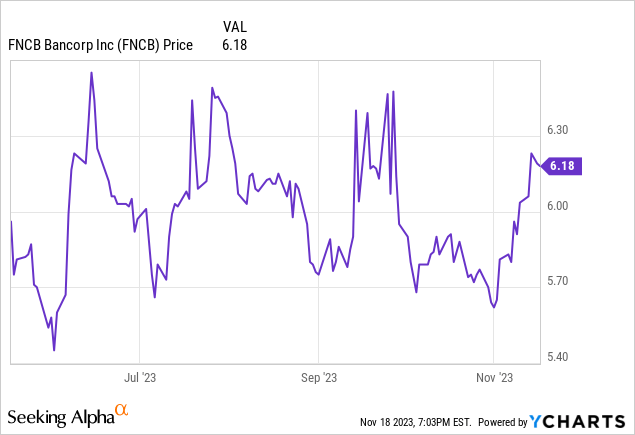

We cover a plethora of regional banks, and we were asked about FNCB Bancorp (NASDAQ:FNCB), which has a nice history of growth. Right now you can collect and attractive dividend yield of 5.8%. Overall, we believe this is a fine bank stock, but it is likely to trade sideways until the overall macro environment improves for the banks. The company has mixed key metrics, so we rate the stock neutral at these levels, although a sideways stock is not the worst thing in the world if you are an income investor. The near 6% yield certainly crushes bonds and cash, though it comes with the equity risk. Now, before considering any action do keep in mind the company recently agreed to merge with People’s Financial Services (PFIS), but we are several quarters away from that. However, this pending merger is also a large reason why shares will move a bit sideways, as the merger details are worked out. Regardless of this pending merger, and there is no absolute guarantee that it will go through, FNCB remains open for trading and one to hold given the yield. However, given the valuation which is discussed below, the performance of the name, and the merger, we see it moving sideways for the most part. Further, the stock has been extremely range bound around the $6 mark for months.

In the recently reported Q3 earnings, we saw relatively strong performance on some metrics and weakness in others. Overall, a hold here makes sense. Let us discuss.

Q3 2023 headline performance

The headline numbers declined in the just reported quarter. There was contraction on both the top line and the bottom line. Net income was down to $4.2 million, or $0.21 per share, dropping from $1.2 million, or 23.4%, compared to $5.4 million, or $0.28 per share a year ago. The reasons for this decline was a drop in both net interest income and non-interest income, and an increase in non-interest expenses. Year-to-date, net income totaled $9.6 million, or $0.49 per share, a decrease of $5.9 million, or 38.0%, from $15.5 million, or $0.79 per share. That is painful performance overall. Let’s talk loans and deposits.

Both loans and deposits grew this year

Loans and deposits are both up from the start of the year and from a year ago. Growth in loans and deposits is key for any bank. However margins were crushed. Total assets are $1.827 billion which rose from $1.746 billion to start the year. Total loans were up 7.5% from the start of the year, and now total $1.194 billion. Deposits rose 5.8% since the start of the year, up to $1.502 billion. But the story of the decline in performance was margins. The cost of funds was up 207 basis points to 2.66%, from 0.59% a year ago as a result of higher rates. The yield on assets however did not keep pace, though the yield on assets was up 106 basis points to 4.93%. As such, margins compressed. Margins were down to 2.85%, but we note this was a 10 basis point increase from Q2 which is positive.

Return metrics here are mixed

Given the lower performance on the headlines and compressed margins, it is no surprise that we saw reduced return metrics. We like to look at the return on average assets and return on average equity. The return on average assets contracted heavily to 0.91%. This is down from 1.26% a year ago. Further it is down from 1.58% two years ago, a troubling trend that is tough to buy. However, this did increase from 0.63% in Q2, so a trough in performance may have occurred. We saw a similar trend with the return on average equity which expanded to 13.39% from 8.89% in Q2, but is still down from 16.95% a year ago. The efficiency ratio was 66.75%, way up from 54.88% a year ago, but improved from 68.11% in Q2.

Asset quality metrics mixed

The provision for loan losses was $0.270 million, down from $0.513 million versus a year ago. That was positive. Nonperforming loans increased by $2.3 million, or 81%, to $5.1 million since the start of the year. This was also 0.43% of total loans, which is up from 0.25% of total loans a year ago. The allowance for loan losses was $12.1 million of 1.01% of loans, and this was an improvement from $13.8 million, which was 1.24% of total loans, last year. Overall, it looks like asset quality metrics may have bottomed out.

Discount-to-book

Despite mixed performance we do like the valuation relative to book value. The stock is also pretty attractive relative to book value. Most banks are trading well above their book values now, and FNCB Bancorp does too, but barely. We are practically trading at book value here. Both book and tangible book value are $5.96, so you are holding shares at about book value. For a dividend growth stock this is attractive in our opinion.

Take home

We have a near 6% yielding stock here that is looking to merge with and into People’s Financial, which is likely to take several more quarters. Performance seems to have troughed, though it remains mixed. The price relative to book is attractive, and we expect shares to move sideways going forward, which is not the worst thing in the world for an income name. All things considered we rate this ticker a hold.

Read the full article here