BV Is On The Cusp Of Recovery

I have previously discussed BrightView Holdings (NYSE:BV), and you can read the latest article here. At the end of FY2023, the company primarily looks to improve profitability and cash flows through grabbing higher-quality contracts. It has a robust backlog in the Development Service business. The economic indicators have not shown any real sign of risks, thus fueling the scope for fast recovery. The impetus came from a significant investment by One Rock Capital. It will go a long way in strengthening its balance sheet and providing opportunities to seek various growth alternatives.

On the other hand, low volume in the Maintenance segment may cap the topline growth. Nonetheless, I think the upside outweighs the negatives. The stock appears undervalued versus its peers. Investors should consider “buying” at this price level, expecting solid positive returns in the near-to-medium term.

Strategic Investments And Leverage

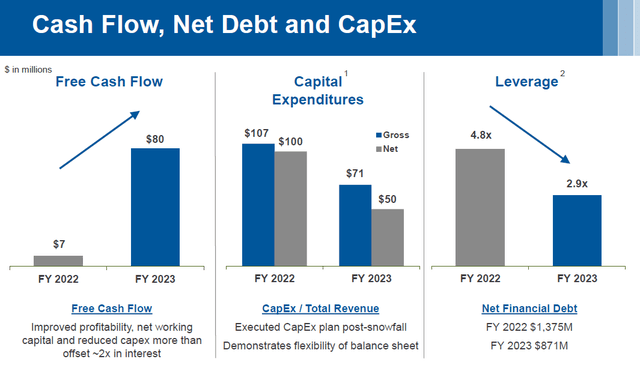

In August, BV announced a strategic investment of $500 million from One Rock Capital. The company plans to use 90% of the proceeds from the investment to pay down debt. As a result, its leverage came down by ~2x and reached a low of 2.9x compared to 4.8x in the prior year. This strengthened its balance sheet and provided flexibility to pursue acquisitions in the landscape businesses or other accretive initiatives. In addition, the company made a leadership change as it appointed Dale A. Asplund as the President and CEO in October.

Capex and Cash Flow Strategy

BV’s Q4 2023 Earnings Call Presentation

BrightView has strategically decided to reduce capex after implementing cost reduction and margin expansion strategies. It also looks to improve its working capital and benefit from better tax planning. In 2023, when snowfall was lower than the past average, a reduction in capex enhanced cash flows.

Investors may note that while its evergreen operations require year-round landscape maintenance, its snow removal services are a counter-seasonal source of revenues because they allow for better utilization of its crews and equipment during the winter. In FY2023, its free cash flow ballooned to $80 million from $7 million a year ago. With enhanced cash flows, the company looks set to carry the momentum in 2024.

The Changing Dynamics

After Q4 2023 (ending September 30, 2023), BrightView’s management focus has shifted to grabbing higher-quality contracts, a continuum to its previous margin expansion strategy. In addition to boosting profitability, it has increased its land revenue. In Q4, the company’s adjusted EBITDA margin in the Maintenance segment expanded by 30 basis points, while the margin in the Development segment increased by ten basis points. The company expects this margin expansion trend to continue in its segments.

BV also continued with its strategy of cost reduction. Its strategies include enhancing branch performance, better procurement, and capital allocation to grow customers. The EBITDA margin and cash flow growth in 2H 2023 reflected the initiatives. To achieve these, the company invests in employee performance to improve sales and operations. Employee improvement, in turn, results in higher customer retention as employee incentives align with prioritizing growth. Together, these efforts create higher returns and lead to higher shareholder value.

FY2024 Outlook

In FY2024, BV expects revenues to increase by 5% compared to FY2023. In the maintenance business, the end market has remained resilient, which offers the opportunity to pursue profitable growth in the near term. In the snow business, its topline will likely remain steady or may return to its past five-year average. The company has a robust backlog in the development business, which will lead to revenue and margin growth.

In FY2024, BV’s margin can expand in the Maintenance and Development segments. In aggregate, it can record an adjusted EBITDA of $310 million-$340 million, resulting in a margin expansion of 40 to 80 basis points. Based on improved profitability, the company’s cash flows will remain strong in FY2024.

The Economy And Inflation

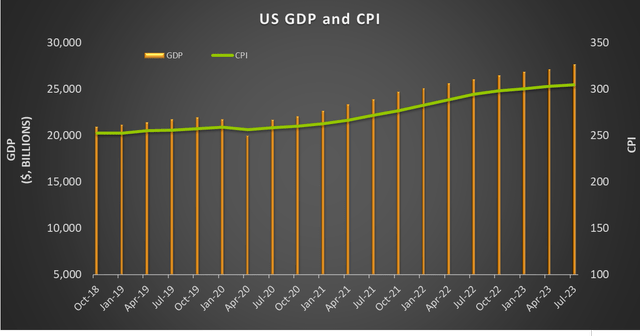

FRED Economic data

Quarter-over-quarter, the US GDP increased by 1.5% on average over the past four quarters. The US consumer price index (or, CPI) increased by 0.8% during this period. However, since the beginning of 2023, the US GDP growth rate has outpaced CPI. So, at least until the recent past, the economy indicates a reassuring sign for BV’s near-term outlook.

Analyzing The Q4 Performance

BV’s Filings

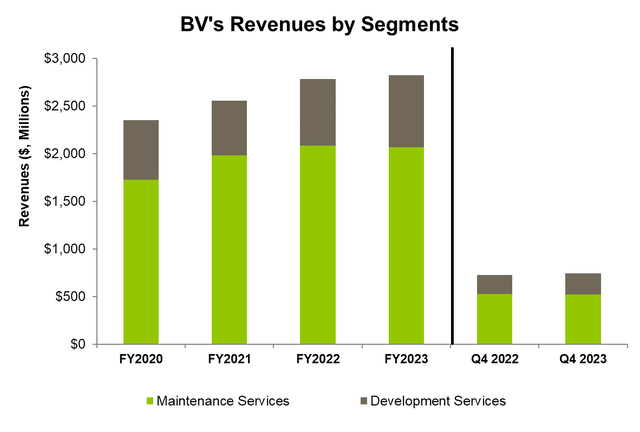

Year-over-year, BV’s revenues increased by 2.8% in Q4 2023, due primarily to a 13% rise in the revenues in the Development Services segment. Robust backlog translated into higher project volumes in the Development Services segment. On the other hand, pursuing higher-quality contracts resulted in a revenue loss in Q4 in the Maintenance segment. However, a better product mix boosted this segment’s EBITDA margin.

Cash Flows And Balance Sheet

In FY 2023, BV’s cash flow from operations increased by 22% compared to a year ago. Although the company’s revenues remained nearly unchanged from the previous year, a decrease in cash used by accounts payable and other operating liabilities led to a rise in cash flow. As a result, its free cash flows turned positive in FY2023.

BV’s liquidity was $300 million as of September 30, 2023. Its leverage (debt-to-equity) of 0.71x is lower than its peers’ average (SP, HCCI, and CENT). The recent strategic investment from One Rock Capital strengthened its balance sheet and reduced its leverage by the end of the year.

Analyst Rating

Seeking Alpha

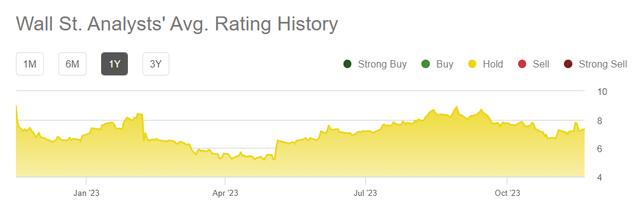

Seeking Alpha said four analysts rated it a “hold” in the past 90 days, while only one sell-side analyst rated BV a “buy.” One of the analysts rated it a “sell.” The consensus target price is $9.1, suggesting a 26% upside at the current price. But I think the sell-side analysts underappreciate the company’s financial strength and growth prospects. Below, I discuss why its relative valuations appear cheap.

Relative Valuation

BV’s forward EV/EBITDA multiple contraction is steeper than its peers. This typically results in a higher EV/EBITDA multiple because its adjusted EBITDA is expected to rise more sharply than its peers. The company’s EV/EBITDA multiple (6.3x) is lower than its peers’ (SP, HCCI, and CENT) average (9.6x). So, the stock appears to be undervalued at this level.

If the stock trades at the past average, it can more than double from the current level. Given the near-term drivers, I think the stock may increase slightly less but would still provide sufficient upside. With strengthened strategic positioning, it should back up to yield impressive returns in the medium term.

Why Do I Upgrade My Rating On BV?

In my previous discussion on BV, I showed the company’s mature business model that followed a stable growth path, primarily due to a growth in annual contracts and increased snow volume realization. However, the variability in the snow business, high inflation rates, and a spike in fuel prices prompted a “hold” rating. I wrote:

Because the evergreen operations require year-round landscape maintenance and the average contract size is reasonably large, its cash flows are predictable. However, the snow business is highly seasonal. Due to the warmer start in 2023, the company faces some imminent challenges.

After Q4, BV shifted its focus to improving cash flows and profitability, even at the expense of a mild revenue loss in some operations. It pursued high-valued contracts that changed its product mix. With a positive momentum of margin expansion and a robust balance sheet, the company has opportunities to take an inorganic growth route. With a strategic investment from outside, the company offers an exciting valuation multiple. So, I upgraded my rating to a “buy” from the previous “hold” position.

What’s The Take On BV?

Seeking Alpha

BV is currently pursuing a two-pronged strategy: grabbing higher-quality contracts and initiating cost reduction methods like enhancing branch performance, better procurement strategy, and capital allocation. These efforts created higher returns and shareholder value for the investors. I expect its cash flows to remain strong in FY2024 based on improved profitability. During Q4, a significant strategic investment from One Rock Capital helped it to pay down debt and lower leverage by ~2x.

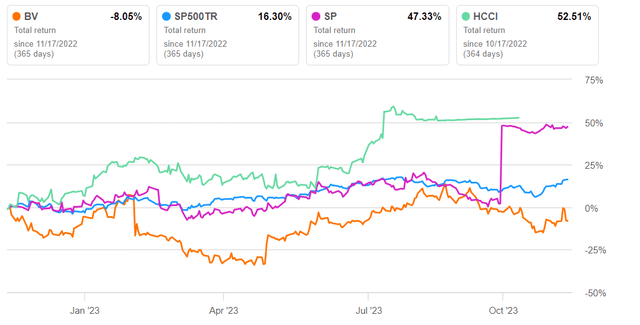

However, pursuing higher-quality contracts resulted in a revenue loss in Q4 in the Maintenance segment. Plus, the uncertainty over the economic condition also played a role in toning down the company’s outlook. So, the stock underperformed the SPDR S&P 500 Trust ETF (SPY) in the past year. It currently trades at an attractive valuation multiple compared to its peers. So, I think investors would do well to “buy” it for medium-term solid returns.

Read the full article here