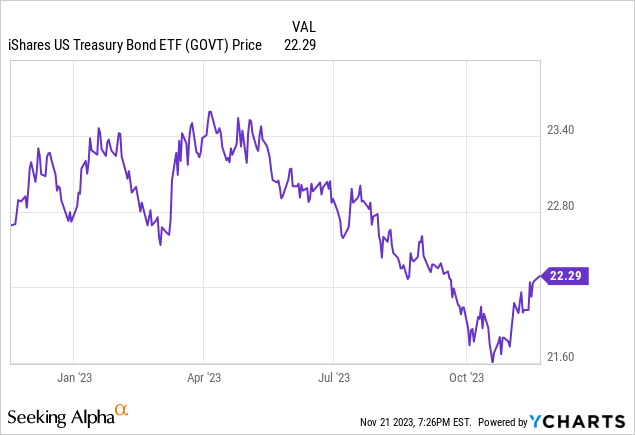

Yields have risen meaningfully since I last covered the iShares U.S. Treasury Bond ETF (BATS:GOVT), and the ETF has dipped as a result (yields move inversely to price). The Treasury backdrop has changed in recent weeks, though, as a relatively benign quarterly refunding announcement and decelerating inflation data have relieved pressure across the rate complex.

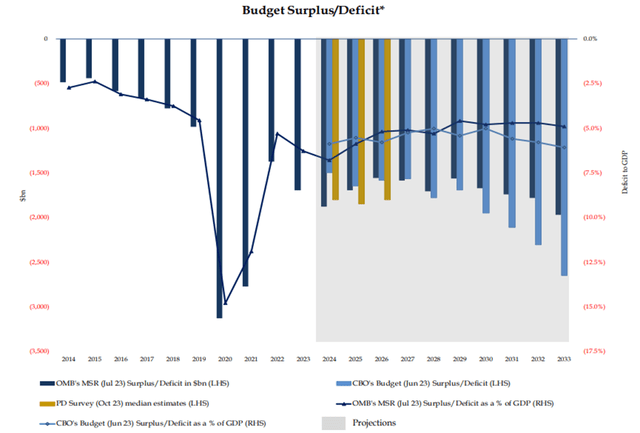

While a slower growth outlook (at least relative to this year’s base) is probably on the cards for 2024, presenting a meaningful headwind to inflation prospects, the 100bps of cuts newly priced into the curve is too far too fast, in my view. After all, we still have a widening fiscal deficit tailwind offsetting any slowdown in private sector credit creation from higher rates. Supply/demand mismatches at the long end of the Treasury curve also haven’t been resolved, though for now, the Treasury seems content with running bill issuance well above target to compensate.

Net, locking in a higher 4.8% yield offered by long-duration Treasury ETFs like GOVT might seem appealing, but the risk/reward, particularly relative to >5% yielding T-bill ETFs, isn’t particularly appealing here.

Fund Overview – Low-Cost Vehicle to Access Treasury Duration

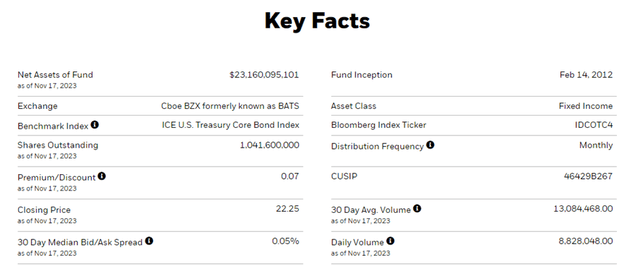

BlackRock’s (BLK) iShares US Treasury Bond ETF tracks (pre-expenses) the total return performance of a basket of dollar-denominated fixed-rate securities spanning one to thirty-year maturities based on the market value-weighted ICE US Treasury Core Bond Index. The ETF saw a slight decline in net assets to ~$23bn over the last quarter but maintains its ultra-low-cost 0.05% expense ratio.

By comparison, Treasury bond ETFs with comparable portfolio maturities like the Franklin U.S. Treasury Bond ETF (FLGV) and the Invesco Equal-Weight 0-30 Year Treasury ETF (GOVI) charge 0.09% and 0.15%, respectively. Longer duration iShares offerings also come with higher fees – the iShares 20+ Year Treasury Bond ETF (TLT) and the iShares 10-20 Year Treasury Bond ETF (TLH) both charge 0.15%.

iShares

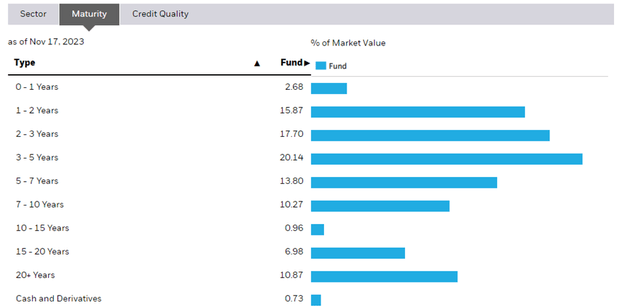

The fund is spread across 169 Treasury holdings, with the largest allocation shifting forward to the 3-5-year maturity (20.1%). Additionally, the 2-3 Year (17.7%) and 1-2 Year (15.9%) maturities now contribute to larger shares of the GOVT portfolio relative to its previous largest holding, the 5-7 Year maturity (down to 13.8%). In tandem, GOVT’s weighted average and effective maturities have been reduced to 7.5 and 5.8 years, respectively. While the GOV portfolio is now AA-rated (vs AAA pre-Fitch downgrade), the credit rating still implies limited credit risk.

iShares

Fund Performance – Better Income; Lower Returns

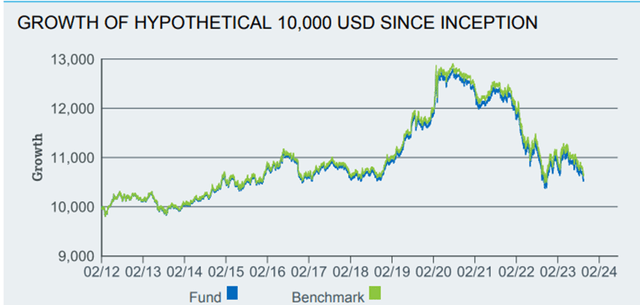

On a year-to-date basis, the ETF has seen its total return further decay to +0.2%. In turn, the fund has annualized at a slower +0.4% pace in market price and NAV terms since its inception in 2012.

That said, GOVT deserves credit for its relative outperformance vs other iShares Treasury bond offerings, with TLT and TLH down -6.8% and -4.5%, respectively. Similarly, FLGV (+0.3%) and GOVI (-7.7%) have trailed GOVT performance this year, a result of the fund’s shifting duration profile.

Over longer five and ten-year periods, GOV hasn’t returned much at -0.3% and +0.4%, respectively, though it has again outperformed comparable funds here. The shift from ultra-low rates to a ‘higher for longer’ rate regime has, however, driven a notable increase in monthly distributions, with the 30-day yield currently at 4.8%.

iShares

Some Reprieve Warranted but Too Far Too Fast

The US Treasury’s latest quarterly refunding provided some much-needed respite from concerns about the pace of bond supply, particularly at the long end. While overall issuance sizes have been raised significantly YoY, it was slightly less than consensus expectations. Further, the Treasury kept a lid on the supply of new longer-duration bonds in favor of <12-month bills, relieving pressure on bond yields across the curve.

The catch is that this also means the bill mix is now set to run at >20% of overall issuance for some time (vs the recommended 15-20%). Expect a further rise, given the strong demand for >5% yielding Treasury bills thus far, particularly from money market funds.

The sustainability of using higher-cost short-term debt as a fiscal ‘shock absorber’ remains unclear, however. Should deficits and debt levels follow a similar trajectory to the CBO’s (Congressional Budget Office) projections, expect structural upward rate pressure across the Treasury complex going forward.

US Treasury

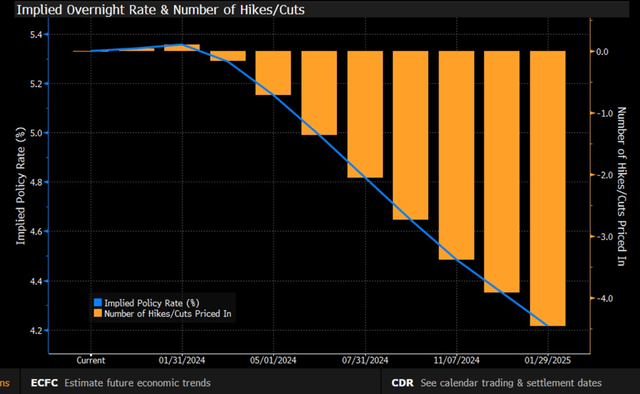

Adding to the momentum was that economic data in the US appears to be taking a turn for the worse. Soft consumer and producer inflation reports, in particular, signal more room for policy rate cuts next year.

Yet, it’s hard to justify how this stream of softer-than-expected data justifies pricing in ~100bps of 2024 Fed cuts into the curve. This degree of easing seems not only inconsistent with Fed commentary this week but also Q3 earnings growth, which has remained broadly robust, led by the ‘Magnificent 7’ companies.

Barring tail scenarios like a severe recession or a deflationary spiral that necessitates even more aggressive cuts than currently priced, there is likely more risk than reward to underwriting a further Treasury bond rally from here.

Greg Daco

Staying Sidelined on Longer-Term Treasury Bonds

It hasn’t been a great year to be long Treasury bond ETFs, as pressure from higher policy rates and increased government bond issuance drove yields higher (and prices lower) across the board. Positioning was perhaps too extended heading into this month’s refunding, so the combination of a lower-than-expected Q4 issuance schedule (though still higher YoY), as well as weaker inflation and jobs data, led to sharp reversals.

I am concerned, though, that the market has instead overextended in the other direction, with investors now having to underwrite a massive 100bps of 2024 rate cuts (in contrast with comparatively hawkish Fedspeak) to own Treasury bonds. Also in the price is a negative term premium at the long end, which will weigh heavily on returns in the likely event that the yield curve un-inverts. Net, I don’t see a compelling reason to buy duration in GOVT at sub-5% yields when lower-risk T-bill ETFs currently offer >5%.

Read the full article here