Student loan forgiveness continues to be in the news. Despite losing a key legal battle over the summer, the Biden administration has approved tens of billions of dollars in student loan forgiveness under multiple programs. And the Education Department is working on more initiatives.

In the meantime, a whirlwind of student loan legal and policy developments will impact millions of borrowers. Here are the latest updates.

Nearly 3 Million Will Get Student Loan Forgiveness Credit Due To Servicing Problems

Earlier this month, the Biden administration announced that at least 2.7 million borrowers will be compensated due to widespread loan servicing problems associated with the return to repayment. Millions of borrowers received untimely, improper, or incorrect billing statements resulting in at least 800,000 delinquencies by November, according to the Education Department.

To rectify the situation, the department is placing impacted borrowers into an administrative forbearance, during which time no payments will be due. While historically forbearances do not count toward student loan forgiveness terms under Income-Driven Repayment and Public Service Loan Forgiveness, top department officials indicated that these forbearance periods will count toward forgiveness. Affected borrowers may also be eligible for a waiver of interest accrual, and refunds of any erroneous payments made.

Senate Defeats Republican Effort To Repeal Student Loan Plan

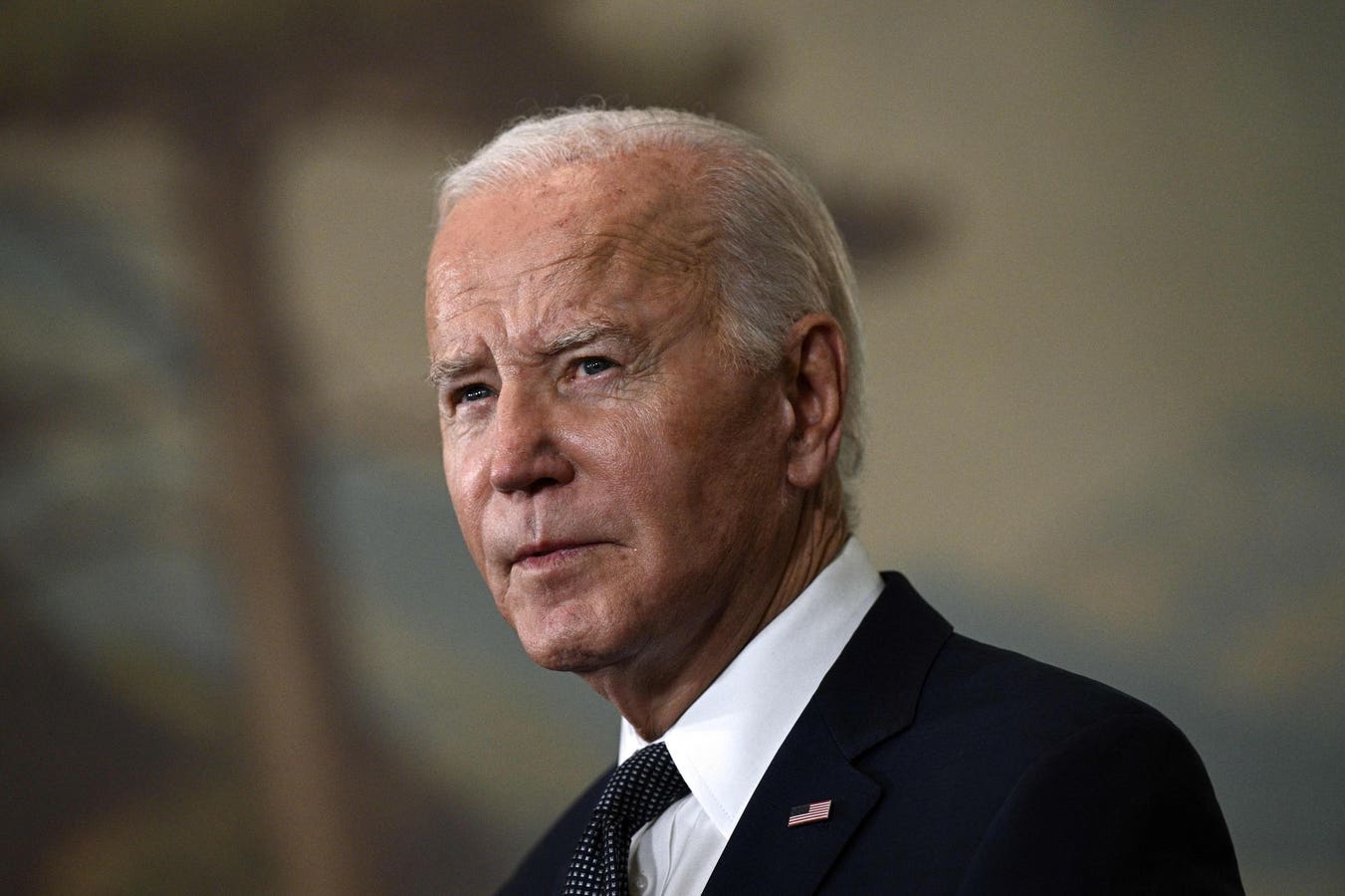

This week, the Senate defeated Republican-led efforts to repeal President Biden’s new SAVE plan. The SAVE plan is an income-driven repayment option that top officials have argued is the most affordable federal student loan repayment program ever created. SAVE will lower the monthly payments for many borrowers, and will provide them with a shorter or less expensive pathway to student loan forgiveness compared to current IDR options. At least 5.5 million borrowers have enrolled in SAVE so far, according to the Education Department.

But Senate Republicans launched an effort to repeal SAVE via the Congressional Review Act, a federal statute that gives Congress an opportunity to reverse regulations recently enacted by a presidential administration. GOP leaders have called SAVE a “scheme” that effectively operates as backdoor student loan forgiveness.

On Wednesday, the Senate Congressional Review Act resolution failed in a 49-50 vote. Had the repeal effort passed, President Biden had vowed to veto it.

Student Loan Forgiveness Under Account Adjustment Continues, With Key Deadline Approaching

Nearly a million borrowers have already received student loan forgiveness through the IDR Account Adjustment, a temporary Biden administration initiative that provides borrowers with credit toward loan forgiveness under IDR programs.

The Education Department is “running” the IDR Account Adjustment roughly every two months. The last round of loan forgiveness approvals occurred in September, with borrowers starting to receive discharges in late October. The next round may occur later this month, although it is not yet clear how many borrowers may qualify for a discharge this time.

Some borrowers will need to consolidate their student loans via the federal Direct loan program to qualify for the adjustment or maximize the available benefits. The consolidation deadline of December 31, 2023 is rapidly approaching. However, advocates are pushing the Biden administration to extend this deadline.

Biden Administration Takes Next Steps For New Student Loan Forgiveness Program

The Biden administration is also taking steps to create a new student loan forgiveness program using the “compromise and settlement” authority of the Higher Education Act.

In October, the Education Department released draft regulations outlining four broad categories of borrowers who could qualify for student loan forgiveness under the new program. These include borrower with very old loans, those who qualify for existing student loan forgiveness programs but haven’t applied, former students of predatory schools, and people who owe more now on their student loans than what they originally borrowed due to interest accrual and capitalization. It is not yet clear how many borrowers may be eligible.

The department is also looking to provide student loan forgiveness to a fifth group of borrowers based on hardship. A negotiated rulemaking committee debated what could qualify as a hardship at a public hearing last week. That committee is set to reconvene in early December, after which the department will finalize and release regulations governing the new student loan forgiveness program.

Further Student Loan Forgiveness Reading

Student Loan Forgiveness Could Happen If You Graduated In These Years

Didn’t Get A Student Loan Forgiveness Email? 7 Possible Reasons Why

2.9 Million Borrowers Will Not Have To Pay Their Student Loans Under New Biden Plan

More Big Student Loan Servicing Switches May Happen (Yes, Again)

Read the full article here