Heading into the holiday season, the American consumer will benefit from a lower inflationary backdrop, including lower prices at the pump. Recent surveys also indicate spending levels on holiday gifts are largely expected to be the same or higher than last year.

Leading in, many retailers have released quarterly reports with mixed results. Those with bigger ticket items or more discretionary offerings have struck a more cautious tone, while those offering a greater value proposition to their customers have been more positive in their remarks.

With Black Friday just days away, I am bullish on both Lululemon (NASDAQ:LULU) and Best Buy (NYSE:BBY). BBY was one that reported mixed results, while LULU is set to report in early December. I see both companies as well-positioned to benefit this holiday season despite the recent shortcoming in BBY’s quarterly results and LULU’s rich valuation. Here’s what else investors should know about the retail sector in advance of the holidays, as well as why both LULU and BBY are attractive buys leading up to it.

How Healthy Is The U.S. Retail Sector?

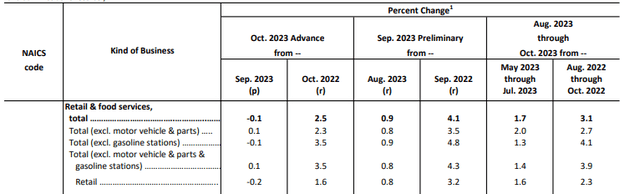

Following a blowout September for retail sales, spending moderated in October. In fact, U.S. retail sales fell 0.1% during the month, according to monthly data released by the Commerce Department. The decline was the first negative showing since this past March.

Commerce Department Monthly Retail Report – Partial Summary Of Monthly Retail Sales Growth

One factor driving the declines was less spending at auto dealerships. This was perhaps due to the higher rate environment, a key deterrent to many from initiating big-ticket purchases. Americans also spent less at gas stations, likely due to falling prices at the pump.

When excluding these categories, sales were up 0.1%, below the 0.6% monthly average over the last six months.

Recently released results from retailers such as Target (TGT) and Home Depot (HD) complemented the retail sales report by showing that consumers are continuing to pull back on discretionary purchases. TGT, for example, noted that comparable sales fell 4.9% during the period, citing the higher rate environment and the return of student loan payments as two headwinds holding consumers back.

Other retailers, however, reported more positive figures. Walmart (WMT) and The TJX Companies (TJX) both reported comparable sales growth and paired their results with generally positive commentary. Additionally, DICK’S Sporting Goods (DKS) also benefitted from a stronger-than-expected back-to-school season.

The mixed picture on retail is mainly related to value proposition. In the case of TGT and HD, their products are more discretionary and towards the middle to upper end of the pricing spectrum. WMT and TJX, on the other hand, benefit from more value-oriented offerings, as well as through a greater mix of necessity items. Consumers, therefore, still have an appetite to spend but they are choosier than years past.

What Is The Outlook For U.S. Retail This Holiday Season?

Heading into the holiday season, consumers are more cautious. Nevertheless, inflationary pressures have been on the mend and the employment picture remains healthy, with household finances largely intact. Together, this could support retail sales in the final quarter of the year.

Recently, the National Retail Federation announced that holiday spending will increase between 3% and 4% from last year. The rise would increase sales to a record level of about +$960B. According to the survey, the growth rate would be consistent with the average increase seen from the years 2010 to 2019.

The increase is expected to be supported by growth in online and other non-store sales, which are seen increasing between 7% and 9%. This should bode well for retailers with an established online presence or robust direct-to-consumer model.

A recent report from Goldman Sachs (GS) also noted that holiday sales could come in better than expected due to a more favorable inflationary backdrop. The report further found that over 60% of consumers plan to spend the same or more on gifts this year, up from 53% from last year’s survey.

Two Possible Stock Winners Of Black Friday 2023

Potential Winner# 1: Lululemon Athletica

Shares in LULU have been on a tear over the past year. The stock is up over 20% in the last year and over 30% YTD. The performance handily outperforms other discretionary retailers, including Nike (NKE), Under Armour (UA), and Ralph Lauren (RL), who are all either sporting losses or sitting on gains a fraction of that realized by LULU.

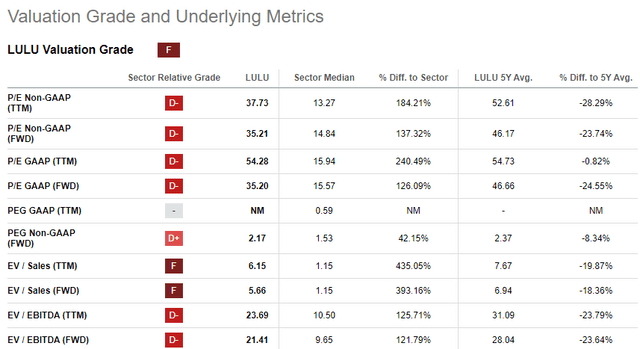

The outperformance has earned LULU a rich trading multiple, at about 35x. This compares to 28x for NKE and less than 10x or less for both UA and RL. The premium valuation metrics have ultimately negatively impacted the stock’s quant rating, which currently assess LULU as a “hold.”

Seeking Alpha – Quant Valuation Ratings Summary For LULU Stock

While the furious rally thus far and the higher trading multiple do subject the stock to a pullback in advance of the earnings release set for Friday, December 1, I view the company as well-positioned to grab additional market share this holiday season.

After disappointing investors at the beginning the year with weak guidance for the 2022 holiday season, LULU’s sales have surged across a diverse customer base that includes both the younger and older generations.

With the younger crowd, LULU has seen its market share grow at the expense of others such as Adidas and Under Armour, two brands that were once coveted by teenagers but are now increasingly overshadowed by LULU, a premium maker that exudes a certain type of status and luxury to younger customers who are eager to show off their “Lululemon Haul” on platforms such as TikTok.

The student loan restart may create a headwind for the younger cohort, but this may not be enough to hold them back from capitalizing on several attractive deals being offered this holiday season. This includes up to 50% off an assortment of product offerings, as well as a healthy selection of “under $50” items in LULU’s “We Made Too Much” program.

While investors may express concern regarding the threat of a more promotional environment, it’s worth noting that LULU was recently observed to be still largely selling at full prices, according to analyst commentary at Truist.

And for those on the other end of the spectrum, who worry about the higher priced items in a pressured macroeconomic environment, it’s important to note that LULU has one of the most resilient brand loyalty followings among all activewear companies. This is another competitive advantage that should benefit LULU this holiday season.

In their most recently completed quarter, LULU beat on both the top and bottom lines, reporting comparable sales growth of 11%. The growth was notable considering the declines seen by their competitors over the same period. Following the strong showing, LULU guided Q3 sales growth of between 17% and 18% and an earnings midpoint modestly ahead of consensus estimates of $2.24/share.

LULU has a strong track record of turning in above-guidance results, and I am expecting this to continue when the company reports on December 1. At that time, I also am expecting positive commentary regarding the holiday sales trend. In my view, this could instill further momentum in the stock, supporting a possible run to the $450/share mark.

Potential Winner #2: Best Buy

At first, BBY may not inspire the highest degree of confidence for investors seeking to scoop up a possible winner from the holiday season. Yesterday, BBY reported a mixed Q3, where consumer demand was said to be more uneven and difficult to predict. And as a result, the company lowered their annual revenue outlook.

Shares slipped following the news but ended the day flat. Still, the stock is down nearly 16% YTD. The broader S&P (SPY), on the other hand, is up about 18% in the same period. More pertinently, the SPDR S&P Retail ETF (XRT) is also up about 6% YTD.

Seeking Alpha – YTD Returns Of BBY

The weakness ahead of the holiday season presents investors an attractive opportunity to pick up shares at a discount. The stock currently commands a forward multiple of less than 11x, well below the 20x multiple held by the broader S&P.

Valuations are also below the five-year average of 13x. While the consensus rating on BBY is a “hold”, Wall Street’s average price target on the stock is just shy of $80/share or about 18% above current trading levels.

BBY reported declining comparable sales growth in Q3 and lowered its expectations for the holiday quarter. While this could be viewed negatively by investors, it does create a low bar for the company to clear. Looking ahead sales figures may get a boost from an eventual upcycle in the environment for tech-related upgrades and replacements. BBY also noted growth in gaming during the period, growth that I expect to continue in the months ahead.

Margins also appear to be stabilizing. In Q3, domestic gross profit improved 100 basis points to 22.9% on increased uptake in their membership offerings, as well as efficiencies realized within the supply chain. The improvements in margins heading into the holiday season should provide an adequate buffer against any heightened level of promotional activity.

Investors in BBY could also lock in a relatively attractive dividend, which is presently yielding about 5.4%. While this may not appeal to those seeking a high-yielding payout, the dividend is growing at a 3-YR compound rate of nearly 20%. On cost, investors could be sitting on a much higher yield in the years ahead if the dividend continues growing at its current rate.

This year, BBY is expecting shopping patterns to resemble historical holiday periods, with activity concentrated on Black Friday and Cyber Monday in the near-term. In advance of these events, BBY is noting strong product availability, with additional flexibility in the way of free next day delivery on a large lineup of items. Innovative product offerings incorporating AI-powered devices may also prove to be a hit for more forward-looking customers.

In my view, the bar is set relatively low following a mediocre Q3. This should set the company up for a surprise in the final quarter of the year. And this could support a rebound in the share price to the middle of its 52-week range, which would indicate a price of about $75/share or approximately 10% above current trading levels.

Are Retail Stocks A Buy This Holiday Season?

While I continue to believe retailers with more value-oriented product offerings are best suited to capture consumer spending dollars this holiday season, I view both Lululemon and Best Buy as two companies that could reap the benefits this Black Friday, with the momentum then carrying forward into the final month of the calendar year.

LULU doesn’t scream of value either in its trading value or its product offerings. However, the athletic-apparel maker benefits from strong brand loyalty across a cross-generational demographic. A healthy lineup of Black Friday deals, including a wide selection of offerings less than $50, could attract newer customers looking to join in on the trend. It could also appeal to the younger cohort looking to stretch their dollars following the restart in the student loan repayments. With earnings set for release at the start of December, I can see the company surpassing expectations on continued sales momentum.

BBY presents a better value proposition to investors, and they may have the most to gain in the months ahead. Recent results were mixed and may not have done enough to inspire confidence. The tempered guidance the management team put forward, however, sets the bar fairly low. The company is also entering a more favorable comparable environment. An expected upcycle in tech-oriented replacement/upgrades could also drive customer traffic. In my view, I see BBY benefitting from a more innovative-based product offering, as well as a better-than-expected selling environment in the final quarter of the year.

Falling inflation, particularly in gasoline and holiday meals, as well as relatively tempered expectations for the season set the sector up for a surprise to the upside. In my view, retail stocks are a buy, with a special emphasis on both LULU and BBY as potential winners this Black Friday.

Read the full article here