We present our note on Aroundtown (OTCPK:AANNF), the Frankfurt-listed property firm, with a Hold rating. The company has built a real estate empire on the back of low rates and is now facing significant pressure with a different interest rate environment and rental market fundamentals. We will briefly describe the company, its history, and its portfolio, discuss underlying trends and operational performance, analyze the firm’s balance sheet and deleveraging measures, value the shares, and examine risks.

Introduction to Aroundtown

Aroundtown is a leading real estate company with a focus on income-generating quality properties with value-add potential primarily in Germany, the Netherlands, and the UK. Key asset classes include hotels and offices, and the firm also owns a majority stake in Grand City Properties, a listed real estate company investing in the German residential real estate market. The group was founded in 2004 by Yakir Gabay, the Cypriot-Israeli billionaire, who owns ca. 15% of outstanding shares through investment vehicles Avisco Group and Vergepoint.

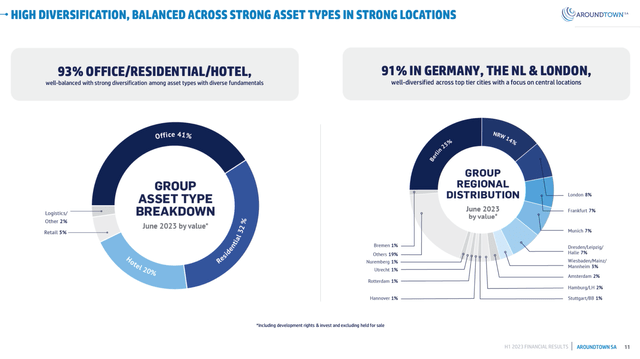

The group’s business model centers around centrally located assets in top-tier German and Dutch cities; operational performance improvements including rent increases, occupancy increases, and lease extensions; extraction of synergies and economies of scale; and high cash generation while maintaining low leverage and a conservative financial profile. Aroundtown’s portfolio has an area of around 9587k sqm, an average rent of €10.6 per sqm, and 7.3 years of weighted average lease term. The distribution of the portfolio by asset type (by value) is the following: 41% Office, 32% Residential, 20% Hotel, 5% Other and Retail, and 2% Logistics. In terms of regional distribution, 25% of the portfolio is located in Berlin, 14% in North Rhein-Westphalia, and 8% in London.

Aroundtown has a current market capitalization of ca. €3.4 billion, representing a nearly 70% discount to EPRA NRV as of June 2023. The company has lost nearly three-quarters of its market value from its peak in February 2020.

Aroundtown H1 Results Presentation

Operating performance trends

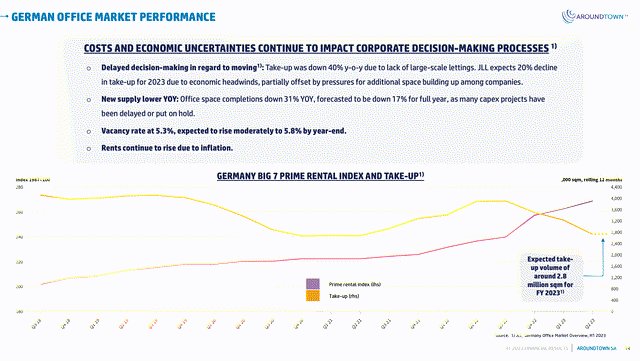

Aroundtown is focused on maintaining stable occupancy levels, especially in office properties, given the unfavorable current market dynamics. Meanwhile, the hotels segment is still in recovery and the residential market faces supply-demand disparity, leading to 3.4% rental income like-for-like growth in H1. Despite rental income increases, we believe more expensive financing will lead to a negative net FFO effect in the mid-high single-digit percentage range.

Aroundtown H1 Results Presentation

Balance sheet stress and deleveraging

Low-interest rates allowed the firm to amass a real estate portfolio with a book value of nearly €30 billion. However, the rates backdrop has significantly changed and Aroundtown’s leverage situation is not sustainable over the long term. The increasing cost of debt puts pressure on profitability, and the interest coverage ratio is likely to drop over the mid-term, potentially leading to credit rating downgrades and even higher financing costs in turn. LTV (loan-to-value) covenants still look comfortable, and the portfolio would need to devalue by ca. 40% to trigger a breach. However, the market would like more disclosure on the portfolio, and it is reasonable to believe that the current property valuations in Aroundtown’s accounts aren’t congruent with the prevailing market conditions.

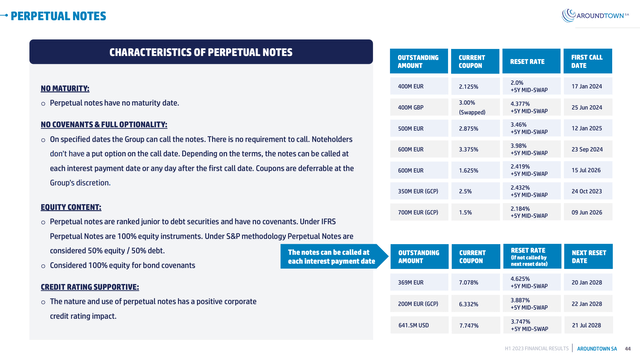

We would like to note that Aroundtown and its subsidiaries have ca. €5 billion in perpetual debt, callable until 2026. We see some additional risks related to these instruments. If not called these instruments will remain perpetual but be considered fully as debt post the call date by credit rating agencies. The repriced financing cost is likely to lead to even lower interest coverage ratios and can potentially trigger LTV covenants at a much lower (and realistic) portfolio devaluation of around low double-digit percentage points. This is not our base case scenario, but we believe it should be monitored closely.

Aroundtown has sold in excess of €6 billion of assets since 2020, which has helped to keep leverage at bay, however, the balance sheet needs to be deleveraged further to a sustainable long-term ratio. This depends largely on property market conditions and presents additional issues. If higher-quality assets are sold, portfolio quality will drop sharply. Meanwhile, if lower quality assets are sold, that is likely to happen below book value, which would lead to Aroundtown booking losses and leverage ratios deteriorating.

Aroundtown H1 Results Presentation

Valuation and investment recommendation

We value Aroundtown using a dividend discount model. Our estimates are largely in line with the sell-side analyst consensus. We forecast €1.2 billion of net rents in FY2024, around €1.1 billion of EBITDA, and ca. €300 million of FFO. We assume a long-term FFO payout ratio of 90% (over the long term), hence €270 million of dividends per year. We assume a 10% cost of equity and a long-term growth rate of 2% in line with the underlying long-term growth rates of OECD countries. This implies an equity value of €3.4 billion, implying virtually no upside. Moreover, we estimate a nearly €8 billion headline NTA by the end of FY2024. As the return on capital is significantly lower than the cost of capital, a major discount to NTA is warranted, likely higher than historical levels to reflect the current uncertainties.

We believe Aroundtown does not have an attractive risk/reward and we would avoid buying the shares until the valuation is more appealing, the balance sheet looks better, or interest rates are down and commercial real estate market fundamentals improve.

Risks

Downside risks include but are not limited to deteriorating macroeconomic conditions, deteriorating rental market fundamentals, higher than expected interest rates straining FFO and leading to less favorable financing conditions, accelerating remote work trends leading to lower office space demand, adverse regulatory changes, operational underperformance, failure to deliver on deleveraging leading to the need for an equity raise, capital misallocation, governance risk, etc.

Conclusion

We find the risk/reward unattractive, and we have a neutral rating on Aroundtown shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here