Zscaler (NASDAQ:ZS) reports Q1 FY2024 earnings on 27th November. While results are likely to be robust, demonstrating continued growth and improved profitability, much of this already appears to be baked into the share price. Management commentary and forward guidance are likely to be more important than Q1 results, and there are reasons to be cautious about these. The SASE market continues to be an area of strength within cybersecurity, but the macro environment remains challenging. Absent an acceleration in growth, Zscaler’s stock may have limited upside from current levels.

Market

Zscaler has suggested that the macro environment continues to be challenging, with customers scrutinizing larger deals. This is somewhat offset by the fact that cybersecurity remains a high priority for IT executives. Zscaler recently stated that conditions were easing somewhat, though. Zscaler is also trying to minimize the impact of macro headwinds by engaging with customers earlier on and building a clear case around ROI. As a result, Zscaler entered Q1 FY2024 with a record pipeline.

Figure 1: Zscaler Business Environment Commentary (Zscaler)

A number of Zscaler’s peers have already reported earnings, and results were generally solid. Fortinet (FTNT) continues to struggle, which is largely a function of its revenue mix and customer base (greater exposure to hardware and SMBs). Fortinet has stated that deal scrutiny continues to increase and as a result sales cycles are lengthening. In response to soft demand in its core markets, Fortinet is shifting focus towards SASE, where demand remains more robust. SASE only currently accounts for around 20% of Fortinet’s business, though. It is difficult to infer much about Zscaler from Fortinet though as nearly 50% of Fortinet’s SASE customers are SMBs, polar opposite to Zscaler’s focus on large enterprise customers.

Cloudflare (NET) has attributed recent soft growth to sales issues, which are likely related to its SASE business. The company is working through these problems though and now appears to be more constructive about its forward prospects. Interestingly, Cloudflare essentially didn’t discuss its security business on the third quarter earnings call, choosing instead to highlight AI, despite the fact that this is not yet a growth driver. Cloudflare did state that it is seeing strength around its network security and Zero Trust products, though.

Palo Alto Networks (PANW) has suggested that the macro environment continues to cause difficulties, but its business is adapting. The rising cost of capital in particular is creating some headwinds, with customers reluctant to commit a large amount of cash up front. Palo Alto appears to be leaning on incentives to continue driving growth, like financing and incident response support for strategic customers. While Palo Alto’s total revenue growth is only moderate, its SASE ARR increased 60% YoY in Q1 FY2024.

Zscaler

Zscaler believes that, in general, cybersecurity is evolving towards platforms which subsume adjacent categories. Palo Alto Networks, Cloudflare and Fortinet have all also suggested that the cybersecurity market is consolidating and that customers prefer platforms with tightly integrated products. This can be seen in the rapid growth of Zscaler’s emerging products and should ultimately be supportive of margins and barriers to entry for the cybersecurity market.

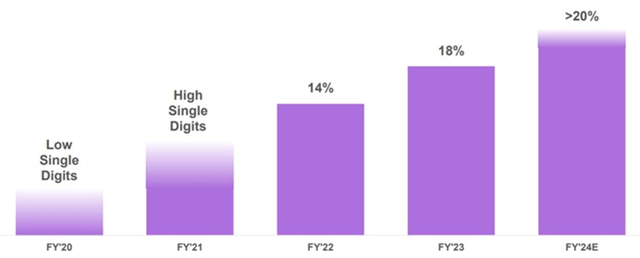

Figure 2: Emerging Products – % of New Business (Zscaler)

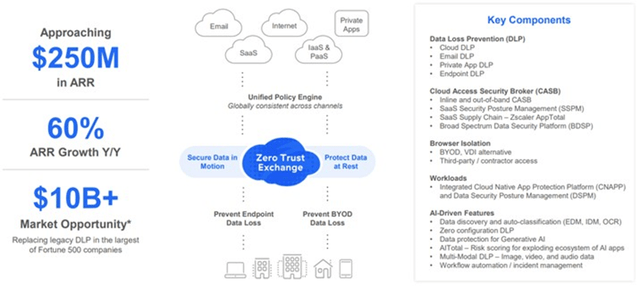

In particular, data protection is emerging as a growth driver for Zscaler. Data protection is a 10 billion-plus opportunity, and Zscaler is now replacing incumbent legacy DLP in the largest of enterprises. Zscaler has suggested that Fortune 500 companies can spend 6-10 million USD annually just on the maintenance of Symantec’s legacy data protection product. Zscaler is also replacing some CASB vendors and believes that CASB is a feature rather than a standalone product.

Zscaler performs DLP on in line traffic and is expanding data protection from users to workloads and devices. The DLP business should be supported by the adoption of generative AI as data loss and data sovereignty are serious risks with this technology. Zscaler already has data protection capabilities that prevent the leakage of sensitive data through AI prompts.

Zscaler believes that CASB, CSPM, Supply Chain Security are converging. In support of this, Zscaler acquired Canonic in early 2023, providing it with integrated SaaS supply chain security capabilities. Zscaler is also slowly moving left, offering more developer-focused security solutions, but the company appears to recognize that it is difficult to suddenly become a developer-focused company.

Figure 3: Zscaler Data Protection (Zscaler)

Financial Analysis

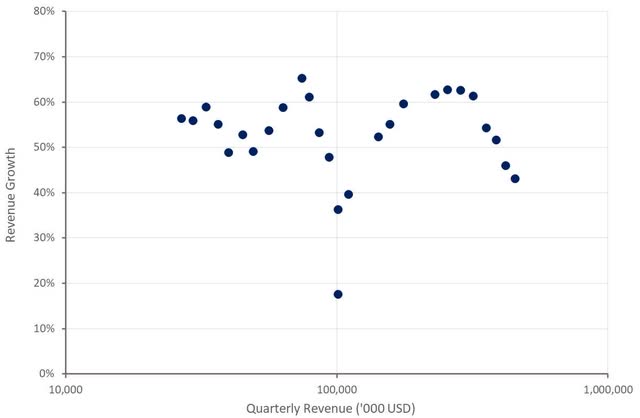

Zscaler’s revenue increased 43% YoY in Q4 FY2023 to 455 million USD, with Zscaler’s ZPA product revenue growing 57% YoY. Zscaler is guiding to roughly 33% YoY revenue growth in Q1 FY2024 and 27-28% growth for the full financial year. This guidance seems overly conservative though given recent management commentary and the results of similar companies. I am expecting growth closer to the 39-42% YoY range.

Expectation of a large earnings beat is not necessarily a reason to invest in Zscaler, though. The company has a history of outpacing estimates by a wide margin but the share price response to this is often negative. Forward guidance and management commentary will also be important, and investors need to bear in mind that Zscaler’s stock is already up over 20% in the last month or so.

Figure 4: Zscaler Revenue Growth (Created by author using data from Zscaler)

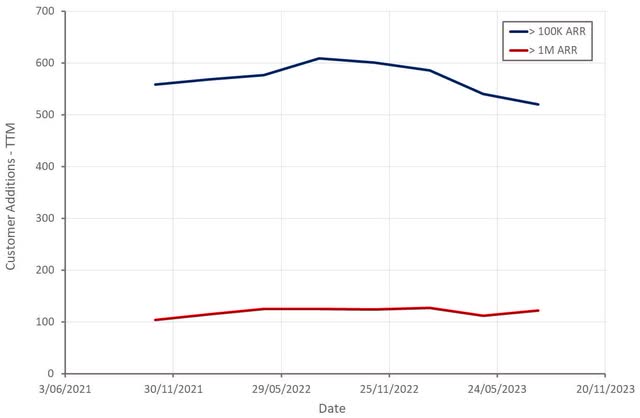

Zscaler believes it is still in the early stages of capturing a large share of its 72 billion market opportunity. For example, the company still only has around 7,700 customers but protects over 41 million users.

Growth amongst larger customers appears to be stronger at the moment. Zscaler ended Q4 FY2023 with 2,609 customers with greater than 100,000 USD ARR. The company’s 12-month trailing dollar-based net retention rate was 121%, indicating solid expansion within its existing customer base.

Figure 5: Zscaler Customer Additions (Created by author using data from Zscaler)

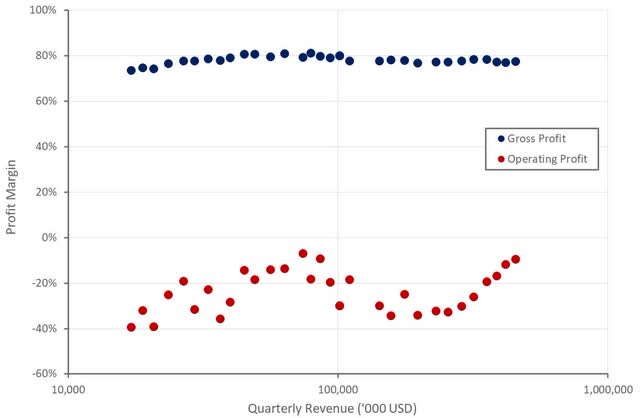

Zscaler’s gross profit margins remain fairly stable, although higher public cloud usage for emerging products is weighing on gross profit margins somewhat. Zscaler is extending the depreciable lives of its servers and network equipment from 4 to 5 years in FY2024. This is expected to create a 0.5% tailwind for the full year, but this is a cosmetic change.

While Zscaler is yet to reach breakeven, the company is already cash flow positive and generates efficient growth. Zscaler’s Net Promoter Score exceeds 80 and its gross retention rate is in the high 90s. As the company scales and growth moderates, operating profit margins should trend toward 25+ percent.

I am expecting a GAAP operating loss in the vicinity of 35-40 million USD in Q1 FY2024, although this could vary significantly depending on topline growth and the extent to which Zscaler prioritizes profits over growth.

Figure 6: Zscaler Profit Margins (Created by author using data from Zscaler)

Conclusion

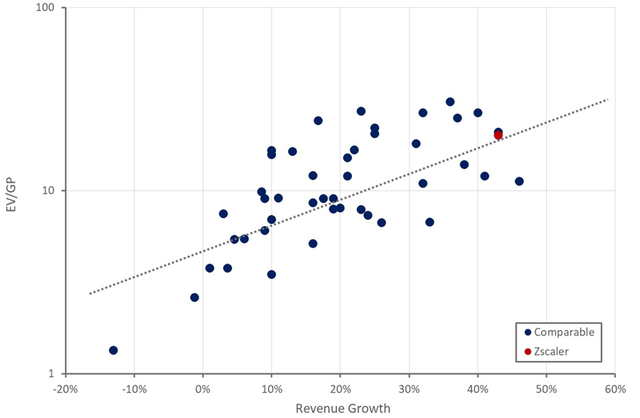

While Zscaler’s valuation is high, it is not unreasonable given the company’s growth rate, competitive positioning, and potential profitability. Given the valuations of similar companies and the high interest rate environment, it is difficult to see the stock moving much higher without growth accelerating, though.

Q1 FY2024 results should be solid, with growth remaining robust and margins continuing to improve. Management commentary and forward guidance will likely determine the share price response, though. Given the stock’s recent move higher, investors will likely want a fairly upbeat earnings call.

Figure 7: Zscaler Relative Valuation (Created by author using data from Seeking Alpha)

Read the full article here