Unlike most commercial banks, for Wintrust Financial (NASDAQ:WTFC) this 2023 was not that bad. The YTD return is +2%, significantly better than the -23% achieved by the SPDR S&P Regional Banking ETF (KRE).

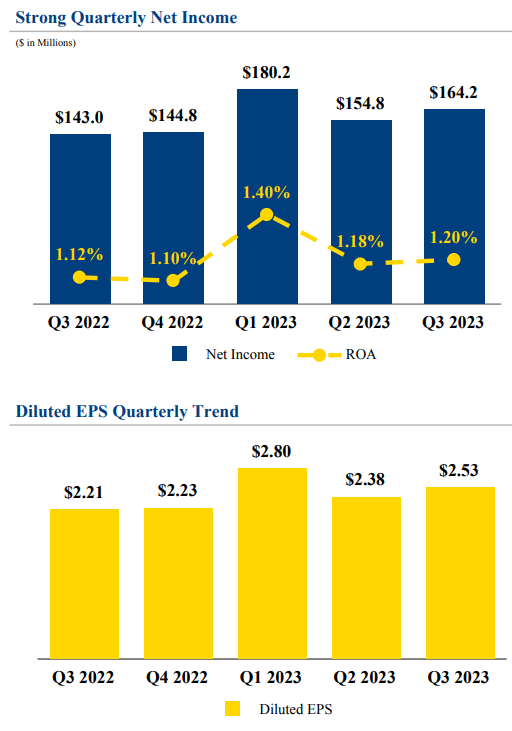

The reason for its positive performance lies in the fact that net income remained high and even improved compared to Q3 2022. In addition, the bank continues to be well capitalized and the fee business is stable despite the difficult macroeconomic environment.

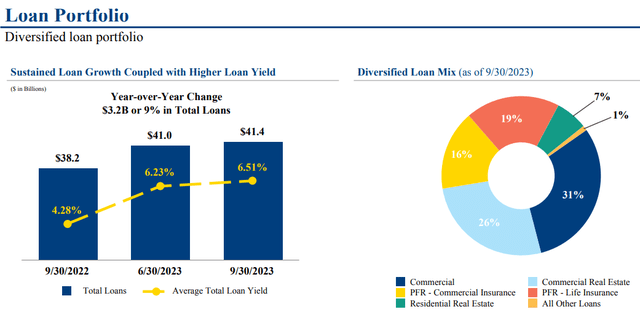

Loan portfolio and securities portfolio

Wintrust Financial Corporation Q3 2023

The loan portfolio increased by 9% year-on-year and reached $41.40 billion. As the Fed Funds Rate increased, the average total loan yield also increased, from 4.28% in Q3 2022 to the current 6.51%: +223 basis points. Commercial and CRE remain the two largest segments, 31% and 26% of total loans, respectively.

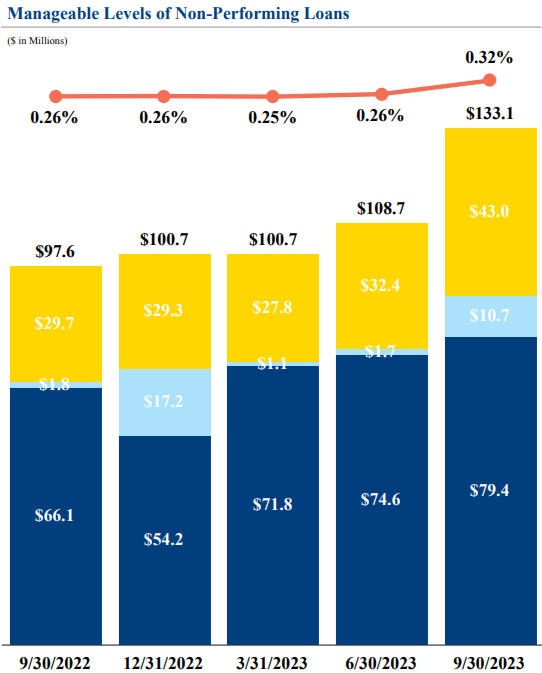

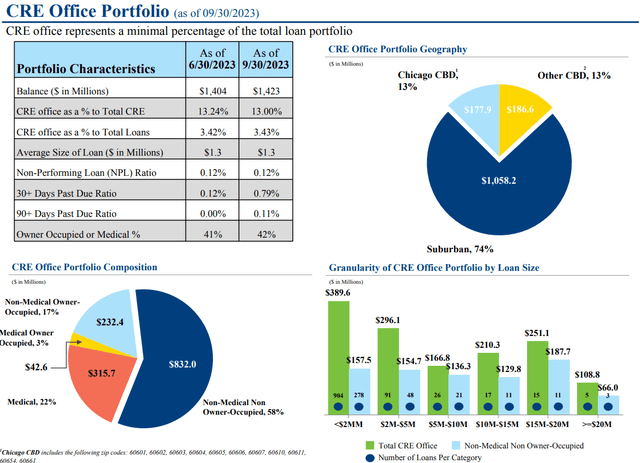

Typically, analysts fear CRE loans because their procyclicality implies greater difficulties for the bank in recessionary phases of the business cycle. Well, while WTFC’s exposure to CRE loans is high, at least for the time being there is no cause for concern.

Wintrust Financial Corporation Q3 2023

Non-performing loans account for only 0.32% of total loans, so borrowers are still managing to meet their indebtedness despite rising interest rates. There is a point to be made, however.

The effects of monetary policy are never immediate within the economy and usually manifest themselves in their full extent with 12-18 months delay. So, at the current stage we have not yet fully discounted all the Fed Funds Rate hikes, which is why I expect that non-performing loans may gradually increase in the coming quarters. Be that as it may, I am not talking about a significant increase that would substantially deteriorate the loan portfolio.

Wintrust Financial Corporation Q3 2023

Going into more detail to the much-feared CRE Office loans, we can see that the exposure is quite low: 13.00% to total CRE and 3.43% to total loans. The average size of loan is only $1.30 million and the large number of clients makes the specific risk almost irrelevant. Moreover, nonperforming loans are even lower for this portfolio: only 0.12%.

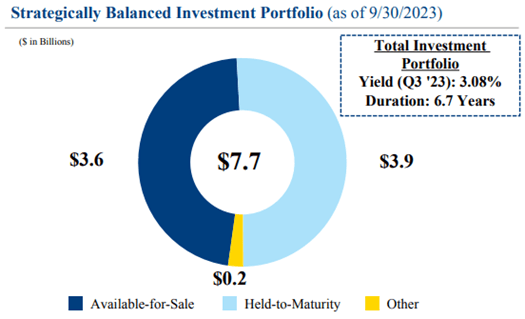

Finally, let’s briefly take a look at the securities portfolio.

Wintrust Financial Corporation Q3 2023

It currently totals $7.70 billion and is composed of $3.60 billion of AFS securities and $3.90 billion of HTM securities. The portfolio’s average yield is 3.08% and has a duration of 6.70 years. The sharp rise in the Fed Funds Rate has resulted in large unrealized losses that now amount to $642.72 million, about 12% of total common equity.

Deposits and net interest margin

Wintrust Financial Corporation Q3 2023

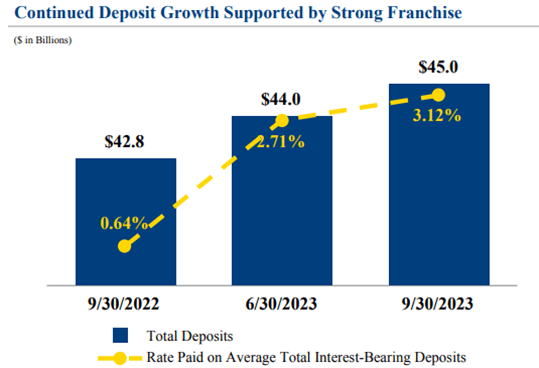

Deposits continue to increase and have reached $45 billion, which is positive. This factor denotes the bank’s ability to attract capital but it should be noted that they are not at a discount. The rate paid on average total interest-bearing-deposits reached 3.12% and will probably continue to increase over the next few quarters. Compared to the previous quarter this is an increase of 41 basis points, compared to the previous year by 248 basis points.

In any case, although all this had a negative impact on profitability, the overall result is positive.

Wintrust Financial Corporation Q3 2023

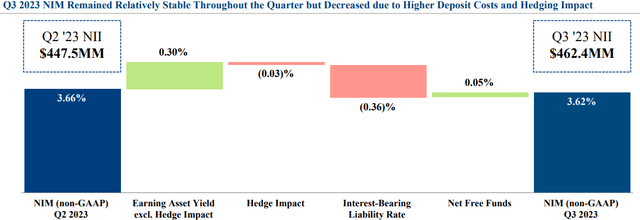

The increase in earning asset yield has almost entirely offset the increase in the cost of liabilities, so net interest income is still quite high, 3.62%. This is a slight deterioration from the previous quarter, only by 4 basis points. On a year-on-year basis, there was an improvement in EPS and earnings, however.

Wintrust Financial Corporation Q3 2023

Compared to Q3 2022, net income improved by $21.20 million while EPS improved by $0.32. Overall, even though 2023 was a difficult period for the entire banking industry, WTFC managed to keep its profitability stable, which enabled it to achieve a better YTD return than its peers.

Dividends

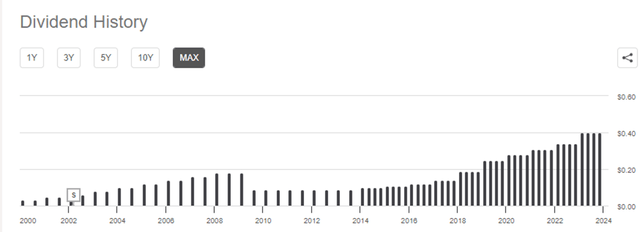

The dividend yield of this bank is quite low, 1.86%; nevertheless, I think it is very interesting.

Seeking Alpha

First of all, it has been 10 consecutive years that the dividend has been increased and 20 consecutive years that the dividend has been issued. WTFC used to issue semi-annual dividends in the past, but has been favoring quarterly dividends for years.

During the great financial crisis the dividend was cut given the difficulties at the time, but since then a long-term growth phase has begun. The latter, in particular, is far better than that of peers:

- Dividend Growth Rate 5Y (CAGR) of 16.05% versus 6.79% for peers.

- Dividend Growth Rate 10Y (CAGR) of 24.42% versus 7.89% for peers.

So, the dividend yield is low, but the dividend growth is very fast. Assuming the growth rate is the same as the last 10 years, buying WTFC at the current price, we will have a yield on-cost of 16.75% in 2033. Of course, it is likely that the growth will be lower, but I would settle for even 10%.

Finally, compared to peers, WTFC has a far lower payout ratio: 16.10% versus 35.95%. This means that its dividend is more sustainable and that it has in the low payout ratio an important driver for dividend growth in the future.

Conclusion

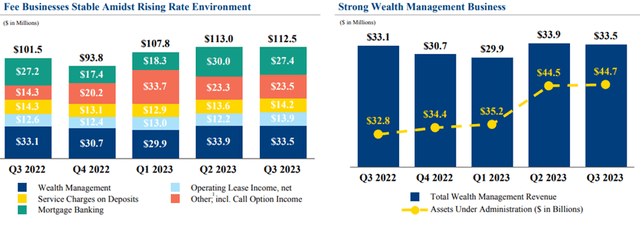

WTFC is a bank that has demonstrated its ability to operate even in a challenging macroeconomic environment, which is why its price per share is not as depressed as that of peers. Its net income has improved from last year and is slightly down from previous quarters, but this is completely normal: many peers have not yet bottomed out. Beyond net interest income, the resilience of non-interest income should also be mentioned.

Wintrust Financial Corporation Q3 2023

It generated $112.50 million in the last quarter, driven by the wealth management division that continues to increase its AUM. In short, this bank is solid from multiple perspectives.

Finally, its dividend, while low, has ample room for growth, and the yield-on-cost outlook 5-10 years from now is quite attractive. WTFC is currently trading at a price/TBV per share of 1.34x, in line with the average over the past 10 years of 1.50x. This is the only reason I do not consider it a buy: it is too expensive right now. I am ready to change my rating if that ratio reaches 1x as it did a few months ago.

Read the full article here