Just two months ago, I wrote on Coeur Mining (NYSE:CDE), noting that there was little reason to own the stock given that while Rochester POA 11 would translate to material growth, the avalanche of new shares dropped on shareholders would not fix what was one of the sector’s worst production per share trends. And despite near-record gold prices in Q1, this share dilution continued, with ~11% share dilution in March and April from its At-The-Market equity program and shares exchanged to pay principal and accrued interest on its 2029 5.12% notes. This has led to a ~50% increase in the share count since year-end 2019, wiping out the benefit of Rochester’s growth (~333 million shares vs. ~189 million shares).

Unfortunately, the significant share dilution to complete construction in this asset isn’t the only major negative to the investment thesis, with the project set to come in ~65% above its initial budget (~$660 million vs. ~$397 million initial budget which included $42 million contingency), and operating costs will be much higher because of inflationary pressures. The impact of higher capex and operating costs have offset the benefit of higher metals prices from a NAV standpoint, making all of this share dilution a tough pill to swallow for shareholders. Let’s look at the most recent Q1 results and dig into why Coeur provides the wrong type of leverage to the gold price.

Q1 Results

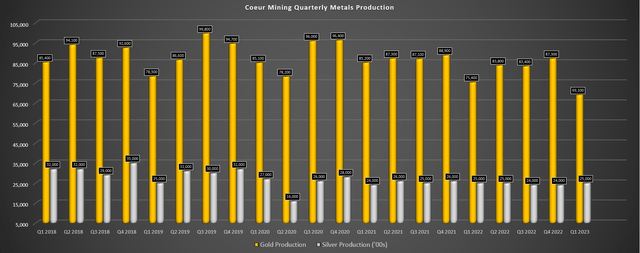

Coeur Mining released its Q1 results last week, reporting quarterly production of ~69,100 ounces and ~2.5 million ounces of silver. This translated to flat silver production on a year-over-year basis but an 8% decline in gold production, and a near 20% decline in gold production on a three-year basis. This decline in output for its gold segment is related to lower grades at Palmarejo and Kensington, where grades have declined from ~0.07 ounces per ton and ~0.20 ounces per ton in Q1 2019, respectively, to ~0.052 ounces per ton and ~0.15 ounces per ton in the most recent quarter (Palmarejo and Kensington). During Q1 2023, Palmarejo’s production was affected by lower throughput and recoveries on a year-over-year basis.

Coeur Mining – Quarterly Metals Production (Company Filings, Author’s Chart)

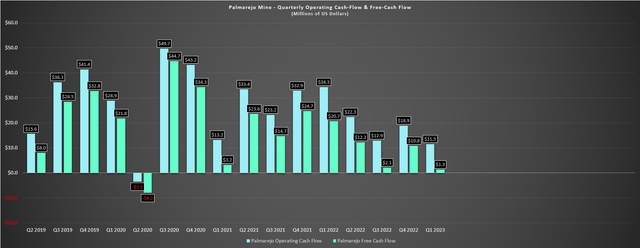

Looking at Palmarejo’s cash flow performance below, the trend hasn’t been pretty, with Q1 2023 operating cash flow coming in at just $11.5 million while free cash flow came in at $1.3 million. Obviously, a dip was expected vs. Q4 2022 levels because of the Mexican mining tax royalty, but even on a year-over-year basis, operating cash flow slid from $34.3 million and $20.7 million, respectively, with cash flow generation hit by higher costs and lower production. In fact, adjusted costs applicable to sales per gold ounce soared to $926/oz (Q1 2022: $730/oz) and adjusted costs per silver ounce increased over 12% to $13.94/oz. With these being the company’s steady cash flow generator with a limited contribution in Q1, consolidated cash outflows were $109 million vs. $75.9 million last year, despite similar capex levels.

Palmarejo – Operating Cash Flow & Free Cash Flow (Company Filings, Author’s Chart)

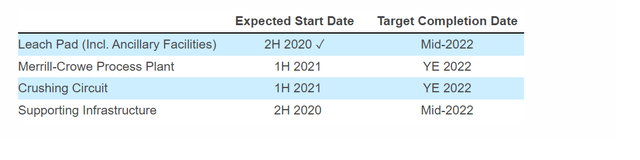

Moving over to Rochester, investors can take comfort in the project finally being near completion at 82%, and the company noted that stacking began on the Stage VI leach pad and mechanical completion of the new Merrill Crowe Plant was achieved early. However, this appears in line with the initial schedule provided in Q4 2020 (Merrill Crowe Plant), and as investors are aware, we’ve seen a massive capex blowout, with total capex expected to come in just shy of $670 million. That said, at least Rochester had a better quarter and is nearing the finish line, with ~761,000 ounces of silver produced (+10% year-over-year) and ~8,200 ounces of gold (+34% year-over-year) at slightly lower costs.

While costs were lower at Rochester, costs were still at industry-lagging levels with razor-thin margins, with adjusted costs applicable to sales of $20.24/oz and $1,655/oz on silver and gold, respectively.

Rochester POA 11 Items – Expected Start Date/Target Completion Date (Company Filings)

Finally, looking at Coeur’s two smaller assets, Wharf’s production was down year-over-year to ~15,500 ounces of gold despite higher grades due to the timing of ounces placed on the leach pads, and costs were up from $1,118/oz to $1,466/oz on an adjusted costs applicable to sales basis. Meanwhile, Kensington’s production was down year-over-year to ~20,300 ounces of gold (Q1 2022: ~22,600 ounces) due to lower throughput (mine production challenges) and lower recoveries that offset the benefit of slightly higher grades. From a cost standpoint, there wasn’t anything to write home about, with adjusted costs applicable to sales of $1,775/oz (Q1 2022: $1,610/oz).

Costs & Recent Developments

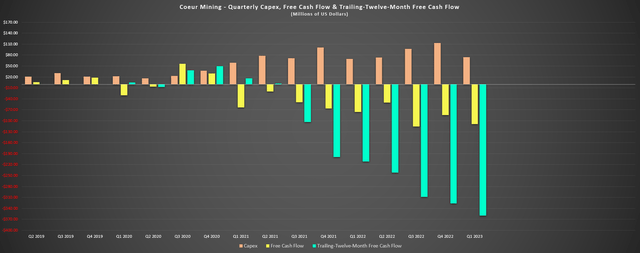

Moving over to costs and recent developments, Coeur’s consolidated adjusts costs applicable to sales per gold ounce increased to $1,381/oz vs. $1,169/oz, while its adjusted costs applicable to sales per silver ounce increased to $15.83/oz vs. $14.95/oz in Q1 2022. This led to lower operating cash flow in the period, which came in at [-] $35.0 million vs. [-] $6.4 million, partially impacted by unfavorable working capital changes from tax payments and interest on its 2029 notes. Meanwhile, the company’s adjusted net loss slid to $33.1 million, down from a $13.8 million loss in Q1 2022. And while Palmarejo’s costs were below the industry average at $926/oz per gold ounce, they are expected to rise as the year progresses (2023 guidance range: $900/oz to $1,050/oz).

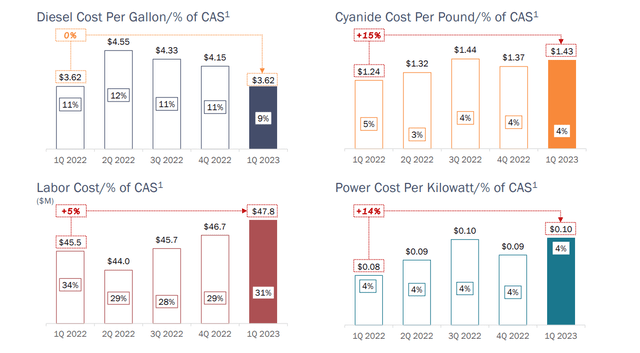

Coeur Mining – Diesel, Cyanide, Labor & Power Costs (Company Presentation)

From a positive standpoint, it looks like we saw peak costs in Q3/Q4 2022 and Coeur is seeing some relief from a cost standpoint. This is evidenced by the above chart provided by the company which highlights rising labor, power, and cyanide costs on a year-over-year basis, but diesel costs being flat from Q1 2023 to Q1 2022. Given the weakness in energy prices we’ve seen since Q1, the company’s diesel cost per gallon could trend lower which should benefit unit costs when combined with higher production. And while labor, cyanide and power costs are still rising, we are seeing a deceleration in the rate of change. This is positive news, but it’d be nice to see the Mexican Peso give up some strength which could impact costs at Palmarejo with guidance assuming a 0.20 to 1.0 USD/MXN exchange rate (0.176 currently).

Unfortunately, while costs for some consumables are moving in the right direction according to commentary from producers and it looks like inflation peaked in Q3/Q4 2022, it was another quarter of significant cash outflows and Coeur noted that costs for Rochester POA 11 were likely to come in at the high end of the $650 to $670 million range. Even if we assume costs come in at the midpoint of $660 million, this would represent a 66% increase from the initial estimate of $397 million, and while Coeur’s liquidity position (~$380 million) is satisfactory as it works its way through the highest-capex period of construction, it came at the cost of dumping more Victoria Gold (OTCPK:VITFF) shares at a loss from its initial price paid (US$6.70 vs. US$10.92), and ~32.9 million shares of its own stock sold at US$3.04, translating to ~11% share dilution.

Coeur Mining – Quarterly Capex & Free Cash Flow (Company Filings, Author’s Chart)

Coeur also noted that after quarter-end, ~2.1 million shares were exchanged for principal and accrued interest on its 2029 5.12% notes, pushing the share count to ~333 million shares or ~27% share dilution from the weighted average share count in Q1 2022 (263.3 million shares). This dilution on a year-over-year basis (which doesn’t even factor in share dilution from previous years) has roughly offset the incremental production growth from Rochester POA 11 on a per share basis. This means that while investors might be excited to see the fruits of the past two years’ labor, they have a much smaller ownership of this production once it starts up.

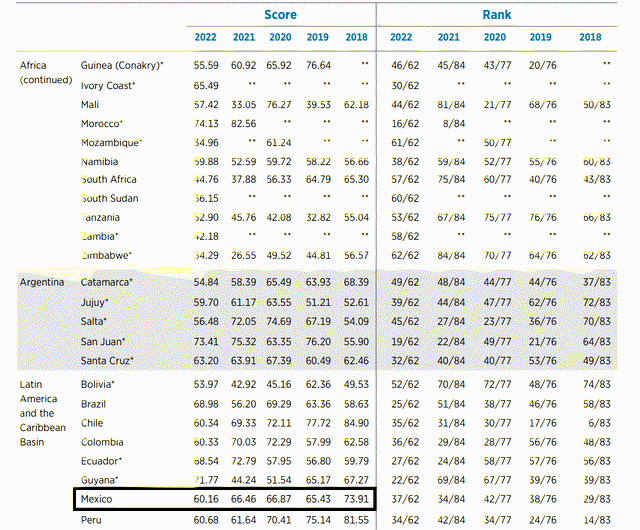

Mexico – Investment Attractiveness Rankings 2018 to 2022 (2022 Fraser Institute Survey)

Another recent development which isn’t encouraging is that Mexico has dropped materially from an investment attractiveness standpoint in the 2022 Fraser Institute Survey and this was before the recent mining law reforms that could affect investment in this jurisdiction and investor perceptions around Mexico further. Notably, the decline in rankings and overall investment attractiveness (74% to 60%) was before the recently passed mining law reforms, which impact profit-sharing to the community, a shortened period for mining concessions (30 years vs. 50 years), and allows authorities to cancel concessions if no work is done on them in two years.

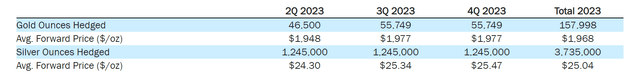

For what it’s worth, these changes appear to affect developers more than established producers like Coeur at its Palmarejo Mine in Mexico, but they certainly do not help from a perception standpoint, and this arguably the company’s best asset from a quality standpoint. And last, but certainly not least, Coeur has increased its hedges, with a hedging program for 2023 that’s one of the most aggressive sector-wide. So, if investors were hoping to get leverage on gold and silver prices this year by owning a high-cost producer like Coeur, this benefit won’t be as significant with ~158,000 ounces of gold hedged at $1,968/oz, and ~3.7 million ounces of silver hedged at $25.04/oz.

Coeur – Current 2023 Hedges (Company Filings)

Let’s look at Coeur’s valuation and see whether these negative developments appear to be discounted already.

Valuation

Based on ~333 million shares and a share price of US$3.35, Coeur Mining trades at a market cap of ~$1.16 billion and an enterprise value of ~$1.60 billion. This might appear to be a cheap valuation for a company with a predominantly Tier-1 jurisdictional profile (Alaska, Nevada, South Dakota, Mexico, British Columbia), but one of these assets remains in care and maintenance, most of these assets are higher-cost, and its best asset may produce at industry-leading costs, but as noted earlier, a sizeable portion of output is going to Franco-Nevada (FNV) at a cost of $800/oz under the stream agreement. Hence, simply comparing production figures to market cap is not a complete assessment for determining valuation.

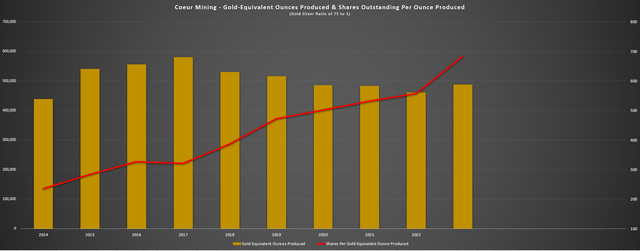

However, besides Coeur’s lower-quality portfolio, the bigger issue here is share dilution and the fact that production per share continues to trend in the wrong direction. This is the exact opposite of what investors want to see if they are investing in a precious metals stock, and I see zero value in owning a precious metals stock from an investment standpoint if one’s exposure to production of precious metals is steadily declining due to share dilution. The reason? This is negative leverage as opposed to the positive leverage one should look for to justify taking on the higher risk of owning a gold producer. And if one is consistently seeing a declining share of production per year, they are better off to just own the metal itself.

Coeur Mining – GEOs Produced, 2023 Estimates & Shares Outstanding Per Ounce Produced (75 to 1 Gold/Silver Ratio) (Company Filings, Author’s Chart)

As we can see above, Coeur has one of the worst production per share trends sector-wide, with gold-equivalent ounce production relatively flat from 2014 to 2023, while the share count has risen from ~105 million shares to closer to 335 million shares by year-end 2023. This means that an investor was getting one gold-equivalent ounce of production per ~230 shares that they owned in 2014, but today they would to own nearly three times as much shares (~680 shares vs. ~230 shares) to get the same level of production per share held. And while not every company grows production per share consistently, this is by far one of the worst looking trends sector-wide.

Even if we assume an average of ~550,000 GEOs in 2024/2025 to be fair which accounts for the benefits of the Rochester Expansion, one will still need to hold over 600 shares per GEO produced, well above the ~470 shares just ahead of the start of construction at year-end 2019.

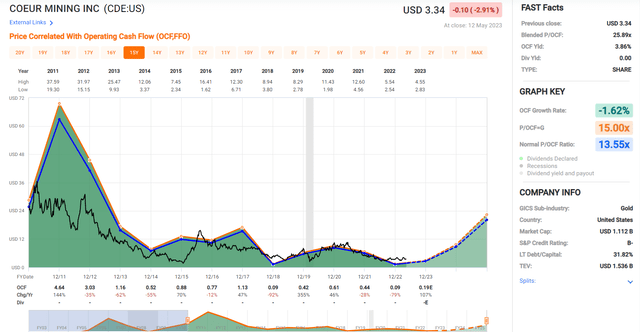

Given this poor track record of production per share growth and the fact that this continuous dilution and its high-cost assets with arguably its best asset in a jurisdiction whose investment attractiveness continues to erode, I believe Coeur’s industry-lagging multiple is justified. So, while the stock may look cheap at just ~5.4x FY2024 cash flow per share estimates vs. a historical multiple of ~13.6x cash flow, I don’t see reason to anchor one’s valuation estimates on the 15-year average. In fact, Barrick Gold (GOLD) trades at less than FY2024 cash flow per share estimates currently, a larger company that’s steadily reducing its share count, returning significant capital to shareholders (buying back shares, paying dividends + performance dividends), and has much higher margins.

CDE Historical Cash Flow Multiple (FASTGraphs.com)

Using what I believe to be a more conservative multiple for Coeur of 6.0x cash flow and FY2024 cash flow per share estimates of $0.62, I see a fair value for Coeur of US$3.70. This points to an 11% upside from current levels, which doesn’t offer nearly enough margin of safety to justify owning the stock. To summarize, I continue to see Coeur Mining as an Avoid in favor of some other producers that have stronger businesses and are trading at a discount to fair value.

Summary

Coeur Mining has always looked cheap, but this is the case of a stock being cheap for several reasons. Aside from new mining law reforms in Mexico that could impact investor appetite for owning producers and especially developers operating in this jurisdiction, it operates primarily low-grade and high-cost mines, with its best mine being encumbered by a massive gold stream. And as highlighted above, it has a track record of diluting at a pace well above the sector average.

This doesn’t mean that the stock can’t participate in sector-wide rallies, but with over 80 precious metals producers to choose from, I believe in owning the best or not owning them at all. And if one is going to stoop to own those names that have a track record of declining production per share at rising costs, one better ensure there’s an adequate margin of safety to account for the higher risk. At a share price of US$3.35 or ~5.3x cash flow, I don’t see any real margin of safety here. Therefore, I continue to see the stock as an Avoid and believe there are far more attractive opportunities elsewhere in the market today.

Read the full article here