Overview: What I Look For In Producers

Long-term I’m bullish on oil and gas so I’m looking for energy producers that meet my thesis. The issue with most management in E&P companies is that they don’t “get it”, in that they don’t understand the bullish thesis on energy and how to invest in it.

When it comes to large-cap companies they are primarily returning capital to shareholders via stock buybacks and dividends. This doesn’t offer any growth opportunities as all capital is just being returned to shareholders. Combining that with the fact that most of these companies are going at a high multiple (around 8x P/E) it offers a very low return. Most of these companies might pay a small dividend of a couple of per cent and are only growing at a few per cent per year. So the return profile is such that they will only offer an IRR in the teens. The other major issue I have with these large companies is that they are forced, due to their shareholder base, to be ESG-friendly. This means that these companies will have to make decisions that will make a lower return just so they can satisfy shareholders who want them to be environmentally friendly. This is why we see most of the large-cap oil and gas producers talking about transitioning to green energy when in reality this transition, if it ever happens, is far away and capital is already crowing the green energy space making for low returns. On the other hand, I haven’t seen a single investor presentation from a nano-cap or micro-cap oil and gas company discussing green energy because they understand that the opportunity is still in oil and gas production.

Because of the above reasons I look to buy smaller producers. Even with many smaller producers though I still see issues in their growth strategies. Most smaller producers will focus their growth strategies on repeatedly drilling wells that oftentimes have high decline rates and the returns aren’t very high. Along with this, a large risk is associated with it.

Instead, companies should focus on buying high-quality assets at a low multiple to cash flow, which the current environment allows for. This is where Journey Energy comes in.

Roll-up Strategy At Journey Energy

The CEO of Journey Energy, Alex Verge, has seen an opportunity to acquire production for a cheap multiple and be able to find synergies with the current assets they have.

For example, they could acquire leases at 2x cash flow. 0.5x cash flow would be financed in the form of a vendor takeback. With another 1x cash flow from reserve-based lending. This leaves the acquirer with only 0.5x cash flow that has to be put in as their equity. If this strategy is done correctly, it can provide a triple-digit ROE for acquiring assets. On top of this, there could be further cost-cutting synergies.

This strategy works well in this environment as the industry is highly fragmented and current multiples for buying smaller assets is only 1.5-2x cash flow at the current strip.

Another edge that Journey Energy has is its reputation. If you’re a motivated seller and you have two options: a buyer offering a high price with a low likelihood of closing or a buyer offering a fair price who will close with full certainty, you are likely to go with the buyer who will buy for a fair price but with full certainty of closing. This is because M&A transactions can be very long and there is a certain timeline to close, so being able to close is more important than the price. This is where Journey Energy’s reputation of being able to do deals quickly and with the certainty of closing comes in; over time this will give them an edge whereby they will be able to bid low for assets and still be the acquirer.

Roll-up Strategies Can Go Wrong

While a roll-up strategy sounds great in this environment, there can be drawbacks and massive risks to it too.

An example of an energy sector company that went through Chapter 11 bankruptcy while applying an M&A-based strategy is Weatherford International which was rolling-up oilfield services.

A few key mistakes during a roll-up are the following:

-Too Much Leverage

-No Secular Bull Market

-Buying Random Assets

-Using Multiple Arbitrage As The Only Strategy

-Not Knowing When To Stop

The first mistake is self-explanatory. PE funds are notorious for acquiring companies and using 5x or more of debt to EBITDA. For example, if a PE fund were to acquire a company for 6x EBITDA it would use 5x of debt and only put in 1x of its own equity. This would massively boost their IRR, but the moment the business ran into any issues they would default on the debt or break a covenant. Hence excessive leverage is to be avoided in a roll-up.

The second mistake is tied in with the first. If you break the first rule and overleverage an acquisition it is far easier to deal with that in a bull market where earnings are expanding and credit is freely available than in a bear market where it isn’t. This is why you need a secular tailwind to help grow earnings.

The third mistake of buying random assets is one that is common and was seen in Weatherford International. Management of certain companies often feel as though they must buy something to show shareholders they are growing, so they oftentimes end up buying random assets that have no operation synergies or they way overpay.

The fourth mistake of using multiple arbitrage as the only strategy ties in with the third mistake. Companies will often dilute stock at a high multiple and use the capital to acquire companies at a low multiple. The issue with this strategy is that the market eventually finds out and the stock crashes and private equity sellers will ask for a higher multiple when selling, completely removing the artificial multiple arbitrage.

The fifth mistake is the biggest one I find. Roll-up strategies work great when a market is fragmented with dirt-cheap acquisitions, but that only stays for so long. Eventually more capital will flood in causing multiples on acquisitions to go up and the market will be more consolidated. Good management teams in this situation should be able to realise that this strategy that used to work won’t work anymore in the new market environment and pivot. This is why understanding when to stop a consolidation play is key.

So far Journey Energy’s management seems to understand these issues and is avoiding them. They aren’t using excessive leverage and are instead paying down debt, and they are only buying accretive assets. Journey Energy has also gone through a bear market from 2014 to 2020 when they almost went bankrupt in which they learned many of the mistakes that I highlighted above and because of that likely won’t repeat it.

I’m also confident that the management understands when to stop acquiring new assets as I recently listened to an interview with the CEO Alex Verge where he highlighted what he saw as the lifecycle of an E&P company and how he ran his previous companies. He said that he sees three stages for Journey Energy:

1. Roll-up

This is the stage which historically has the highest returns but also the highest risk. This phase focuses on acquiring high-quality assets at a cheap valuation while operational integrating those assets. This phase happens at the beginning of the cycle when assets are dirt cheap.

2. Internal Growth

The second phase focuses on repeatable strategies. This phase takes place mid-cycle. At this point acquiring assets becomes pricy so the emphasis is instead put on internal growth. Also, mid-cycle oil and gas prices would be higher so the return on invested capital received for more production is higher. The most common repeatable strategy is to drill shallow vertical wells where extra acreage exists on a lease.

3. Return Capital To Shareholders

This phase would take place at the end of the cycle. Stock buybacks or dividends would return capital to shareholders.

Analyzing A Recent Acquisition By Journey Energy

The best way to get a view of their growth strategy would be to look at their recent acquisition.

CLOSING OF THE ENERPLUS TRANSACTION

Journey announces that it has closed the acquisition for the purchase of petroleum and natural gas assets (the “Acquisition“) is currently producing approximately 4,000 boe/d (71% oil and NGL’s) as of October 31, 2022. The assets are located in the Medicine Hat, Kaybob, Ferrier, and Ante Creek areas of Alberta. The purchase price for the acquisition was $140 million, prior to closing adjustments. The acquisition is highly accretive to both Adjusted Funds Flow and net asset value per share while still allowing the Company to maintain a conservative corporate leverage ratio.

The above is a release on their website. We can do some rough back of the napkin math to get a view of what cashflow multiple they acquired this company at. 4000 boe/d*365.25*70 (the flat price of oil in USD) = 102,270,000 USD. After taking out royalties and other costs of revenue we are left with a netback of around 70mm USD which in CAD would be 94mm. 94mm CAD in netback with currently lower prices is very good for a 140mm CAD purchase price.

I would point out here that this deal was initially negotiated in early 2022 when oil and gas prices were far higher, so if prices were still as high as they use to be then this deal would have a significantly higher cash flow. Also, boe/d links NGLs and natural gas to a dollar equivalent amount of oil, but since NGL and natural gas prices have gone down significantly the boe/d would be lower.

Another major positive I see with this acquisition is that it has a low decline rate. Both their 2021 and 2022 decline were only 14%, while it is estimated that their 2023 decline rate will be 12%.

I believe that this acquisition of Enerplus will be an excellent blueprint for future acquisitions.

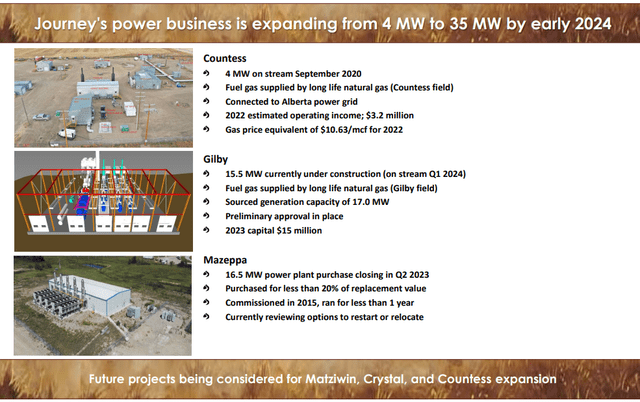

Journey’s Power Business

Journey Energy

Journey Energy has gotten into the power business. I suspect one of the reasons they did this is because they can vertically integrate this with their upstream business, and unlike the upstream business, this is a non-cyclical business. They are also acquiring these assets below replacement cost.

The only issue I see here is that there is a lack of upside, in that once a generating plant is at full capacity there is little that can be done to grow it. Also, if Journey were to one day get acquired, the buyer would likely want the power business carved out as the power generation business is very different from the upstream business.

Why I’m Holding Back From Buying Journey Energy Right Now

As the rating shows I’ve put a hold on Journey Energy. While the long-term prospect looks great and the valuation is lower than industry peers, I see significant risks in the macro environment which will in the short-term hurt them.

As I mentioned in this write up a secular bull market in oil is needed for Journey Energy to successfully implement a roll-up. Journey Energy has unhedged production so all moves in oil will impact them.

My view over the last year has been that due to higher supply from OPEC+ nations along with demand destruction, as the economy goes into what I believe is a deep recession, energy prices will go lower. I still have this view and I believe that market participants in energy equities still haven’t priced in a deep recession that comes with a larger supply, and a strong dollar.

This ties into another issue, which is the position of traders in the market. Much to their annoyance, as a trader I always tell buy and hold fundamental investors: flows over fundamentals. This means that what ultimately dictates price moves is not fundamentals but flows of capital in and out of the underlying asset. More often than not fundamentals will not be correlated with flows. A great example of this is when GameStop went up around 100-fold from low to high in a short period of time. Even though everyone in the market knew that there was no way the stock was worth as high an amount as the market was pricing it for, the shorts were in a weak position as the short interest was high and their margin requirements were going up; at the same time, call buyers could gamma squeeze the stock to the upside and market makers had to buy the stock to hedge their short call book. This caused the price to rise even though it made no fundamental sense. On top of that, still to this day implied volatility on GameStop options is extremely high compared to recently realized volatility and the stock is still multiple times higher than it used to be in early 2021.

Of course, this is an extreme example, but it shows that flows really dictate where markets will go in the short term even though they revert to fundamentals in the long run.

In the energy equities market, I believe we’re seeing something similar whereby a large amount of capital crowded into this sector in 2022. A lot of this capital is inexperienced and hyped retail and institutions that normally don’t buy energy equities and don’t believe in the long-term thesis. These buyers are what I would refer to as weak hands in that they will sell the moment they find the slightest reason to sell and they are often forced to liquidate due to redemptions from investors.

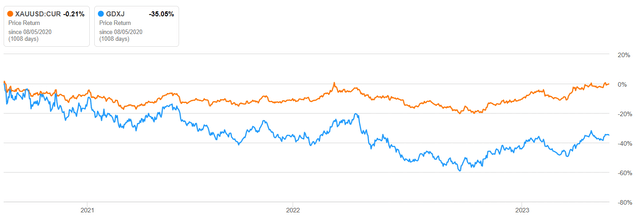

An example of when we saw something more relatable to this was in the junior gold mining space over the last three years.

Below is a comparison chart between spot gold and GDXJ since August 2020:

Total Return: Gold Spot relative to GDXJ (Seeking Alpha)

As can be seen gold has been flat since August 2020. But, GDXJ from peak to trough was down around 60%. This is because many portfolio managers were overweight junior gold stocks in 2020 as they were up while most of the market was down, so managers felt as though they had to be long a part of the market that was going up so they could outperform peers and the benchmark, but they didn’t really believe in the long-term bullish thesis. Also, the sentiment by many in the market at the time was that gold was going higher; at the time not a day would go by where I wouldn’t see a headline saying something along the lines of “gold could soon hit $3000”, now I’ll be hard pressed to find a headline even saying that gold is headed to an all-time high. Over time the bullish sentiment went away and these weak hands sold causing miners to go down 60% while gold traded sideways.

I see something similar in the energy market. I’ve seen portfolio managers who are clueless about energy equities who simply bought them because in 2021 and 2022 it was the only sector in the market that was going up while the rest of their portfolio was down, so they felt forced to buy it to keep up with their peers and their benchmark, and similar to what I said above about gold there is an overly positive sentiment about oil and gas which, I believe, has to at some point reverse. These are the same portfolio managers who will quickly sell when energy stops outperforming other sectors, hence why I call them weak hands.

Weekly chart with volume for Journey Energy on TXS:

JOY Price and Volume (TradingView)

The price and volume of Journey Energy on the Toronto Exchange are as seen above. Going along the lines of my previous comment about institutions and retail buying energy equities as it was a pain trade to not be overweight in 2021 and 2022, I believe that Journey Energy is one of those companies that both institutional investors and retail were overweight. The reason I speculate this is because prior to 2022 the volume on the TSX for Journey Energy was very low, as expected for a micro-cap. This indicates that most investors that bought into Journey Energy were buy and hold. In Q1 of 2022, there’s been a large spike in the volume, which I have circled on the bottom right of the chart. Sudden spikes in volume along with a strong trend are common, but it worries me when I see that there is continued high volume, for well over a year, but no price move since Q1 of 2022 the stock has traded sideways. Q1 of 2022 is also when oil spiked to its highest since 2008 and capital flowed into anything energy related to hedge what many saw as geopolitical risks at the time. This means that we could speculate with high certainty that when a bearish catalyst appears those who bought in over the last year are likely to sell.

To further the above point it seems retail investors own a majority of the company, which for a company this small is unusual. Using data from Market Screener 84.4% of the outstanding shares are public float. When it comes to the cap table according to Yahoo Finance 8.93% of the outstanding stock is owned by insiders and 12.83% by institutions. This leaves a majority to be owned by small retail investors. Combining a primary retail investor-owned float with high trading volume means that we could with a high likelihood presume that most of these retail investors are trading the stock rather than buying and holding it, hence they are more likely to sell after a bearish catalyst than a primarily buy and hold investor base.

To add to that, the price action over the last week has looked bearish. On the chart, I’ve put on trendlines to show a symmetrical triangle forming over the last year. It seems that now it is finally breaking. The last five days have all been down days and the recent earnings announcement has only added to the selling pressure. To add on this is the largest weekly drop since June of last year, down 15% on the week at the time of writing.

Long story short, I believe that most shareholders of Journey Energy are weak hands who during a broad market downturn and oil bear market would sell the stock, and the price action looks very bearish. Since flows matter more than fundamentals this leads me to put a hold on Journey Energy.

Key Takeaways

The key takeaways here are that Journey Energy is one of the few companies in the industry that understands the opportunity to roll up cheap synergistic assets. Also, unhedged production will allow for upside to be captured during a bull market in oil. Along with that the valuation for the company is quite low.

I’m not buying this stock right now though because the price action looks bearish. This is likely due to retail investors selling due to downside macro pressure as we head into a recession. I would definitely buy this on the other side of a recession and market crash when the price would likely be lower.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here