Amcor plc (NYSE:AMCR) has been able to achieve strong growth over the years in regard to sales but has lagged in its share price performance. With a strong dividend, expansion of margins through acquisitions, and overvaluation assuming my DCF figures, I rate Amcor a hold.

Business Overview

Amcor plc is a packaging products company that has over 44,000 employees and operates in several regions including Europe, North America, Latin America, Africa, and the Asia Pacific. The company is divided into two segments: Flexibles and Rigid Packaging. The Flexibles segment provides packaging products that are flexible and made of film. These products are used in various industries such as food and beverage, medical and pharmaceutical, fresh produce, snack food, personal care, and others. On the other hand, the Rigid Packaging segment offers containers that are rigid and used for different types of beverages and food products like carbonated soft drinks, water, juices, sports drinks, milk-based beverages, spirits, and beer, as well as sauces, dressings, spreads, and personal care items. In addition, plastic caps for various applications are also offered by this segment. The company sells its products through its direct sales force.

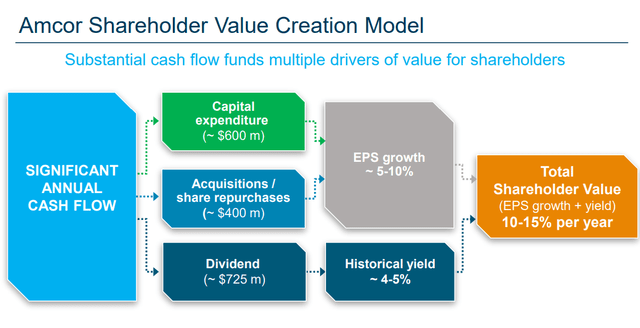

Investor Presentation

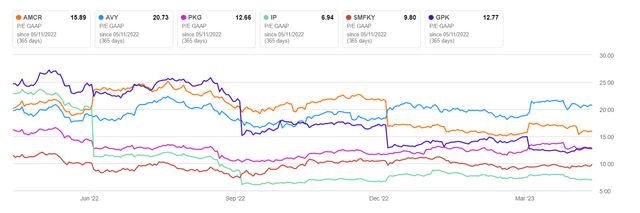

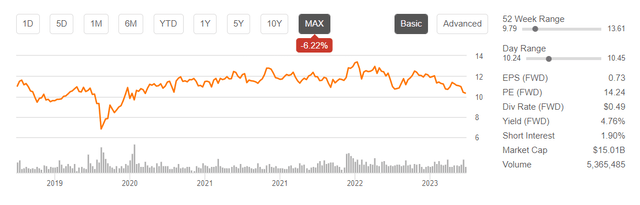

Amcor has a market capitalization of $15.156 billion and a ROIC that is at 7%. The stock’s 52-week high is $13.61 and its low is $9.79, while the current price is $10.30 with a P/E ratio of 15.89. The stock is currently trading below its 200-day moving average and compared to its competitors, Amcor’s stock price is slightly higher in terms of value on a P/E basis, as illustrated below.

Amcor P/E Compared to Peers (Seeking Alpha)

Amcor also pays a high dividend of 4.76% representing a safe payout ratio of 73.8%, giving shareholders constant returns through income while maintaining adequate FCF to expand the company’s operations.

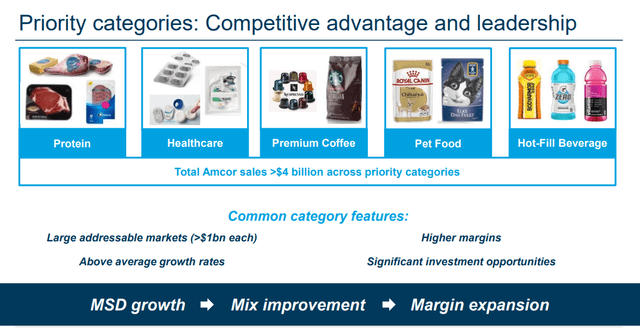

Seeking Alpha

Amcor has fallen short of expectations in its March 2023 results, missing both revenue and earnings per share estimates. Specifically, the earnings per share came in at $0.119, which is $0.05 lower than expected, while revenue was $3.67 billion, missing the forecast by $20 million. These results suggest that the company is facing challenges in a period of moderate economic difficulties. As a result, Amcor is looking to shift its focus away from its core business products and expand into more profitable segments such as protein, premium coffee, and healthcare. The company has revised its EPS estimates downwards from $0.77-$0.81 to $0.72-$0.74 per share, due to anticipated lower demand for core products as a result of economic pullbacks. Amcor’s exposure to the broader market is due to its significant presence in various industries, which leaves it vulnerable during times of economic recession. However, this also provides a hedge against underperformance in individual industries, which can be advantageous for investors focused on stability.

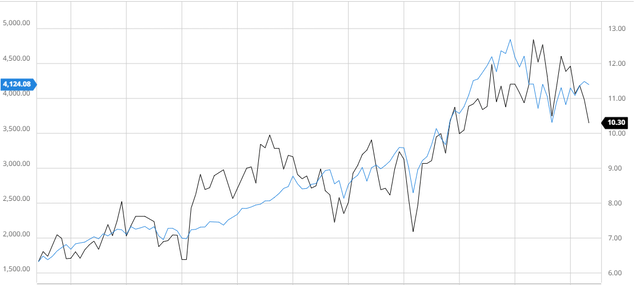

Amcor Compared to the Broader Market

In the last decade, Amcor’s performance has been below that of the S&P 500 after accounting for dividends, partly attributed to their recent earnings shortfall and the subsequent downgrades by analysts. However, based on the company’s historical correlation with the wider market, I anticipate that its shift towards premium packaged products will improve its stock performance in the future.

Amcor Compared to the S&P 500 10Y (Created by author using Bar Charts)

Premium Packaging Acquisitions to Boost Growth and Margins

In recent years, Amcor has emphasized the significance of transitioning towards higher-margin industries for their packaging products, aimed at generating increased cash flows and future growth. A demonstration of this strategy in action is their recent acquisition of Moda Systems on May 8th, 2023. Moda Systems is a global designer, manufacturer, and supporter of cutting-edge modular vacuum packaging solutions for the meat, poultry, and dairy industries. This acquisition will enable Amcor to further advance its focus towards the high-profit protein segment, while diversifying revenue streams, thereby offering greater protection against industry-specific challenges.

Investor Presentation

Amcor receives a competitive edge from its recent acquisition with new equipment that enables the company to be more effective and direct with clients, in addition to improved profitability and rapid growth. With this acquisition, Amcor distinguishes itself as the only flexible packaging producer to provide this technology for fresh meat. This equipment includes high-speed, rotational machinery for automated protein packing. Amcor now has a competitive advantage over rivals who only offer standard shrink bags thanks to the new equipment’s ability to deliver bespoke format solutions.

I believe that such acquisitions are a big part of why Amcor is positioned for long-term success because it is using capital more effectively and has greater free cash flow to grow the business.

Investor Presentation

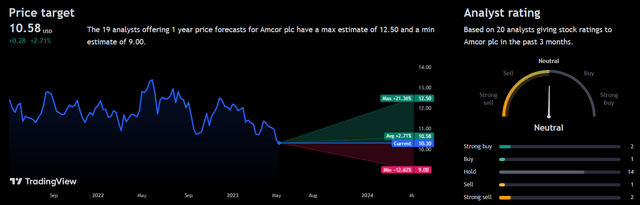

Analyst Consensus

Analyst consensus rates Amcor as a “hold”. With ratings all over the board, analysts are very conflicted over Amcor’s performance with an average 1Y price estimate of $10.58 presenting an average 2.71% upside.

Trading View

Valuation

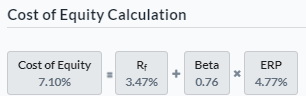

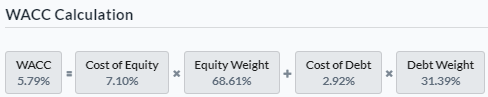

Before creating my assumptions and calculating my DCF, I will calculate the Cost of Equity and WACC for Amcor using the Capital Asset Pricing Model. Factoring in a risk-free rate of 3.47%, I was able to conclude that the Cost of Equity was 7.10% as displayed below.

Created by author using Alpha Spread

Assuming this Cost of Equity value, I was able to calculate the WACC to be 5.79% as shown below, which is under the industry average of 7.25%.

Created by author using Alpha Spread

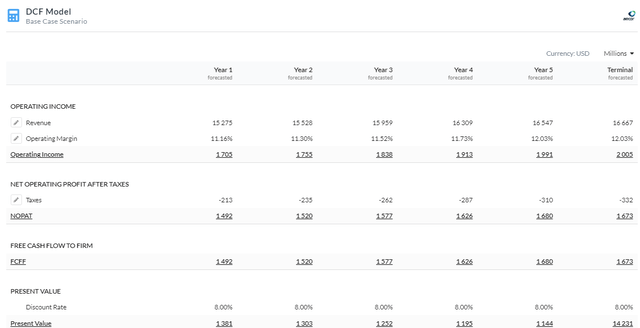

By employing a Firm Model DCF analysis using FCFF without CapEX, I have ascertained that Amcor is presently overvalued by 4% when considering a fair value of around $9.93. To arrive at this figure, I utilized a discount rate of 8% for a 5-year duration. I decided to add a 0.9% risk premium due to macroeconomic headwinds which will impact Amcor due to their diversification and exposure to multiple industries. Furthermore, I predicted that the company will continue to shift into more profitable segments through acquisitions and succeed in integrating these purchases resulting in margin expansion over the years.

5Y DCF Model Using FCFF Without CapEX (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread)

Risks

Raw material costs: The price of raw materials like plastic resins and aluminum has a significant impact on Amcor’s profitability. Cost increases for raw materials may have a negative effect on Amcor’s profit margins.

Regulatory and environmental risks: Amcor works in highly regulated sectors such as the packaging of food and pharmaceuticals, which are held to exacting regulatory standards. The reputation and financial performance of the company could be harmed by regulatory changes or non-compliance with already-existing restrictions. Additionally, environmental issues like pollution and waste disposal may have an impact on Amcor’s operations.

Conclusion

In summary, I recommend a hold on Amcor due to its attractive dividend yield and strategic acquisitions aimed at entering high-margin industries but caution that it may be overvalued based on my DCF analysis. It may be worth revisiting the company in the future, as it has the potential to generate consistent returns if the stock price is at a suitable level.

Read the full article here