Following our Stevanato initiation of coverage (NYSE:STVN), we are back to comment on the company today. Here at the Lab, we positively view Stevanato for the following reasons: 1) free float expansion to support liquidity, 2) Secular Tailwinds In Biologics Support Downstream Demand, 3) economic moat, and 4) margin expansion supported by a well-diversified CAPEX plan.

Q3 analysis

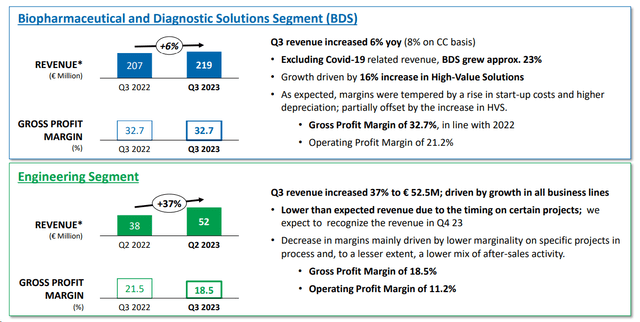

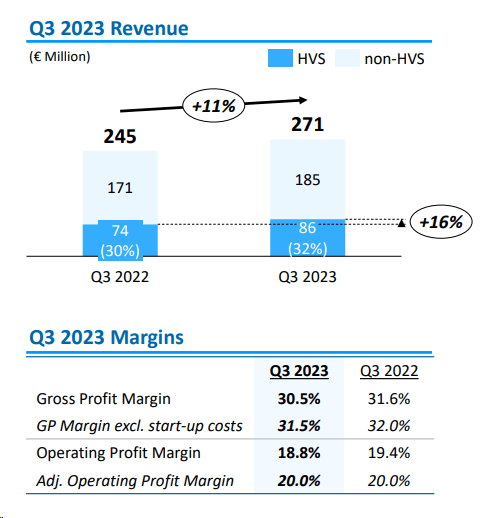

Q3 was not the expected quarter. The company reached €271 million in sales, missing consensus expectations by 2%. Compared to Q3 2022 results, Stevanato grew by 11% (13% on a constant currency basis). Looking at the divisional level (Fig 1), the Biopharmaceutical and Diagnostic Solutions (BDS) segment reached €219 million, with a plus 8% organic revenue growth. In comparison, the Engineering segment reached €53 million, with a plus 37% organic revenue growth. This might seem a good result; that said, the CEO emphasized that the Engineering segment came below expectations because some projects were pushed into Q4. This was due to supply chain delays. Here at the Lab, we believe this information would have been helpful if this downside had been flagged during the Investor Day in late September. Going down to the P&L analysis, Stevanato’s gross margin was 30.5% and came below Wall Street estimates at 31.7%. In our first publication, we analyzed how we expected higher start-up costs due to the company’s new manufacturing facilities. Despite that, the Engineering segment reached a gross profit margin of 18.5% vs. a 21.5% margin recorded in Q3 2022. The adjusted EBITDA totaled €75 million with a margin of 27.5%, and the EPS was at €0.15 (Fig 2).

Stevanato Group Q3 divisional results

Fig 1

Stevanato Group Q3 Financials in a Snap

Fig 2

Why are we positive?

-

Even if Stevanato missed its Q3 revenue, the company achieved solid results. The miss was due to delays in the Engineering segment; still, the division performed a 37% yearly growth. Looking at the press release, the company will “recognize revenue from these projects in the fourth quarter of 2023“. In addition, according to the CEO, tailwinds are emerging, and growth in biologics is driving demand for assembly lines and visual inspection;

-

In detail, COVID-19 sales decreased by approximately 84% vs. last year, representing 2% of the total company’s sales. This suggests that organic sales ex-COVID-19 at constant currency increased by high-double-digit (25%). Here at the Lab, we believe that many sell-side analysts are looking at the broader sales generation. Considering the pick-up in sales in the Engineering segment coupled with BDS growth, the company is set for a bright future. In addition, aside from our supportive macro trend on biologics growth and aging populations, there is another upside that we should consider: the shift toward medicine self-administration. According to research, the global self-administered medication is forecasted to surpass $200.5 billion by 2032 with a CAGR of 8.6%. The chronic diseases support the self-administered medication growth trends increase, and Stevanato will likely take advantage of this macro trend;

-

Post Q3, we believe the company is fine with client inventory management. The total backlog reached €924 million and was aligned with our expectations;

- Looking at the ongoing CAPEX plan, the Latina facility expansion is close to generating its first commercial sales. Audits were successfully completed. The Fishers Indiana project will produce and start sales in mid-2024 (as planned). The company still plans capital expenditures in the range between 35% and 40% of revenue, with acceleration in Western countries and deceleration in China;

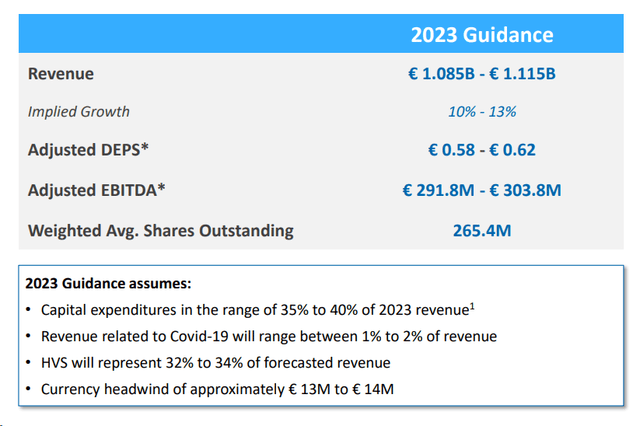

- The company reiterated 2023 revenue, earnings per share development, and adjusted EBITDA guidance. Stevanato sales are expected between €1.085 and €1.115 billion. As a reminder, this is well above the company’s internal estimates set at the IPO time (€955 million). Stevanato EPS is in line with consensus as well as the EBITDA range. Looking back, the company set a 2023 EBITDA of €251 million at the IPO time.

Changes in Estimates and Valuation

Post Q3 results, we are updating our revenue sales forecast. 2023/2024/2025 sales are estimated at €1.08/€1.21/€1.33 billion with an adjusted EPS of €0.61/€0.68/€0.73. With an unchanged CAPEX plan, we still forecast an EBITDA of €345 million in 2024. Despite that, we are now lowering our EV/EBITDA multiple from 25x to 24x. This is due to a lower valuation of CDMO players, which fell to low-to-mid teens in 2024. Looking at Stevanato’s peers, West Pharmaceutical Services (WST) trades at 24x EV/EBITDA. For this reason, we arrived at a valuation of $31.8 per share (from $35.5 per share), confirming a buy rating for the company. Additional risks to our target price include further pressure on BDS growth and lower order backlog.

Stevanato Group FY 2023 guidance

Read the full article here