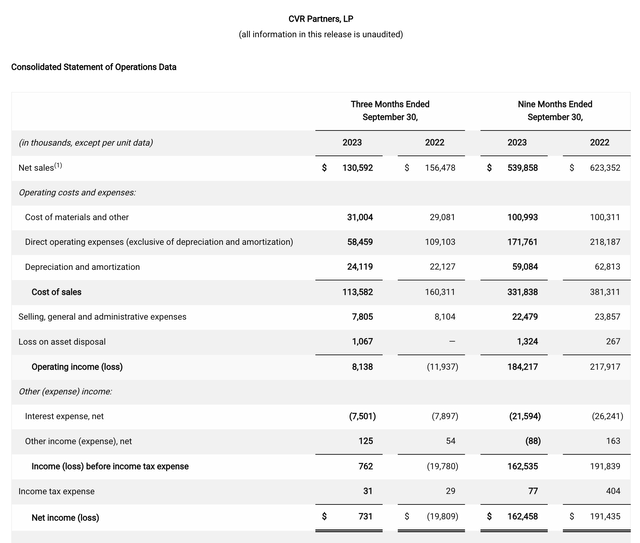

For example, at the end of October, the company reported its third-quarter earnings.

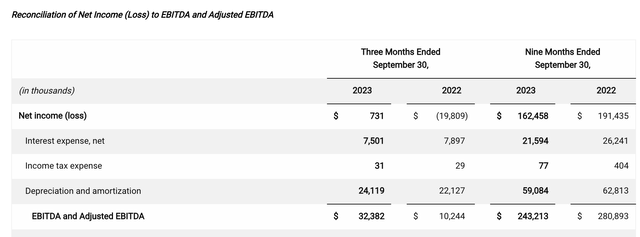

The company reported net sales of $131 million, operating income of $8 million, net income of $1 million ($0.07 per common unit), and EBITDA of $32 million.

Revenue was down significantly compared to 3Q22. Note that net income was technically $800 thousand. However, the company rounded it to $1 million in its own reports, so I did the same.

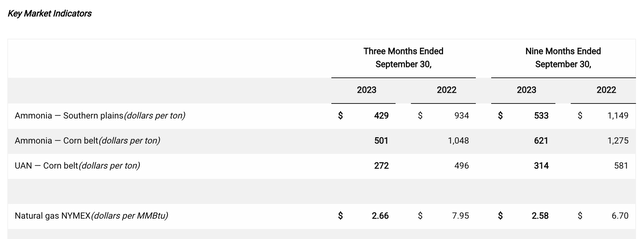

CVR Partners

The increase in EBITDA compared to 3Q22 was attributed to higher production and sales volumes and lower operating expenses.

Adding to that, the overview below shows the impact of depreciation and amortization on net income, which resulted in a significantly higher EBITDA result.

CVR Partners

Furthermore, facilities ran well, with consolidated ammonia plant utilization at 99%.

Combined ammonia production for the quarter was 217,000 gross tons, with 68,000 net tons available for sale.

UAN production reached 358,000 tons, and sales included approximately 387,000 tons of UAN at $223 per ton and 62,000 tons of ammonia at $365 per ton.

However, prices declined, with ammonia prices falling 56% and UAN prices falling 48%, which explains why strong volumes weren’t able to keep total sales from falling.

CVR Partners

The good news is that after a reset of nitrogen fertilizer prices in July, prices rose throughout the summer due to strong demand and reduced supply from planned and unplanned industry outages.

The company is optimistic about nitrogen fertilizer demand for 2024.

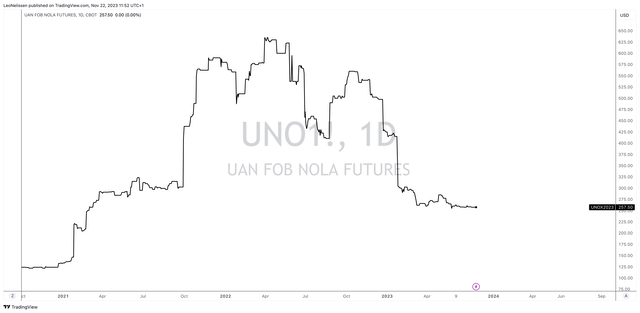

Looking at CBOT UAN futures, we see that prices have gone sideways since March, which is good, as prices have settled at much higher prices compared to levels before the surge in natural gas prices and the related Ukraine war.

TradingView (UAN Futures)

Before I get to related developments, it needs to be said that the company ended the third quarter with total liquidity of $137 million, including $89 million in cash and $48 million available under the ABL facility.

During Q3, the company amended its ABL credit facility, increasing the maximum availability to $50 million and extending the maturity to 2028.

Although the company has a B+ “junk” rating, its balance sheet is no major risk. Almost all of its total liabilities consist of long-term debt, which mature in 2028.

The company has a 64% capital ratio.

Industry Developments & Shareholder Distributions

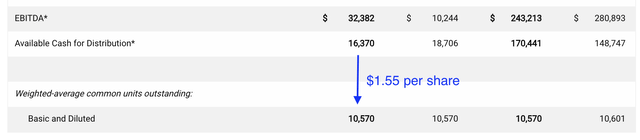

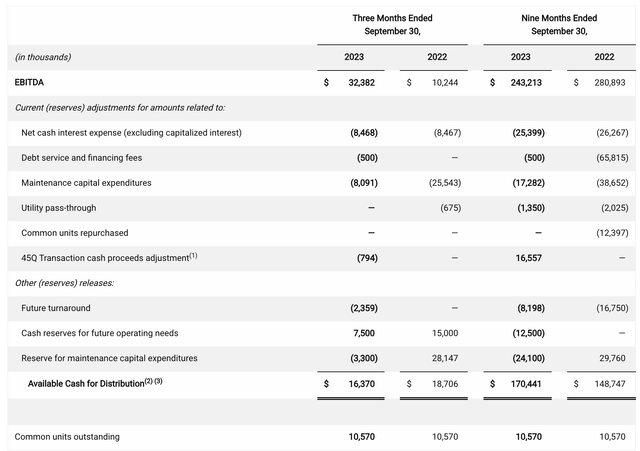

After generating an EBITDA of $32 million and addressing net cash needs of $16 million for interest costs, maintenance CapEx, and other reserves, there was $16 million of cash available for distribution.

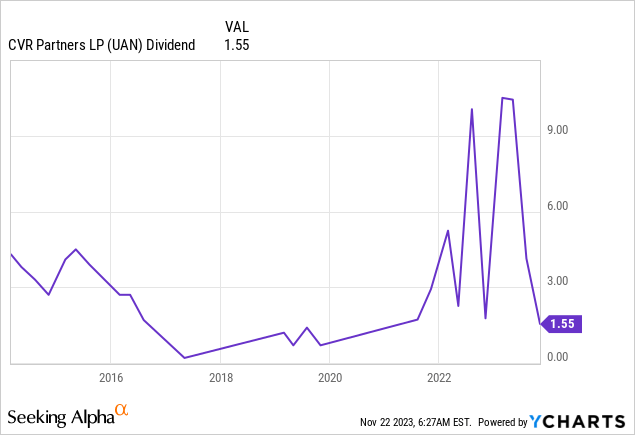

During the third quarter, the Board declared a distribution of $1.55 per common unit.

Looking at the numbers below, UAN distributed every penny to shareholders in the third quarter.

CVR Partners

Adding to that, within the total cash needs, there was a release of $8 million from the reserve taken in the second quarter of 2023 for expected working capital needs (visible in the table below).

An additional $6 million of reserves for future turnarounds and planned capital projects were included. The remainder of the working capital reserve taken in 2Q23 might be released in the future at the discretion of the Board.

CVR Partners

Having said that, a $1.55 per share per quarter dividend translates to an annualized yield of 8.5%! That’s not bad.

However, we need to consider that the third quarter is often the worst quarter for dividends.

In August, the company declared a $4.14 dividend, which is an annualized yield of 23%.

Although a lot depends on capital requirements and fertilizer prices, we’re at a point where a mid-cycle dividend could be in the high-10% to low-20% range.

Again, deeper recessions with subdued fertilizer prices could cause that number to be lower.

However, when it comes to buying income in good (or even average) times, I don’t think there’s a company that can beat the potential yield of UAN!

Speaking of fertilizer prices, in its third-quarter earnings call, the company noted that overall grain market conditions are steady, with positive implications for nitrogen fertilizer demand in 2024.

USDA estimates reveal an increase in corn acres planted and a decrease in soybean acres due to drought conditions. Grain prices, coupled with lower fertilizer prices, support attractive farmer economics, contributing to the positive outlook for nitrogen fertilizer demand.

Furthermore, production challenges since July, including unplanned outages, plant turnarounds, and natural gas availability issues, have tightened supply-demand balances.

This, coupled with steady customer demand to replenish inventories, has led to a significant firming of prices in the market.

Adding to that, geopolitical risks, especially in the Middle East and North Africa, remain a wildcard for the nitrogen fertilizer industry.

Natural gas prices in Europe and the U.S. differ significantly, impacting the global nitrogen production cost curve.

As Europe’s natural gas market issues are expected to persist over the next two to three years, we can assume that North American producers continue to enjoy significant pricing (and demand) benefits!

Moreover, with regard to its valuation, I have a hard time giving the stock a fair value for a number of reasons.

- We have no analyst estimates to use as a benchmark. That’s not the main reason, but I always like to have comparisons.

- I cannot estimate what fertilizer prices will look like in 4Q23, FY2024, or even beyond.

Having said that, I believe that fertilizer prices have plateaued, which means we can expect a longer-term dividend in the 10% to 25% range (depending on price fluctuations).

Also, after the long-term stock downtrend, I like the risk/reward.

However, please be aware of the company’s cyclical behavior. Do not ignore the risks that come with this potentially very juicy yield.

Treat UAN as a wild card. Do not make it a cornerstone of your income portfolio!

Nonetheless, in its space, I believe there’s no better place to get high income than by buying UAN.

Takeaway

In the realm of agriculture fertilizer investments, CVR Partners stands out for its compelling distribution yield.

With strategic assets in Kansas and Illinois, UAN benefits from a robust distribution network and access to competitive feedstock prices, enhancing its competitiveness.

Despite recent earnings challenges, the company maintains strong liquidity, allowing it to declare a noteworthy $1.55 per share distribution in Q3.

While UAN presents an enticing yield potential, cautious investors should approach it as a high-risk, high-reward wild card rather than a cornerstone of their income portfolio.

Read the full article here