Thesis Summary

Alibaba Group Holding (NYSE:BABA) reported its Q3 earnings last week, and the stock sold off, approaching a 52-week low.

However, Alibaba showed a promising trend in profitability while still focusing on new growth initiatives.

Furthermore, I see at least three possible catalysts that could take the stock higher: money, power and macro.

Given the technical outlook, I think this is a good spot to buy

Last Rating

In my last article on BABA, I rated the stock a strong buy, given the fact that China was beginning to ease monetary policy and support the stock market. I still think this will help the company, and I see even more promise moving forward as the macro improves, politics get better and also due to the fact that the company now pays a dividend.

I maintain my strong buy rating, given the fact that the fundamentals have improved while the price is below where it was the last time I covered the stock.

Earnings Results

Let’s begin by looking at the latest results to see how the company is doing.

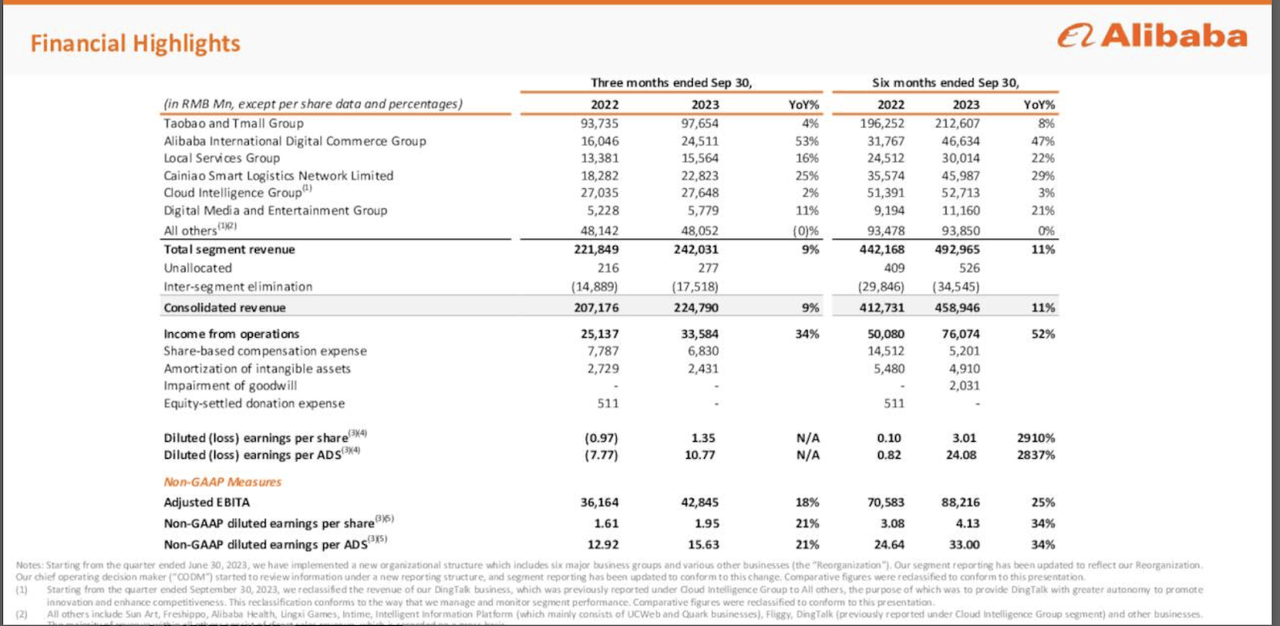

Financial Highlights (Company Presentation)

As we can see, international commerce and Cainao did very well, growing 53% YoY. However, the growth of Taobao and Cloud was lacklustre.

EBITDA grew by 18% YoY, showing a continued improvement in profitability.

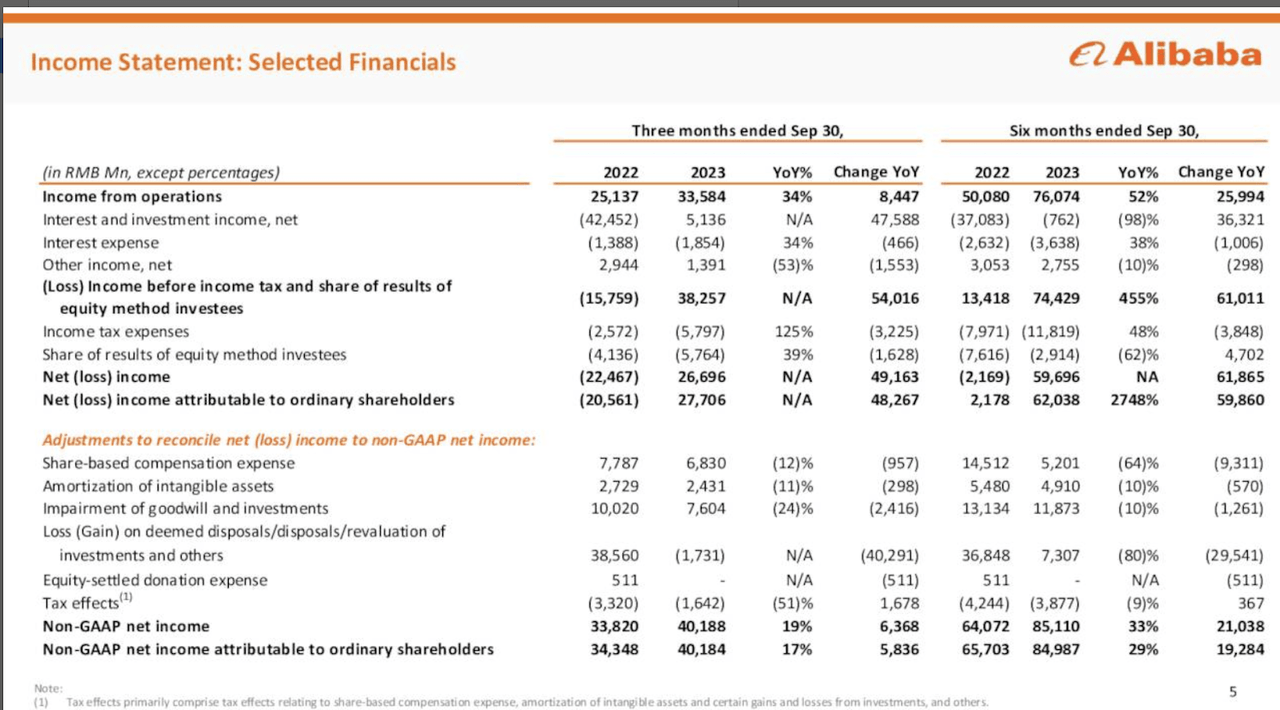

c (Company Presentation)

As we can see in this slide, Alibaba has done very well to increase its income from operations, which has translated into much higher cash flow and earnings.

Overall, and as I’ve pointed out before, Alibaba is made up of many different businesses, and each of these segments may need to pursue a different strategy.

For example, international business and Cainao continue to be the growth engines. Meanwhile, some of the other segments, like Cloud, which are lagging behind, need to improve profitability, which is something the company focused on and mentioned in the earnings call:

This quarter, we began proactively managing the quality of our cloud revenue and achieved enhanced profitability. Alibaba Cloud has advantages in terms of pricing power, high renewal rates and highly scalable cloud computing infrastructure and application service products. Going forward, we will be selective about all of our products and business models.

Source: Earnings Call

With that said, the company is also pursuing various new strategic investments, and the company mentioned four, specifically 1688, Xianyu, DingTalk, and Quark.

DingTalk, for example, is a popular productivity tool in China, and the company talked about it becoming the next standard for AI assistants.

Overall, Alibaba focuses on profitability but keeps its eyes open for new opportunities.

What Is Fair?

The thing with BABA is that it has become increasingly difficult to value. By many conventional standards, Alibaba trades well below its “fair value”, but what is exactly fair when we are talking about such a unique company?

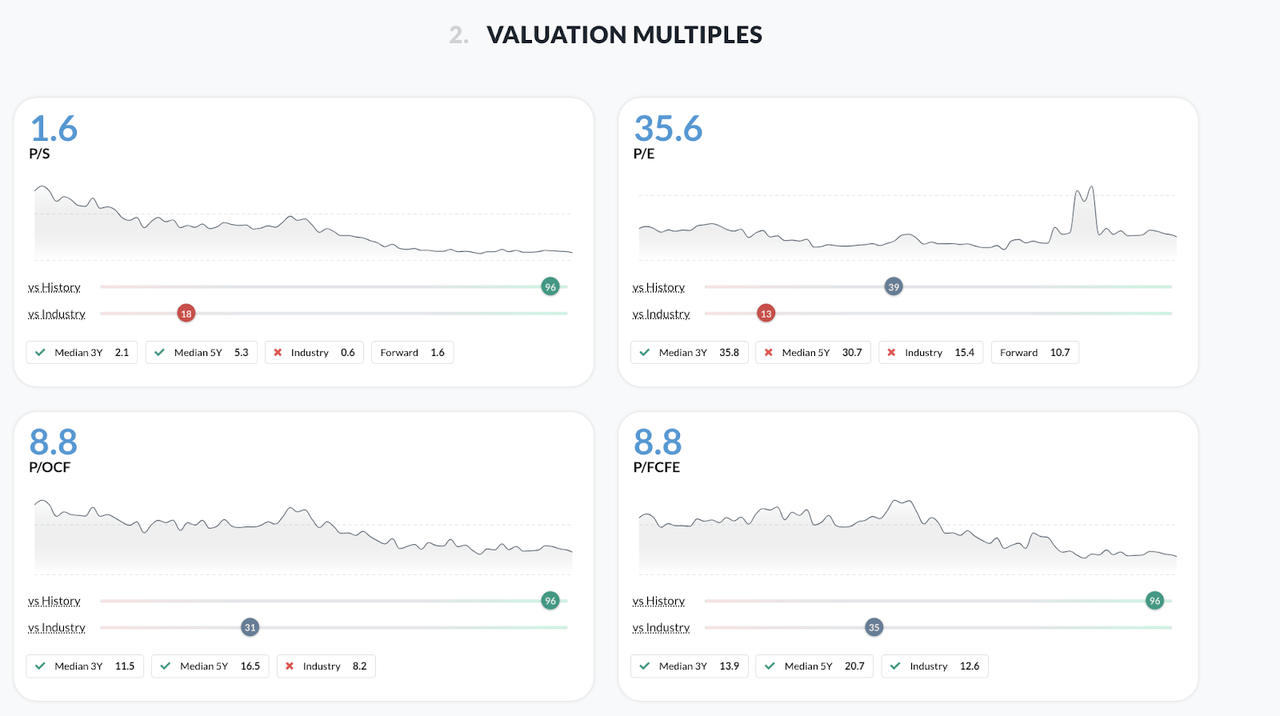

Valuation Multiples (Alphaspread)

In the charts above, we can see some of BABA’s valuation metrics and how they compare to the industry and to its own history.

As we can see, in terms of P/S and Price/Cash Flow, Alibaba is trading close to its cheapest levels in history. Based on a P/S multiple, Alibaba has been priced cheaper than 96% of the time over the past five years.

With that said, the company is not so cheap compared to historical earnings.

Now, let’s compare BABA to some of its competitors:

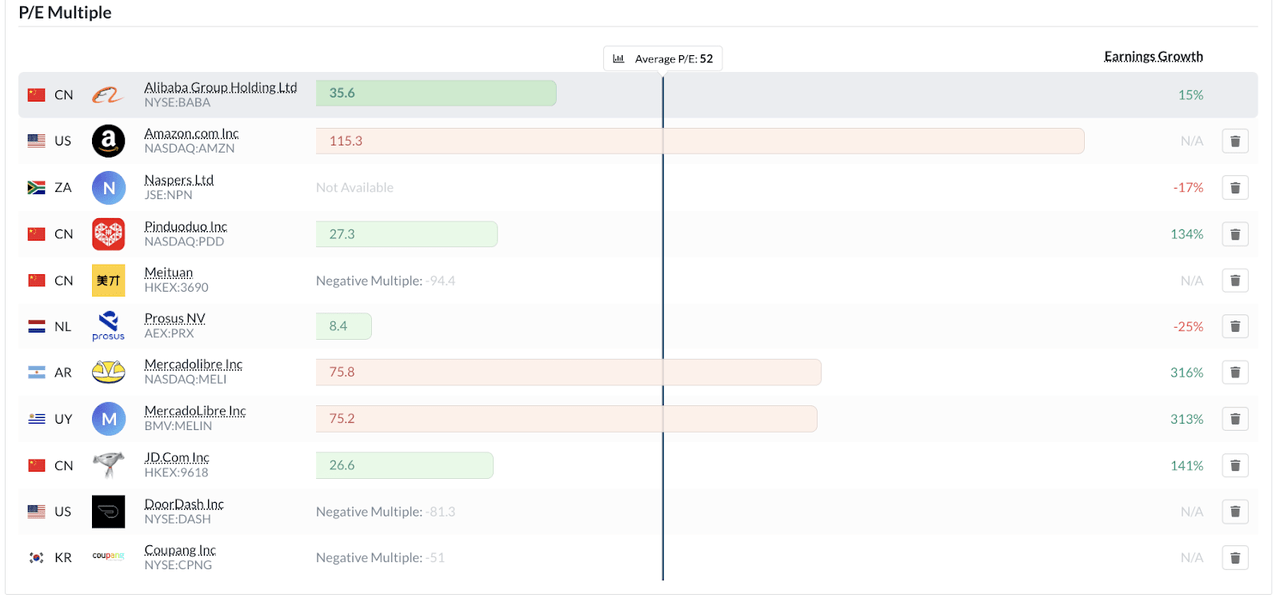

PE multiples BABA and competitors (Alphaspread)

As we can see, BABA trades below the average PE of the overall market. Other companies like Amazon (AMZN) and MercadoLibre (MELI) garner much higher premiums.

However, Alibaba trades very much in line with other similar Chinese companies, like PDD Holdings (PDD) and JD.com (JD).

Valuation is always relative. Alibaba is cheap historically, and when compared to American companies., but there are reasons for this. A few years ago, Alibaba had more promise, and the political situation was very different.

With that said, and relating to these issues, I can see at least three compelling reasons why Alibaba’s valuation could expand from here.

Money, Power, and Macro

Money talks, that’s undeniable, and Alibaba’s recently announced dividend could go a long way in swaying investors. The company announced a $1/ADS distribution, which equates to a 1.15% forward yield.

A big problem with the company is that a lot of investors don’t trust the whole VIE structure, and of course, they are ultimately right in that foreign investors don’t actually own Alibaba. But if the company makes a habit of paying out cold hard cash to investors, it will become a lot harder to ignore the e-commerce giant trading at 7.8x free cash flow.

On the other hand, international relations with China look to be improving. The recent Bide-Xi summit was seen as a positive according to Chinese news outlets:

People’s Daily, the biggest state-run newspaper, called the four-hour bilateral meeting a “new starting point” for China-US relations.

Source: BBC

With tensions rising in the Middle East and with Russia, it looks like the China-US conflict could have been put on the back burner.

Lastly, from a macro perspective, it looks like Chinese stocks could be ready to turn:

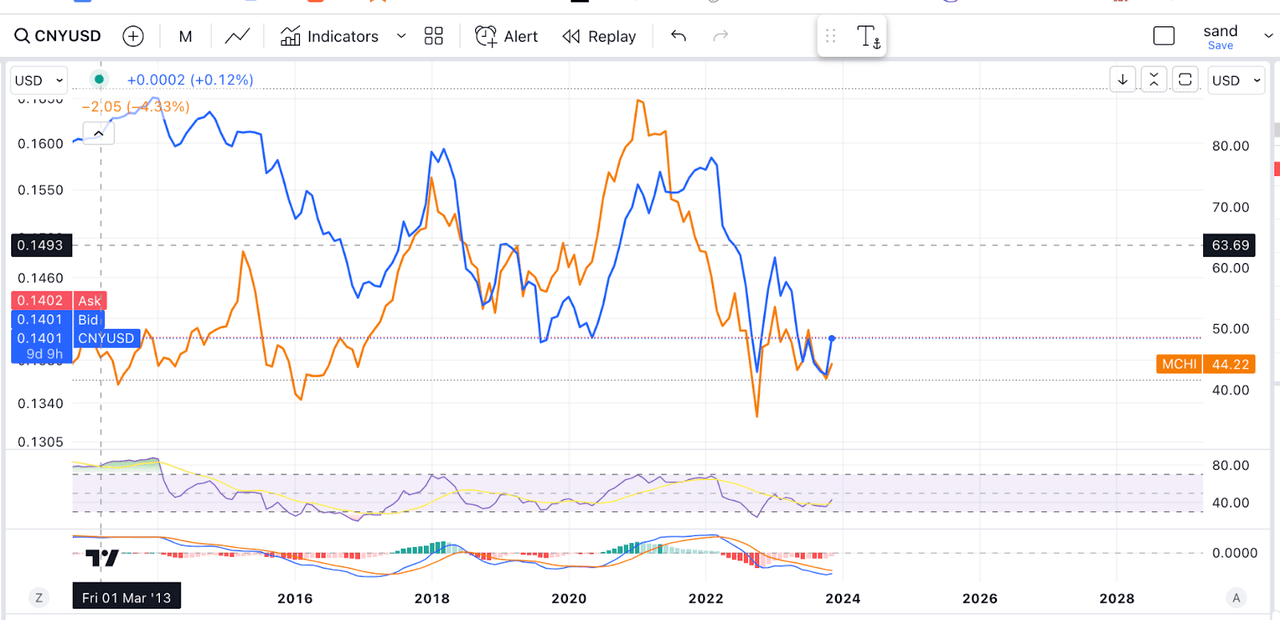

CNY and MCHI (TV)

There has been a strong correlation between the CNY and Chinese stocks, measured here by the iShares MSCI China ETF (MCHI). When the currency strengthens against the dollar, so do Chinese stocks, and I believe the CNY could have put in a meaningful bottom.

Or, as I have discussed in other macro articles, the DXY could have put in a meaningful top.

Technical Analysis

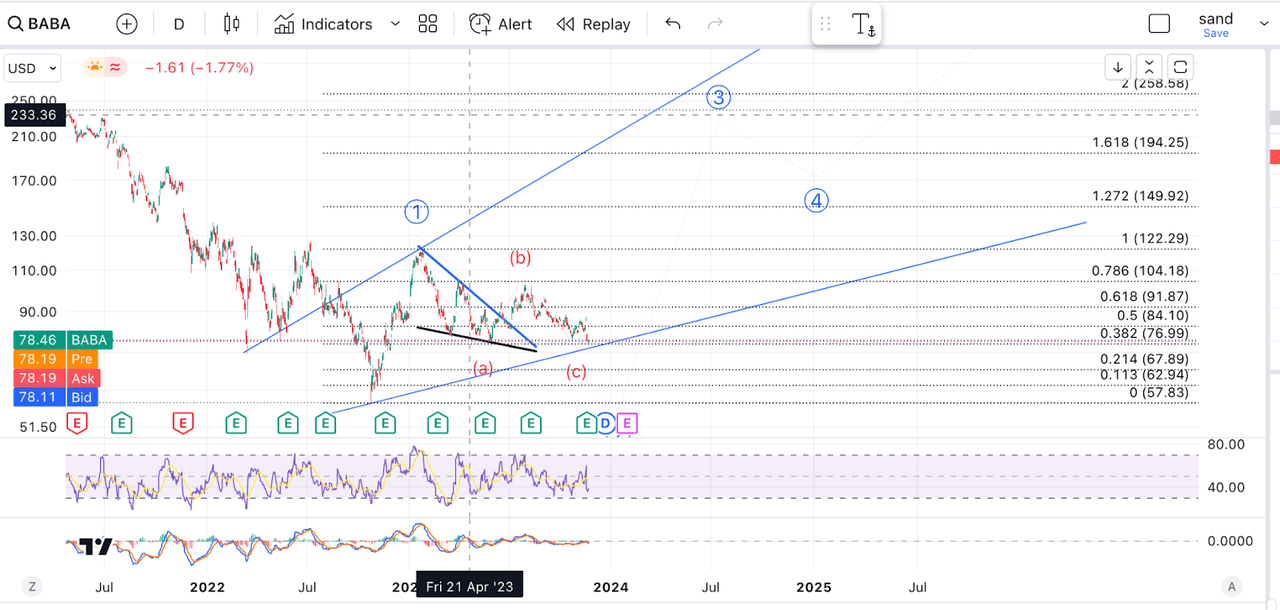

From a technical perspective, BABA has put in a double bottom, which could have completed an ABC correction in wave 2.

Alibaba Technical Analysis (Author’s work)

Though it is still very early to tell, we’d have to see a full impulse up and then a corrective retracement; this could be the beginning of a wave 3, which could take BABA back to $200.

Takeaway

Overall, there’s nothing to dislike from Alibaba’s earnings, and the situation in terms of macro and politics seems to be improving. The addition of the dividend makes for a compelling case to buy the company. I’m going to be looking to add at these lows, and at least hold until we reach the next key level of resistance above.

Read the full article here