Palladium’s bull market began in early 2016 when the price found a bottom at $451.50 per ounce. The rare precious and industrial metal made higher lows and higher highs for over six years, reaching $3,380.50 per ounce on the nearby NYMEX palladium futures contract in March 2022. Palladium’s rally took the metal nearly six and one-half times higher. Palladium’s peak coincided with Russia’s invasion of Ukraine.

Palladium is a platinum group metal, and its composition, density, and heat resistance make it a critical ingredient in automobile catalytic converters that clean toxins from emissions. The most recent decline took palladium below the $1,000 per ounce level for the first time since 2018. The abrdn Physical Palladium Shares ETF (NYSEARCA:PALL) moves higher and lower with the metal’s price.

Palladium ran out of upside steam at the March 2022 record high

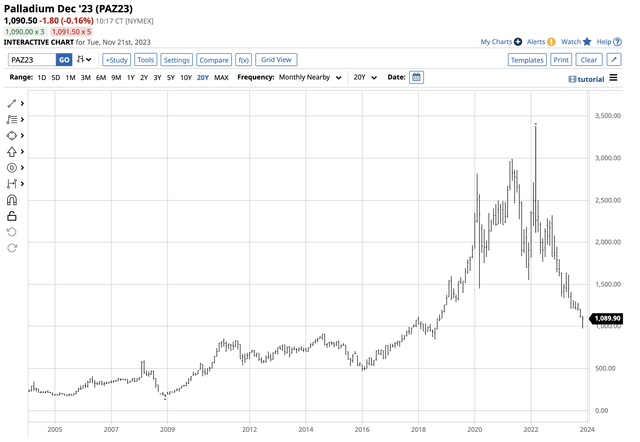

Palladium embarked on a fourteen-year rally in 2008 after reaching a bottom at $160 per ounce.

Twenty-Year NYMEX Palladium Futures Chart (Barchart)

The chart shows the pattern of higher lows and higher highs in the palladium futures market from the 2008 low. In 2018, the price eclipsed the $1,000 level, leading to an upside explosion. When Russia invaded Ukraine in March 2022, palladium spiked higher to a record $3,380.50 per ounce peak on supply concerns. Palladium ran out of upside steam at that March 2022 high, leading to a bearish trend and implosion that took the metal below $1,000 per ounce in November 2023.

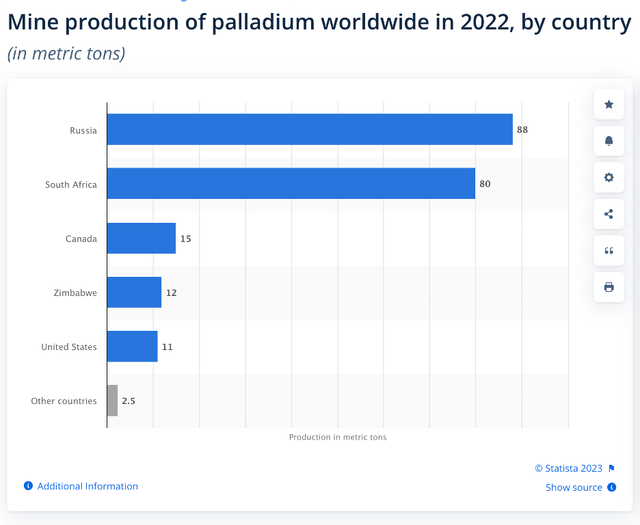

Russia is the leading palladium producer- Most palladium comes from the BRICS block

Palladium is a rare precious and industrial metal, with most supplies coming from only two countries, Russia and South Africa. In 2022, the total worldwide mine output was 210 metric tons or 6.75 million ounces.

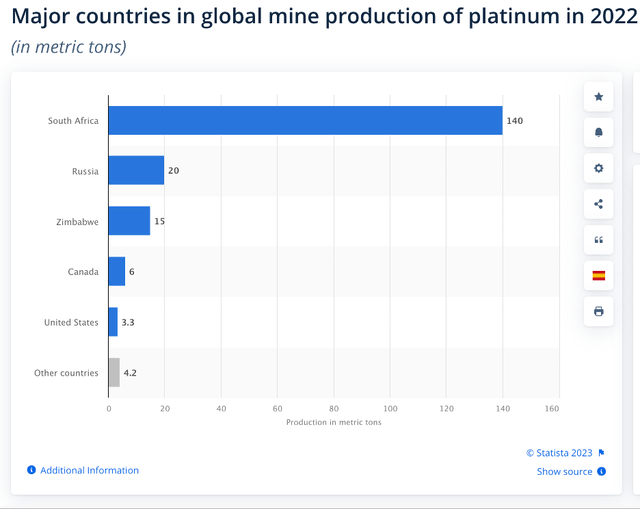

Worldwide Palladium Production by Country (Statista)

In 2022, Russia produced 88 metric tons, or 41.9% of global supplies. South African production of 80 tons was 38%. With nearly 80% of the world’s palladium coming from the two BRICS countries, the war in Ukraine and the bifurcation of the world’s nuclear powers has led to supply concerns in the United States and Europe.

Bull markets can lead to illogical, unreasonable, and irrational prices on the upside. Limited liquidity in the palladium futures market led to a spike over the $3,380 per ounce level as supply concerns caused offers to sell evaporate. However, the palladium price rose to an unsustainable level, leading to the price implosion that took it to less than one-third of the level at the March 2022 high.

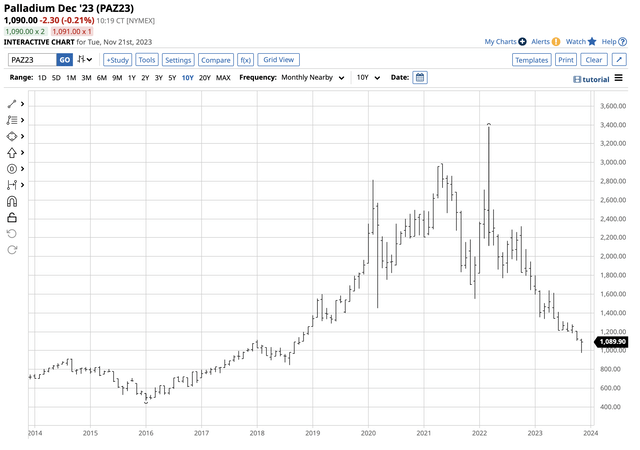

A five-year low below the $1,000 per ounce level in November 2023

Palladium made lower highs and lower lows from March 2022 through November 2023, recently probing below the $1,000 per ounce level.

Ten-Year NYMEX Palladium Futures Chart (Barchart)

The ten-year chart shows the fall to $974.90 per ounce in November, the lowest level since September 2018. The active month December palladium futures contract reached a $948.50 per ounce low on November 7, the lowest price since August 2018.

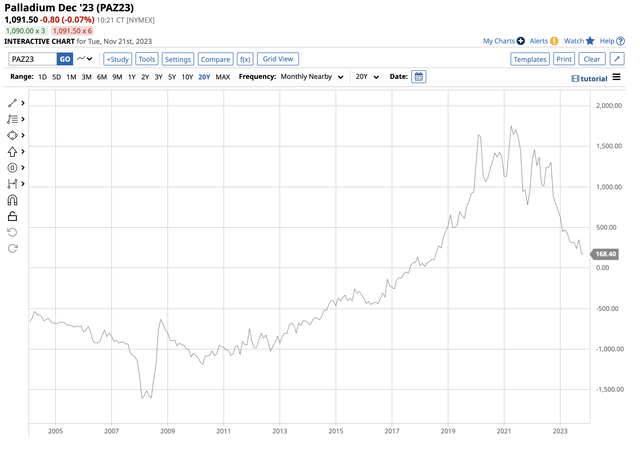

The platinum-palladium spread tanks- Platinum did not go along for the bullish ride

Palladium and platinum are platinum group metals. The other PGMs include rhodium, ruthenium, iridium, and osmium. Platinum and palladium on futures exchanges. Rhodium, ruthenium, iridium, and osmium only trade in the physical market because of limited liquidity compared to the other PGMs.

Gold, silver, and copper trade on the Chicago Mercantile Exchange’s COMEX division. Platinum and palladium trade on the CME’s NYMEX division along with the leading traditional energy commodities. Platinum and palladium have a long history in energy production, refining, and automobile catalytic converters. Oil refineries processing raw petroleum into gasoline and distillate products use platinum and palladium in the refining catalysts because of the metal’s high heat resistance.

Platinum and palladium have many similar characteristics and compositions, making them interchangeable. Platinum’s boiling point is 6,917 degrees Fahrenheit. Palladium’s is 5,365 degrees Fahrenheit. Refining petroleum into gasoline requires a 900-degree Fahrenheit temperature. Distillate refining requires a 750-degree Fahrenheit temperature. Therefore, platinum and palladium are suitable for catalysts that refine crude oil into oil products. They are also ideal for automobile catalytic converters that clean toxic emissions.

South Africa and Russia lead the world in platinum and palladium mine output. The palladium-platinum spread monitors the metal’s price relationship. The prices can be susceptible to the differential because of interchangeability.

Twenty-Year Chart of NYMEX Palladium minus NYMEX Platinum Futures (Barchart)

The chart of nearby NYMEX palladium minus platinum futures shows platinum rose to an over $1,500 per ounce premium to palladium in 2008 when platinum reached its all-time high at over $2,300 per ounce. Industrial consumers favored palladium, substituting the metal for platinum over the following years. As the demand for palladium in automobile catalytic converters rose, palladium prices moved to a premium to platinum in 2017, and the premium increased to over $1,750 per ounce in April 2022.

Over the past months, palladium’s premium shrunk to below $170 per ounce at the most recent low, given the palladium bear market and platinum’s relative price stability. The decline in the spread indicates that industrial users have been substituting platinum for palladium for cost reasons.

Platinum did not go along for palladium’s bullish ride. One of the reasons could be South African dominance in platinum output, while Russia is the leading palladium-producing country.

Total Platinum Production by Country (Statista)

In 2022, total platinum mine supplies were around 171 metric tons or 5.5 million ounces. The chart highlights that South Africa accounted for 81.9% of the output, while Russia contributed 11.7%. Therefore, palladium was far more sensitive to the war in Ukraine and sanctions than platinum, causing the March 2022 price spike.

PALL is the palladium ETF product

The elasticity of palladium demand likely led to the contraction in the palladium-platinum spread as industrial consumers substituted platinum for palladium over the past year, causing the implosion in palladium prices while platinum remained relatively stable.

In palladium, the bullish trend from 2008 through 2022 and the war in Ukraine led to the price spike that took the metal to an irrational price. Bearish trends tend to do the same on the downside, and prices below the $1,000 level in palladium could have created a significant bottom, creating a buying opportunity.

The direct route for palladium investments is via the physical market for palladium bars and coins. Limited production and industrial demand create high premiums for physical buyers. NYMEX palladium futures contract contains 100 ounces of metal. The delivery mechanism allows prices to converge with physical prices during delivery periods.

The abrdn Physical Palladium Shares ETF is a liquid alternative to the futures arena for investors seeking palladium exposure without leverage or margin.

At around the $100 per share level on November 21, PALL had $202.35 million in assets under management. PALL trades an average of 45,199 shares daily and charges a 0.60% management fee. PALL’s fund profile states:

Fund Profile for the PALL ETF Product (Seeking Alpha)

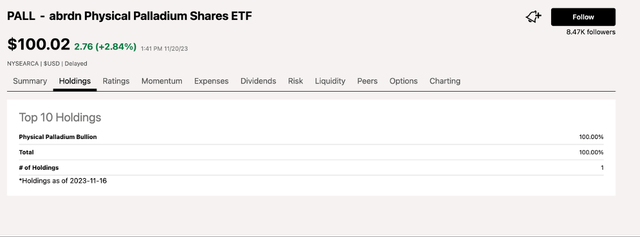

PALL holds 100% of its assets in physical palladium bullion.

Top Holdings of the PALL ETF Product (Seeking Alpha)

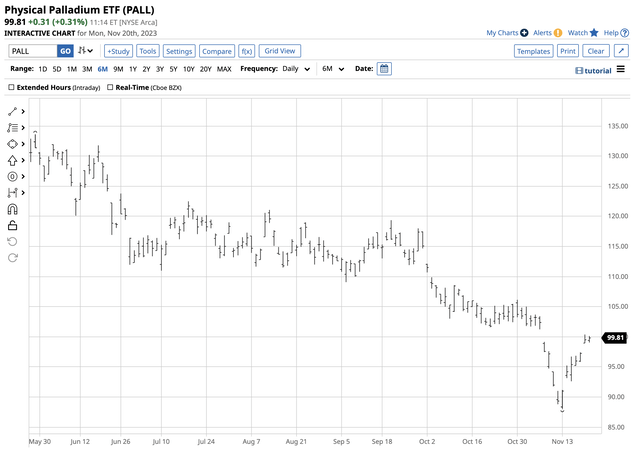

After reaching a $948.50 low on November 13, the active month December NYMEX palladium futures contract recovered 16.1% to $1,101.50 on November 21.

Six-Month Chart of the PALL ETF Product (Barchart)

Over the same period, the PALL ETF rose 14% from $88.07 to $100.37 per share. PALL could miss highs or lows when the stock market is not operating, as palladium futures trade around the clock.

The move below the $1,000 level could have been a spike blow-off low that created a compelling buying opportunity in the rare precious and industrial metal. The most bullish factor facing palladium and the other platinum group metals is most of the production comes from two BRICS countries, Russia and South Africa, that are allied and at odds with the U.S. and Europe.

The plunge in palladium could be a buying opportunity, and PALL is an ETF that could have a significant upside over the coming months.

Read the full article here